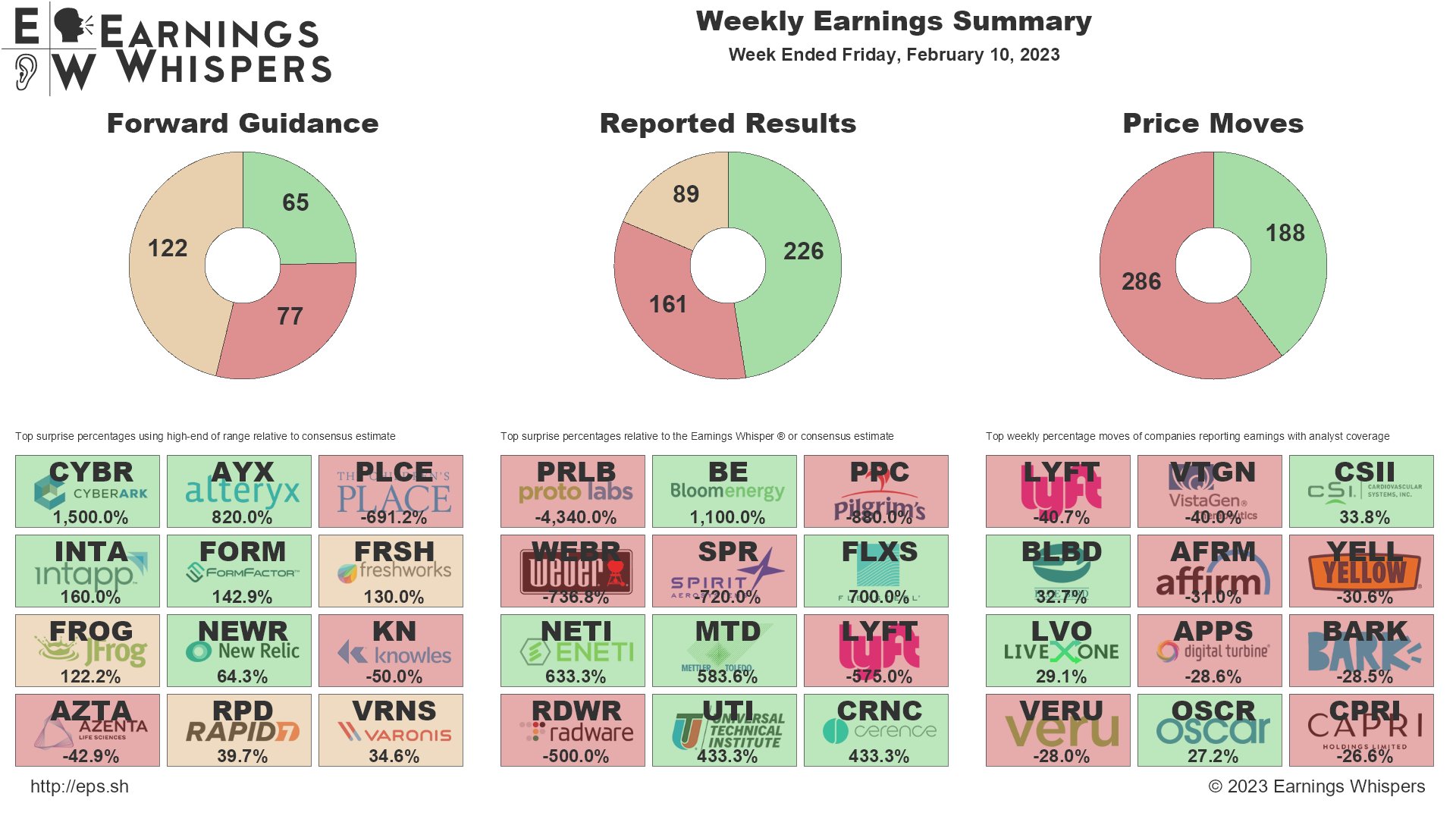

S&P 500 Earnings are about done.

474 of the S&P 500 have reported in and, as you can see, the Reports have been split roughly 50/50 but the Guidance has been a bit on the red but, most importantly, the reaction to earnings has, on the whole, been negative, with 286 (60%) of the reporting companies losing ground. That means the rally, such as it is, has been based on a very small group of gainers and those now need to hold up against thousands of small and mid-caps yet to report.

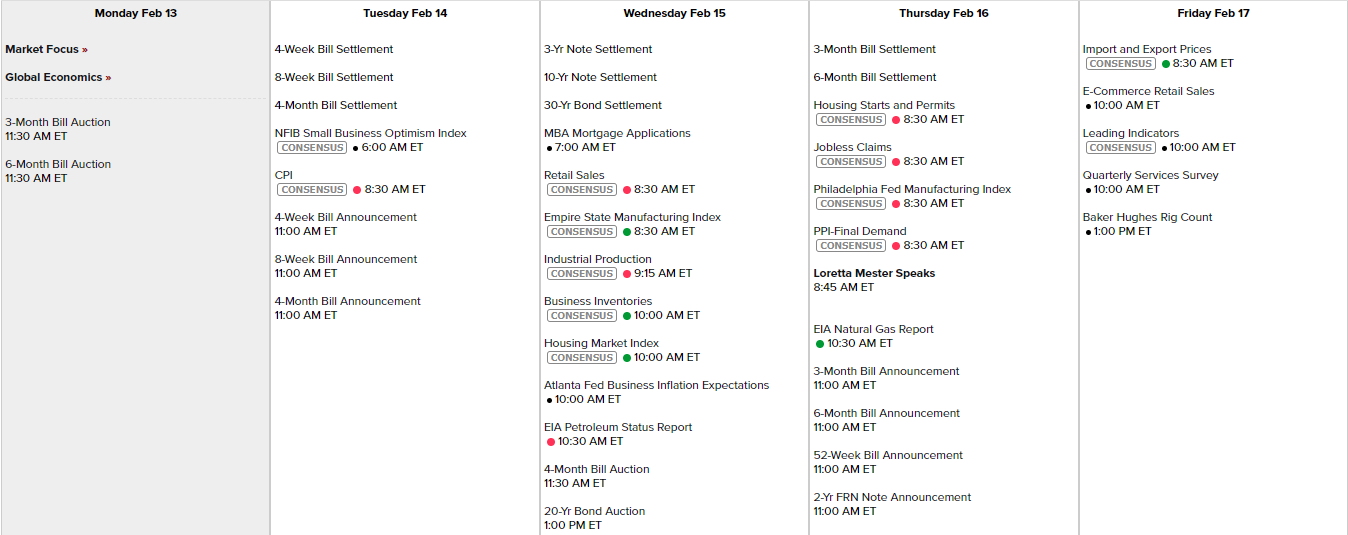

I don’t think this is going to go well but for now we are waiting and seeing. There was not much news of note over the weekend and there doesn’t seem to be a lot of Fed speak scheduled (though, after last week, we don’t trust Econoday’s accuracy in that regard).

This week we’ll also get a look at CPI tomorrow, Retail Sales, Empire State Manufacturing and Industrial Production Wednesday, the Philly Fed and PPI on Thursday and Friday we’ll have E-Commerce sales and Leading Economic Indicators. Also, keep an eye on Wednesday’s 20-year auction but demand has been strong recently – so hopefully not an issue.

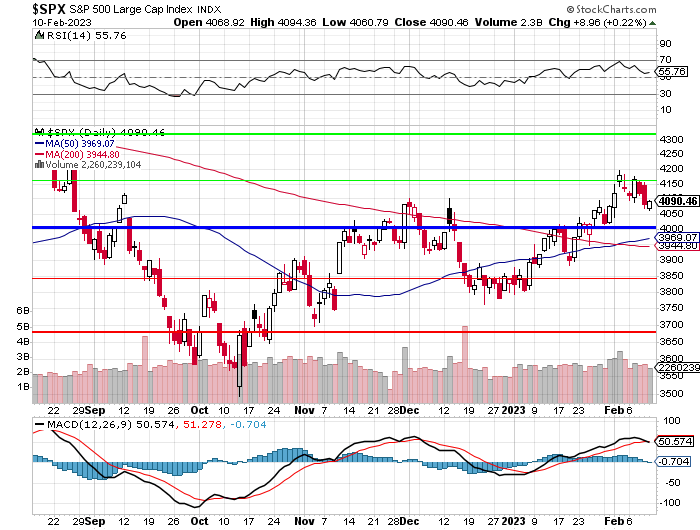

We are still on a bullish trend on the S&P for the year, up from 3,800 to 4,200 was 400 points which made a weak retrace 4,120 and a strong retrace 4,040 – which held last week so we’re still in a bullish trend for now, with Futures indicating 4,113 on a surge this morning (7:30).

That’s up 8% for the year at the moment but, as I noted, it’s a very weak foundation we have built for our rally and it can easily be undone, so we need to watch each data point and each earnings report carefully.

Investors have, in fact, pulled net $31Bn from U.S. equity mutual funds and exchange-traded funds in the past six weeks, according to Refinitiv Lipper data through Wednesday. That marks the longest streak of weekly net outflows since last summer and the most money pulled in aggregate from domestic equity funds to start a year since 2016. Flows toward funds outside of domestic equities indicate a level of apprehension from investors who aren’t buying the 2023 rebound in U.S. stocks.

The 2023 rebound has been driven in part by hopes that the Federal Reserve will cut interest rates later this year as inflation moderates—though central bank officials have repeatedly said they see higher rates for longer to try to ease price pressures. Meanwhile, the gulf between single-stock buying and ETF selling so far in 2023 is the widest on record going back to 2008 with traders making net purchases of more than $15 billion in single stocks year to date, while ETFs have seen more than $10 billion of net outflows.

Hmm, since 2008? I’m glad, at the moment, we pressed our hedges last week but we will be looking for individual stocks of our own to add to this week as we being to review our Member Portfolios.