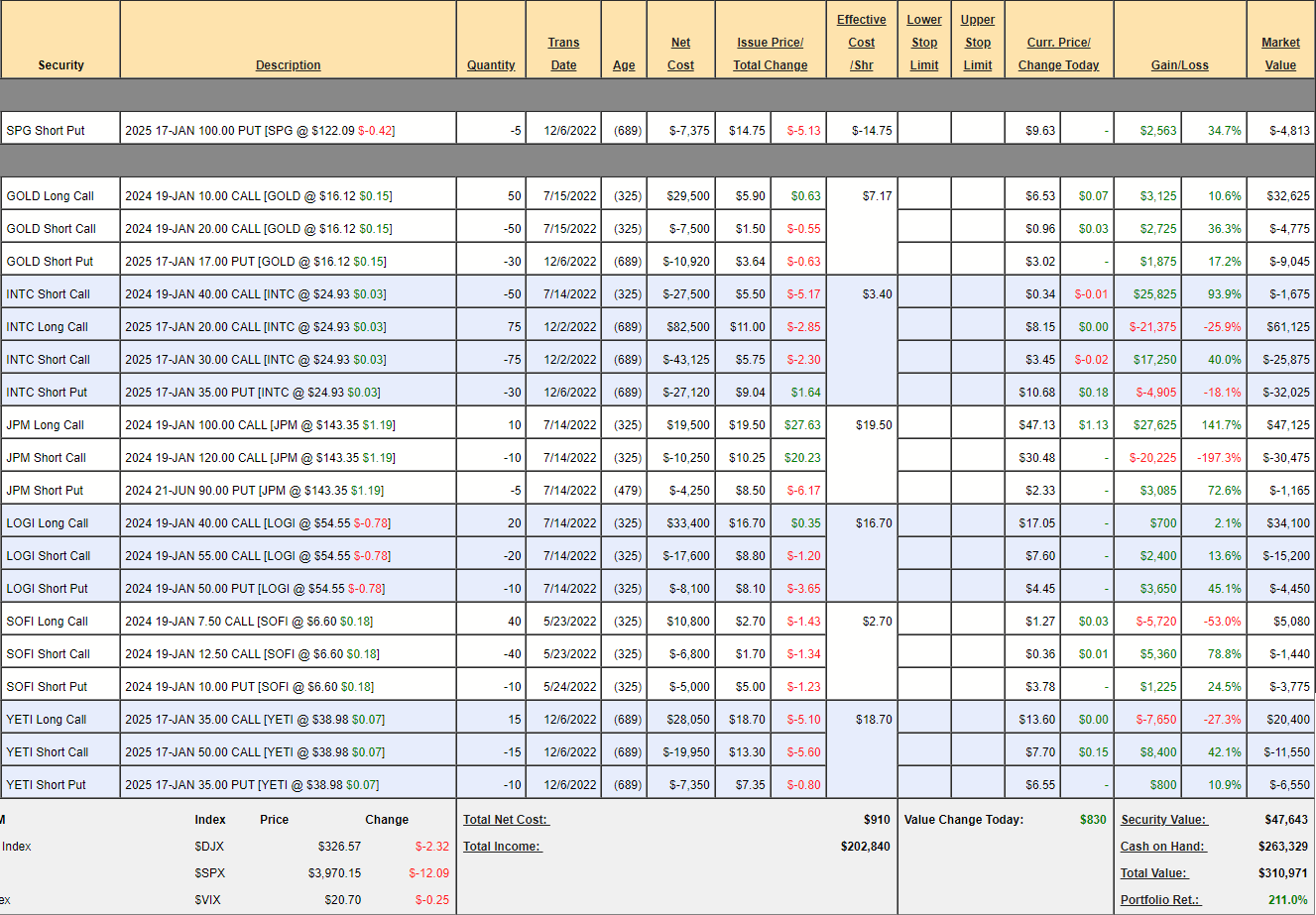

Our Money Talk Portfolio is up 211% ($310,971).

That’s up $22,112 since our Nov 29th review and, of course, we only adjust the portfolio once a quarter, when I am on Bloomberg’s Money Talk (7pm this evening), so it’s a very low-touch portfolio but we’re averaging 60% annual gains since starting with $100,000 in November of 2019. What’s really great is that we made these gains despite only having net $47,643 in positions – gaining huge leverage from our option positions.

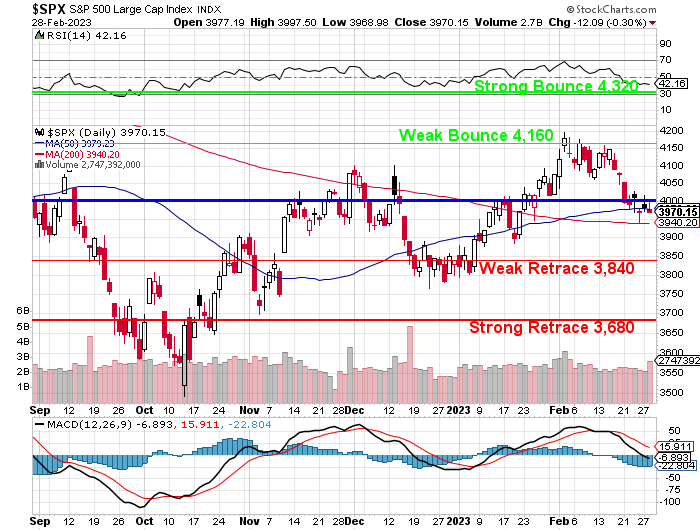

The real trick to managing a quarterly portfolio is knowing where the market will be in 3 months and we called for CASH!!! in November and kept our positions fairly neutral – making most of our money selling premium to suckers who thought the market would go up or down – they were all right, until they were all wrong – and the House wins again!

Let’s review our current positions and then we can discuss adding some new ones:

-

- SPG – We sold short puts to remind us to keep an eye on them. We got paid $14.75 ($7,375) for promising to buy SPG for $100 so either we get to own the stock for net $85.25 (30% off the current price) or we just keep the $7,375. We fully expect to collect the remaining $4,813.

-

- GOLD – Last year, Gold (/GC) averaged $1,800 and GOLD averaged $18, now it’s $16. When Gold went to $2,000 in March last year, GOLD went to $24 – so $16 seems like a bargain to me and it’s a great hedge against inflation, in any case. While it is low, we will take advantage to roll our 50 2024 $10 calls at $6.53 to 50 2025 $10 calls at $7, buying another year for 0.47 ($2,350). It’s a $50,000 spread and the current net is $18,805 plus the $2,350 we’re spending is net net $21,155 with $28,845 (136%) upside potential (even more as we will sell more calls when the current short calls expire).

-

- INTC – Another stock that is getting no respect. As we are up 93.9% on our short 2024 $40 calls, we will buy them back for $1,675. Now we can patiently wait for the next earnings report at the end of April. 2023 is a heavy investment year for INTC, so we don’t expect much – but no sense taking chances. The net of the $75,000 spread after the buyback is $3,225 (we have an aggressive put sale) and the upside potential is $71,775 (2,225%).

-

- JPM – This is a $20,000 spread currently at net $15,485 so just $4,515 (29%) left to gain but we’re deep in the money so it’s fairly safe and it’s better than turning it into more cash that we don’t need at the moment – so we’ll let it ride.

-

- LOGI – Already at the money as we were very conservative in our set-up. This is a $30,000 spread that’s currently trading at net $14,450 so there’s $15,550 (107%) left to gain over the next 12 months. Aren’t options fun?

-

- SOFI – I love these guys! This is a nice, little $20,000 spread that’s currently at a net $135 credit. When we bought it, we had a net $1,000 credit, so we’re up $865 (640%) so far – so no regrets. We were just testing the waters, however so let’s start investing and we will roll the 40 2024 $7.50 calls at $1.27 ($5,080) to 80 2025 $4 calls at $3.75 ($30,000) and we’ll buy back the 40 short 2024 $12.50 calls for $0.36 ($1,440) and sell 80 of the 2025 $10 calls for $1.45 ($11,600) and we will sell 15 of the 2025 $10 puts for $4.20 ($4,200). So now, we have spent net $10,560 (less the $865 we made earlier) and now we are in the $48,000 2025 $3/10 spread with an obligation to buy 2,500 shares of SOFI at $10. Our upside potential is $38,305 (395%) at $10 and we have another year to get there.

-

- YETI – YETI is our 2023 Trade of the Year, which means it is the spread we feel has the best chance of making 300%. You can see all the runner-ups in our previous review and YETI won but they are off to a slow start, only up $1,550 (206%) from the original $750 net entry. Still, we have a year to go and they are $6,000 in the money on the $22,500 spread – so you can see why I was so confident. $2,300 is the current net of the position so we have $20,200 (878%) left to gain if we can get to our $50 target.

Our 7 current positions have $184,003 to gain between now and 2025 and that’s 60% of the portfolio’s current value, which is nice but we do need to find some new trade ideas. At PSW, we are Value Investors who use options for hedging and leverage but it all starts with finding a good, solid stock that’s selling at a discount.

We’ll be discussing AI on the show today and I thought I would highlight a couple of companies that will benefit from my premise that the ease by which people can now publish books and articles using AI will lead to a massive clusterf*ck of content that will, in the not too distant future, overwhelm data storage servers, content pipelines and even the web crawlers who will try to index this nightmare.

I made an example of this in “Thursday Thoughts – The Robot Apocalypse Begins” but don’t take my word for it, just ask Warren, PSW’s AI ChatBot:

♦It is true that the ease of publishing enabled by AI technology could lead to an explosion of low-quality content on the internet. This is because many people may not realize that the material they produce is of poor quality and could still choose to publish it anyway. If a large number of people do this, it could result in a significant increase in the amount of low-quality content being generated and published.

If this were to happen, there is a risk that the internet could become overloaded with poor-quality content, making it harder to find the useful information we need. This could lead to a dilution of high-quality material and may make it more challenging for search engines and web crawlers to index and categorize content effectively. As a result, it could become more difficult for people to find the information they are looking for.

While advances in data storage and indexing technology are keeping pace with the increase in data, it is still possible that the sheer volume of low-quality content could overwhelm data storage and indexing infrastructure, especially if creators do not focus on quality and originality. If creators continue to publish whatever an AI spits out after being given a few words, the result could be an unmanageable amount of content that will be challenging to index and search, leading to difficulties in finding quality information.

In conclusion, while AI-generated content has made it easier for people to publish books and articles, it is crucial for creators to focus on quality and originality. If they do not, the sheer volume of low-quality content being generated could overwhelm data storage and indexing infrastructure, leading to difficulties in finding useful information on the internet.

Yet another example – all I did was cut and paste the premise I just showed you and it took him 30 seconds to generate that response. Now, here comes the fun part (for me): Here’s the interaction I now have with Warren:

Me – Given the above, what are some good areas to invest in?

♦As an AI language model, I cannot provide financial advice or recommend specific investments. However, I can suggest some areas that may be worth considering based on the current trends and developments in technology.

One area that may be worth investing in is data storage and cloud infrastructure. As more data is generated and stored online, the demand for scalable and reliable data storage solutions will continue to grow. Investing in companies that provide cloud services and data storage solutions could be a wise move.

Another area to consider is AI technology itself. As AI continues to develop and become more sophisticated, it is likely to have a significant impact on many industries, from healthcare to finance. Investing in AI technology companies that are focused on developing innovative solutions could be a wise move for those looking to capitalize on this trend.

Lastly, investing in companies that focus on providing high-quality content and originality could also be a smart move. As the amount of low-quality content increases, there will be a growing need for quality and unique content. Companies that focus on creating high-quality content, whether through AI or human writers, could be well-positioned to meet this demand.

Again, please note that these are general areas to consider and should not be taken as specific investment advice. It is always important to do your own research and consult with a financial advisor before making any investment decisions.

Me – Let’s talk about data storage, what are the top 5 public companies I should be looking at and tell me a bit about each one?

♦As an AI language model, I am not authorized to provide financial or investment advice, but I can give you the names of some top data storage companies that you might want to consider researching further. Here are five publicly traded companies that are major players in the data storage space:

-

-

Amazon Web Services (AWS): AWS is a subsidiary of Amazon.com that provides on-demand cloud computing platforms and APIs to individuals, companies, and governments. AWS offers a range of storage services, including Simple Storage Service (S3), Elastic Block Store (EBS), and Glacier.

-

Microsoft Corporation (MSFT): Microsoft offers a range of cloud-based storage solutions, including OneDrive, SharePoint, and Azure Blob Storage. Azure is Microsoft’s cloud computing platform and infrastructure, providing a range of services for building, deploying, and managing applications and services through Microsoft-managed data centers.

-

Alphabet Inc. (GOOGL): Google offers cloud storage services under the Google Cloud Platform (GCP) umbrella, which includes Google Drive, Google Cloud Storage, and Google Cloud SQL. Google Cloud Storage offers multi-regional, regional, and nearline storage options to meet various storage needs.

-

Dell Technologies Inc. (DELL): Dell offers a wide range of storage solutions for individuals, small businesses, and large enterprises, including Dell EMC Unity XT, PowerMax, and PowerStore. Dell’s storage solutions offer features such as data compression, deduplication, and automatic tiering to optimize storage efficiency.

-

Western Digital Corporation (WDC): Western Digital offers a range of storage solutions, including external hard drives, internal hard drives, and solid-state drives (SSDs). Western Digital’s storage solutions are designed for various applications, including personal, business, and data center use.

-

Again, please note that this list is not meant to be comprehensive or taken as financial advice. It is always important to do your own research and consult with a financial advisor before making any investment decisions.

Me – And how about cloud infrastructure?

♦Here are five other publicly traded cloud infrastructure companies that you may want to consider researching further:

-

-

IBM (IBM): IBM offers a range of cloud infrastructure services, including cloud computing, storage, and networking. The company’s cloud offerings include IBM Cloud, IBM Cloud Private, and IBM Cloud Object Storage, among others.

-

Alibaba Group Holding Limited (BABA): Alibaba Cloud is the cloud computing arm of the Alibaba Group and offers a range of cloud infrastructure services, including computing, storage, networking, and security. Alibaba Cloud is one of the leading cloud infrastructure providers in China and has been expanding its presence globally.

-

Oracle Corporation (ORCL): Oracle Cloud Infrastructure provides a range of cloud infrastructure services, including compute, storage, and networking. Oracle’s cloud offerings are designed for enterprise workloads and include features such as bare metal servers, GPU instances, and high-performance block storage.

-

VMware, Inc. (VMW): VMware offers a range of cloud infrastructure services, including compute, storage, and networking. The company’s cloud offerings include VMware Cloud on AWS, VMware Cloud Foundation, and VMware Cloud Director, among others.

-

Cisco Systems, Inc. (CSCO): Cisco offers a range of cloud infrastructure services, including cloud networking, security, and storage. The company’s cloud offerings include Cisco Meraki, Cisco Umbrella, and Cisco HyperFlex, among others.

-

Please note that this list is not meant to be comprehensive or taken as financial advice. It is always important to do your own research and consult with a financial advisor before making any investment decisions.

Me – How about data management companies?

♦Certainly! Here are five publicly traded data management companies that you may want to consider researching further:

-

-

Informatica Corporation (INFA): Informatica offers a range of data management solutions, including data integration, data quality, and master data management. The company’s solutions are designed to help organizations manage and integrate their data across different sources and applications.

-

Teradata Corporation (TDC): Teradata provides a range of data management solutions, including data warehousing, big data analytics, and data integration. The company’s solutions are designed to help organizations manage and analyze large volumes of data.

-

Cloudera, Inc. (CLDR): Cloudera provides a range of data management solutions, including data warehousing, big data analytics, and data engineering. The company’s solutions are designed to help organizations manage and analyze data across on-premises and cloud environments.

-

MongoDB, Inc. (MDB): MongoDB provides a document-oriented database platform that enables organizations to store, manage, and analyze unstructured data. The company’s solutions are designed to help organizations manage and scale their data across different applications and environments.

-

Splunk Inc. (SPLK): Splunk provides a range of data management solutions, including machine data analytics, IT operations, and security. The company’s solutions are designed to help organizations gain insights from their data and improve operational efficiency.

-

Please note that this list is not meant to be comprehensive or taken as financial advice. It is always important to do your own research and consult with a financial advisor before making any investment decisions.

Me – And what about chip manufacturers that supply AI?

♦Sure, here are 5 AI chip manufacturers that are publicly traded, along with a brief description of each and some information that might be of interest to investors:

-

-

Nvidia (NVDA): Nvidia is a well-known player in the AI space, with its graphics processing units (GPUs) being widely used in machine learning and deep learning applications. Nvidia’s revenues have grown rapidly in recent years, driven by strong demand for its gaming and data center products. The company is also making significant investments in autonomous vehicles, which could be a major growth area in the coming years.

-

Intel (INTC): Intel is a dominant player in the semiconductor industry, and its CPUs have been widely used in AI applications. However, the company has faced increasing competition from Nvidia and other specialized AI chip manufacturers. Intel is investing heavily in developing its own AI chips and has made several acquisitions in the space. The company also has a significant presence in the data center market, which could be a major driver of growth for its AI chips.

-

Advanced Micro Devices (AMD): AMD is a smaller player in the semiconductor industry than Intel, but it has been gaining market share in recent years. The company’s CPUs and GPUs are widely used in gaming and data center applications, and it has been making investments in AI chips. AMD recently acquired Xilinx, a leading provider of field-programmable gate arrays (FPGAs), which could be a major growth area for the company.

-

Taiwan Semiconductor Manufacturing Company (TSM): TSM is the world’s largest contract manufacturer of semiconductors, and it produces chips for a wide range of customers, including many AI chip manufacturers. The company has been investing heavily in advanced chip manufacturing technology, which could give it a significant competitive advantage in the space. TSM also has a strong balance sheet and has been returning capital to shareholders through dividends and share buybacks.

-

Qualcomm (QCOM): Qualcomm is best known for its mobile processors and modems, but the company has been making significant investments in AI chips. Qualcomm’s AI chips are designed to be used in mobile devices and the internet of things (IoT), which could be a major growth area in the coming years. The company also has a significant presence in the 5G market, which could provide a tailwind for its AI chips.

-

See what I mean? All that took about 5 minutes to ask and 5 minutes to copy it to this page for publishing. I have to do the research now as ChatGPT only goes up to Sept 2021 and can’t give me much of a rundown. Bing is better at that but Bing says I used my limit in the past 24 hours, so I have to wait? Wait? What BS!

Anyway, lots of good suggestions, we’ll check out INFA and others in more detail later this week but, for now, my choices for adding to the Money Talk Portfolio are as follows:

I love INTC but we already have it (see above). TSM and QCOM are my next favorites (NVDA ship has sailed). BABA is cheap but threat of de-listing, ORCL reasonable but so is IBM and we LOVE IBM and it fits better in our portfolio.

So, we can add QCOM as follows:

-

- Sell 5 QCOM 2025 $85 puts at $7 ($3,500)

- Buy 10 QCOM 2025 $115 calls for $30 ($30,000)

- Sell 10 QCOM 2025 $130 calls for $23 ($23,000)

That’s net $3,500 on the $15,000 spread that is starting out $8,500 in the money. All QCOM has to do is get over $130 by Jan 2025 and the upside potential is $11,500 (328%) and the worst case is owning 500 shares of QCOM at net $92, which is still $31.50 (25.5%) below the current price.

And, for IBM, which was our 2022 Trade of the Year – so we know we love them – we can add the following:

-

- Sell 5 IBM 2025 $130 puts for $14.70 ($7,350)

- Buy 15 IBM 2025 $120 calls for $20 ($30,000)

- Sell 15 IBM 2025 $135 calls for $13 ($19,500)

That’s net $3,150 on the $22,500 spread with $19,350 (614%) upside potential at $130 and IBM is at $129.30 at the moment, so it needs to gain 0.70 in a bit less than two years to make 614% and the risk is owning 500 shares of IBM at $136.30, which is, in this case, more than the current price but we’re very confident IBM is far too undervalued here. It was our 2022 Stock of the Year – so we’re pretty sure!

And just like that we’ve used $6,650 of our cash to add $30,850 of upside potential, which means our Money Talk Portfolio now has a total upside potential of $214,853. Wasn’t that easy?