Taxes

Courtesy of Scott Galloway, No Mercy/No Malice, @profgalloway

Politicians get elected by telling us we can have our cake and eat it, too. The only thing that’s passed for bipartisanship over the past four decades is reckless spending. Democrats want more social spending, Republicans want lower taxes. OK, let’s compromise — do both and fuck over our grandkids. The result is an accelerating and unsustainable increase in the national debt, with no slowdown in sight. Democrats say we need to raise tax rates, particularly on the top 1%, and Republicans say we need to reduce spending. As Yoda said, “There is another (way).” The good news: We don’t have to raise taxes (we may even be able to lower them). The bad news: Everyone has to pay what they owe.

Bipartisanship

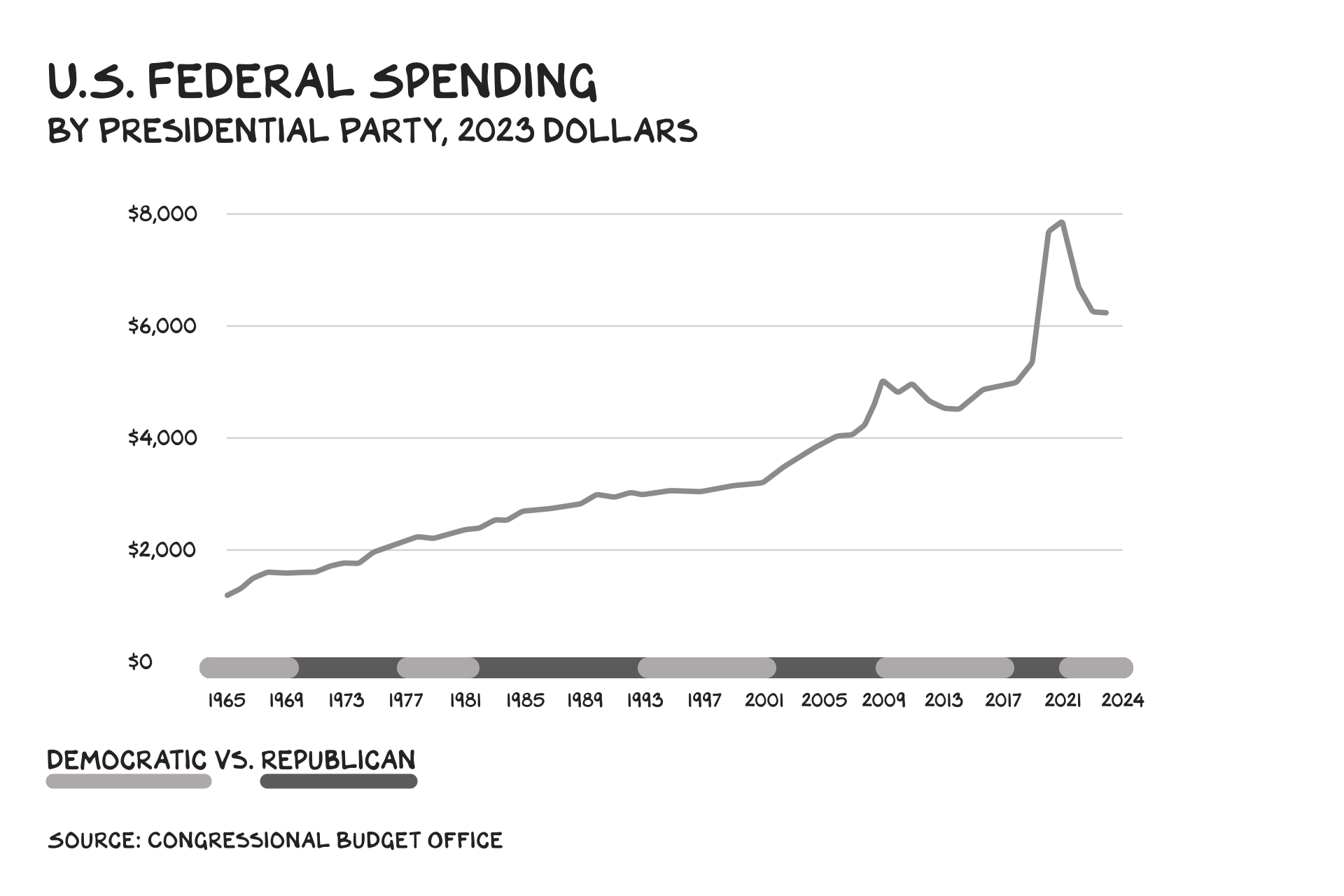

How did we get here, and how bad is it? First off, let’s dispense with one of the most tired false dichotomies in American politics: that increased government spending is the exclusive product of the Democratic Party. Republicans spend as much as Democrats, often more; they just spend on different things. If D.C. were a new-economy startup, it would be a Buy Now, Pay Later SPAC.

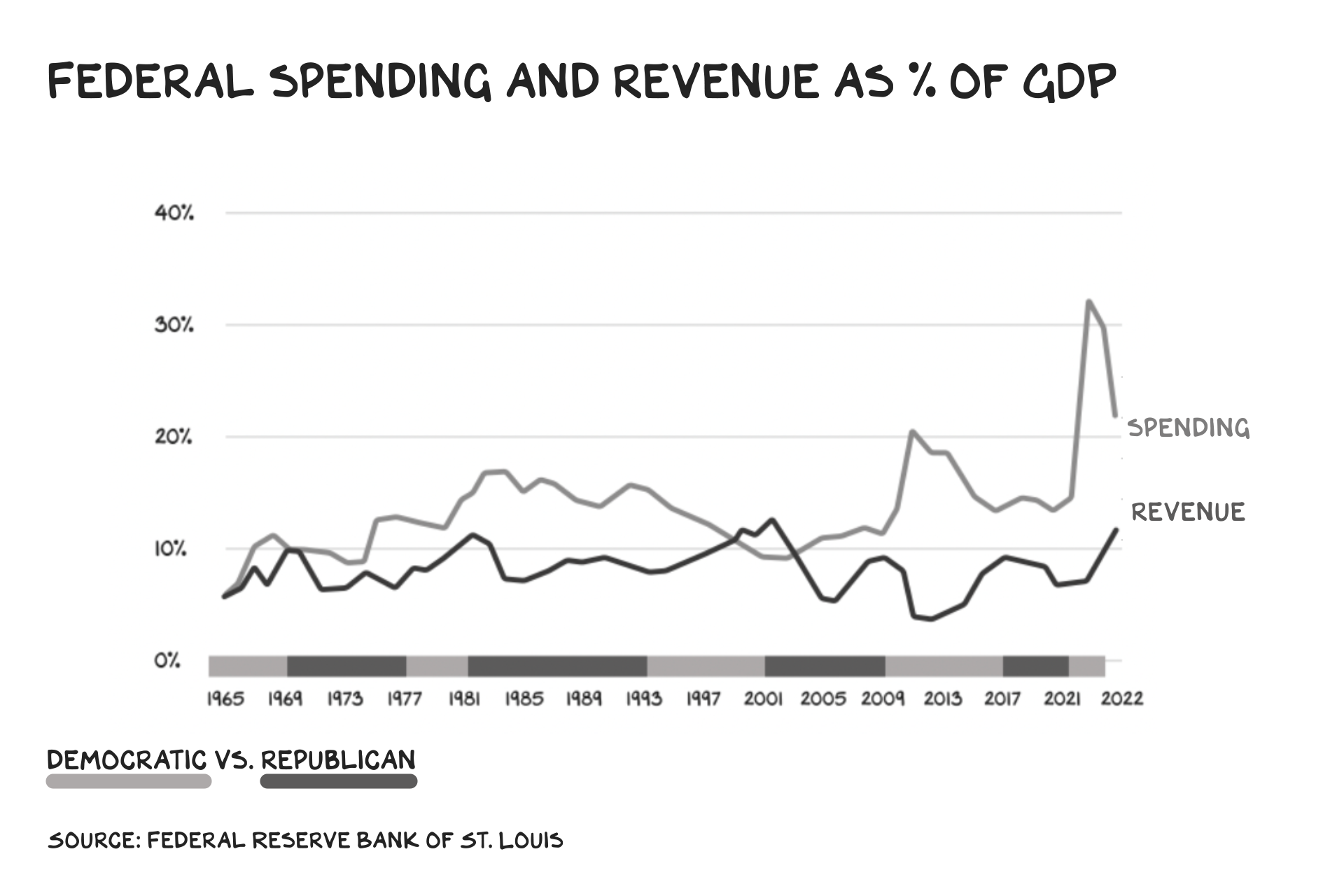

Steadily increasing government spending is justified — a larger economy can support more spending, and a larger population requires it. In fact, except for the financial crisis and Covid bailouts, our spending as a percentage of GDP has grown only modestly since the 1960s, from about 17% to just over 20%. Certainly, we could spend less, but spending isn’t the problem. The problem is that we aren’t funding the spending we’ve agreed upon.

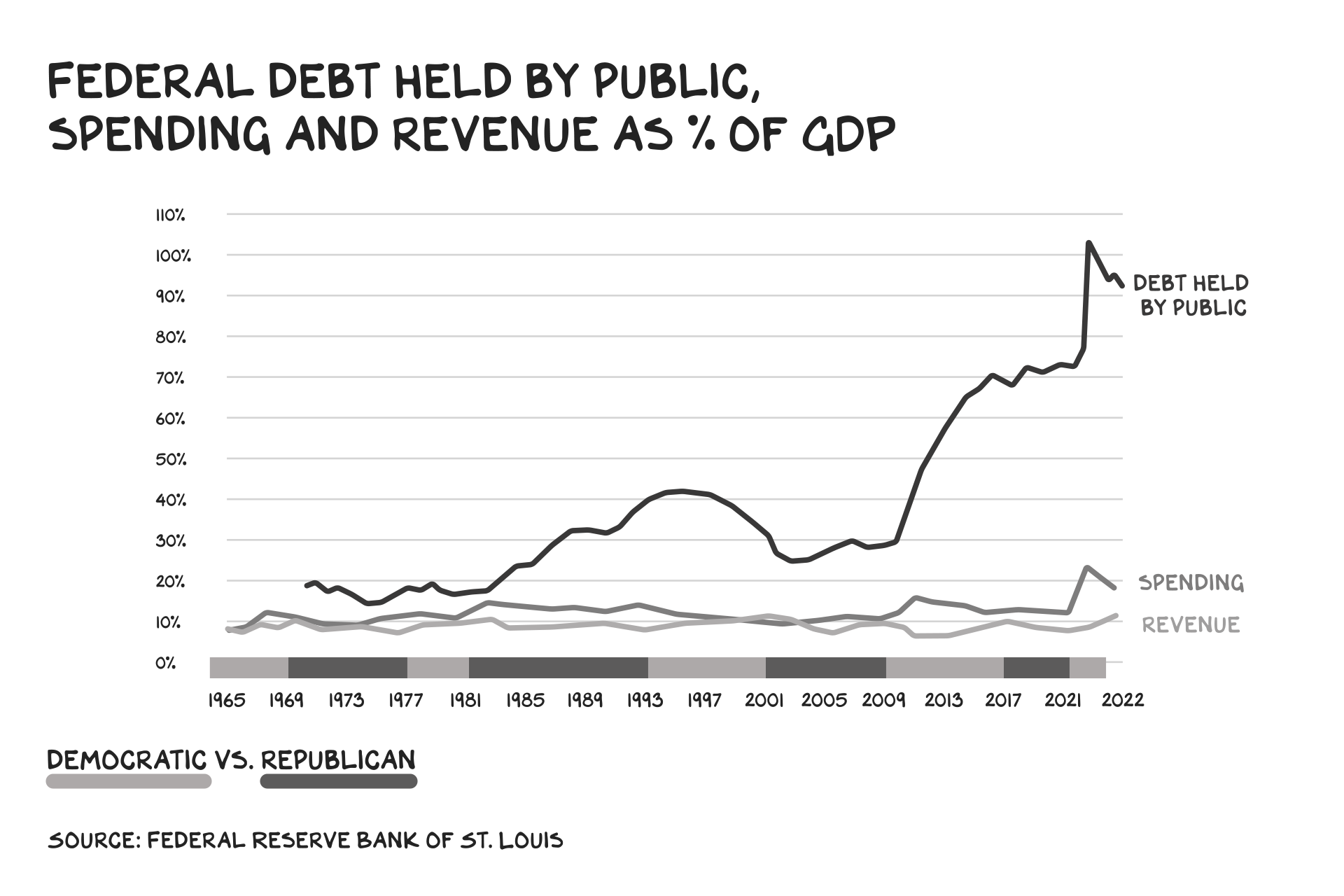

We’ve covered the difference with debt. Math doesn’t care about our preferences, however, and the result is that the U.S. government now owes what our economy produces in a year.

Government debt is not all bad: the government enjoys an extremely low cost of debt, and every dollar of spending we fund with cheap debt is a dollar we don’t have to pay in taxes today. Economists argue over what constitutes a healthy level of national debt, but 100% of GDP doesn’t seem great. The U.S. was born with a debt of 30% of GDP, and we kept it below that level for most of our history. The latest projections put it at 118% by 2033.

And so politicians promise to reduce spending. Which they aren’t going to do. That means if we want to stop the debt load from spiraling upward, we’re going to have to increase revenue. “Revenue” however, is government-speak for taxes, and raising taxes is neither politically palatable nor economically appealing. But we can make a major step toward closing the gap between our spending and our revenue. By actually collecting the taxes we’re owed. The distraction is tax rates; the focus should be the tax code and enforcement.

Mind the Gap

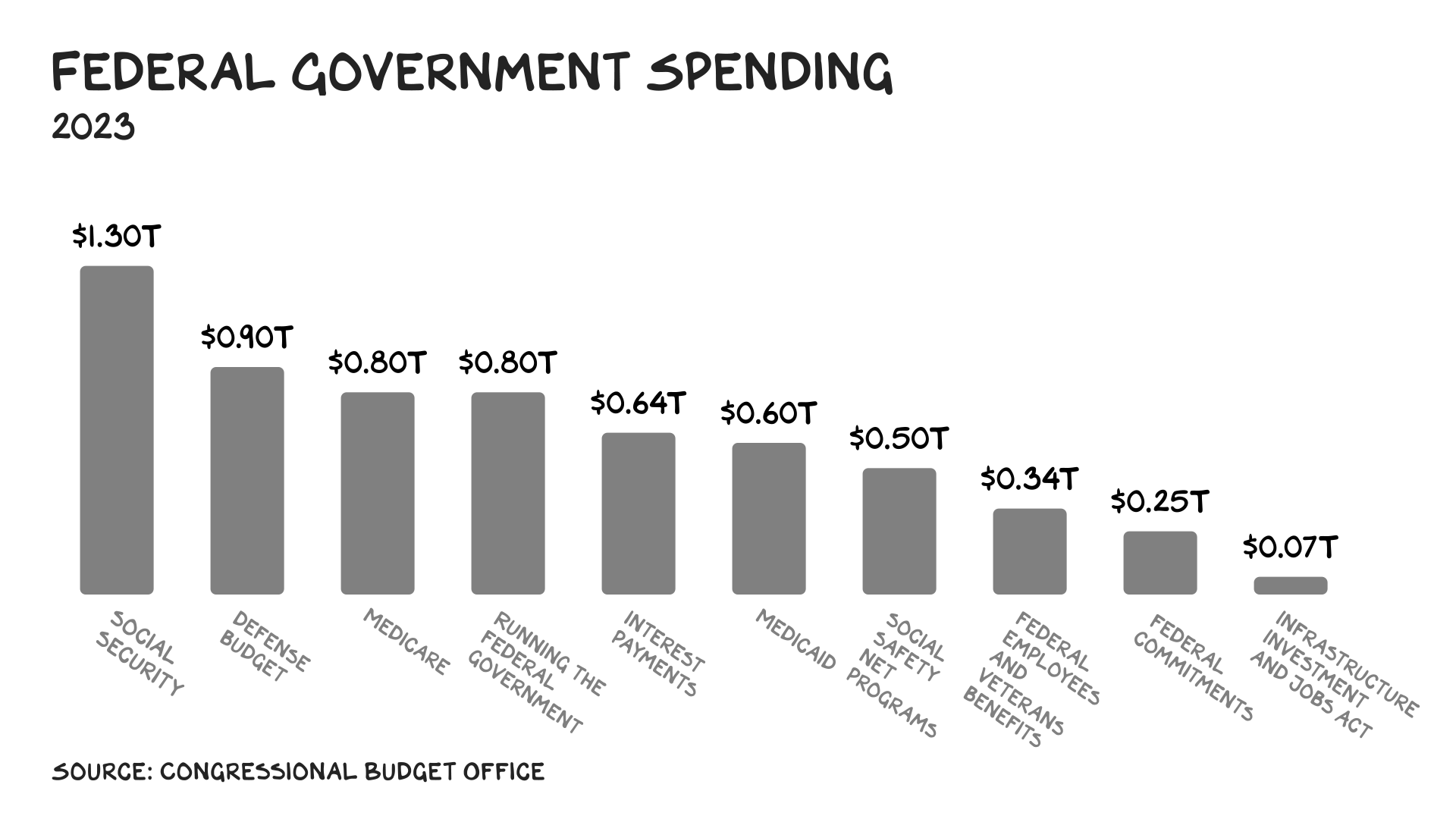

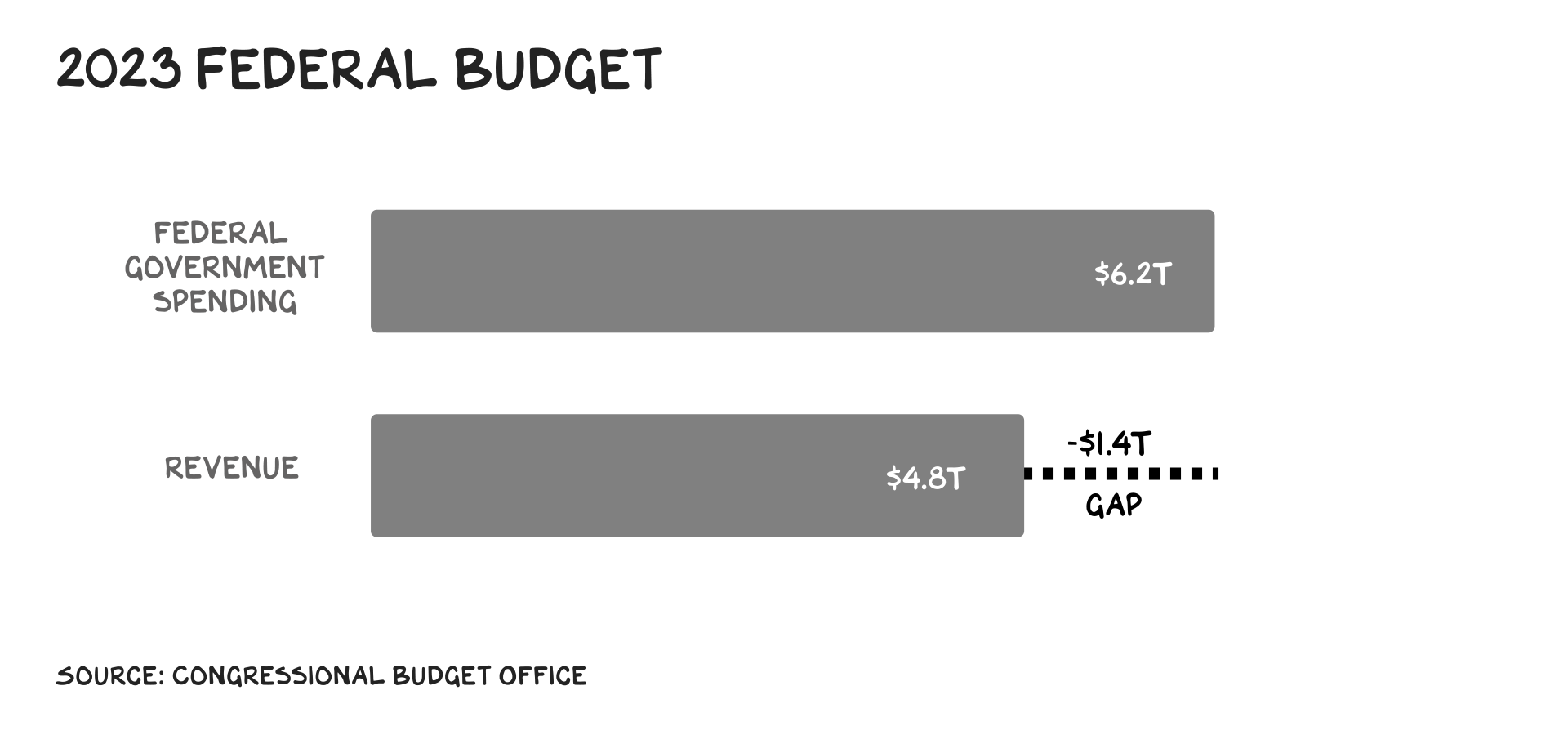

The CBO estimates the federal government will spend $6.2 trillion in 2023. How do you spend $6.2 trillion?

To pay for that spending, we’ll raise $4.8 trillion.

So how can we avoid adding an additional $1.4 trillion to our national debt this year? We can narrow the gap substantially by clamping down on two massive drains on revenue: tax evasion and tax avoidance.

Evasion

There are two ways to not pay taxes: illegally and legally. The illegal method is called “tax evasion.” This is where you understate or underpay how much you owe, or simply don’t pay at all. The laws forbidding this behavior are barely enforced. The IRS officially estimates we lost $470 billion to tax cheats in 2019, and in 2021 the head of the IRS told Congress that the figure is likely much higher, perhaps as high as $1 trillion per year. Somewhere around the entire U.S. defense budget is stolen by tax cheats.

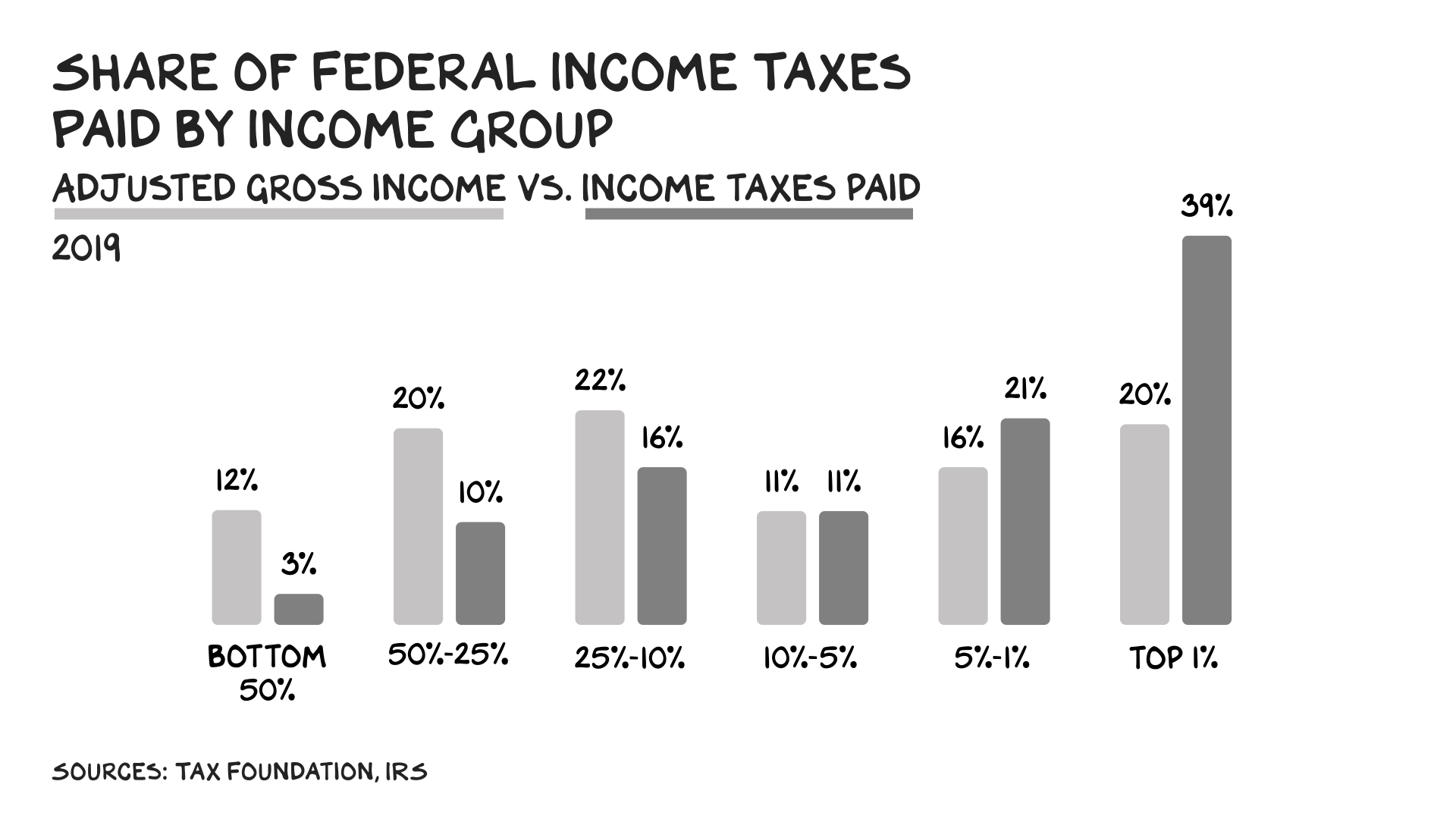

The lion’s share of the problem lies in the tax returns of the wealthy, as that’s where the money is. The top 5% of households by income lay claim to over a third of all income; the top 25%, two-thirds. And their income tax obligations make up the bulk of income taxes owed. (Note: Payroll taxes and sales taxes consume a greater share of lower-income household earnings — the net tax burden is much closer across income levels.) One study by a team from the IRS and several leading universities found that 36% of evaded taxes are owed by just the top 1% of households.

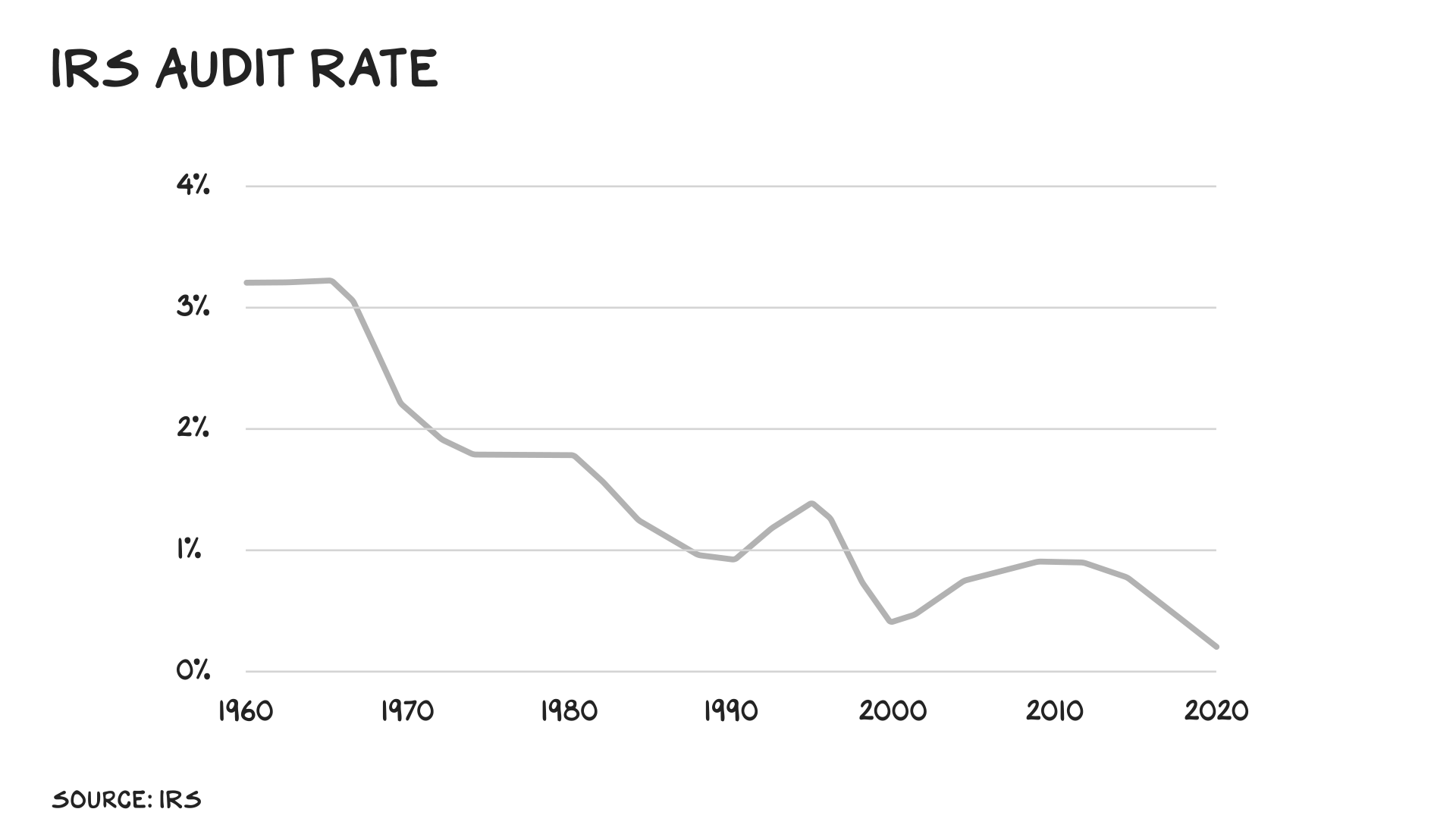

The source of this problem is no mystery. We’ve defunded the tax police. Demonizing the IRS gets votes. Especially Republican votes. From Reagan to Trump, the federal budget’s relationship with the IRS has been an abusive one. The agency hasn’t had enough money to do its job for years, which is reflected in its audit rates, now at all-time lows. For the wealthy, this is a feature, not a bug. Cutting the IRS’s budget has effectively raised taxes on lower- and middle-income households, shifting the burden to fund the government from the wealthy to the less wealthy, even as debt stifles programs the less wealthy depend on.

Fixing this should be a bipartisan issue. How to do it? Give the IRS back the resources to enforce the law. Yet Biden’s revitalization of the IRS, the first in decades, was met with a torrent of falsehoods, including Speaker McCarthy’s claim that it would fund an “army of 87,000 IRS agents” (actual number: fewer than 200). In truth, Biden’s program is a start, though it likely won’t be enough to bring that $500-billion-plus-per-year number down to zero. We need to invest more.

Avoidance

Tax avoidance is legal, and from the taxpayer’s perspective, I would argue it’s moral. The government is not a charity, and nobody should cough up taxes they aren’t legally obligated to pay, or the entire system loses its democratic footing. Prisoners of war have an obligation to try to escape; citizens of capitalist countries have an obligation to pay the lowest legal tax.

What’s immoral, and costing us billions, is the system that permits tax avoidance schemes of the scale and complexity we have. Again, it’s the rich who benefit, because working-class people have neither the means to hire tax lawyers, nor the complexity of finances necessary to take advantage of all the loopholes in the law. And the biggest beneficiaries are the richest taxpayers of all, corporations. If you can navigate by starlight, you want to run boat races at night.

Corporate income tax revenue as a share of GDP has been slashed from 3.5% in the 1960s to 1% today. (Not entirely because of fancy tax avoidance: The Trump tax cuts lowered the corporate tax rate from 35% to 21%, the lowest it’s been since 1939.) The argument in favor of low corporate tax rates is that greater capital inflows and investment will get passed on, i.e., “trickle down,” to employees and consumers. There is no evidence this has ever worked. As in … ever.

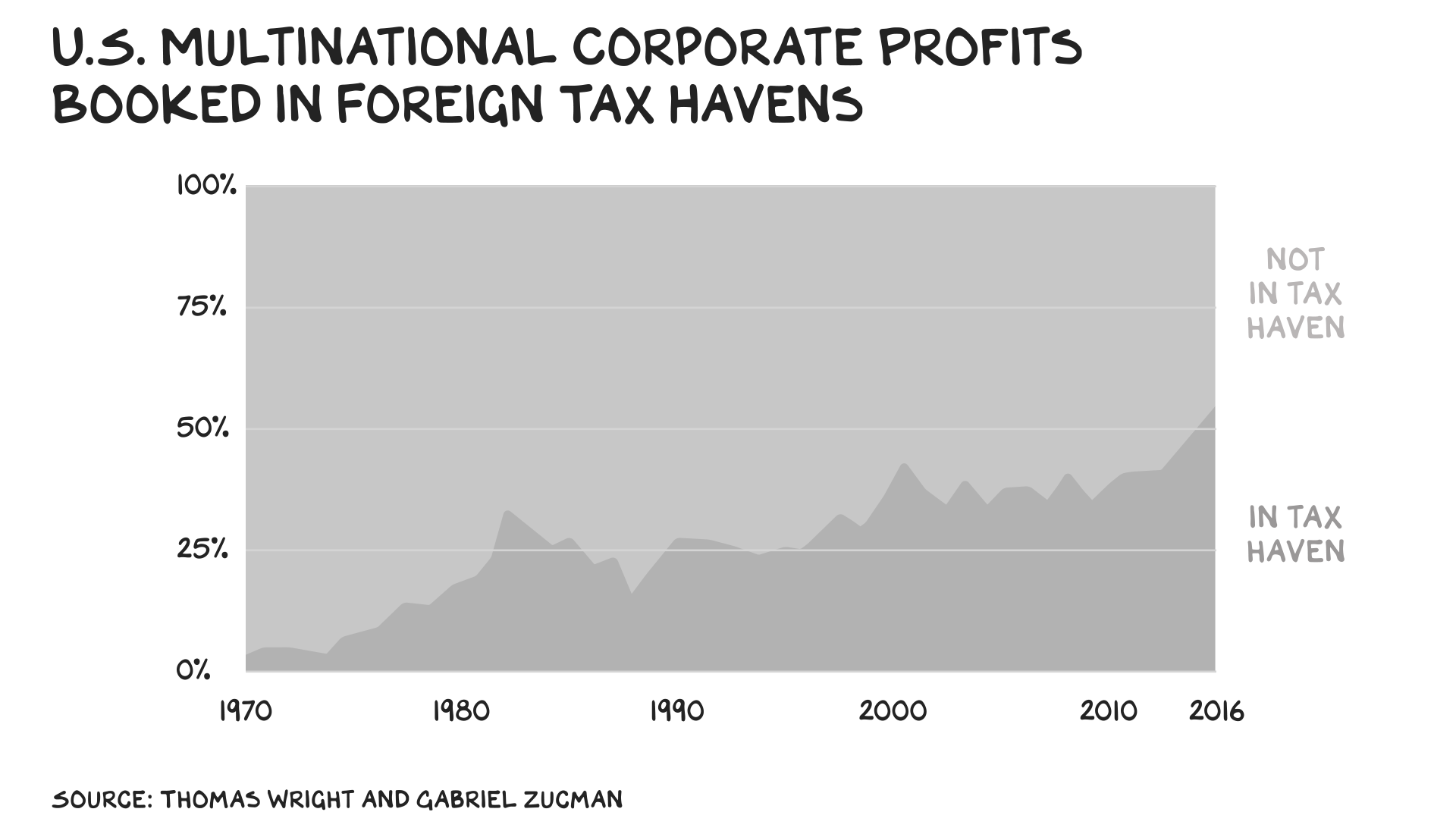

The preferred means of tax avoidance by corporations is offshoring and profit-shifting. That is, setting up operations in low-to-zero-tax-rate domains such as Ireland and then reporting your income there. In 2015, U.S. companies booked $46 billion in profits in the Cayman Islands alone, 17 times the value of the entire Cayman economy. Today more than half of multinational corporate profits are booked in foreign tax havens. Read the last sentence again: The fruits of the American system are funding other nations’ prosperity in exchange for lower tax rates on corporations — which, again, transfer wealth from the poor to the rich. The top 10% of households own 89% of U.S. stocks, and register the gains from companies paying less tax.

The amount of money we’re losing to this practice and other corporate tax avoidance strategies is devastating. Amazon, one of the most valuable companies in the world, paid $162 million in taxes in 2019: 1% of its pre-tax income. Across the corporate landscape, it’s difficult to reach an exact number for what this costs us in lost revenue, and many different studies have tried, but the consensus appears to be somewhere in the ballpark of $200 billion per year.

We’ve tried to fix the problem. The same Trump tax cuts that reduced the corporate tax rate were supposed to address tax havens, but data has shown it didn’t work. We’ve also tried to fix things with a 15% global minimum tax on companies — that deal was signed by 136 countries in 2021, but it’s still a work in progress. And research suggests 15% isn’t high enough. It’s projected that a 15% minimum tax would generate roughly $50 billion more in revenue for the U.S. — compared to the $200 billion we’d get at a 25% rate.

Then there’s the tax avoidance of individuals, i.e., not corporations. The standard playbook among the ultrawealthy is to minimize your cash income — and instead, borrow money against your assets (stock, real estate, etc.). This is what allowed Jeff Bezos, Mike Bloomberg, Warren Buffett, Elon Musk, and others to pay zero dollars in taxes for several years. Of course, the media sensationalizes this to make it sound more nefarious than it is, as if they were illegally evading income tax, when in reality they were taking out loans against their holdings at ultralow interest rates. Rich people take out big loans, and loans aren’t taxable — another win for the rich. Senators barking at billionaires to “pay their taxes” are referees complaining about their own bad calls. Mssrs. Warren and Sanders, why do billionaires not pay their taxes? A: Because you let them. Do your damn job.

Tax havens are lucrative for individuals, too. According to one study, the top 1% of Americans avoid $175 billion per year using this strategy. In this case, the line between “avoidance” and “evasion” is blurry — per the researchers, it’s a “gray area.” Still, legal or illegal, that’s a shit-ton of money we’re choosing not to collect from the people best positioned to give.

Then there’s the unlock we’d get from reallocating talent. Some of the sharpest, hardest-working people I know are my tax advisers. No joke. I pay these people six figures, and they routinely save me seven. It’s a great ROI but a drain on society. We’re paying some of our best and brightest to solve problems of our own making — helping rich people navigate a maze other Americans can’t afford to enter. Am I a hypocrite for engaging in these strategies? Maybe. But I’m not going to disarm unilaterally … said every wealthy household.

Do the Math

Substantially reducing tax evasion and corporate tax avoidance could save us $1 trillion per year. That could go a long way toward closing the $1.4 trillion gap between our spending and revenue in 2023, without “raising” taxes at all. Indeed, it would more than pay for our current spending — it’s the $640 billion in interest costs on the debt that drags us back into the red.

Collecting the taxes we’re owed and aligning what’s owed to what’s paid is fundamental to building trust in the government and our institutions — something lacking in the U.S. Edmund Burke, a founding father of conservative thought, was deeply concerned about the stability and legitimacy of government. In his masterpiece, Reflections on the Revolution in France, he warned that the failure to collect taxes owed would be the downfall of the revolution. Failure to effectively impose a fair tax policy, he wrote, was akin to punishing the law-abiding and the productive for their virtue, and it would lead to tyranny. “Nothing turns out to be so oppressive and unjust as a feeble government.”

What could a strong and just government do with an additional trillion in revenue? The sensible thing to do would be to narrow the deficit. But if we’re comfortable with continued deficit spending (and that looks to be the case) imagine what else we could do merely by collecting the taxes we are owed.

- It’s within our reach to eliminate the federal income tax burden of the lower 90% of all U.S. households. That’s right, if your family makes less than $200,000 per year, your federal income tax goes to zero.

- Or we could make the child tax credit permanent — and 5x it to $15,000 per year. Why not? An aging nation needs a growing population to support it.

- Or we could eliminate payroll taxes (i.e. Social Security and Medicare taxes) on the lower half of households by income, thus hugely relieving their tax burden.

Whatever you think about these as policy, aren’t they better than letting the wealthiest Americans and the corporations they own continue to evade and avoid their just tax obligations? Americans are a prosperous, generous people. Let’s start acting like it.

Life is so rich,

![]()

P.S. Need more No Mercy/No Malice in your life? Every Monday, get our insights on Markets. On Wednesdays, we’ll answer your questions in Office Hours. And Thursdays we’ll share a Conversation — this week’s guest was Baratunde Thurston. All on The Prof G Pod. To resist is futile.

P.P.S. Our second-highest-rated sprint is coming up: Productivity & Performance (75 NPS). Berkeley Haas neuroscientists will teach you to build a plan suited to your unique brain so you can do better work without burning out. Sign up now.

Top Image by ❄️♡💛♡❄️ Julita ❄️♡💛♡❄️ from Pixabay