The markets are so silly!

The markets are so silly!

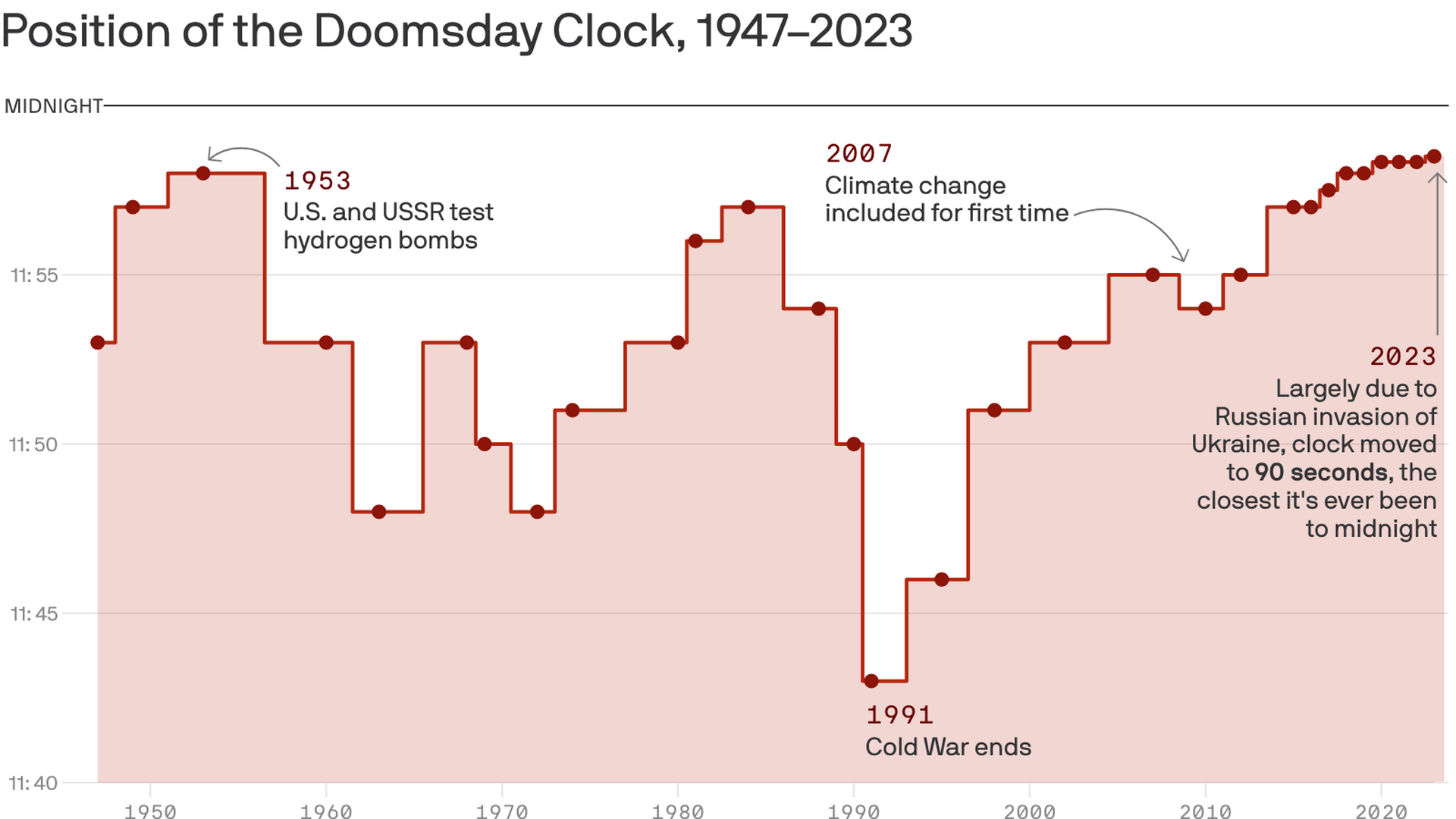

As you can see on the chart, the Dow rose an impressive 400 points off the bottom on Friday and now it’s given it all back this morning for pretty much the same no reason. Well, let’s say one reason could be Putin suspending Russia’s Nuclear-Arms Treaty with the US and pledging to continue the Ukraine War.

This came during Putin’s address to Russia’s federal legislature, where he blamed the West for provoking the “special military operation” in Ukraine. The U.S. State Department previously accused Russia of violating the treaty, which was established in 2011 to cut long-range nuclear arms by refusing to allow on-site inspections and ignoring Washington’s compliance concerns.

If you are not greeting your children every morning with a sincere “I’m sorry” – now would be a good time to start!

The United States and its allies plan to increase efforts to enforce sanctions against Russia by targeting foreign companies that help Moscow evade economic restrictions. In a speech ahead of the first anniversary of Russia’s invasion of Ukraine, Treasury Deputy Secretary Wally Adeyemo is expected to say that the Kremlin is making an all-out effort to evade Western sanctions, and that the US and its European Union and Group of Seven allies will be prepared to use sanctions, export controls and other tools to give companies doing business with Russia a stark choice: “To do business with a coalition representing half of the global GDP, or to provide material support to Russia.”

He added that Washington and its allies will also broaden export controls or sanction Russian companies that have been repurposed to help the military effort, and intensify efforts to identify and sanction the intermediaries helping Russia work around the oil-price cap.

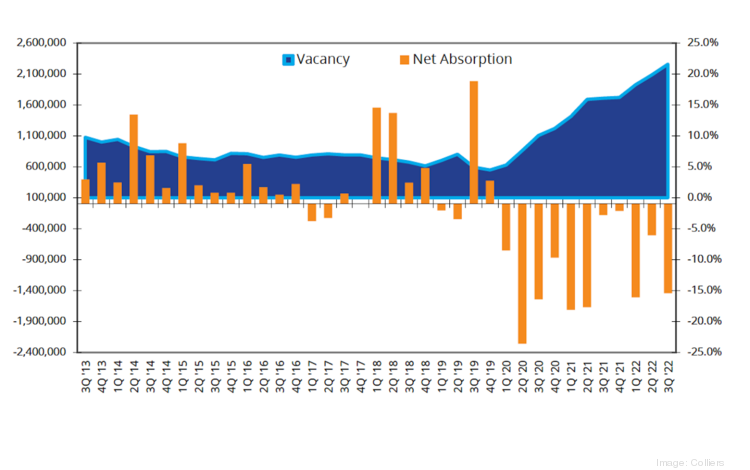

Meanwhile, in our local economy: A growing number of large office landlords are defaulting on their loans as remote and hybrid work habits permanently impact the office market. The trend comes as concerns mount over the health of the office building industry, with a weak return-to-office rate leading to soaring vacancy levels in many cities. While landlords have previously stayed current on their mortgages as lenders have extended expiring mortgages, most offices remain at around half the level they were pre-pandemic, with many employees favoring remote and hybrid work policies. As a result, many landlords and lenders have recognized that the robust return to the office they had hoped for is unlikely to ever materialize.

Offices emptied out in 2020 and now, 3 years later, we’re back to about 50% occupancy but are flattening there. 5 and 10-year leases are standard for commercial space and many companies received bail-outs during Covid, so we are only just now feeling the real effects of the crisis. Even if “only” 10% of the spaces come up for renewal this year, there’s going to be massive pressure on prices along with the fact that companies don’t actually need all the space they had before. That means Commercial Landlords face the double whammy of lower prices and lower footage renewals from their existing tenants.

Offices emptied out in 2020 and now, 3 years later, we’re back to about 50% occupancy but are flattening there. 5 and 10-year leases are standard for commercial space and many companies received bail-outs during Covid, so we are only just now feeling the real effects of the crisis. Even if “only” 10% of the spaces come up for renewal this year, there’s going to be massive pressure on prices along with the fact that companies don’t actually need all the space they had before. That means Commercial Landlords face the double whammy of lower prices and lower footage renewals from their existing tenants.

As you can see from this chart of the San Francisco market, the amount of Sub-Lease (tenants who want to re-lease part of what they have) became larger than the amount of fully vacant space in the 3rd quarter of 2020 – from 1M square feet in 2019 to 5M feet at the end of 2021. This is happening everywhere and that means that the tenants compete with the landlords to lease out space, which leads to this horrifying chart:

Net absorption is a term used in commercial real estate to describe the change in the amount of leased space compared to the previous period. It measures the difference between the total amount of space leased during a given time period and the total amount of space vacated during that same period. Negative net absorption indicates that there is more supply than demand, and that the market is in a downturn.

This is unprecedented stuff, folks! It’s hard to predict what’s going to happen here but “NOT GOOD” is likely to be an appropriate summary.

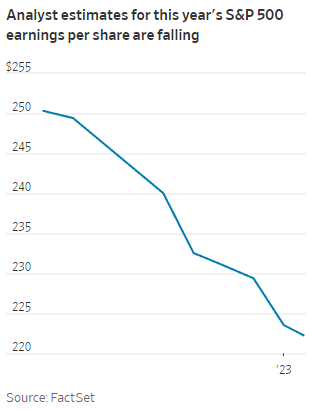

Anyway, we’re most of the way through Q4 earnings now and Net Profit Margin for the S&P 500 have fallen to 11.3%, marking the sixth consecutive quarterly decline from the peak of 13% in 2021. This is due to rising costs for key inputs, such as labor, materials, and energy, which are denting corporate profits across industries, even as (inflated) sales are rising.

Anyway, we’re most of the way through Q4 earnings now and Net Profit Margin for the S&P 500 have fallen to 11.3%, marking the sixth consecutive quarterly decline from the peak of 13% in 2021. This is due to rising costs for key inputs, such as labor, materials, and energy, which are denting corporate profits across industries, even as (inflated) sales are rising.

With earnings estimates now hovering around $220 for 2023, which is down 12.5% from estimates in May, the S&P is now trading at 18.4x future earnings – that’s very high! Falling profits can worry investors and leave companies strapped for cash. The margin squeeze is another headache for investors, who are still facing the impact of sharply higher interest rates, an uncertain economic outlook, and stubbornly high Inflation. Companies may have to cut spending on new projects, dividends or stock buybacks to conserve cash.

The march of smaller-cap earnings does continue and this week we’ll hear from:

So many companies we are interested in and we can’t wait to hear what YETI has to say on Thursday morning. We finished positioning last week in our Portfolio Review but, overall, the bearish re-positioning in the Short-Term Portfolio (STP) was the dominant move of the week as we really didn’t think the recent rally in the markets was based on a realistic foundation.

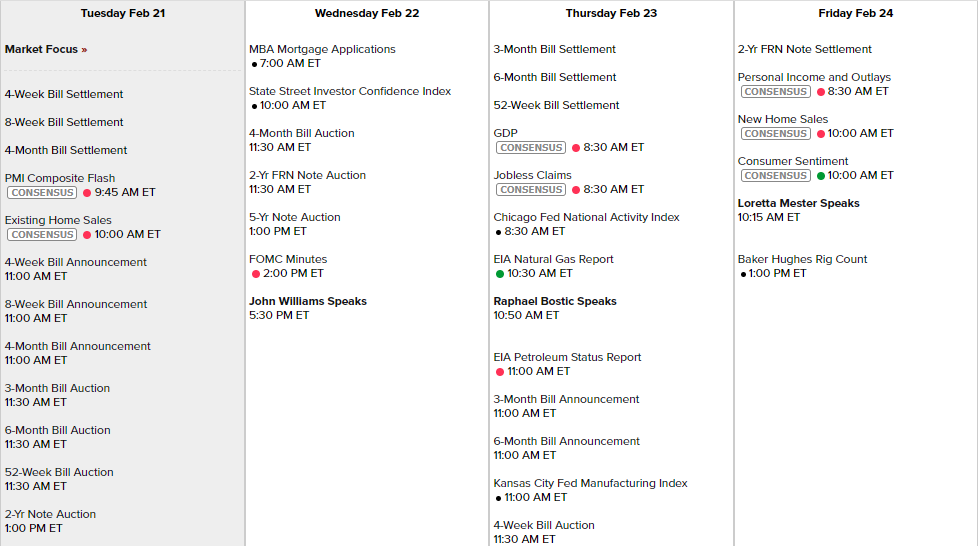

Not too much on the Economic Calendar but we can’t trust the Fed anymore to tell us when they are going to speak but there are Fed Minutes tomorrow and a few other fun things to keep us busy this week: