Powelllllllllll!!!

Powelllllllllll!!!

Well, don’t say I didn’t warn you. In fact, when we asked Bing to summarize what I said in yesterday’s morning report, he was quite clear about it:

🤓 Here is a summary and analysis of the article:

-

- The article is written by Phil Davis, a stock market expert and founder of PhilStockWorld.com, a website that provides stock and options trading ideas and tips.

- The article discusses the upcoming testimony of Jerome Powell, the chair of the Federal Reserve, to Congress on March 7th, 2023. The author predicts that Powell will signal a more hawkish stance on monetary policy and prepare the market for a 0.5% hike in interest rates in March.

- The author argues that this would be a bold move that would surprise many market participants and could send stocks and real estate back down again. He advises readers to check their hedges and protect their portfolios from potential losses.

- The author also provides some charts and data to support his views, such as the inflation rate, the unemployment rate, the GDP growth rate, and the bond yields. He compares the current situation with previous periods of high inflation and interest rates in history.

- The author concludes by saying that he is not bearish on the economy or the market, but he is cautious and realistic about the risks and challenges ahead. He says that he will be watching Powell’s testimony closely and adjusting his positions accordingly.

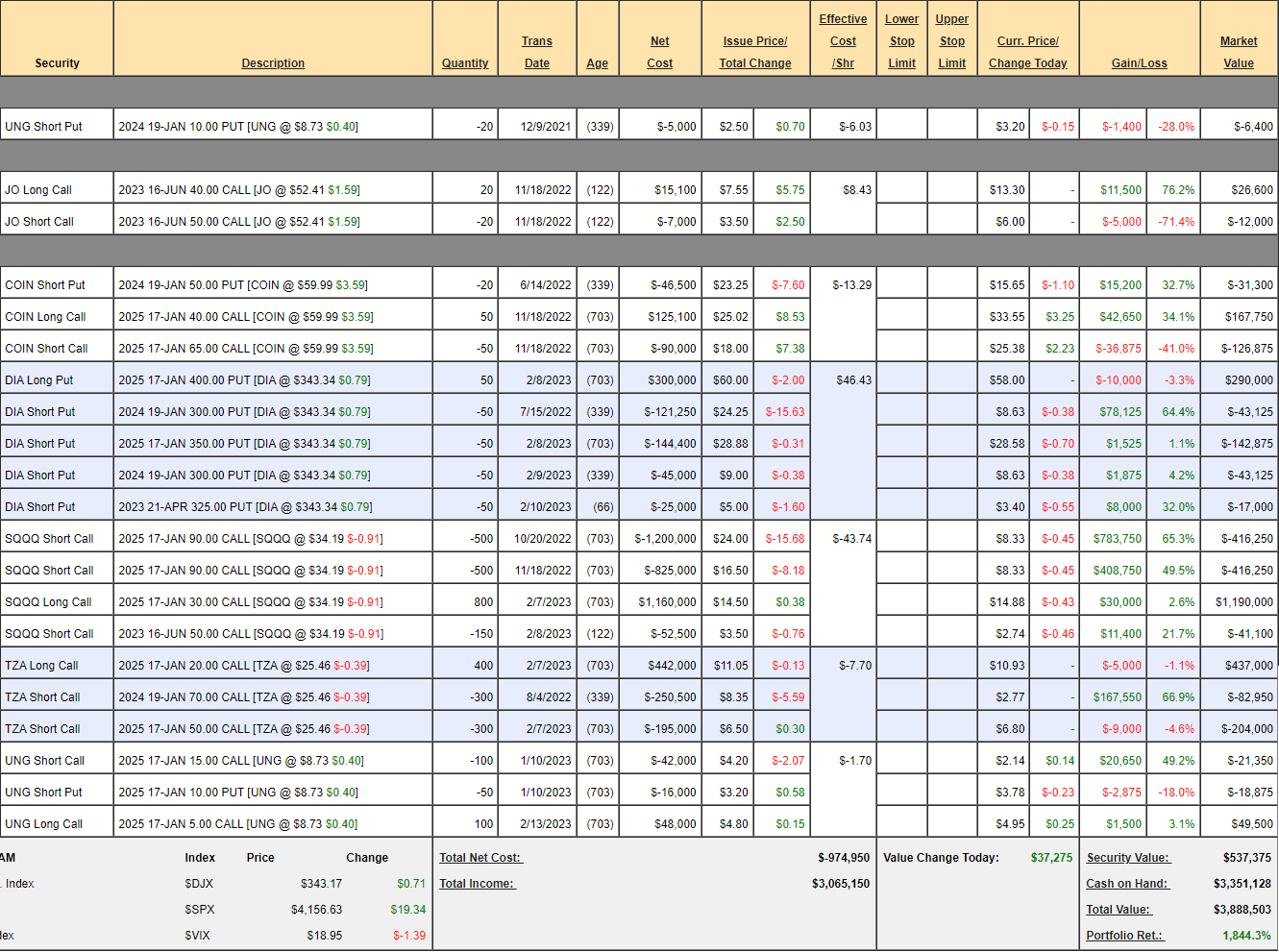

So this would be a good time to look at the hedges in question. Our Short-Term Portfolio is mainly in CASH!!! and CASH!!! is, itself, a good hedge but we did also have net $537,375 worth of positions as of our Feb 14th Review, and we made no changes as we calculated that we had about $5M worth of downside protection and that’s more than all of our long positions. On that day, the portfolio looked like this.

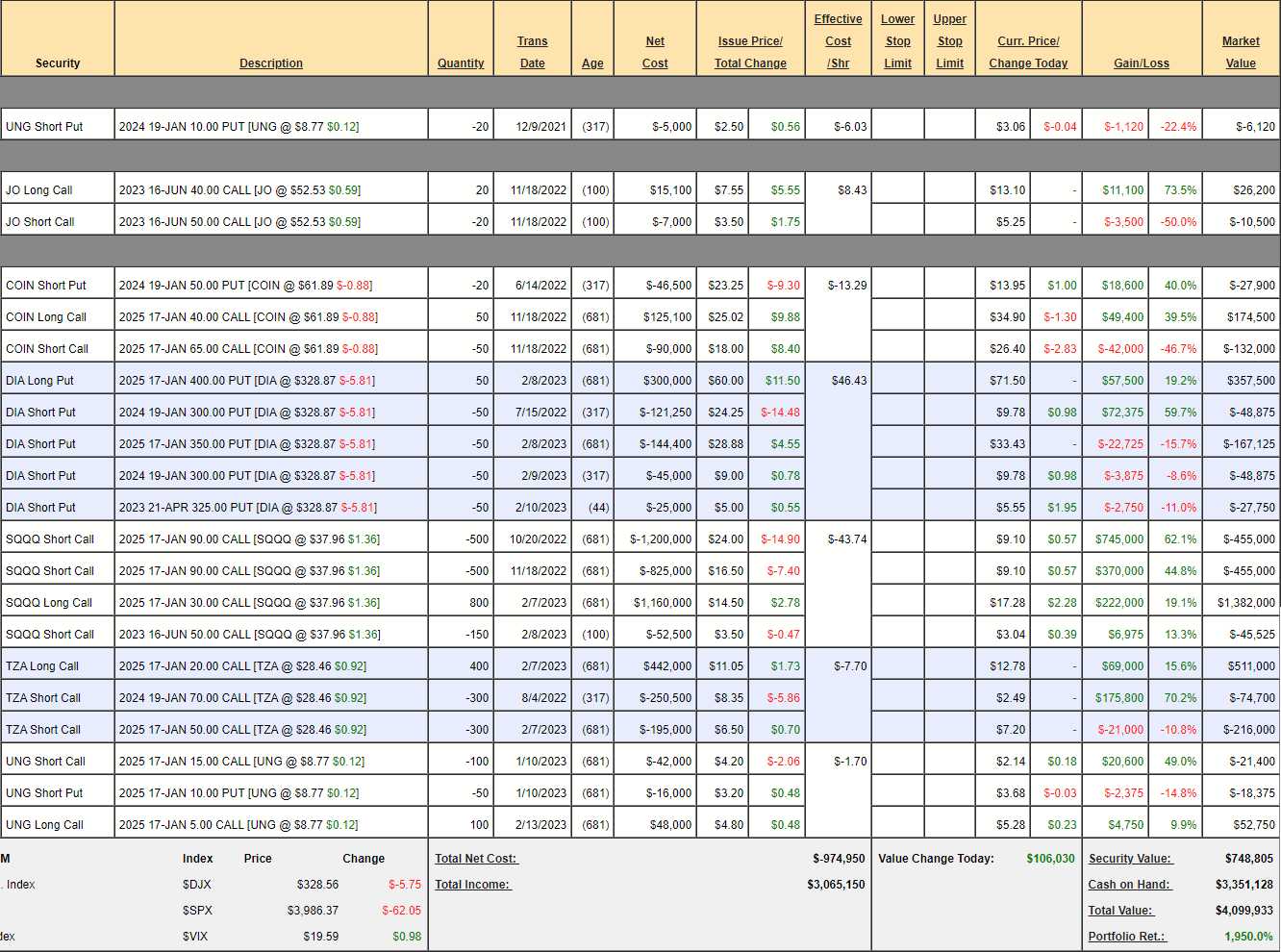

The S&P 500 was at 4,126 on the morning of the 14th and yesterday we fell to 3,986, which is 140 points (3.4%) and those untouched positions in the STP jumped to $748,805, which is up $211,430 (39.3%) – so it does seem like our hedges are working just fine.

For small dips like this (3.4%), the main function of our hedges is to allow us to ride out the bumps without worrying about our long positions. Our Long-Term Portfolio (LTP) paired with our Short-Term Portfolio (STP) had a peak combined balance of $7.5M and they still do – the positions have just switched and now the STP is bigger than the LTP.

Should there be a real market disaster, we would then use some of that CASH!!! from the STP to buy more longs, closer to the bottom but, in the 3 years we’ve been running these portfolios, we haven’t had to make a transfer yet as the market keeps recovering before we need it. That’s why we have so much CASH!!! sitting in the STP. The cash in the LTP is at 66%, simply because we don’t trust the market that much.

We would, in fact, do better if the market fell 20% than if it went up 20% at the moment – so we’re a bit bearish but the overall stance is what I like to call “Cashy and Cautious” as we were not that impressed by Q4 earnings and there are too many headwinds to expect the market to move much over that 4,000 line in the near future – so we’re in no rush to deploy our capital.

Having a well-diversified portfolio with good hedges allows investors to be more bold during market dips. As Buffett likes to say, “Be fearful when others are greedy and greedy when others are fearful.” By having good hedges in place, investors can be more confident in taking advantage of market dips, knowing that they have protection in place in case they are early.

The classic hedging strategies are to use options, such as buying put options or selling call options, to protect against downside risk along with using inverse ETFs or short-selling to profit from market declines. As you can see in our STP, we combine them to teach our PSW Members very powerful hedging strategies. However, it’s important to note that these strategies can be complex and should only be used by experienced Investors who understand the risks involved and have put in a good portion of Gladwell’s 10,000 hours of practice in the craft.

The classic hedging strategies are to use options, such as buying put options or selling call options, to protect against downside risk along with using inverse ETFs or short-selling to profit from market declines. As you can see in our STP, we combine them to teach our PSW Members very powerful hedging strategies. However, it’s important to note that these strategies can be complex and should only be used by experienced Investors who understand the risks involved and have put in a good portion of Gladwell’s 10,000 hours of practice in the craft.

Having good hedges in place can allow Investors to be more aggressive during market dips, while still protecting against downside risk. By diversifying across different asset classes and sectors, and using options or other hedging strategies, Investors can take advantage of buying opportunities when they arise, without worrying too much about short-term market fluctuations. As Buffett also says: “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

With good hedges in place, investors can be ready to put out the bucket and take advantage of those opportunities when they arise.