By Lance Roberts via RealInvestmentAdvice.com

With the collapse of Silicon Valley Bank, questions of potential “bank runs” spread among regional banks.

“Bank runs” are problematic in today’s financial system due to fractional reserve banking. Under this system, only a fraction of a bank’s deposits must be available for withdrawal. In this system, banks only keep a specific amount of cash on hand and create loans from deposits it receives.

Reserve banking is not problematic as long as everyone remains calm. As I noted in the “Stability Instability Paradox:”

The “stability/instability paradox” assumes that all players are rational and such rationality implies an avoidance of complete destruction. In other words, all players will act rationally, and no one will push “the big red button.“

In this case, the “big red button” is a “bank run.”

Banks have a continual inflow of deposits which it then creates loans against. The bank monitors its assets, deposits, and liabilities closely to maintain solvency and meet Federal capital and reserve requirements. Banks have minimal risk of insolvency in a normal environment as there are always enough deposit flows to cover withdrawal requests.

However, in a “bank run,” many customers of a bank or other financial institution withdraw their deposits simultaneously over concerns about the bank’s solvency. As more people withdraw their funds, the probability of default increases, prompting a further withdrawal of deposits. Eventually, the bank’s reserves are insufficient to cover the withdrawals leading to failure.

However, as we warned inJanuary 2022 (2 months before the first Fed rate hike.)

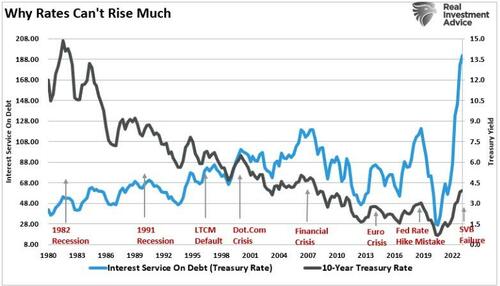

“The rise and fall of stock prices have very little to do with the average American and their participation in the domestic economy. Interest rates are an entirely different matter.“

And, as discussed in “Rates Do Matter,”

“The economy and the markets (due to the current momentum) can DEFY the laws of financial gravity as interest rates rise. However, as interest rates increase, they act as a “brake” on economic activity. Such is because higher rates NEGATIVELY impact a highly levered economy.”

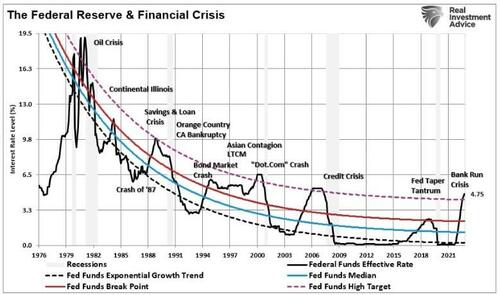

History is pretty clear about the outcome of rate hiking campaigns.

A $17 Trillion Problem

While higher rates increase consumer borrowing costs, they also negatively impact bank capital. As noted above, banks are fine until customers begin to withdraw funds.

What the Federal Reserve didn’t account for in hiking rates were two critical things.

-

The negative impact on bank collateral (as interest rates rise, collateral values fall)

-

At what point would customers liquidate demand deposits for higher-yielding assets?

These two points have a crucial relationship.

When banks take in customer deposits, they loan those funds to others or buy bonds. Since loans are longer-term assets, the bank cannot reclaim its funds until loan maturity. Therefore, there is a duration mismatch between the bank’s assets and liabilities. In addition, banks keep only a fraction of the deposits as cash. What is not loaned out gets used to purchase bonds with a higher yield than what is paid on customer deposits.

This is how the bank makes money.

As the Fed hiked rates to 2, 3, and 4%, the interest on bank accounts remained low, and deposits remained stable, providing a false sense of security for regulators. However, once rates eclipsed 4%, customers took notice and began to buy bonds directly for a higher yield or transfer funds from the bank to a brokerage account. Banks are forced to sell collateral at discounted values as customers extract deposits.

The Fed caused this problem by aggressively hiking rates which dropped collateral values. Such has left some banks, which didn’t hedge their loan/bond portfolios with insufficient collateral to cover the deposits during a “bank run.”

Here is a simplistic example.

-

Bank (A) has $100 million in deposits and $100 million in collateral trading at par (face) value.

-

As the Fed hikes rates, the collateral value falls to $90 million.

Again, this is not problematic as long as customers do not simultaneously demand all $100 million in deposits. If they do, there is a collateral shortfall of $10 million to cover demands. Further, the bank must recognize a $10 million loss and raise appropriate capital. Often, bank capital raises scare investors.

Such is precisely what happened with Silicon Valley Bank, as $42 billion was extracted from the bank literally overnight.

How did that happen?

Mobile banking.

Individuals no longer have to drive to the bank and wait in line to withdraw their funds. It is as fast as opening an app on your phone and clicking a button.

This should scare the “bejeebers” out of regulators.

A $17 Trillion deposit base is now on a “hair trigger” of consumers expecting instant liquidity.

The real problem for the Fed is not just bank solvency but “instant liquidity.”

This Is Likely Only The Start

The events of Silicon Valley Bank should not be a surprise. As noted over the past year, there has never been a “soft landing” in the economy. Notably, this is not the first banking crisis the Fed has caused.

“The failure of Continental Illinois National Bank and Trust Company in 1984, the largest in U.S. history at the time, and its subsequent rescue gave rise to the term “too big to fail.” The Chicago-based bank was the seventh-largest bank in the United States and the largest in the Midwest, with approximately $40 billion in assets. Its failure raised important questions about whether large banks should receive differential treatment in the event of failure.

The bank took action to stabilize its balance sheet in 1982 and 1983. But in 1984, the bank posted that its nonperforming loans had suddenly increased by $400 million to $2.3 billion. On May 10, 1984, rumors of the bank’s insolvency sparked a huge run by its depositors.”

Many factors led to the crisis, but as the Fed hiked rates, higher interest service led to debt defaults and, eventually, the bank’s failure.

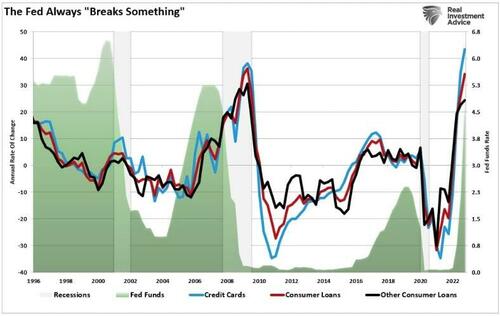

We saw the same impact from the Fed in 1994 with the bond market crash and even Bear Stears in 2007. At each point, the Fed was aggressively hiking rates to the point that it “broke something.”

The Fed remains abundantly clear that it still sees inflation as a “persistent and pernicious” economic threat that must be defeated. The problem is that higher rates in an economy dependent on debt for economic growth eventually lead to an “event” as borrowing costs and payments increase.

Such is why consumer delinquencies are now rising due to the massive amount of credit at higher rates. Notice that when the Fed begins cutting rates, delinquencies decline sharply. This is because the Fed has “broken something” economically, and debt is discharged through foreclosures, bankruptcies, and loan modifications.

While the economy seems to be holding up well, this is the first crack in the “soft landing” scenario.

The Federal Reserve has never entered a rate hiking campaign with a” positive outcome.” Instead, each previous attempt resulted in a recession, bear market, or some “event” requiring a monetary policy reversal.

Or, instead, a “hard landing.”

I am pretty sure this time won’t be any different.

(This article is as posted on ZeroHedge.)