We had some huge gains yesterday.

We had some huge gains yesterday.

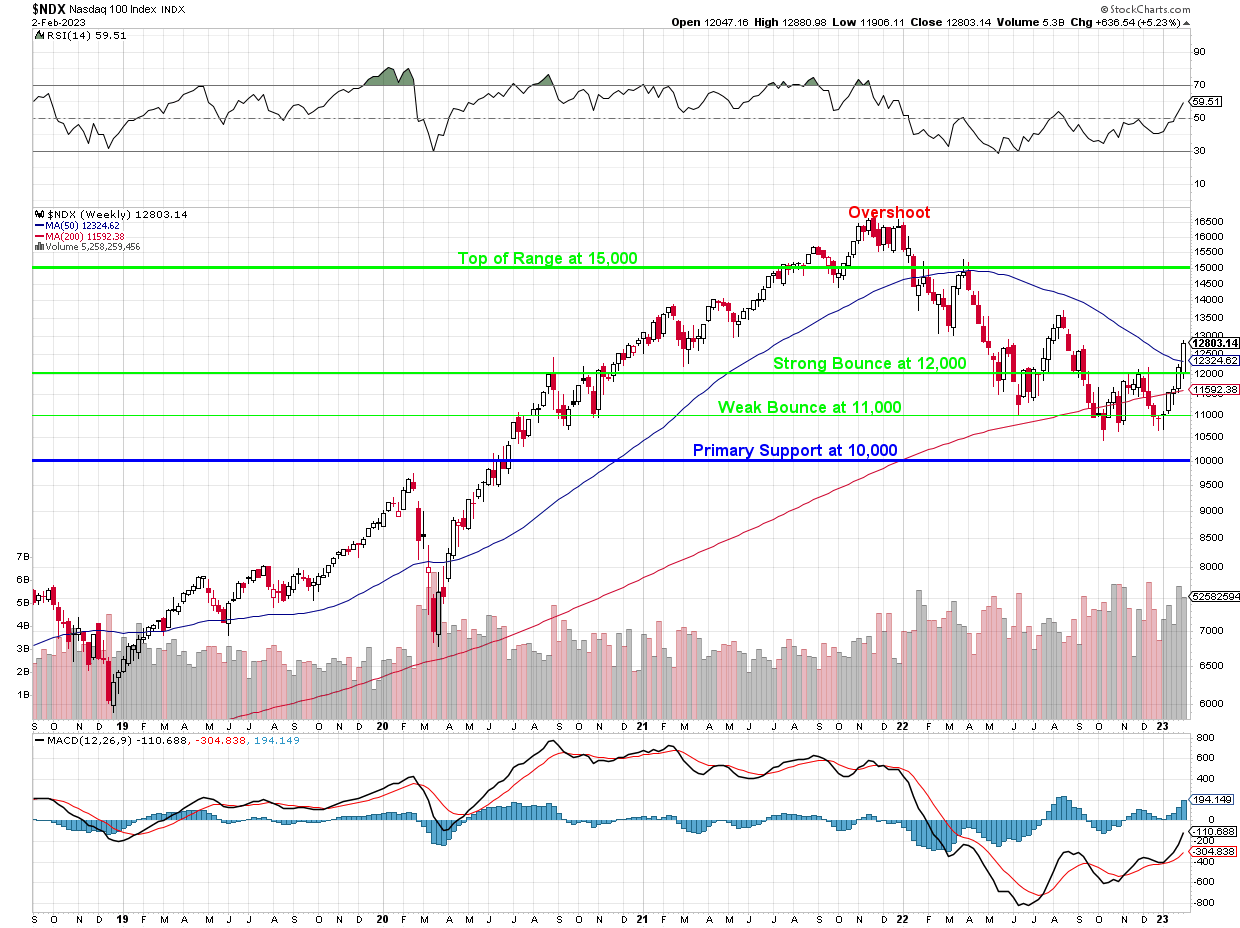

The Nasdaq broke all the way up to 13,000 before being rejected and, even though we had a disappointing earnings reports from Tech heavyweights like Apple (AAPL), Amazon (AMZN) and Google (GOOGL), we have, so far, only given up some of the gains.

In fact, if you apply our 5% Rule™ to the 1,000-point rally from 12,000 to 13,000, then our retraces would be 20% of the run (200 points), back to 12,800 (weak retrace) and 12,600 (strong retrace) and finishing the week over the Strong Retrace line at 12,600 would be a bullish indicator for next week – especially as we are now past the Fed.

The Nasdaq is, in fact, up 2,000 points (18%) for the year already at 13,000 and the pullbacks there would be 400 points so there’s nothing alarming about 12,600 and we could fall all the way back to 12,200 without being too alarmed – though it would be nicer if we held the 50-week (200-day) moving average at 12,324. This is a huge and unexpected (by us) turnaround in the market.

We have Non-Farm Payrolls coming up shortly (8:30) and that will be a major data-point but other employment data indicates we should be well over the 200,000 new jobs expected by our leading Economorons, which the Fed considers way too hot but no one seems worried about the Fed anymore so Que Sera Sera, I guess.

As I noted to our Members yesterday, we’ll have to do a bit of buying if this keeps up as we’re pretty bearish in our portfolio balances. It’s not hurting us yet but it will if this keeps up.

8:30 Update: 517,000 new jobs?!? WTF?!? There’s no way this doesn’t turn us lower as it’s the exact opposite of what the Fed wants. How could they not have had an idea of this on Wednesday before they only raised rates 0.25%? That’s an out of control number and unemployment is, of course, going the wrong way – now 3.4%

I think it’s great – F the Fed and their idiotic concept that it’s better to kill demand than boost supply to control prices. More workers, more stuff, more Economy is the way to go. More stuff and more people to load ships and trains and trucks fixes the supply chain and so what if we HAVE to pay them fair wages for a day’s labor – slavery was outlawed almost 200 years ago – Corporate America seems to have never gotten the memo…

517,000 new jobs means 517,000 x $4,000 ($2Bn) additional Dollars are required next month for payroll so the DEMAND for Dollars increases and the SUPPLY of Dollars doesn’t change that fast therefore – the Dollar goes up! See how easy economics is?

517,000 new jobs means 517,000 x $4,000 ($2Bn) additional Dollars are required next month for payroll so the DEMAND for Dollars increases and the SUPPLY of Dollars doesn’t change that fast therefore – the Dollar goes up! See how easy economics is?

In fact, on Wednesday I said to our Members at 3:35:

Dollar testing 101 – that should be the first thing to turn as currency traders are a lot more sophisticated than equity traders (usually). 34,283, 4,145, 12,454 and 1,976 are where we are at the momnent. Dollar 102 would wipe out all these gains for the day.

We’ll see what happens as the Dollar was 102 Wednesday morning and the S&P was 4,075 – that’s down quite a bit from here and would turn us flat for the week, which would be a shame after all the excitement.

Have a great weekend,

-

- Phil