The Dollar is up 2% since Friday.

The Dollar is up 2% since Friday.

That means the indexes, which are down about 1.25%, are holding up very well considering they are going against the current. Stocks are priced in Dollars so a stronger Dollar lowers the stock prices almost automatically. This rally was caused by last week’s Non-Farm Payroll Report, which showed over 500,000 new jobs were added (increasing the demand for Dollars to pay them).

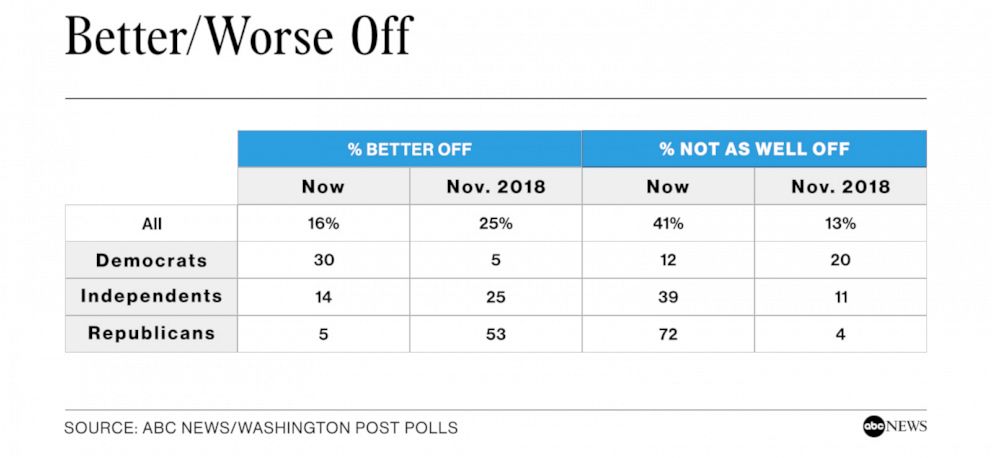

We will hear Biden’s State of the Union speech this evening. Despite 12M jobs being created since he took office two years ago, 4 out of 10 Americans say they are worse off financially since he took office. Of course, within that number, an amazing 72% of the Republicans said they were worse off under Biden vs 12% of the Democrats. That means partisanship has now gotten into polling and you can’t trust the numbers anymore.

However, 39% of people who say they are Independent also say they are worse off than they were 2 years ago – and this was during Covid! Unemployment was 6.4% when Biden took office, now it’s 3.4% – the lowest level since 3 men were hired to land on the moon in 1969. That’s more than double the number of jobs Trump created in his first 3 years (they all disappeared in his 4th), when Republicans insisted we were experiencing the single greatest economy in the history of Western civilization.

It was against this backdrop that Republican National Committee Chairwoman Ronna McDaniel released a written statement in response to the January jobs report. “The Biden-Harris economic agenda has caused nothing but pain and misery for American families,” the RNC chair said.

This is why 72% of Republicans believe they are worse off – that’s what they are constantly being told. In a CBS/YouGov poll, 62% of the people feel the Economy will be slowing or in a Recession over the next 12 months.

This is why 72% of Republicans believe they are worse off – that’s what they are constantly being told. In a CBS/YouGov poll, 62% of the people feel the Economy will be slowing or in a Recession over the next 12 months.

I think the disparities can be found in yet another survey from Stanford (and Son), which indicates 10% (not 5% as previously thought) of the labor force has a second job. That means 10% of the jobs people have are not enough to pay their bills, unfortunately.

Despite a strong labor market underscored by historically low unemployment and solid wage gains — which, for some workers, are finally outpacing inflation — the cost of living is still a huge financial strain for many Americans. That’s leading them to load up on credit cards and tap into savings to make ends meet, and, in some cases, pick up another paycheck.

We get the Consumer Credit Report at 3pm and we’ll see if people seem to be slipping. As of November, people were 8% further in debt than they were the year before, now totaling $4.94Tn – $60Bn in December will put us over the $5Tn mark for 2022 but that’s not likely as last Dec was “only” +$22Bn.

We get the Consumer Credit Report at 3pm and we’ll see if people seem to be slipping. As of November, people were 8% further in debt than they were the year before, now totaling $4.94Tn – $60Bn in December will put us over the $5Tn mark for 2022 but that’s not likely as last Dec was “only” +$22Bn.

There were only 8 clean beats last night and 13 companies either missed earnings or lowered guidance (or both). This morning, so far, we have 20 clean beats and 13 negatives so 28 and 26 since the last close. Of course, companies like KKR get a beat due to low expectations, even though earnings barely half of last year and revenues were off 37.6% as well. DD is in the same boat, with revenues down 28% and earnings down 25%.

We are certainly not out of the woods yet and, if 12,500 fails on the Nasdaq, I’m going to be inclined to pull the trigger on the rolls we have planned for our Short-Term Portfolio (STP) from last Thursday’s Report.

We were talking about spending about $300,000 to improve the positions on our shorts and I wasn’t worried enough to pull the trigger into last weekend, but we’re down 55 (1.3%) from Friday’s 4,170 open at 4,115 and the retraces from 4,000 to 4,200 are 40-points so 4,160 is weak and 4,120 is strong and we just lost 4,120 so – if it doesn’t come back soon and the Nasdaq fails – it will be a good time to add some more hedges.