We reviewed the SPWR Earnings Report and Conference Call with Warren (my AI assistant):

https://seekingalpha.com/article/4580146-sunpower-q4-earnings-growth-surges

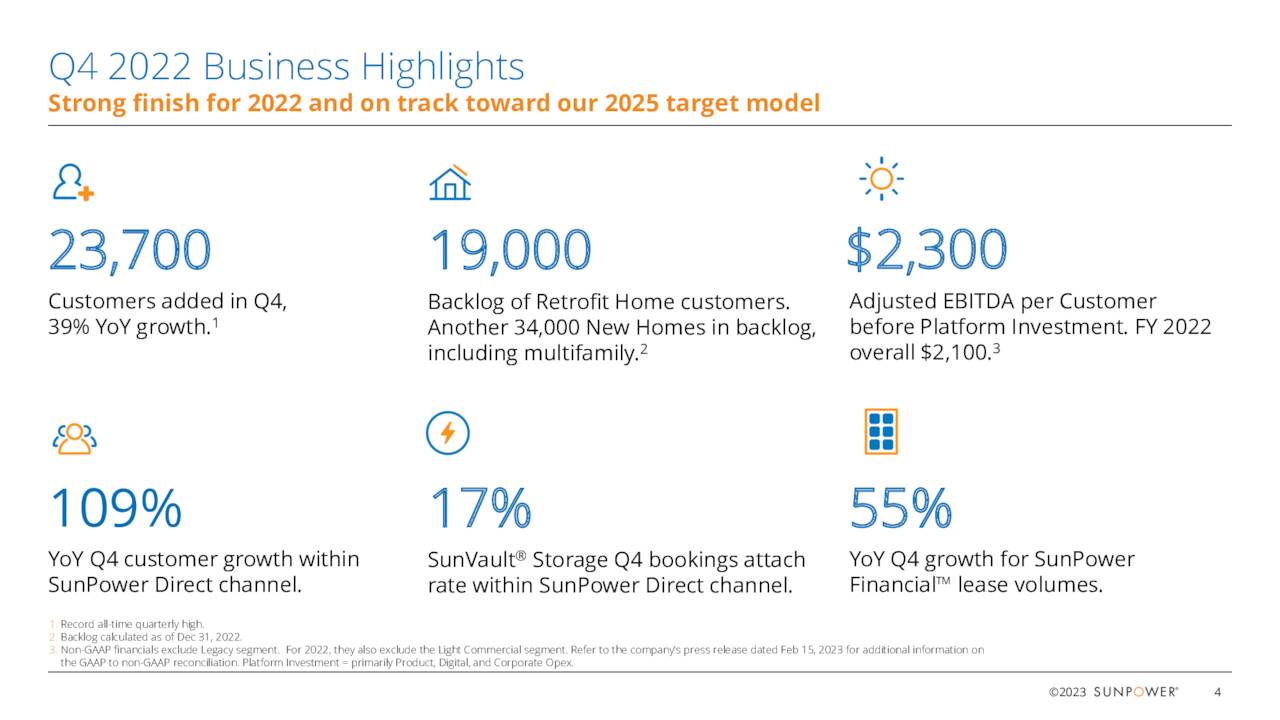

🤖 The analysis suggests that SunPower, a home solar company, is increasingly looking like a good value investment option against a current market cap of $2.84 billion and a price-to-sales ratio of 1.6x, given its expected growth of at least 30% for the 2023 fiscal year. The company has reported strong revenue growth of 43% in the fiscal 2022 fourth quarter, beating consensus estimates, and adding 24,000 new customers during the quarter. SunPower’s gross margins have also increased, driven by the continued pass-along of higher input costs to customers with greater pricing power exerted by the company on the back of rising demand. Adjusted EBITDA has also increased, and the company is guiding for adjusted EBITDA per customer to continue to rise for the full year 2023.

The article notes that macroeconomic uncertainty could pose a near-term headwind to an expansion of SunPower’s valuation multiple. However, the author suggests that the company’s growth momentum, driven by new customer adds and the increasing uptake of home solar across the US, is likely to continue. The author is leaning towards starting a position later this year and waiting for a few more quarters of earnings to see whether the current growth momentum is sustained.

Overall, the analysis paints a positive picture of SunPower’s financial performance and growth prospects, suggesting that the company may be an attractive investment opportunity for those interested in the renewable energy sector. However, as with any investment decision, it is important to conduct thorough research and consider all relevant factors before making a decision.

https://seekingalpha.com/article/4578759-sunpower-corporation-spwr-q4-2022-earnings-call-transcript

https://seekingalpha.com/article/4578759-sunpower-corporation-spwr-q4-2022-earnings-call-transcript

🤖 SunPower reported strong financial results for Q4 2022. The CEO, Peter Faricy, highlighted that the company added 23,700 new customers in Q4, which represents a 39% YoY increase.