SVB

The spectacular blow-up currently taking place at SVB and its primary subsidiary, Silicon Valley Bank, is the biggest story in the markets this week. SVB is systemically important for the technology sector and its Northern California ecosystem. As Jim Cramer put it last night, the Federal Reserve has been firing a machine gun at the economy for the last 12 months but it hasn’t hit anything yet. Until today.

The general story here, without repeating all of the detailed accounts out there, is that this is a bank that grew deposits and assets at a rapid rate between 2015 and 2021 as the technology bull market became a full-blown bubble. They had to stuff all the deposits somewhere and that somewhere was in 10-year Treasurys yielding 1.5% on average. Now that interest rates have gone up almost 500 basis points, those bonds are down in price. At the same time, there have been no IPOs or exits for their clients (founders and VCs) and the cash burn rates at these businesses have necessitated the ongoing withdrawal of funds from their SVB accounts.

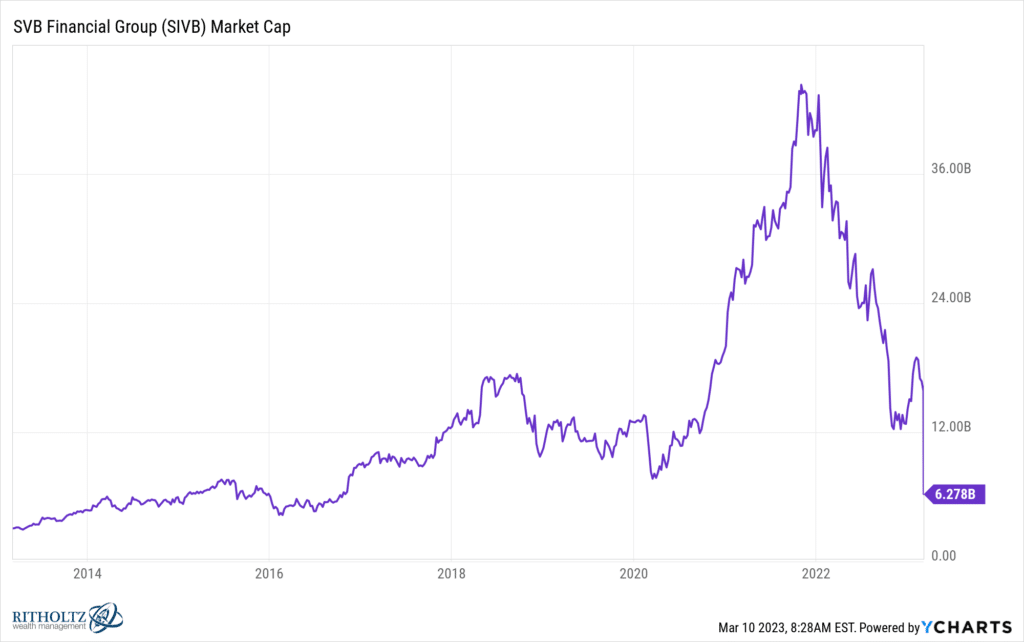

Therefore, the bank had money going out faster than it had been coming in and an asset portfolio with big losses. They decided to sell a chunk of their portfolio assets at a loss and do a capital raise to account for the funding gap. This set off a chain reaction that led to a classic run on the bank as many prominent venture capitalists began telling their portfolio companies to move their money away. This sort of thing can feed on itself. SVB went from a $45 billion market cap to sub-$5 billion as of this morning’s open.

In good times, SVB’s willingness to lend to the “innovation economy” has been instrumental to the tech industry. The virtuous circle this creates put the bank at the center of all this activity and generated loads of profit and goodwill. In more difficult times like these, everything goes into reverse. The virtuous circle becomes a death spiral where the worse things get, the worse things get and this could eventually become a panic. I think that’s where we are today, with the stock price being cut in half two days in a row.

A few related thoughts:

There’s always more than one. Other banks that have lent to or supported technology entrepreneurs and startups are going to be at risk before the storm passes.

The larger banks will be fine. This is not going to be a problem for them. However, their stock prices will trade lower no matter what. The Great Financial Crisis was fifteen years ago but the PTSD from that era is permanent. If you lived through it, you see parallels to it everywhere you look and the urge to de-risk is almost primal in its intensity.

Commercial real estate is also going to be a problem. If you’re a bank with exposure to commercial real estate – office buildings specifically – and commercial mortgage backed securities (CMBS), there will be write-downs and losses. And this is basically every bank and financial institution under the sun, so prepare yourself mentally for an ocean of headlines. The solution is for a mass conversion of office buildings into residential condos. Zoning laws in places like New York City and San Francisco will have to be changed. Capital must be raised. This will take a decade. There will be large losses for developers and banks in the meantime. But it’s the right solution. Last month, the average rent for a New York City apartment hit $5200 a month. That’s average. Meanwhile, there are a thousand half-empty office buildings where leases will run off and companies will negotiate for less space and fewer dollars per square foot. Very few companies will have all of their employees showing up for work five days a week. The knowledge economy’s new status quo is hybrid. Obviously we have an imbalance to correct. More apartments, less offices. Lower lease prices for both. It’s obvious but it takes awhile. It’s going to get messy and stay messy for a long time.

If you’ve been around for awhile and this isn’t your first cycle, you will spend the coming period with a mindset alternating between fear and greed. At one moment you’ll be thinking “Oh my god things are going to get so much worse” and then a moment later a different part of your brain will be shouting “I gotta buy something! This is a generational opportunity.” As your thoughts oscillate back and forth between these two poles, confusion and frustration will set in. You must remind yourself that there’s no reason to be first to buy and real opportunities rarely need to be capitalized upon with any urgency. Have patience.

What’s gotten “too cheap” today can get much cheaper before it’s over. Cure yourself of the disease of needing to nail the bottom. If you buy something two thirds of the way down, endure the last third, and then are positioned for the recovery, it’ll all work out.

In your comments to others or in social media posts, try to keep in mind that the institutions that are struggling through this employ millions of ordinary people who are not at fault for the decisions that have been made at the top. These are people who work for a living and are just trying to support their families. Piling on with mean-spirited commentary or spreading unfounded innuendo might be fun in the moment, but there are real-life consequences to this for others. And who knows – the next time it might be happening to you or a company you are involved with. When in doubt, be kind.

We discussed this on today’s all-new episode of The Compound and Friends with trader Joe Fahmy and Carleton English, who covers banks for Barron’s. Timely discussion, I hope you enjoy the show: