We are still long on Natural Gas (/NG), of course but now we’re playing the April (/NGJ23) contracts at $2.45, which they are back to this morning. Those contracts came down 0.25 ($2,500 per contract) since early yesterday morning so we’re expecting a nice bounce today.

We are still long on Natural Gas (/NG), of course but now we’re playing the April (/NGJ23) contracts at $2.45, which they are back to this morning. Those contracts came down 0.25 ($2,500 per contract) since early yesterday morning so we’re expecting a nice bounce today.

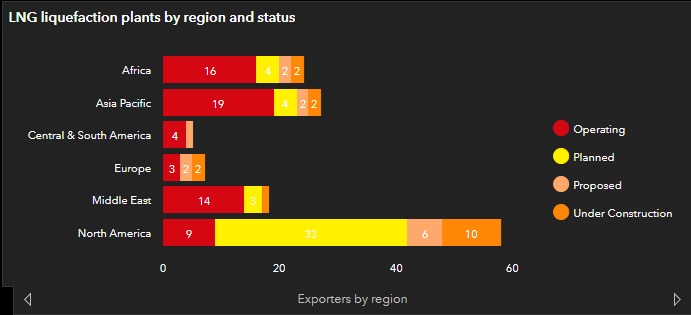

For the longer-run, there are 264 Regasification Terminals proposed or completed in the World. 79 of the open receiving terminals and 57 of the planned receiving terminals are in Asia and 42 open and 32 planned are in Europe – that’s 210. There are only 139 Liquefaction Terminals proposed or completed and Africa has 16 in operation, Asia 19, Central/South America 4, Europe 3, Middle East 14 and US has 9 – and one of them has been down for a month.

That’s why /NG is so cheap at the moment – a combination of a mild winter and 10% of our exports off-line is causing a surplus in the US but notice that 33 new export terminals are planned, 6 more are proposed and 10 are already under construction – which will double our export capacity over the next two years. By the end of this year, exports are expected to be up 50% over last year.

That’s why /NG was speculated all the way up to $9 early last year but the reality of how long it takes to build and permit the terminals (/NG is kind of explosive) along with the pipeline issues began to cool off the speculators and then Freeport LNG in Texas shut down due to an explosion in June, which meant that all the gas that was set for export was now flooding the US markets. Freeport expects to restart in March.

When Freeport comes back online (along with some new terminals), our exports will skyrocket and /NG prices should begin to climb.