Courtesy of ZeroHedge

Amid the mounting speculation of a soft landing, and even chatter of a “no landing” (see here and here), one strategist is laughing at the market’s renewed sense of optimism and hope, which he counters simply by observing the latest economic and Fed developments and says that “a typical end-cycle environment is coming into place — mixed economic signals with a downward bias combining with a Fed laser-focused on corralling inflation by reducing labor demand.”

Yes, for TS Lombard economist Steven Blitz, there is no thesis drift (or rather elevation) and his big picture assessment refuses to budge: “recession will result.” Here’s why: “Forget the Fed stopping to wait and watch and hope that inflation bends towards 2% without a recession. That horse has left the barn. A key question is where the funds rate is when the Fed realizes recession is already underway.“

Blitz’s base case is “this summer” with the funds rate around 5.25%, or about 2 more hikes. That said, the TS Lombard analyst hedges and warns that if he is wrong, the funds rate can easily move up to 6.5%, which will make the coming recession that much more brutal.

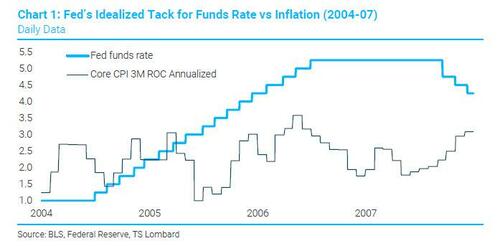

Here a quick compare and contrast: according to Blitz, the policy tack in 2005-07 is the one the Fed are communicating: “get to a spot and stay there”, but of course the problem with 2007 was that “it was not the idealized recession” as everyone still remember what happened in 2008.

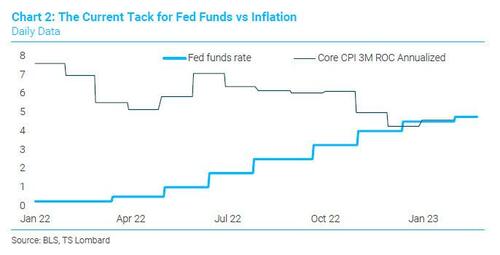

The policy approach in this cycle has been quite different because the Fed started so late, and the economy’s underlying dynamics are very different from 04-07, so too the Fed’s balance sheet policy. At this stage, they keep hiking until recession begins – even though they continue to advertise that getting to spot and sticking is the intention.

Looking at Chart 2, the TSL strategist says that it was good to read in the latest Fed Minutes that the FOMC sees the funds rate only now “moving toward a sufficiently restrictive stance of monetary policy”. As Blitz has repeatedly argued, rates have just gotten to the starting gate in terms of restricting activity. He also notes that in his view, the economic slowdown to date has little to do with Fed policy (though they took their bows), it had to with the economy naturally slowing from the unsustainable 6% pace in 2021– created by fiscal transfer, reopening, and Fed underwriting. Chart 1 above also suggests “why the Fed thinks they have a much longer road of hikes ahead before inflation bends back to 2%, but they are probably wrong on this too.”

With this 2005-2007 idealized tack (which, again, ended in disaster) as the Fed’s focus, it makes allowing financial conditions to ease by slowing the pace of hikes an incredibly counterproductive move, according to Blitz: “they seem to now understand that — “[a] number of participants observed that financial conditions had eased in recent months, which some noted could necessitate a tighter stance of monetary policy”, and in the strategist’s view, “if they had to do it again, especially given the run of data after the meeting, they would’ve hiked rates 50BP, as some wanted to.” Although, as Mester noted last week, after going 25, they are now pretty much stuck with that, unless they feel like risking another major communications disaster.

Additionally, in the latest FOMC minutes, we also read that “Participants observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time.” And “stressed that substantially more evidence of progress across a broader range of prices would be required to be confident that inflation was on a sustained downward path.” To that point, “as long as the labour market remained very tight, wage growth in excess of 2 percent inflation and trend productivity growth would likely continue to put upward pressure on some prices in this component. A couple of participants observed that changes in wages tend to lag changes in prices, which can complicate the assessment of inflation pressures.”

Taking all this in, Blitz concludes that the Fed may well hike 50BP in March (overriding Fed concerns about reversing to a 25bps cadence) if there is a large enough upside surprise to February employment (that said, Blitz agrees with us that the January number was a grotesque outlier and that “the employment surprise will be weakness”). Otherwise, we get a 25BP hike and the data watch begins for May, although according to TS Lombard, “the Fed keeps hiking until unemployment hits 4.5%, at least. As for when that occurs, it depends on one’s start date for recession. I still believe there is a 55% probability of a mid-year recession, so they stop in Q3.”

But what if the “no landing” narrative ends up being right, and how high for the funds rate if there is no recession?

According to Blitz, very dovish inputs in a Taylor Rule model produce a 6.5% rate. Somewhat less dovish inputs deliver a 7.2% rate, and more traditional inputs (including 2% neutral real rate) produce a 9.7% rate. In other words, the longer it takes to weaken employment, the higher the rate, which means that if the unemployment rate has been artificially sustained lower as per Biden admin instructions we may see a Fed Funds rate on the edge of double digits, which would presage a great depression.

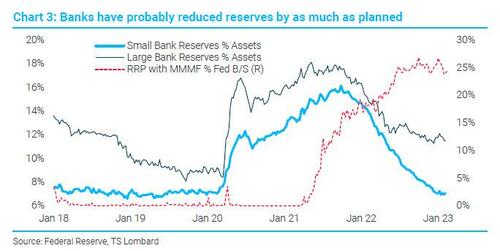

One final point brought up by Blitz who notes that the latest FOMC Minutes had a brief discussion of QT which noted the potential for private money-market rates to “experience some temporary pressures as reserves declined if use of the Federal Reserve’s ON RRP facility continued to remain high.” This facility is about 25% of the Fed balance sheet – up from zero two years ago.

The Fed has repeatedly assumed that these pressures on RRP work themselves out as wide spreads pull MMMF monies from ON RRP and move them into CP, CDs, etc. The Fed would love this result because banks have pretty much hit their desired bottom for reserve/asset ratios – banks began reducing reserves on their own in mid-2021 and flipped them into loans. Going forward, the balance sheet shrinks with ON RRP dropping, something the Fed can do arbitrarily, but they appear unlikely to “just say no”.

With rising real returns on cash, and increased recession risk, banks are buying T-bills along with the Fed and MMMFs may not rescue private money market disruptions (i.e., lower usage of the Reverse Repo facility) as the Fed hopes. According to Blitz, “disruption, or even a credible threat, plus sharply rising marginal funding costs for banks, will eventually curtail credit extensions and, in turn, bring forward recession’s start date” who notes that “this dynamic alone makes unlikely the idealized policy tack of getting the funds to a spot and staying there for an extended period.”

In conclusion, between the upcoming reserve crunch, and the continued Fed hikes, Blitz holds that the coming “asset crunch” will be enough to create a mild recession mid-year. And if it doesn’t, “steadily rising real funding costs deliver a “credit crunch” at some point. Recession is inevitable. And once it occurs, the cutting begins.”