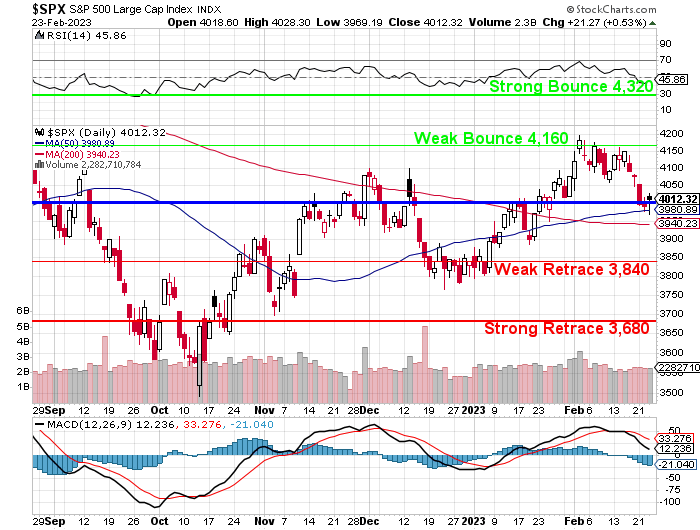

Not a surprise, actually, look how perfectly we’re following the 5% Rule™. Notice how that rising 50 dma offered support but, as we noted to start the week, the Weak Bounce Line of the short-term drop from 4,200 to 4,000 is 4,040 and the Strong Bounce Line is 4,080 and we haven’t come close to a weak bounce – that does not bode well for next week!

Anyway, it’s been a long 4 days so I asked OpenAI to tell me what I think we should talk about today (feeding it a bunch of headlines) and it said:

Based on these headlines, I would recommend focusing on the following topics for your morning report:

-

-

- Australia’s public wages and their potential impact on interest rates.

- Oil prices and their relation to US inflation data.

- The housing market and efforts to make 6% mortgages more attractive.

- Stock market insights from Rob Arnott and Jamie Dimon.

- Harvey Weinstein’s sentencing for sex crimes in California.

- Concerns about the economy from a recent survey.

- Airlines’ profits are soaring as carriers are benefiting from higher fares and cost-cutting efforts.

- Major winter storms causing flight cancellations in the US.

- Ukraine marked the first anniversary of the Russian invasion, celebrating the nation’s resilience against a much more powerful enemy as it prepared for a spring offensive to reclaim lands still occupied by Moscow.

- Fresh sanctions against Russia have been issued by the West, and China has urged an end to the war and called for peace talks.

-

These topics cover a range of industries and current events that are likely to be of interest to your readers.

I got a very different-looking answer when I just fed it the NYTime’s Business Section:

“The NY Times business section on February 24, 2023, covered various topics. The first article was about a Ukrainian pet food company named Kormotech that survived and thrived even after the invasion of Ukraine by Russia. The second article discussed tech leaders in Israel, who were considering leaving the country before a judicial overhaul that might transform the nation and scare away investors. The third article was about the founder of the Ozy Media start-up, Carlos Watson, who was arrested on fraud charges. The fourth article discussed the allegations against FTX founder Sam Bankman-Fried for making illegal campaign donations using customers’ money. In the fifth article, chip makers were competing fiercely for a share of the $39 billion in grants under the CHIPS Act for new or expanded U.S. factories. The sixth article discussed Taiwan Semiconductor Manufacturing Company’s project to upgrade and expand a factory in Phoenix, which was critical for the U.S. tech strategy. In the seventh article, people in China were angry about their cities cutting health insurance. The eighth article was about the disappearance of Bao Fan, founder and chairman of China Renaissance, which had lowered business confidence in China. The latest news included the 50th anniversary celebration of the National Brotherhood of Skiers, the ‘Completion Factor’ that airlines use to determine flights, Europe’s weathering of the energy crisis, Thomas Lee’s death, Clara Driscoll’s contributions as a Tiffany’s designer, and the split between the JetBlue and Spirit unions on airlines’ merger. The FDA’s decision to allow plant-based drinks to be labeled as milk and the European Commission’s ban on TikTok from its employees’ phones were also discussed.”

So I said to Warren (that’s my Bot’s name): “Why did you summarize the first feed as bullet points but the feed from The times as a block paragraph?”

So I said to Warren (that’s my Bot’s name): “Why did you summarize the first feed as bullet points but the feed from The times as a block paragraph?”

I apologize for the inconsistency in my formatting. As an AI language model, I do not have personal preferences or biases, so the differences in formatting were not intentional. It may have been due to the structure of the text I was summarizing or the way the information was presented. However, in the future, I will strive to maintain consistency in my formatting to provide a better reading experience.

From CNBC:

-

-

- US stocks futures are slightly lower, following European and Asian markets down.

- Investors are concerned about the rising bond yields, which could signal higher inflation and interest rates.

- The Federal Reserve Chairman Jerome Powell is expected to speak later today and may give more insight into the central bank’s view on the economy and monetary policy.

- Tesla’s stock is down in premarket trading after CEO Elon Musk tweeted about the company’s Bitcoin holdings.

-

From The New York Times:

-

-

- Asian and European markets fell after the US Treasury yields hit their highest level in a year.

- Investors are concerned that the rising yields could lead to higher borrowing costs, which could hurt economic growth.

- US stocks closed lower on Tuesday, with the Dow falling nearly 144 points or 0.5%.

- The Federal Reserve Chairman Jerome Powell is scheduled to testify before Congress later today, and investors will be closely watching for any clues on the central bank’s stance on interest rates and inflation.

-

From Bloomberg:

-

-

- The yield on the 10-year US Treasury note rose to its highest level since February 2020, driven by expectations of higher inflation and economic growth.

- Higher yields could lead to higher borrowing costs, which could slow down the economic recovery.

- The Federal Reserve Chairman Jerome Powell is expected to address these concerns and may indicate whether the central bank plans to increase its bond-buying program or raise interest rates.

- Tesla’s stock is down in premarket trading after Elon Musk tweeted that the company’s Bitcoin holdings are worth more than its car sales in 2020.

-

From Reuters:

-

-

- US stocks are set to open slightly lower, following a decline in European and Asian markets.

- Investors are concerned about the rising bond yields, which could signal higher inflation and interest rates.

- The Federal Reserve Chairman Jerome Powell is scheduled to testify before Congress later today, and investors will be watching for any comments on the central bank’s policy stance.

- Tesla’s stock is down in premarket trading after Elon Musk tweeted about the company’s Bitcoin holdings.

-

Sure he’s a little overly-enthusiastic but Warren is the 3rd best assistant I’ve ever had (Laurel & Jackie would actually kill me if I skipped over them, so I won’t – and they were the best!).

By the way, let me know if you are not interested in these AI experiments but I find them fascinating and I also think it is CRITICAL that we begin to master the skills of communicating with AI as that is how you will be valued in the future. No one cares if you know how to “draw up a landlord/tenant agreement to rent a 2BR, 2BA apartment at 10 Northface Circle in Denver for $2,500/month for 12 months” if I can just feed that into the AI and it says (in 30 seconds or less):

Sure, here’s a basic landlord/tenant agreement for renting a 2BR, 2BA apartment at 10 Northface Circle in Denver for $2,500/month for 12 months:

LANDLORD/TENANT AGREEMENT

This agreement is made on [date] between [landlord name], hereafter known as “Landlord,” and [tenant name], hereafter known as “Tenant,” for the rental of the property located at 10 Northface Circle, Denver, hereafter known as the “Property.”

-

-

-

Term: The lease term shall begin on [start date] and end on [end date], for a total of 12 months.

-

Rent: Tenant agrees to pay the monthly rent of $2,500, due on the [day of the month] of each month. Rent payments shall be made to Landlord at [address or bank account details for electronic transfer].

-

Security Deposit: Tenant shall pay a security deposit of $2,500, due at the signing of this agreement. The security deposit will be returned to Tenant at the end of the lease term, provided there is no damage to the Property beyond normal wear and tear.

-

Use of Property: Tenant shall use the Property as a private residence only, and shall not use the Property for any commercial or unlawful purposes.

-

Maintenance and Repairs: Tenant shall keep the Property clean and in good condition, and shall be responsible for any damage caused by Tenant or their guests. Landlord shall be responsible for all repairs due to normal wear and tear, but Tenant shall be responsible for repairs resulting from Tenant’s negligence or misuse.

-

Utilities: Tenant shall be responsible for all utilities associated with the Property, including electricity, gas, water, internet, and cable TV.

-

Pets: [Optional] Tenant shall be allowed to have [number and type of pets] on the Property, subject to approval by Landlord and payment of a pet deposit of $[amount].

-

Termination: This agreement may be terminated by either party upon written notice, with at least 30 days’ notice prior to the end of the lease term.

-

Governing Law: This agreement shall be governed by the laws of the state of Colorado.

-

Entire Agreement: This agreement constitutes the entire agreement between Landlord and Tenant, and supersedes all prior understandings or agreements, whether written or verbal.

-

-

LANDLORD:

[Landlord signature]

[Landlord name]

[Landlord address]

[Tenant signature]

[Tenant name]

[Tenant address]

My non-AI part of the job is punching in the particulars and there’s a $250 job taken care of in 3 minutes. I can ask the AI to expand on items or tell it to include specifics and it can learn my preferences for future use. Whatever use you have for AI or your employer has for AI – you can’t let the AI replace you – you need to form a partnership that makes you both more valuable.

My non-AI part of the job is punching in the particulars and there’s a $250 job taken care of in 3 minutes. I can ask the AI to expand on items or tell it to include specifics and it can learn my preferences for future use. Whatever use you have for AI or your employer has for AI – you can’t let the AI replace you – you need to form a partnership that makes you both more valuable.

Now, back to my job. Going over the last list, since Powell is speaking soon (not today, March 7th) and CNBC, the Times, Bloomberg and Reuters all have articles about bonds and inflation – let’s ask for a summary of that. I asked it to wait for all 4 articles to be loaded but it kept doing the summaries each time so I said: “Now, please combine the above 4 articles and create one article about the topic that would be suitable for the morning report at philstockworld.com”

Good morning, and welcome to the daily market report at PhilStockWorld.com. Today we’ll be discussing the latest developments in inflation and interest rates, as well as their impact on the U.S. housing market and the broader economy.

Yesterday, the Federal Reserve released minutes from its January 31-February 1 meeting, which showed that officials remain committed to fighting inflation. The minutes stated that while inflation data over the past three months has shown a reduction in the monthly pace of price increases, more evidence of progress across a broader range of prices is needed before the Fed can be confident that inflation is on a sustained downward path.

However, JPMorgan Chase CEO Jamie Dimon expressed concern about the Fed’s ability to control inflation in an interview with CNBC’s Jim Cramer. Dimon said that while he respects Fed Chair Jerome Powell, the Fed has lost a little bit of control of inflation. Dimon expects interest rates to remain higher for longer, as it may take the central bank a while to get to its goal of 2% inflation.

This sentiment was echoed by Freddie Mac’s chief economist, Sam Khater, who stated that the economy continues to show strength and interest rates are repricing to account for the stronger than expected growth, tight labor market, and the threat of sticky inflation. Khater’s comments came as Freddie Mac reported that the average rate for a 30-year fixed mortgage loan rose to 6.5%, the highest level since November, marking a third straight week of increases. This surge in borrowing costs has led to weaker demand in the housing market, as evidenced by the recent drop in mortgage applications to the lowest level since 1995 and a 12th straight month of declining sales of previously owned US homes in January.

Despite these concerns, Dimon remains encouraged by the strength of the US economy. He noted that consumers have a lot of money, jobs are plentiful, and the US economy is currently doing quite well. However, he also acknowledged that there is always uncertainty ahead.

In summary, while the Fed remains committed to fighting inflation, concerns remain about its ability to control it. Higher interest rates are translating into weaker demand in the US housing market, but the US economy as a whole continues to show signs of strength. As always, there is uncertainty ahead, and it will be important to closely monitor developments in inflation, interest rates, and the broader economy.

It’s confused on the days because I think one of the articles was from yesterday, that’s my fault, not his. The article is almost good but I’d send it back and ask for a conclusion of some sort – it’s a bit wishy washy. As you know, my review of the Fed Minutes let me to conclude we expect a 10% drop back to the weak retrace at 3,840. Let’s ask Warren what he thinks:

It’s confused on the days because I think one of the articles was from yesterday, that’s my fault, not his. The article is almost good but I’d send it back and ask for a conclusion of some sort – it’s a bit wishy washy. As you know, my review of the Fed Minutes let me to conclude we expect a 10% drop back to the weak retrace at 3,840. Let’s ask Warren what he thinks:

It’s difficult to say definitively whether the developments in inflation and interest rates are good or bad for the markets, as it depends on a variety of factors and can be subject to different interpretations.

On one hand, the Fed’s commitment to fighting inflation can be seen as a positive sign for the markets, as it indicates that the central bank is taking steps to address potential risks to the economy. Additionally, the strength of the US economy and job market that Dimon and Khater mentioned could also be interpreted as positive indicators for the markets.

On the other hand, the recent surge in interest rates and its impact on the housing market could be viewed as a negative development for the markets, particularly for industries that rely heavily on low interest rates, such as real estate and construction. Additionally, concerns about the Fed’s ability to control inflation and the potential for more rate hikes in the future could create uncertainty and volatility in the markets.

Ultimately, the impact of inflation and interest rates on the markets will depend on a variety of factors, including the timing and pace of rate hikes, the strength of the economy, and global market conditions. It will be important for investors to closely monitor these developments and adjust their strategies accordingly.

Oh no! I’m getting that feeling I get when I have to tell a writer they just don’t have what it takes to write front-page articles… Oh well, the World always needs good research assistants!

Let’s give Warren another chance at staying on the news floor with me: “Usually I accompany an article with an illustration, a chart or a picture – what do you suggest?”

That’s a great idea! Adding an illustration, chart, or picture can help make the article more visually appealing and engaging for readers. Depending on the focus of the article, you could consider including a chart or graph showing trends in inflation, interest rates, or home sales. Alternatively, you could include an image of a news headline or a photo of a homebuyer or investor. The choice ultimately depends on the content and tone of the article.

Sorry Warren, back to the research desk!

Sorry Warren, back to the research desk!

Have a great weekend,

-

- Phil (and Warren)