2/3 of Q1 are gone and we’re most of the way through the Q4 earnings reports and things have not been that good. Here’s a sample of earnings reports from last night and this morning to give us an idea of how things are really going while “THEY” dress the windows to close out February:

- Norwegian Cruise Lines (NCLH), lost $1.04 per $16.50 share or $439.7M and they vow to pack every ship in Q1 and give the passengers 15% less for their money (“cost reductions”) to make their experiences truly miserable.

- JM Smucker (SJM) achieved 8.3% more sales by raising prices 15% but, despite giving you less product for more money, Operating Income fell 5% and the food giant warned that ongoing cost inflation, volatility in supply chains and the overall macroeconomic environment continue to impact financial results and cause uncertainty and risk for the 2023 outlook.

- Target (TGT) did better than expected (by others, we were bullish) but that’s still a 44.7% decline in Operating Income with Gross Margin down to 22.7% from 25.7% last year. The drop reflected pressure from higher clearance and promotional markdown rates, higher net merchandise costs, and higher inventory shrink, which has become a problem for all of retail.

Target did not repurchase any shares in Q4. At of the end of the quarter, TGT had approximately $9.7B of remaining capacity under the repurchase program approved by Target’s board in August of 2021, when the stock was at $250. This illustrates what pisses me and Buffett off about buybacks – NOW is the time to buy back their stock – when it’s 40% off the highs – NOT once it’s back up again!

- Keurig/Dr. Pepper (KDP) is bad enough off that they are selling more shares. Coffee sales are up 12.7% on a 10.6% increase in prices but the real increase (and realize this about all Q4 Reports) is because there were 53 weeks in accounting calendar 2022 (because it ended on a Saturday. Yes, we add one day to the calendar every 4 years, where do you think those accumulated days end up?) so that’s 2% more than 2021 and Q4 had 14 weeks vs 13 weeks, 7.6% more! Overall, prices were up 14.9% (sensing a theme?) and there was a 4.8% DECREASE in total sales volume.

- Cracker Barrel (CBRL) raised their prices by 9% and made 8.4% more overall sales so customers simply paid more for less and, in fact, comp store retail sales were only up 4.1% – very short of expectations. Commodity inflation of 8.5% and wage inflation of approximately 6.5% are expected for the remainder of the fiscal year.

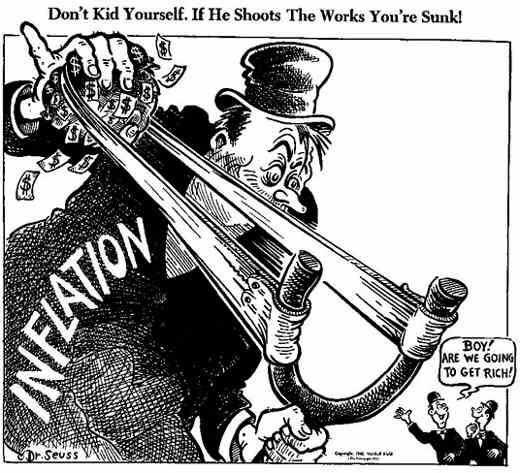

Is this sustainable? Real inflation last year (and we all know this) was about 15% and companies portions and services to make up for their 15% increases in costs and we all notice it a little but what happens if we go another 15% in 2023? Will you really be OK with 30% less for the same money you paid a few years ago? Something is going to snap at some point and it isn’t going to be pretty. A few things you may have noticed recently:

- Food products: Toblerone reduced the size of its chocolate bars from 170g to 150g while keeping the price the same, resulting in a 12% reduction in weight. Kellogg’s reduced the size of its cereal boxes while keeping the price the same.

- Airline fees: In 2018, Ryanair started charging passengers for carrying hand luggage onto the plane, now checked bag fees make up 5% of the average airlines revenues but that’s 100% of their profits.

- Streaming services: Netflix removed popular shows like Friends and The Office from its library while increasing the monthly fee for its standard plan by 10%.

- Banking fees: Bank of America increased the fee for overdrafts 10% from $35 to $39, resulting in customers paying more for the same service. Chase Bank started charging a monthly service fee of $12 for its basic checking account, which used to be free and, of course, this deeply impacts poor people, where $144/year can be much of their savings. Let’s keep in mind, folks, that YOU are GIVING the Bank YOUR MONEY to hold and they are giving you no interest on checking and lending it out for a profit. How did this get to be OUR loss?

- Mobile phone plans: AT&T reduced the amount of data included in its unlimited plans and increased the price by $10 per month (20%). Similarly, T-Mobile increased the price of its unlimited plan by $10 per month (25%) while reducing the amount of data included in the plan.

Never forget what a destructive force inflation is on the poor and vulnerable sections of our society, who often lack the means to protect themselves from rising prices and economic uncertainty. Inflation disproportionately affects those who are already struggling to make ends meet, while the wealthy are better able to insulate themselves from its effects.

Inflation can lead to a host of negative consequences for ordinary people, including reduced purchasing power, lower standards of living, and increased financial insecurity. As Arun Jaitley said: “”Inflation, like a wave of fire, sweeps away the destitute and leaves the rich unscathed.”

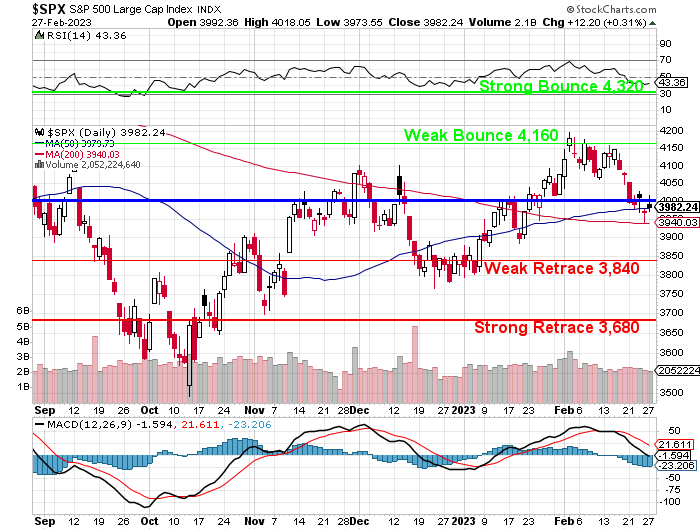

We get the Chicago Purchasing Manager’s Index at 9:45 and we get Consumer Confidence at 10 and tomorrow morning we get ISM and Construction Spending – so lots of data to chew on and, of course, more earnings reports.

Be careful out there!