January flew by.

January flew by.

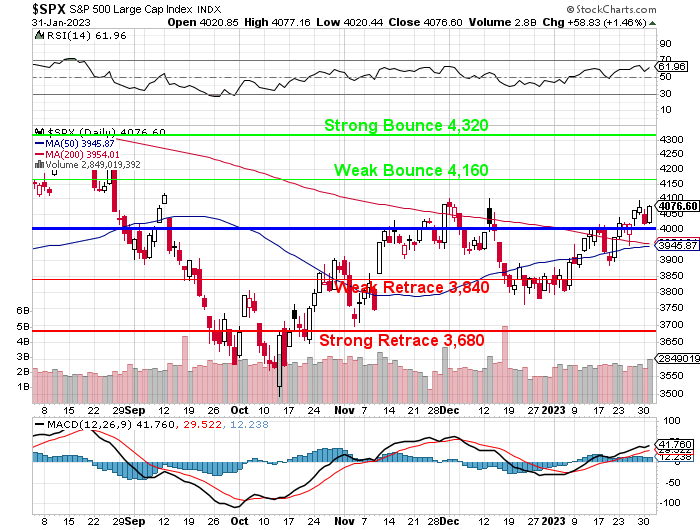

We didn’t do a lot of trading but it has been an interesting month. Jan 3rd was our first day of trading and we opened at 3,853 on the S&P 500 and now we’re at 4,076, up 223 points (5.8%) for the month. As I noted last week when we went over our Top Trades, the few trades we did make have done very well.

Our primary paired portfolios the LTP ($3,577,943) and the STP ($3,823,633) and that’s a combined $7,401,576 so now up 10x from our $700,000 start on 10/1/19. As our last Portfolio Review (Jan 17th) it was $3,413,883 and $3,818,848, which is $7,232,731 in the past two weeks. Originally we were going to cash out at $5M in the summer, but I’m glad we didn’t – it’s been a Hell of a ride!

We are actually mainly in CASH!!! 66% in the LTP and 93% in the STP and THIS is the moment we’ve been waiting for – to see what the Fed has to say about their rates – now that we will have almost 200 (40%) S&P reports to mull over.

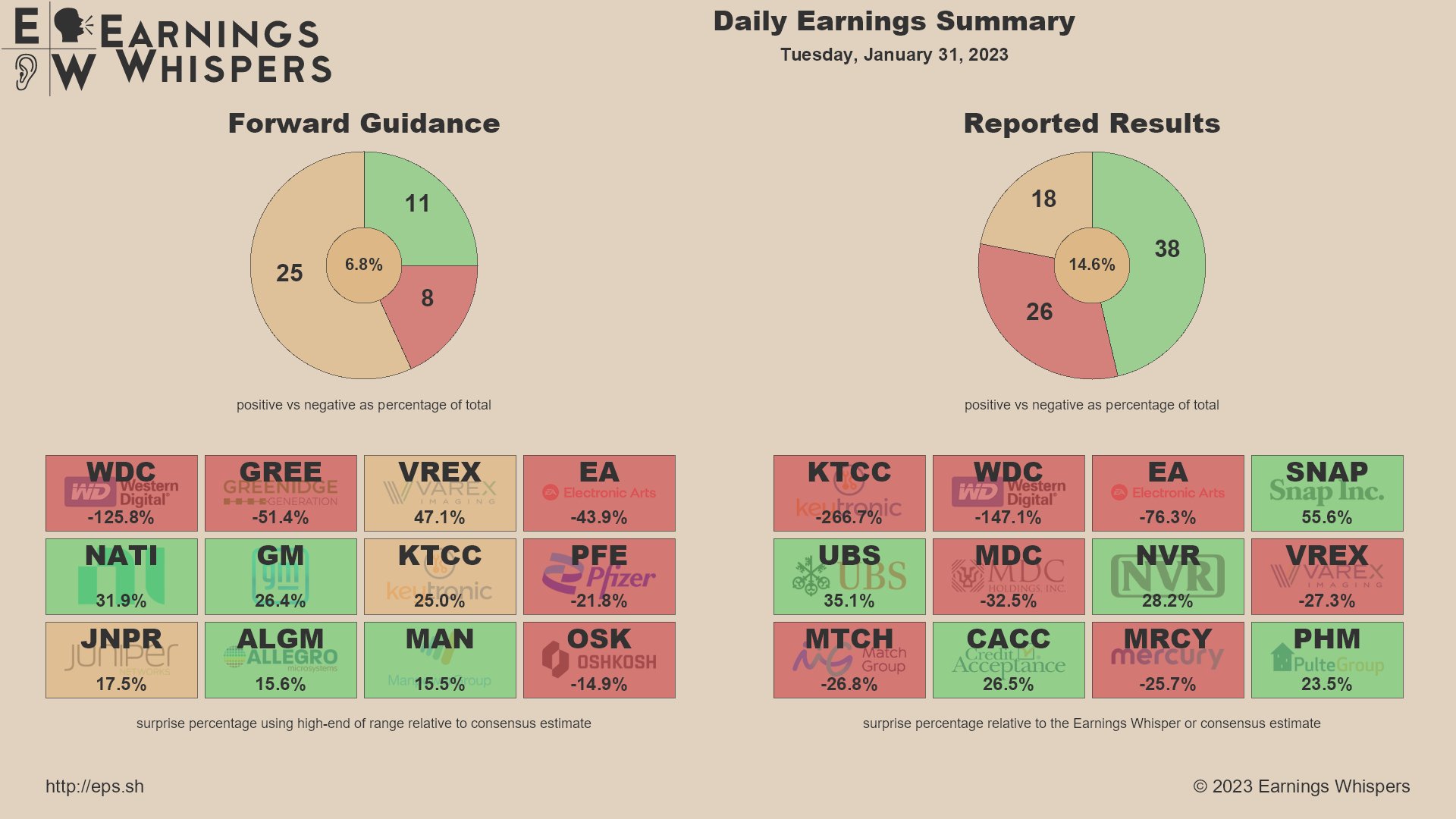

As of yesterday morning we were running 59% beats (out of the non-neutrals) and we need to be over 70% to call earnings “healthy“, so the jury is still out there at the moment. Too many negative guidance reports as well for us to be blindly jumping into longs just because we are getting antsy, right?

We had a good day yesterday thanks to the declining Dollar, which is back to 101.60 this morning from 102.40 yesterday morning and that’s a 0.8% drop which should have given the indexes a 1.6% pop and we hit 4,007 yesterday morning and +1.6% would be 4,071 – which is right where we are this morning so thank you Dollar!

We had a good day yesterday thanks to the declining Dollar, which is back to 101.60 this morning from 102.40 yesterday morning and that’s a 0.8% drop which should have given the indexes a 1.6% pop and we hit 4,007 yesterday morning and +1.6% would be 4,071 – which is right where we are this morning so thank you Dollar!

If the Fed indicates they are done easing, the Dollar will fall and that will boost the indexes (along with the relief that the Fed is almost done) but, if the Fed tightens 0.5% or more and indicates more rate hikes to come, that will rally the Dollar AND piss off the markets – a double whammy the Fed is likely to want to avoid. So, most likely they raise 0.25% and have tough language about staying on top of inflation in an attempt to carve a middle ground – we’ll see at 2pm and then, at 2:30 Powell will speak.

ADP says this morning that only 106,000 jobs were added in January, down from 253,000 in December so the Fed should be happy that they are destroying the job market and keeping wages well below inflation for their Corporate Masters.

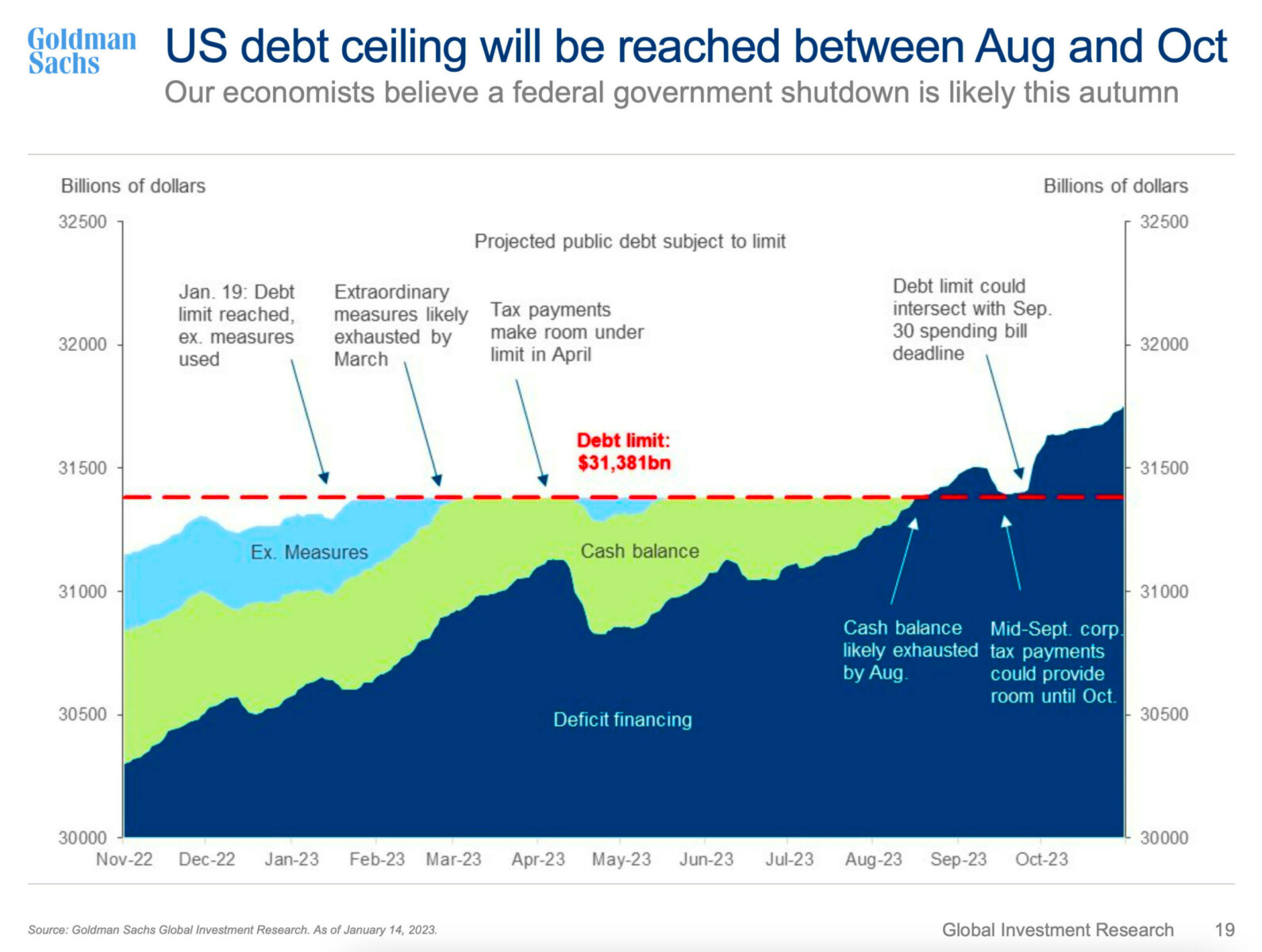

Meanwhile, Goldman Sachs is projecting a Government shutdown in the Fall, meaning no agreement through the summer and then a catastrophe. That makes it kind of hard to get excited about opening up long-term investments but it’s like Global Warming – no sense in changing our habits until it’s far too late to stop it, right?

Speaking of habits, China seems to have passed their Lunar New Year without a total melt-down. China is not releasing figures but Global figures are holding steady at 250,000 case per day (100M infections per year) and 2,500 deaths per day (1M per year) so Covid is miles behind cancer (10M Globally) and Heart Disease (18M Globally). In fact, it’s right behind Tuberculosis & Car Accidents (1.2M each) and just ahead of HIV (900,000).

So out of the 100M people who usually die each year, Covid is now just “one of those things” and that should be good for the Global Economy. If we can put fear of the Fed behind us today, we’ll only be left with Global Warming and the War in Ukraine as our major concerns and, as noted above, Global Warming clearly isn’t worth worrying about until it kills us so then it’s just the war as the Supply Chain should work itself out and then Inflation should come down a bit.

So out of the 100M people who usually die each year, Covid is now just “one of those things” and that should be good for the Global Economy. If we can put fear of the Fed behind us today, we’ll only be left with Global Warming and the War in Ukraine as our major concerns and, as noted above, Global Warming clearly isn’t worth worrying about until it kills us so then it’s just the war as the Supply Chain should work itself out and then Inflation should come down a bit.

The new worries will be the Housing Crisis, the Debt Ceiling, China’s Property Bubble, Spot Materials Shortages and Mass Extinction but those crises bring opportunities as well.