Happy Valentines Day!

Happy Valentines Day!

Q1 is off to a loving start and that’s certainly not what we expected, but it’s what we’ve accepted for the moment. We did just press our Short-Term Portfolio (STP) hedges last week to lock in our ill-gotten gains. That means our focus this month is going to be on improving the long positions we already have – just in case the love fades and, if the rally does continue into March, then it’s time to go shopping and add new positions as well.

As I noted on Friday, there have been more misses than hits in the S&P 500 and 77 of the S&P 500 companies have guided down and only 68 have guided up – that’s not a good ratio but we have constructed a narrowly-focused rally based on certain companies – like TSLA (who gained 60% this year) – going back from oversold to overbought already.

The main factors driving the bulls at the moment are “Covid is over” (it might be), “China Re-Opening” (kind of the same thing and don’t count on it) and a “Soft Landing” from the Fed on Lower Inflation (data pending). Very Goldilocks if they all work out but also very speculative at the moment and NOT showing up in the actual data so far – but we’ll get more this week.

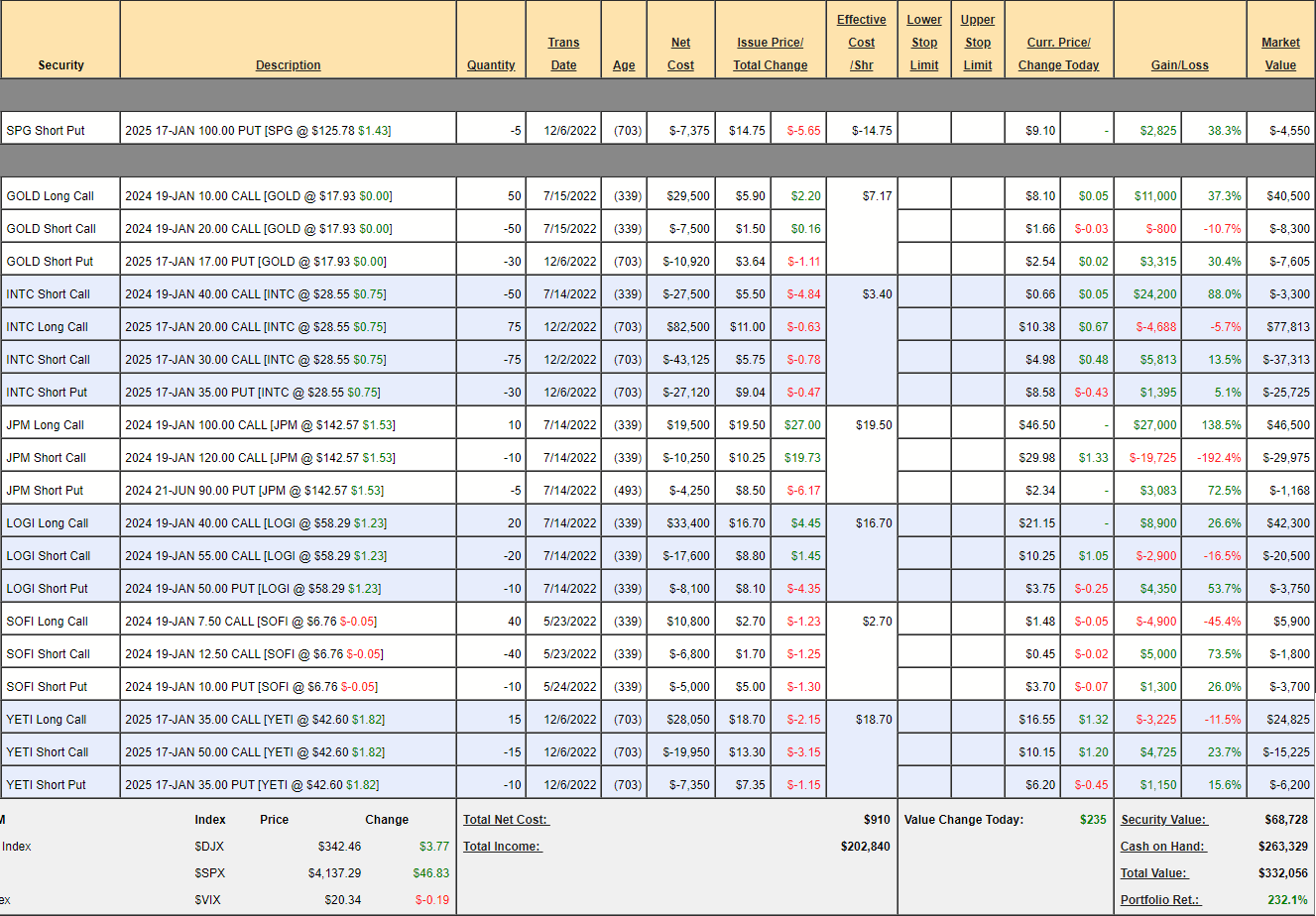

Money Talk Portfolio Review: We like to review the Money Talk Portfolio first as we can’t make changes to it unless we’re on the Money Talk Show on Bloomberg, which makes it a nice way to see how things have gone vs our expectations from the previous quarter. It’s also a very important lesson that you don’t have to constantly adjust to make good money.

I was last on the show on Nov 30th and, at the time, we were at $288,859, which was up 188.9% from our 11/13/19 start – so just over 3 years was well outperforming our 40% annual goal (see “The Secret to Consistent 20-40% Annual Returns“). We made 3 changes at the time, cashing in Jackson Financial (JXN) and adding long positions on Simon Properties (SPG) and our Trade of the Year, Yeti Holdings (YETI).

We’re a couple of weeks shy of 3 months and YETI has earnings on the 23rd but the rest of the portfolio is looking good and now we’re at $332,056, which is up 232.1% overall and up $43,197 (15%) in less than 3 months – tracking for yet another 60% year so far!

You do not need to constantly fiddle with your positions to make money. Just pick solid positions on good-value stocks and you can relax and enjoy the rest of your life. That’s what we try to teach you at PhilStockWorld!

-

- SPG – They beat on top and bottom line and we fully expect to collect the additional $4,550 on these short puts.

-

- GOLD – Barrick reports earnings tomorrow but we’re not worried, this is a long-term hold for us and a great hedge against inflation. As it stands it’s a $50,000 spread that is mostly in the money but currently showing net $24,595 so there’s still $25,405 left to gain.

-

- INTC – We don’t expect too much from INTC this year but next year we think the new plants come on-line and they re-assert their dominance and we don’t want to miss it if people start anticipating the run-up. The bull call spread is $75,000 if we hit $30 (not far at all) but we’d lose $15,000 on the short puts at $30 so we are hoping for $35 in two years. Currently the net is just $11,475, which means the upside potential is $63,525 (553%). This is one of my favorite trades!

-

- JPM – Who bets against JPM? This is a $20,000 spread at net $15,357 so we make the other $4,643 (30%) if JPM just holds $120. Not very exciting but it’s essentially free money, so no reason to cash it out.

-

- LOGI – They aren’t much higher than when we came in but we took a very conservative net $7,700 spread with $30,000 potential and now it’s net $12,050, which is up $4,350 (56%) in our first 6 months with 12 more months to collect the next $17,950 (149%) if they can just hold $55. Aren’t options fun?

-

- SOFI – I love these guys. There were too many unknowns to make them our Trade of the Year but I think the risks are worthwhile. This is a $20,000 spread we picked up for a net $1,000 credit so our upside potential was $21,000 and now it’s net $400 so we’re up $1,400 with $18,600 (1,328%) left to gain. Still good for a new play but I’d take the lower spread now that the VIX has calmed down.

-

- YETI – We will see how they did for Christmas next week but our goal is a very modest $50 in two years and I’m certain they’ll get these, which is why they are our Trade of the Year – as that honor goes to the stock where we believe we can most likely set up a spread that will make 300% in the current year. This trade was net $750 on the $22,500 spread and already we’re at net $3,400, which is up $2,650 (353%) in just two months so: Goaaaallllllllllll!!! already but I’m very confident we’ll get the other $19,850 (749%) as well – so still a lovely trade – even if you missed the first 353% gain…

See how easy that is? Just 7 positions using just $68,728 of our cash and they are on track to make another $154,523, which is 46.5% of the portfolio’s total balance. As we’re doing well, it’s most likely we’ll be adding new positions on the next show but, for now, all that CASH!!! (79%) is our hedge.

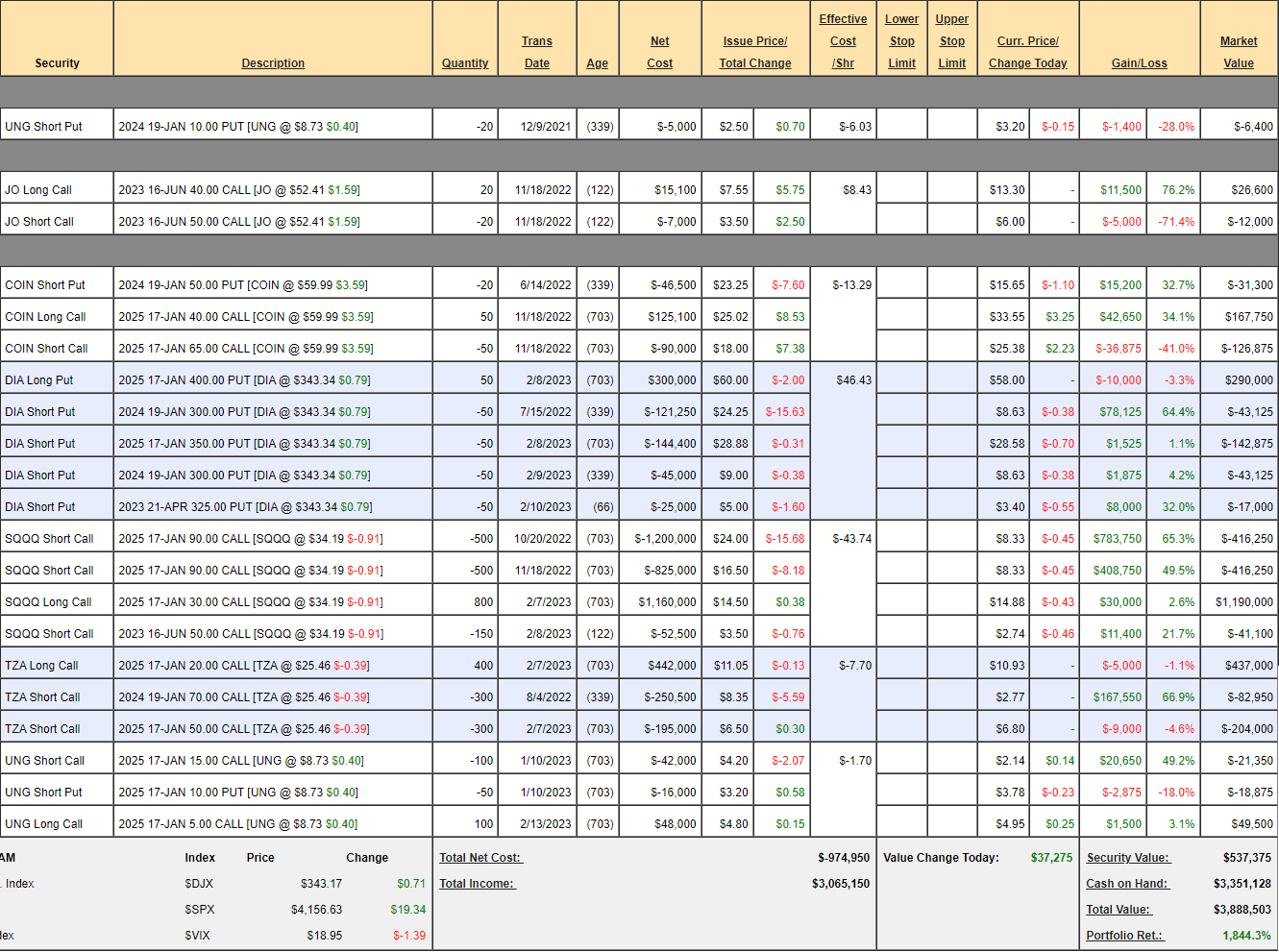

Short-Term Portfolio (STP) Review: We didn’t make any adjustments in last month’s review, when we were at $3,735,555 but last Tuesday we got a bit more bearish in anticipation of a pullback after our nice January rally. The purpose of the STP is to hedge the gains of our long portfolios and, as a rule of thumb, we’ll put 25-33% of our unrealized gains back to work as protection in the STP – to hopefully lock in those gains.

-

- UNG – Leftover short puts from our original position (see below).

- JO – We also make quick bets in the STP and we thought Coffee (JO) was getting too low so we picked up this 6-month trade, which is on track to make us about $12,000 (150%).

-

- DIA – The main trade is the 2025 $400/350 bear spread, which pays $250,000 below $350. We also sold some Jan $300 puts for $121,250 because we thought the Dow wouldn’t go that low (30,000) and we sold some April $325 puts for $25,000 because, again, we’re not that bearish (32,500) and also to hedge all our shorts against a move up. So, if the Dow doesn’t fall 10%, we make $146,250 on the short puts to offset losses on our more bearish positions. If the Dow goes lower than expected, we have MASSIVE hedges in SQQQ and TZA to offset losses here.

-

- SQQQ – The main trade is 800 2025 $30 calls, covered by 1,000 2024 $90 calls and the premise is that the short $90s are so far out of the money there’s no danger from the over-coverage as we would, in fact, be $6.4M in the money on the longs when we hit $90. Realistically, if the Nasdaq were to drop 30%, the SQQQs would jump 100% to $70 and that would put us $3.2M in the money – so that’s the coverage we count on. That being the case, we don’t mind selling some June calls for income.

-

- TZA – Our other major hedge is in the same boat as we doubt $70 will be hit but $50 would be $2M in the money and that’s our coverage (less the current net of the spread, of course).

-

- UNG – We just dropped the $10 calls to the $5 calls and we have 2 years for Nat Gas (/NG) prices to normalize closer to $4.50 and that would put us about $90,000 in the money vs the current net $9,275.

So the DIAs are there to make money but the main hedges (SQQQ and TZA) are offering us about $5M of downside protection against a 30% market drop. That should be more than adequate to protect our long portfolios, which means we can be a little more aggressive with our current and new positions.

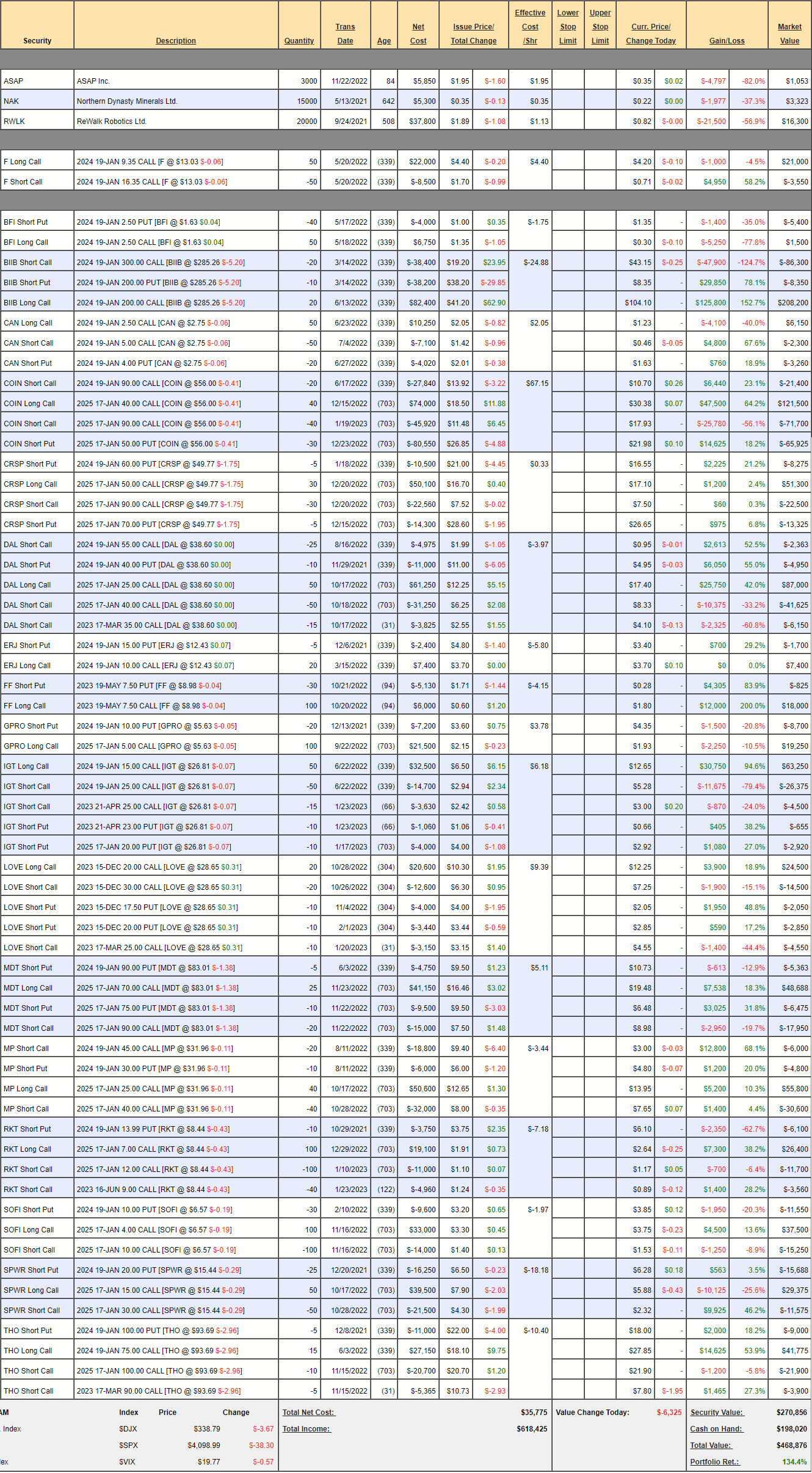

Future is Now Portfolio Review: This is a newer portfolio, from Dec 12th, 2019 and it’s where we put our more forward-looking plays on companies we think will get hot over the next 5-10 years. These are a lot more speculative than our usual plays and returns can be very erratic but $468,876 is up $53,134 (12.8%) from our last review and we barely changed it and added no new trades.

-

- ASAP – If we spend $2,070 more we have 9,000 shares at 0.88 and a double gets our money back. Now, do we think it can double? They have $37M in debt and $20M in cash and last year they lost $100M. The market cap at 0.35 is $100M so let’s say they need $100M to get to break-even and that means they need $80M more cash/debt so we’ll get 40% diluted in the best case. Nope, not worth $2,000 but maybe if we can buy 12,000 more shares for $2,000 and get our net to 0.53, we MIGHT consider it so we’ll see what happens.

- NAK – They just lost their appeal to drill so another one that’s only there to keep an eye on. I’m not sure they’ll survive long enough to see the next Republican Administrations – which is their only shot.

- RWLK – Now these guys I like but they don’t like me so far. 0.81 is $50M and they have $13M in sales projected for 2023 (up 130%) and they’ll lose about $17M but they have $74M in the bank with no debt, so I like them! We’ll see how earnings and outlook are reported at the end of the month.

-

- F – They paid a special dividend of 0.80 on Friday, 0.65 more than usual so our strikes were adjusted lower but no big deal. We’re on track and we can sell 25 2025 $12.35 puts for $2 ($5,000), so let’s do that.

-

- BFI – This is a small burger chain I like. We’ll wait for earnings to decide if we want to spend more.

- BIIB – Mostly in the money at net $113,550 on the $200,000 spread so still $86,450 (76%) more to be made by the end of the year if they hit $300 and hold it. Seems like free money to me!

-

- CAN – About where we came in at net $590 on the $12,500 spread. They are a Chinese chip company that mainly supply BitCoin miners so a bit out of favor at the moment but I like them because $2.75 is $476M and they have $642M in sales and $117M in profit (so 4x profits) AND $300M in the bank! And that’s WITH Covid lockdowns… So, let’s buy back the short 2024 $5 calls at 0.45 and see how earnings play out in early March.

-

- COIN – Now it’s doing well for us. Another Crypto that went out of favor and we have 2 years to go with massive upside potential. Getting to $90 would be $200K and we’re currently at a net credit of $37,525, which means the upside potential is $237,525. Even if we hold $50, the short puts would go worthless and we’d have $40,000 on the long calls for a $77,525 gain – the rest is just gravy!

-

- CRSP – Another company I love the concept of. Out of favor at the moment and this is a $120,000 spread at net $7,200. $50 is $4Bn and they lost $700M last year on essentially no sales. The good news is they do have $1.9Bn in the bank, so 3 more years to figure things out is the bet.

-

- DAL – Airlines were the Future during Covid and the Future is certainly now as air travel ramps back up. Guidance was disappointing in January but $38.75 is $25Bn and they make $4Bn in a disappointing year so I think way undervalued to the point that I want to buy back both short calls (March $35s and $Jan $55s) for net even(ish). That will leave us with the $25/40 spread and the short $40 puts at net $40,425 on the $75,000 spread – which is fine for now.

-

- ERJ – They generally make 35-50 seat planes but getting into VTOL is why I like them. Just a small watch and wait play for now.

- FF – I love these guys, they are wildly profitable and no one pays attention to them. $9 is $394M and this year has been an investing year but they made $16M last Q on $118M in sales, up about 33% from 2021, when they made $26M total. That’s not bad but they also have $210M in the bank net of debt as well. We’re already playing them very aggressive.

-

- GPRO – Also playing aggressive. Not working so far but we have 2 years. 43% Subscriber growth is the key as they are hitting $100M (25%) of their revenues in subscriptions – as planned.

-

- IGT – This is our play on sports betting – which is growing like a weed. We’re a bit over our April targets but not worth adjusting yet.

- LOVE – They have a new integrated sound system that makes me like them more. They still have logistics issues holding them back (very bad in their Dec report) but $29 is only $430M and they are making $30M with sales up 100% from 2021, when they made $15M so give them 2 more years and they’ll be making $60M and it will be ridiculous not to own them so I’m just getting a bit ahead of the crowd. No debt.

-

- MDT – Medical devices and replacement parts for an aging population. How easy is that premise? They also have consistently great R&D, so bonus there. Net $16,900 on the $50,000 spread that’s on track seems too easy to me.

- MP – Domestic Rare Earth Minerals – end of premise. And it’s not speculative, they sold $500M last year and made $271M and $32 means it cost $5.5Bn to buy the whole company so not cheap but – Domestic Rare Earth Minerals!

-

- RKT – Mortgages seem like a stay-away but Rocket is gaining market share but that cost them $174M last year and this year hopefully they make $65M on $4.2Bn vs $300M in 2021 on $13Bn. I think the $7/12 spread is reasonable for 2025 and we’re selling 30% of the June $9s for income, so right on track at the moment.

-

- SOFI – See how much I like them! I think they are in almost every portfolio. Same magic here and we’re at net $10,700 on the $60,000 spread at the moment.

- SPWR – Our Stock of the Decade and it’s only year 3! They are out of favor yet again but we’re about even on the spread. The 2025 $10s are $8.60 so it would cost us $2.72 to roll down $5 – kind of worth it but not necessary, really. Buying back the short $30 calls that are 100% out of the money doesn’t seem smart either so we’ll just see what happens on earnings tomorrow.

-

- THO – I see lots of people living in trailers these days. They are way ahead of schedule at $93.69 and we’re making tons of money. All good.

Just two adjustments and lots of on-track positions. That’s what I like to see!

— Thursday —

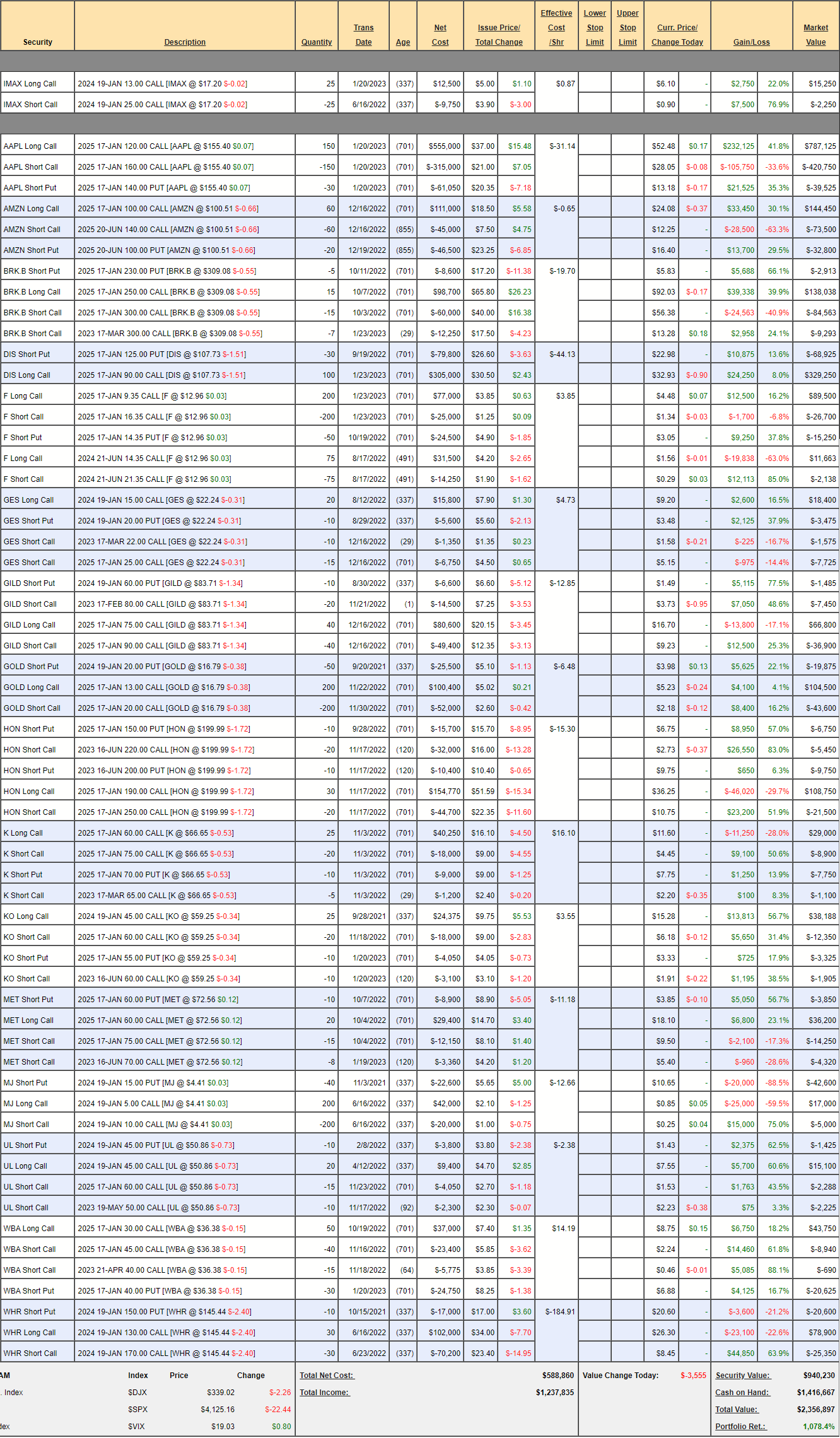

Butterfly Portfolio Review: $2,356,897 is up $340,213 (17%) and that’s up 1,078% overall in our oldest and most reliable portfolio. The reason we didn’t close this out with the others was to demonstrate the power of compounding these spreads – once we were past our first 100% goal (we started with $200K on 1/2/18).

This portfolio fully employs our “Be the House – NOT the Gambler” strategy and there is nothing better for the Butterfly Portfolio than a slowly rising market (so our short calls don’t get blown out). The VIX is also down 10% since our last review – also helpful in a portfolio where we sell a lot of premium.

-

- IMAX – Earnings are next week but Avatar should give them a boost so let’s sell 10 of the July 2024 $17 puts for $3 ($3,000) while we still can.

- AAPL – We doubled down last month with AAPL at $135 and now it’s $155 so great timing and huge gains. We are fully covered and I don’t think AAPL is done going up so we’ll leave them for now.

-

- AMZN – Having spent so much on AAPL, we left AMZN alone last time. Now it’s net $38,150 on the $240,000 spread that’s at the money so the upside is over $200,000 and we have 2 years – so we wait… I am concerned that AI will be a threat to their model too.

- BRK.B – We sold the March calls for income and all is on track.

- DIS – We bought back the short calls and got more aggressive on our longs and we got a nice pop but it’s a rebuilding year and they’ll be lucky to make $8Bn and $107.50 is $200Bn so 25x with $40Bn in debt and we’re currently tying up $260,000. We could sell 100 2025 $120 calls for $17 and there’s $170,000 back and that leaves us net $90,000 on the $300,000 spread. Is this the best use of $90,000? Actually, yeah, it’s pretty good – let’s do that!

It’s not JUST about the spread. DIS is a company we’re happy to own for 20 years and we’re getting $170,000 back over 2 years, which is 15% of the stock price so there’s not much downside if we REALLY intend to stick with them as we’re not worried about having the stock put to us. The $90 calls are $170,000 in the money at the moment so net $90,000 sounds pretty good with 233% upside potential on a very blue-chip stock.

-

- F – Just paid a special dividend so the numbers changed but still on track.

- GES – Earnings mid-March so we wait.

-

- GILD – The short Feb calls expire on Friday so let’s sell 20 of the May $80 calls for $6.20 ($12,400) for the next 90 days. See how we make our income? The whole $60,000 spread is net $20,965 and we’re collecting another $12,400 (59%) over 90 days!

-

- GOLD – They were just at $20 and now back to $17. Still, this is a $140,000 spread at net $41,025 so not too worried about short call income.

- HON – Right on track.

- K – Also on track after being too high for a bit. That’s the nice thing about being a value investor – we KNOW what the right price is – we just have to wait for it…

-

- KO – Right on track.

- MET – A bit higher than I thought but no harm.

- MJ – Gambling that they pass some sort of legislation on banking but have to wait for the budget battle to be resolved. Could be a while.

-

- UL – Right on track.

- WBA – A bit below target but it’s an April target – after their next earnings.

- WHR – Now that earnings are out of the way, let’s buy back the short Jan $170 calls at $8.45 ($25,350) and give them a chance to get back over $160 and then we will roll the 2024s to 2025s and cover.

Things must be going well as DIS is the only major change after earnings (for most).

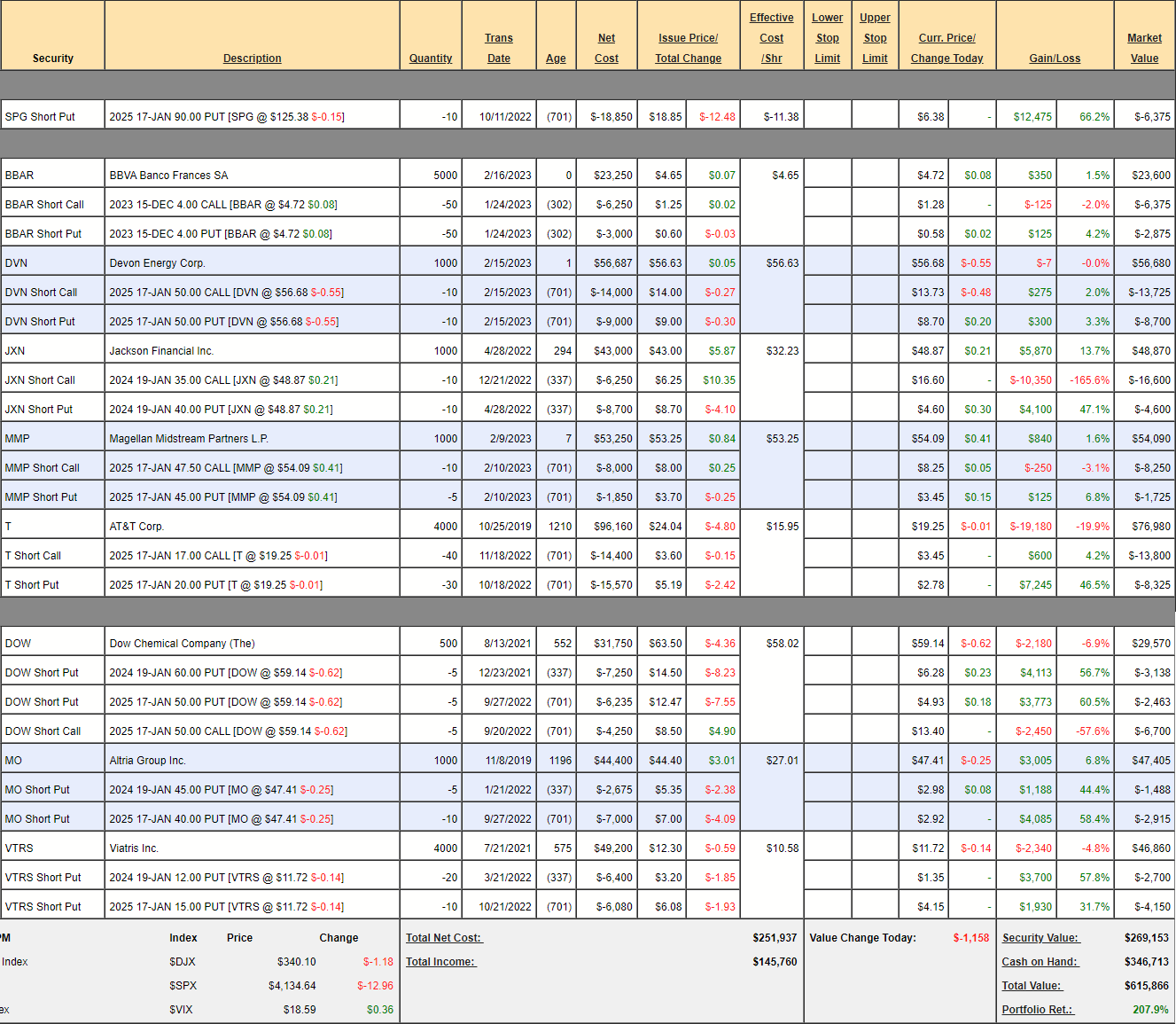

Dividend Portfolio Review: $616,047 is up $19,304 (3.2%) in our most conservative portfolio. Overall we’re up 208% since 10/25/19, so right on track for our 30-40% projected annual returns.

This is so conservative that we made no adjustments last month and we have since added 3 new positions and we’re still about 50% in CASH!!! Still just 9 positions.

-

- SPG – We promised to buy SPG for $90 and they paid us $18.85 so our worst case would have been owning them for net $71.15, which is now about 55% below the current price. We don’t need the margin so no sense in buying them back – even though they are miles ahead of schedule.

-

- BBAR – We just added these and I really like this spread.

- DVN – We just added these and I really like this spread.

- JXN – To the moon, Alice!

-

- MMP – Our other new one. Still a good entry.

- T – Would have been our stock of the year if they hadn’t popped in early November. Now it’s just “on track” – yawn…

-

- DOW – They were stupidly low and we sold extra puts but now back on track.

-

- MO – They seem to be muddling through but I was disappointed on the last earnings.

- VTRS – It’s at our goal a year ahead of schedule but still only net $40,010 on the $60,000 spread plus we expect $3,840 in dividend payments so $23,830 potential profits is 59.5% over the next two years – not bad!

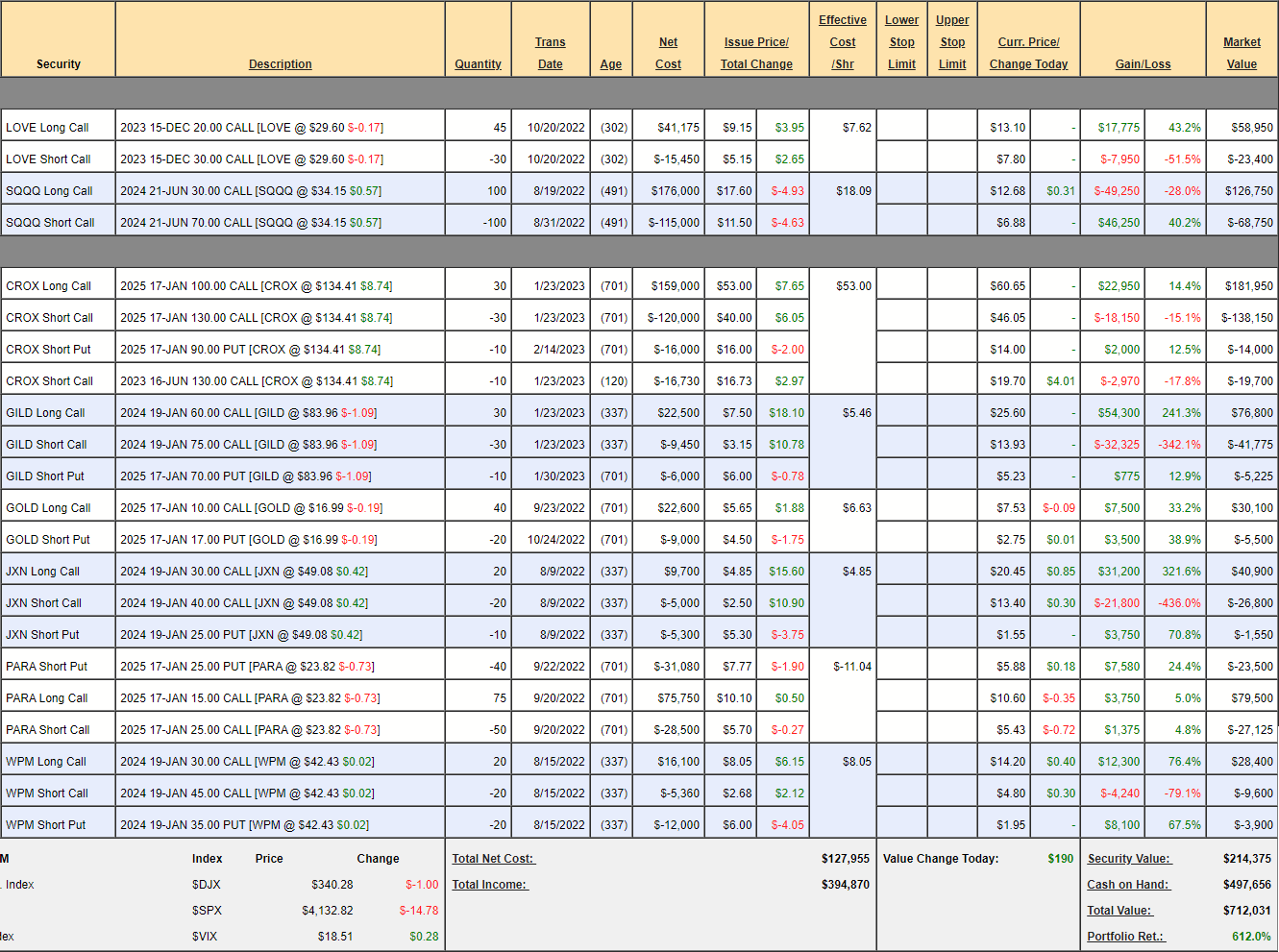

Earnings Portfolio Review: $712,031 is up $36,840 (5%) since our last review, when we didn’t change much and we haven’t added any new ones and we’re 70% in CASH!!! – so what did we expect?

With the SQQQs, this is a self-hedging portfolio.

-

- LOVE – At our goal already and we’ll see how they do around $30. Earnings are the end of March.

- SQQQ – It’s a $400,000 hedge if the Nasdaq drops 33% and we only have $214,375 worth of positions so we’re a bit over-hedged at the moment. Still, it’s pretty cheap insurance at net $58,000 – especially as it’s $41,500 in the money to start.

-

- CROX – We scrapped the old position so this is technically new and still a great spread at net $10,100 on the $90,000 spread with $79,900 (791%) upside potential at $130 and CROX is at $134 now. Why do people hate CROX so much they are scared to take a 100% in the money spread for 12.6% of what it’s worth? I cannot explain it but it seems like a pretty easy way to make $80,000.

-

- GILD – Let’s sell 15 of the June $85 calls for $4.20 ($6,300).

- GOLD – Waiting for $2,000 on /GC.

- JXN – Way in the money at net $12,550 on the $20,000 spread but, as I said, we don’t need the money or margin so we may as well wait for our $7,450 (59%) at the end of the year. It’s funny how spoiled we are at PSW that we don’t even consider that as a new trade!

-

- PARA – Earnings tonight so we’ll see. We’re pretty aggressive here with a 2/3 cover.

-

- WPM – An old Trade of the Year coming around again for a nice payday. It’s a $30,000 spread currently at net $14,900 so another case of a 100% upside potential (in less than a year) being too boring to bother with. Spoiled!!!

— Friday —

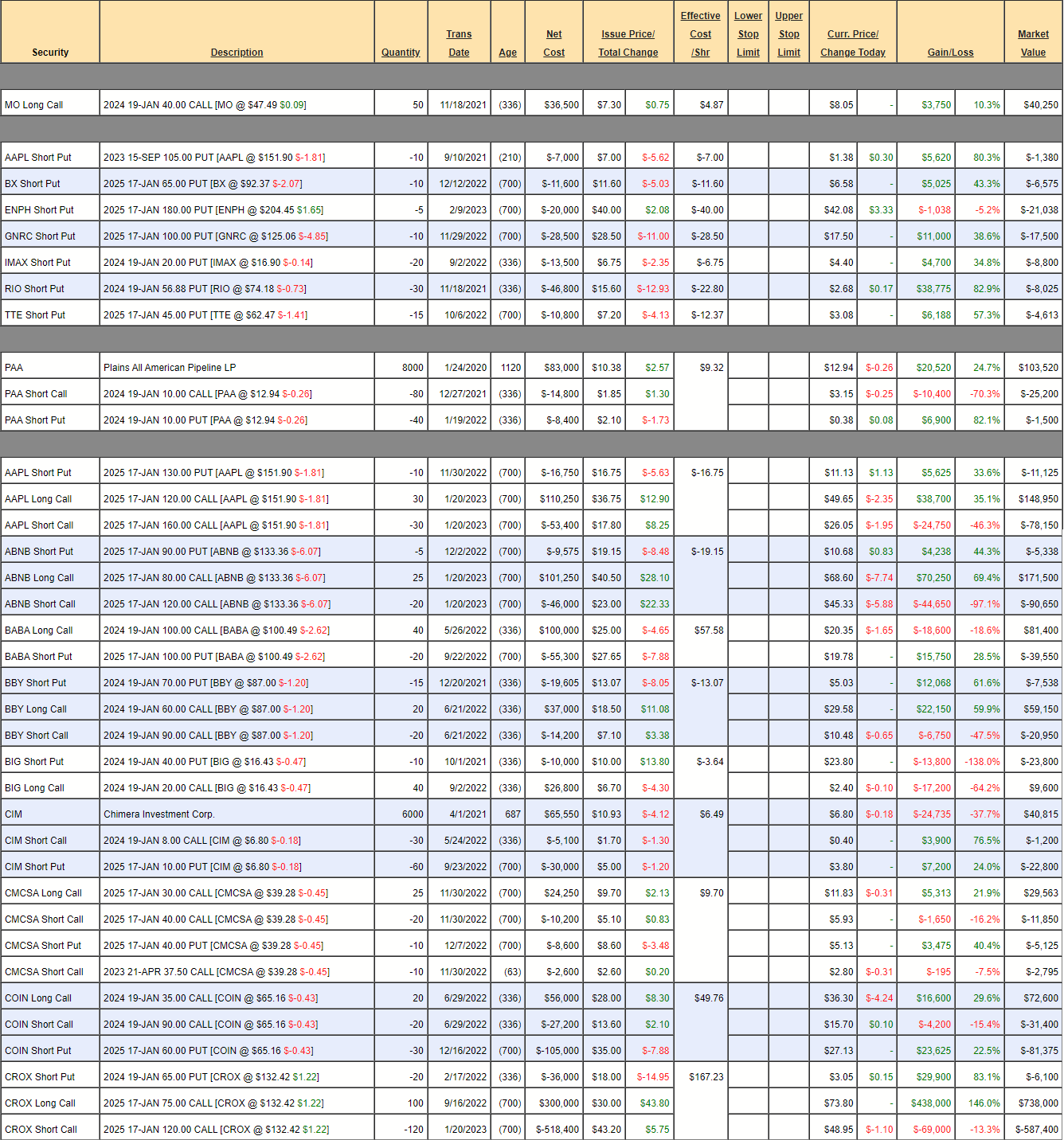

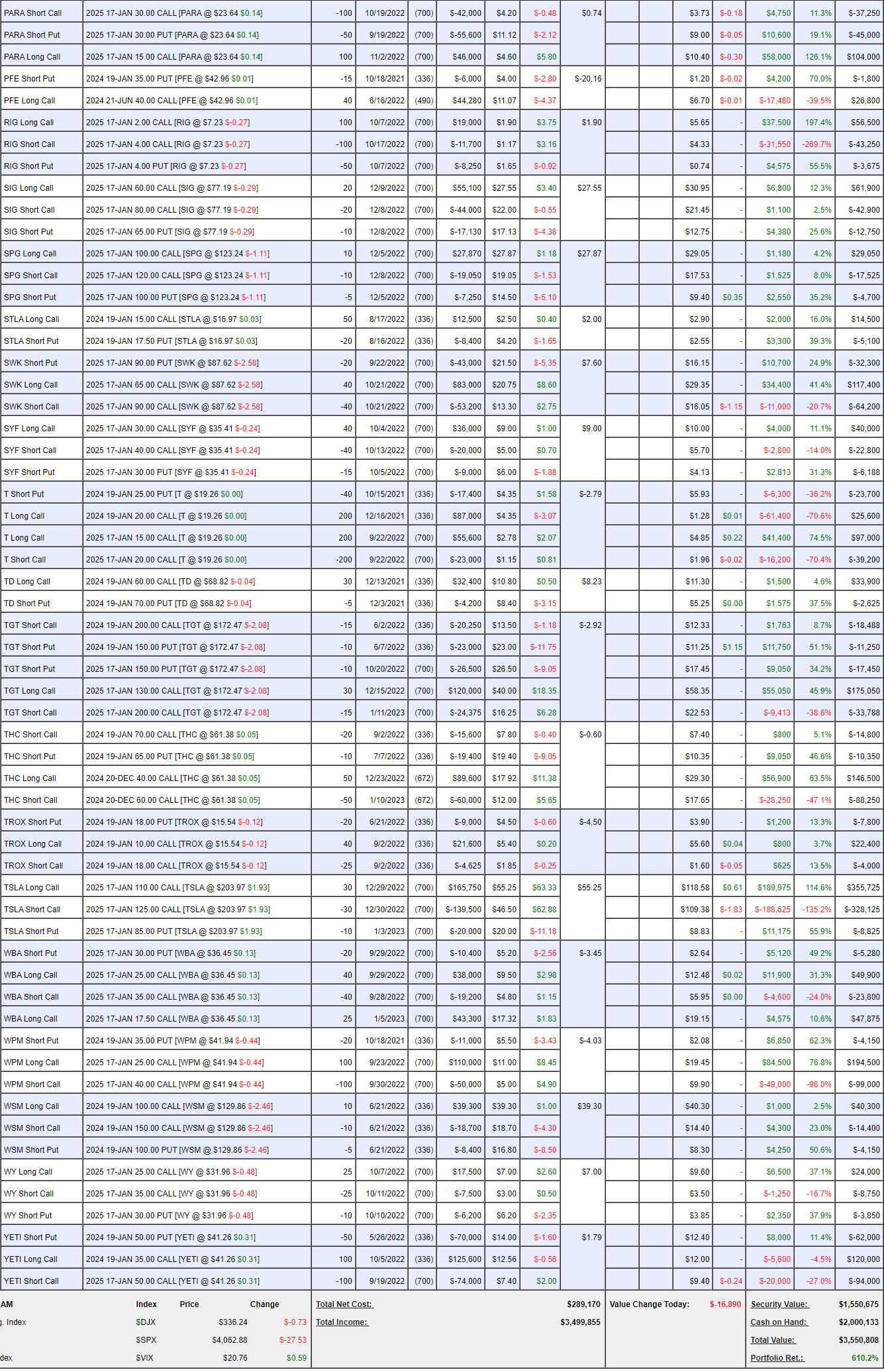

Long-Term Portfolio (LTP) Review: We made only a few changes in last month’s review and only added 3 new positions since yet we’re now at $3,550,808, which is up a nice $268,125 (8%) since last month and that’s really good when you consider we only have net $1,550,675 in positions and the rest is still in CASH!!!

We’ve been waiting for earnings to deploy our cash and it’s almost time but first let’s see if we need to be making adjustments.

-

- MO – We’re waiting for $50 to start to hedge this one.

- Short Puts – ENPH is new and the rest are on track. I’m not worried enough about AAPL and RIO to buy them back early – may as well collect the rest.

-

- PAA – Just paid us an 0.268 ($2,144) dividend on the 30th. We’re tying up $77,100 on the $80,000 spread that’s deep in the money and $2,144 is 2.7% per Q while we wait. Still, we can do better so let’s buy back the short puts ($1,500) and sell 20 2025 $15 puts for $3.40 ($6,800) and use that net $5,300 to roll our 80 short Jan $10 calls at $3.20 ($25,600) to 80 short 2025 $12 calls at $2 ($16,000). The whole change will cost us net $4,300 and we’re giving ourselves $16,000 more upside potential at $12 and another year to collect dividends ($8,576).

-

- AAPL – We had a short put and we added the spread to it last month.

- ANBN – Another new one that took off already. Even though we went conservative with the $80/120 spread at net $45,675, we’re already at net $75,313 – up 65% in a month but still $24,687 left to gain + 5 uncovered long calls. There’s a reason I fixate on value stocks when they are oversold…

You don’t have to take big risks to make big returns. Once you realize that, you will have a lot more fun trading…

-

- BABA – Rejected at $120 and now back to $100, where it’s good for a new trade again.

- BBY – Consolidating below $90 with earnings on March 2nd so we’ll wait.

- BIG – I think they are way undervalued down here but not confident enough ahead of earnings (also 3/2) to put more money in. We’ll just be happy if they pop.

-

- CIM – Just had earnings that disappointed a bit but dividends should be 0.23 ($1,380) next month against our net $16,560 position and that’s 8.3% per quarter while we wait – so we’re happy to wait. If the short calls expire worthless we just sell more and lower our basis (currently net $4.23/7.115). Certainly that’s nothing to worry about.

- CMCSA – At our goal and on track.

- COIN – Finally seeing some nice profits.

-

- CROX – EXPLODED higher! It’s a bit over our $120 target and we’ll see how they settle out.

-

- DELL – On track.

- DVN – Brand new.

- EXPE – Brand new but they missed earnings. Fortunately, we only took a small position so let’s double down on the 2025 $100 calls at $32.50 ($32,500) and let’s sell 5 more 2025 $100 puts for $17 ($8,500). So we’re spending net $24,000 more but we could cover the new 10 for $20,000 and that would be net $4,000 but let’s see if we can get a bounce first and hopefully sell for $25,000+ to cover.

-

- GOLD – Took a big dive from $20 but I want to stay aggressive. Currently a victim of a strong Dollar from a country that’s 150% of it’s GDP in debt.

- GOOGL – I am getting worried about these guys with AI around. We can give them another quarter, I think.

- HBI – They guided down and pulled dividends but we’re in for the long haul.

-

- HPQ – On track.

- INTC – Earnings were not terrible and we’re on track with a very conservative position.

- JD – On track. Again, saved by a very conservative entry at the time.

- JPM 1 – Over our target and only half-covered. We’ll roll the short calls to higher 2025 strikes at some point but I think it’s fine for now.

-

- JPM 2 – Also over our target and this is a $100,000 spread at net $28,205 so lots and lots to gain here.

- JXN – Superstock is in a lot of our portfolios.

- LEVI – They beat and raised guidance on 1/25 but have pulled back from $20. I don’t think we’re too aggressive so we’ll see how it goes.

-

- LMT – Our stock of the Century and we’re only 1/4 into it. Miles over target but net $59,175 on the $70,000 spread makes it kind of silly to sell and not make the additional 18.2% in 11 months, right? We have tons of cash making 0%, so why add to that pile?

- LOW – Also over target (kind of a theme in this portfolio).

- MDT – On track.

- MET – Almost at target with 2 years to go.

- META – At target.

- MRNA – I love them long-term but not so sure how they’ll do short-term. We made $35,000 but that will deteriorate if we can’t crack $200 and 30 puts can get uncomfortable so let’s buy back the short puts for $56,100 with a $45,600 (45%) gain and then we have no downside worries so, if MRNA goes lower, THEN we can sell short puts and roll down our long calls. Our original net was a $41,700 credit with the aggressive puts so now we’re just in the $150,000 bull call spread for net $14,400 – that’s not too risky, is it?

-

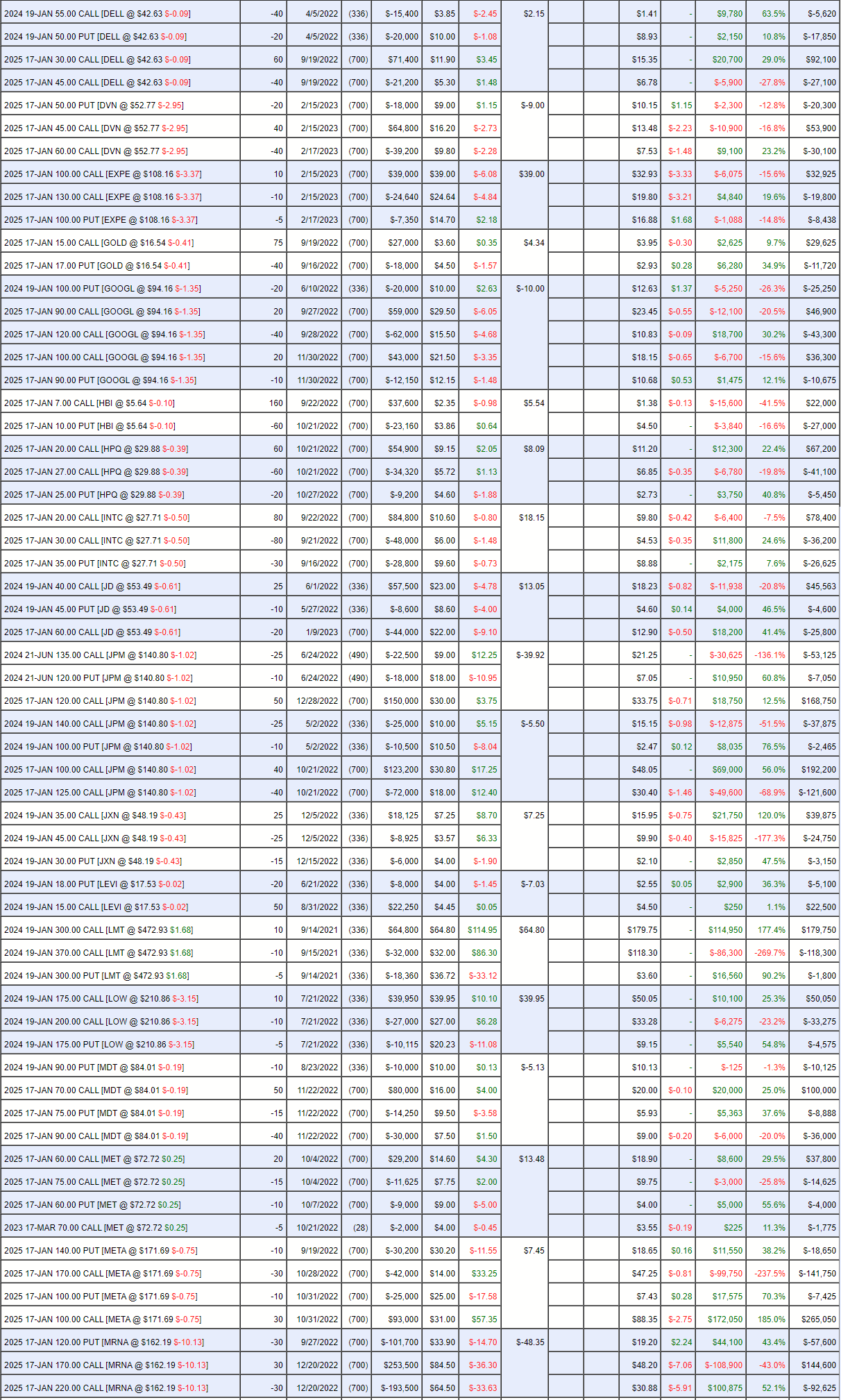

- NFLX – We did not think they’d do this well but that’s fine as we’re +$100 in the money on our $200,000 spread which is currently net $151,222 so we’ll make another $48,778 (32%) in 12 months as long as NFLX doesn’t fall about 30%. Aren’t options fun?

-

- PARA – Finally on track.

- PFE – Back to $43 is time to buy if you don’t own them. They missed Q4 as it was only up 44% from last year – traders are idiots! Lower guidance for 2023 is $3.35 per $43 share so 13x is fine by me in an off year. The June 2024 $40 calls are $6.80 ($27,200) and the 2025 $35 calls are $10.75 so 60 of those are $64,500 so let’s do that roll and sell 15 of the 2025 $50 puts for $8.50 ($12,750) so that’s net $24,550 spent to be $48,000 in the money with more time to be right. If they go lower, THEN we sell 2025 $45s for $6+ and we use that money to roll to the 25 calls (now $19) and we’d be in the $120,000 $25/45 spread for net net about $45,000. If we can live with that then the roll makes perfect sense.

-

- RIG – I can’t believe this $20,000 spread is only net $9,325 when it’s 175% in the money. That’s just crazy!

- SIG – On track.

- SPG – At target already.

- STLA – Also very aggressive and working just fine.

-

- SWK – At goal.

- SYF – On track.

- T – Finally getting a bit of respect. We loaded up in September as I said it was silly and now you can see that it was. Hopefully we can hit $25 and cash out our original 200 Jan $20s better than even but we’ve already made up half the loss.

-

- TD – Waiting for them to have a proper breakout.

- TGT – Earnings 2/27 so we’ll see. Doing very well so far.

- THC – Coming back very nicely.

-

- TROX – Just had disappointing earnings but we love them long time.

- TSLA – Now this one is silly as the short calls are cancelling our gains on the long calls but that means that, even though our $45,000 spread is $75 in the money, the net is still only $18,550. We can’t let that go without a response (not when we’re sitting on $2M in cash!), so let’s sell 10 of the TSLA 2025 $130 puts for $21.50 ($21,500) and let’s roll our 30 2025 $110 calls at $117.50 ($352,000) to 50 of the 2025 $100 calls at $123 ($615,000) and let’s roll 30 short 2025 $125 calls at $107.50 ($322,500) to 50 of the 2025 $150 calls at $93.50 ($467,000). We moved a lot of chips but only spent net $97,000 and now we’re in a net $250,000 spread that’s deep in the money at net $115,550 so the upside potential has gone from $26,450 to $134,450.

-

- WBA – Down from $42 in December is very disappointing but I still like them long-term and our target is $35, which we’re still above with 2 years to go. Once again, conservative betting pays off!

- WPM – Also already in the money with a year to go (and 50% upside from here).

- WY – On track.

- YETI – Our Trade of the Year is not impressive so far. Earnings are next week, so we’ll see. This is a net $33,750 credit on the $150,000 spread so $183,750 (544%) left to gain if we can get to $50 in two years. When I put it that way, I want to double down!

Only 5 adjustments on 57 positions means we must be doing something right. $3,566,985 in the LTP and $3,940,453 in the STP (as of now, which is up $52,000 since Tuesday), which has $5M of protection, gives us a new record-total of $7,507,438, up from a $700,000 start on 10/28/20. Gotta love those pandemics!

Again, the takeaway is supposed to be we don’t need to do crazy things to make great money. Buy blue-chip stocks that are a good value and use options to hedge and leverage the plays and you can make fantastic returns WITHOUT taking a lot of risk.

Check out the last half hour of this week’s Webniar, where I explain how I developed this strategy over time: