“Brenda and Eddie had had it

“Brenda and Eddie had had it

Already by the summer of ’75

From the high to the low to

The end of the show

For the rest of their lives” – Billy Joel

How quickly things change!

Our last Portfolio Review was on St. Valentine’s Day and, since then, it’s been a massacre for the markets. Fortunately, right before our reviews, we pressed our hedges in the Short-Term Portfolio in order to lock in what we considered to be ill-gotten gains as the market was up 10% for the year for essentially no good reason at all. Now we are not.

I don’t think things are collapsing but we thought the S&P was at least 10% and maybe 20% overvalued and now I’m leaning much more towards 20% now that we ALSO have bank earnings (not solvency) to worry about as everyone will have to mark down their holdings in their Q1 reports, which are now around the corner in April.

We are still “Cashy and Cautious” and we made very few changes last month and added very few positions since then – maybe this month we’ll find some more bargains. We still have an abundance of hedges and, of course, CASH!!! is a hedge and let’s discuss why:

- If I have $100,000 I can buy 238 shares of SPY at $420.

- If the market drops 20% and SPY is at $336, my portfolio is down to $79,968 and needs to gain 25% to get even.

- If, on the other hand, I had been cautious and was 60% in CASH!!! and bought 95 shares of SPY for $420 and the market dropped 20%, I’d have $60,000 in cash and $31,920 worth of SPY for net $91,920 and I only need a 10% gain to get even.

Even better, since I have sidelined cash, I can buy 50% more SPY, let’s say 55 shares at $336 ($18,480), which would leave me with 150 shares of SPY and $41,520 in CASH!!! Note that our system encourages us to buy low and we’ve now tipped from cautious to slightly bullish in our mix.

Even better, since I have sidelined cash, I can buy 50% more SPY, let’s say 55 shares at $336 ($18,480), which would leave me with 150 shares of SPY and $41,520 in CASH!!! Note that our system encourages us to buy low and we’ve now tipped from cautious to slightly bullish in our mix.

- If the S&P were to drop 10% more, SPY would be $302.40 and the all in play would be down to $71,971 for 238 shares while our scaling in play would be at $45,360 for 150 shares and $41,520 in CASH!! for net $86,880 – far, far better off.

- If the S&P instead recovers 10% to $369.60, the 238 shares would be worth $87,964.80 and our cautious bet would be at $55,440 for the 150 shares along with the $41,520 in CASH!!! for $96,960 – even though the market is still 10% below where we started.

When you use good cash management skills along with sensible trading and sensible hedging, you can beat the market by quite a bit over the long haul and, when the market takes a dip like it has in the past month – you will sit patiently on the sidelines, excited about all the things you can buy on sale instead of FREAKING OUT over what to do.

Make more money – have more peace of mind – this is what we teach you at PhilStockWorld!

Still, it’s not magic, our long portfolios do lose money in a downturn – just hopefully not too much…

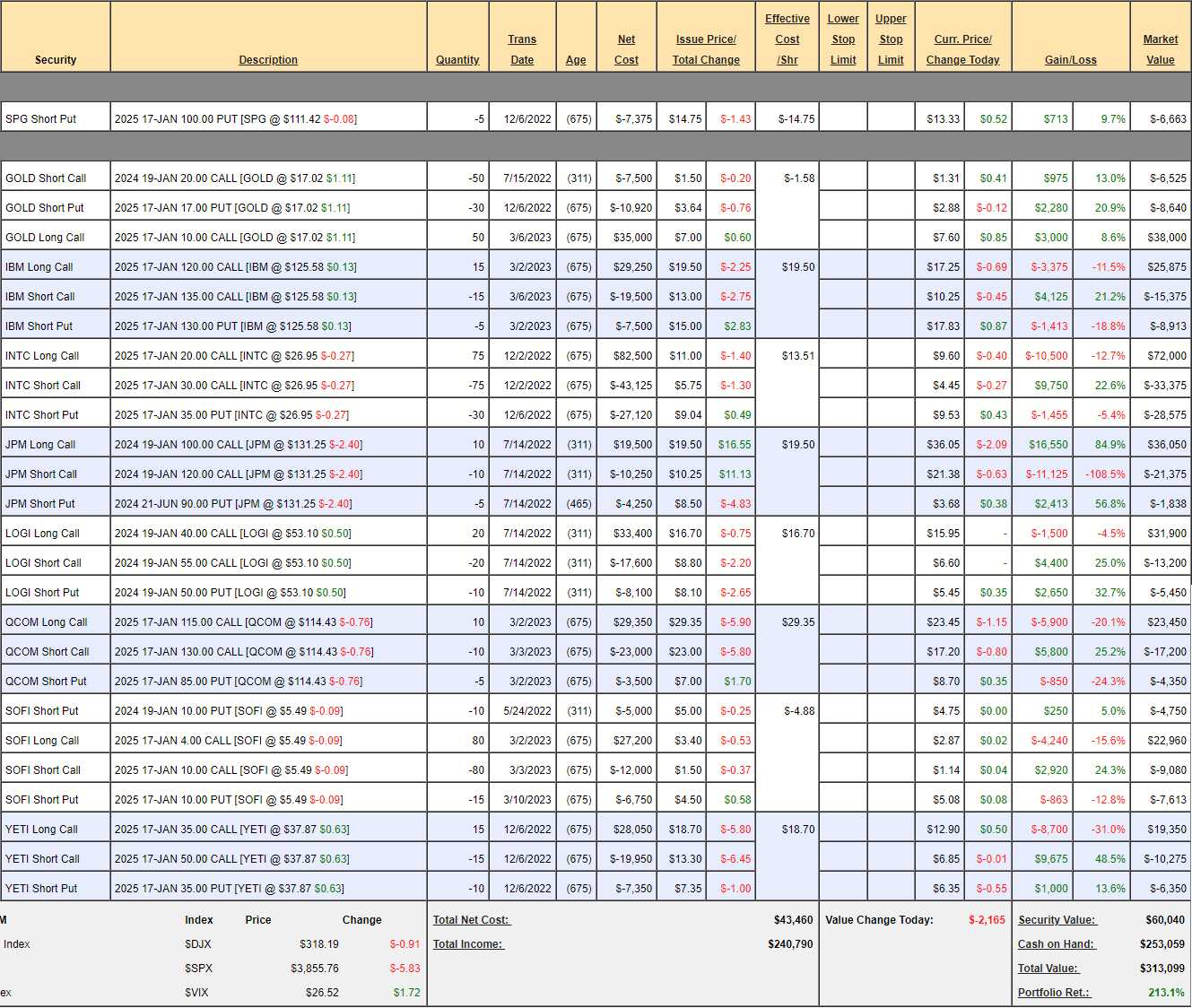

Money Talk Portfolio Review: I was just on the show on March 1st, so we actually have some changes for a change. We only make adjustments to this portfolio when I’m on the show and the time before this was Dec 1st, when we announced our Trade of the Year.

We made several changes to start the month, getting more aggressive on GOLD (good timing) and INTC while doubling down on SOFI – and thank goodness they are not one of the banks that are in trouble (so far). Actually, I wish we could add more now. We added IBM and QCOM as new positions and, despite all the turmoil, we’re at $313,099, which is up $2,128 in two weeks and, considering the two weeks – we’re happy to take it.

The overall gain for the portfolio is 213.1% since we started with $100,000 on 11/13/19 and our goal has been to simply follow our strategy for Making 20-40% Annual Returns – we’re well ahead of that and the best thing is we still have $253,059 (80%) in CASH!!!, waiting on the sidelines.

-

- SPG – We sell the short puts to get a cheap entry and, if we don’t get that, we just keep the cash for our troubles. We fully expect to collect the remaining $6,663 on these puts and, if not, we’ll be in SPG for net $85.25 – nothing wrong with that either! These are great as a new trade – almost back to our entry price.

-

- GOLD – We just pushed this one and it’s already making money. Currently net $22,835 on the $50,000 spread means we have $27,165 (119%) left to gain.

-

- IBM – Still has that new trade smell and that new trade price at net $3,174 on the $22,500 spread with $19,326 (608%) upside potential. Whenever IBM is cheap – we buy it. It was last year’s Stock of the Year and we cashed it out – now back in – very simple.

-

- INTC – This will be our 2024 Trade of the Year if they stay this low into Thanksgiving and they might as 2023 is still a very heavy-investing year for Intel. Still, at some point people will catch on and this thing will fly. At the moment, though, we’re at net $10,050 on the $75,000 spread that’s half in the money with $64,950 (646%) upside potential. You don’t have to wait for the official call to get in…

-

- JPM – Not hit too hard so far by banking concerns. If JPM goes – there won’t be anywhere to hide anyway. This is a $20,000 spread at net $12,837 because we bought it in July but all they have to do is hold $120 (-10%) and we get the other $7,163 (55%) in 9 months.

-

- LOGI – Pulled back a bit but they were over our target still on track for the full $30,000 at net $13,250 so $16,750 (126%) left to gain in 9 months is like 14% a month in interest – not bad!

-

- QCOM – Another new one and it’s a $15,000 spread at net $1,900 so we have $13,100 (689%) upside potential at $130 and we have two years to get there – I’m very confident.

-

- SOFI – Came back down so nice opportunity if you want to take a risk on a bank. The nice thing is, with the short puts, we only risk being assigned 2,000 shares at $10 ($20,000) as a worst-case but it’s a $48,000 spread at net $1,517 so we have $46,483 (3,064%) of upside potential if SOFI can get to $10 in two years (and we’ll roll the short puts).

-

- YETI – Our 2023 Trade of the Year as it’s the spread we fell most likely to return 300% against our cash outlay. That outlay was $750 and now the net of the trade is $2,725 so we’re up 263% so far – after being over goal last month. I think our $50 target for 2025 is very reasonable so we look forward to an upside potential of $19,775 (725%) from here.

We’re only using $60,040 in cash yet our upside potential on 9 positions is $221,375 so I’m very happy with this portfolio – especially the way it has weathered the recent storm.

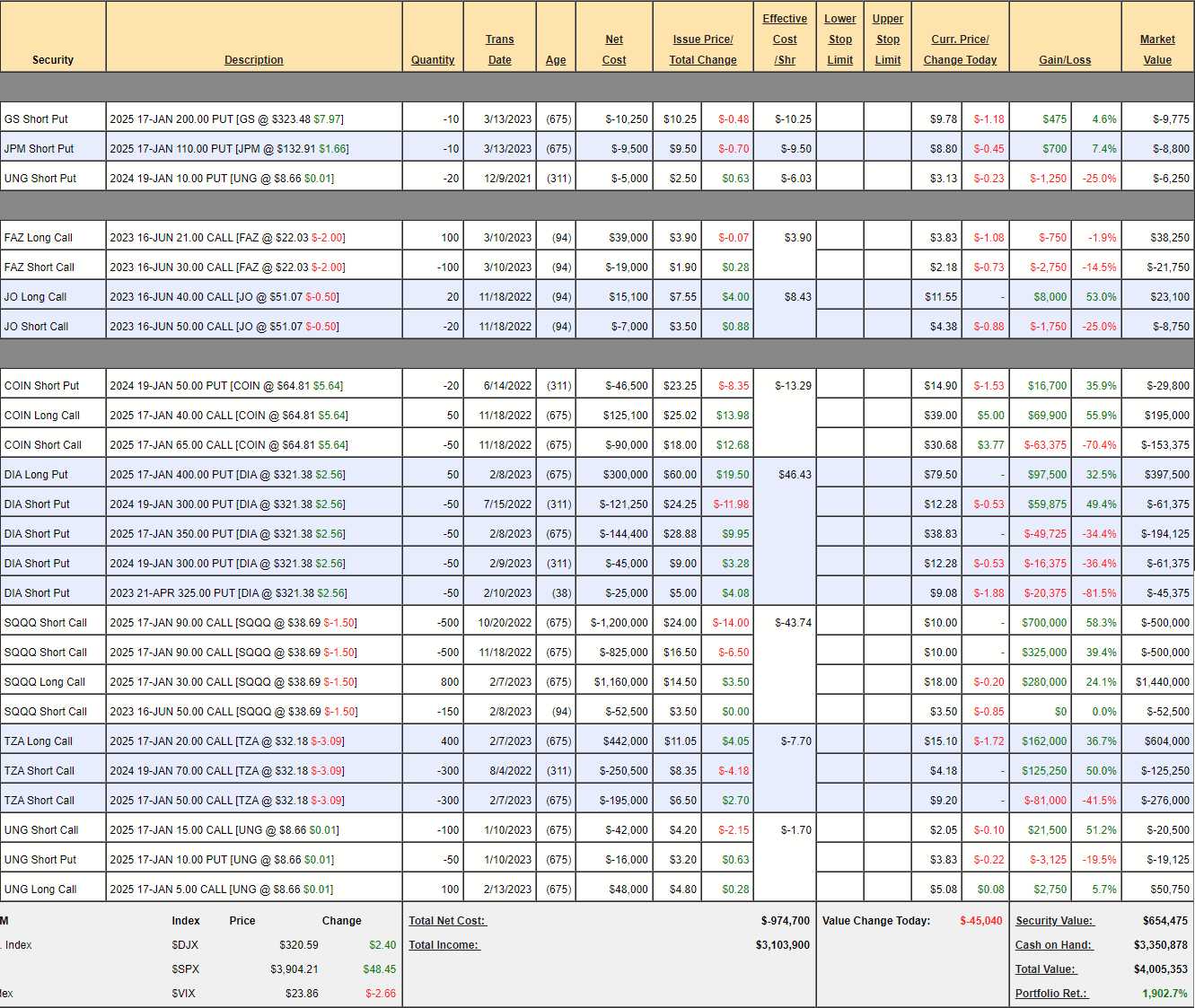

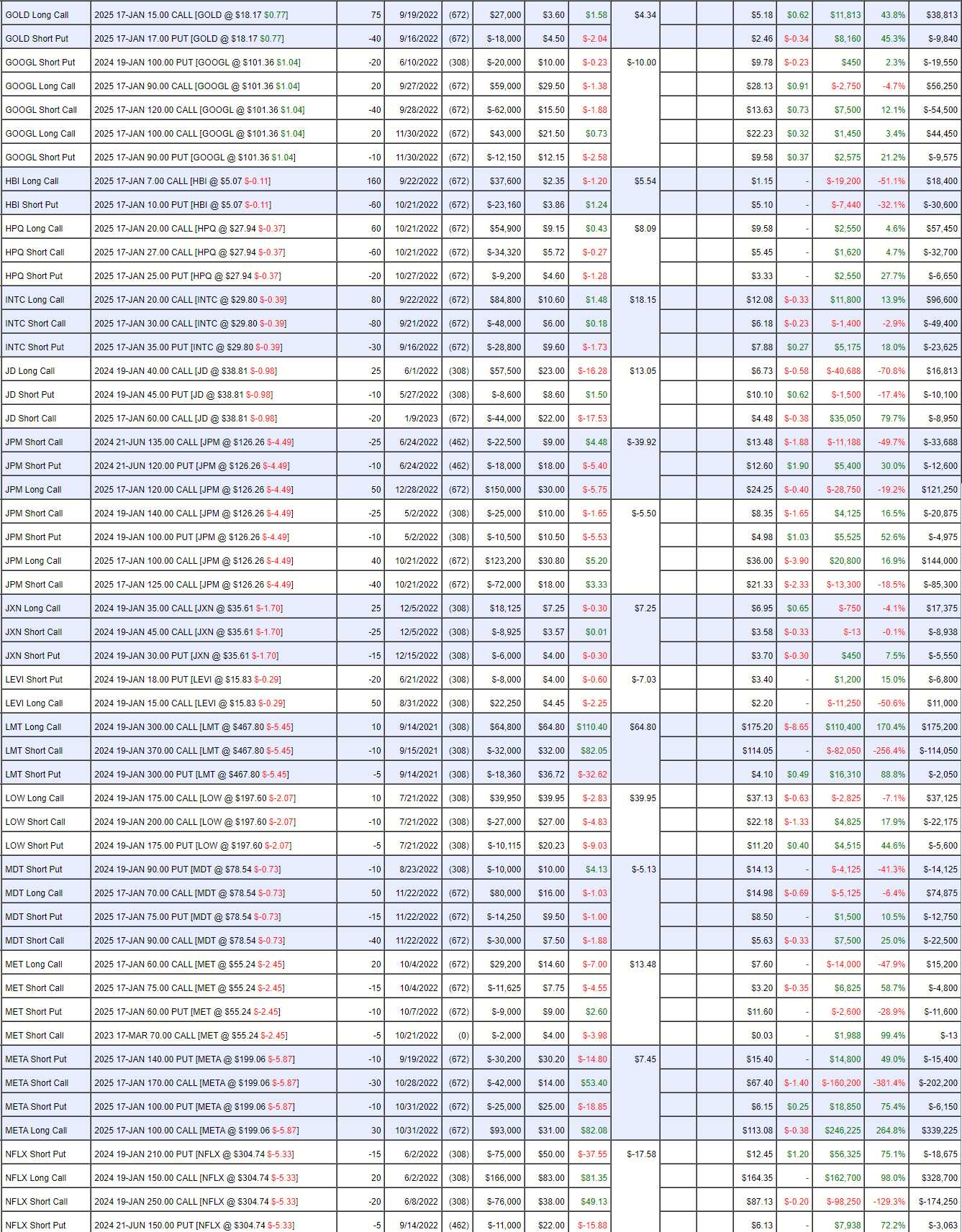

Short-Term Portfolio (STP) Review: Back on Feb 14th the STP was at $3,888,503 and we calculated we had about $5M of protection against a 30% drop and, since we don’t have $5M worth of longs – there didn’t seem to be any need for more hedges. In fact – we looked for more longs to find balance.

We did add a FAZ spread on the 10th but not so much because we needed it but for the educational value of what to do if you find yourself in a crisis and need to add a quick hedge. That’s reflected below and our balance this morning is $4,005,353, which is up $116,850 from last month. The rising VIX makes our hedges seem less effective in the short run – we’ll discuss:

-

- GS, JPM – These are the two puts we sold to help offset the cost of the FAZ spread. Both banks were dipping, both banks are far too big to fail so it’s a good way to raise cash in a crisis. We sold $19,750 worth of puts and we agreed to buy GS for $200 (a 38% discount to today’s price) and we agreed to buy JPM for $110 (a 16.66% discount). I would have gone with 20 GS puts but something about eggs in baskets…

- UNG – Those are leftover from an old spread. For net $7.50 I sure didn’t see the point of paying them off in order NOT to own the longs.

-

- FAZ – And here is the spread. FAZ is a 3x Ultra-Short on the banks and you’ll notice this spread is $12,500 in the money but it’s only net $16,500 (not including the short puts) out of $90,000 potential so we have $73,500 worth of protection if banks drop about 17% (boosting FAZ 50%) between now and June. That works out well as we stand to gain $18,575 on JPM and GS if they don’t go lower – and THAT my friends, is how you construct a hedge!

-

- JO – We correctly called for higher Coffee prices and we’re 100% in the money at net $14,350 out of a potential $20,000 by June.

- COIN – Things were getting better but then the banking nonsense took them back a bit. I still think they’ll be one of the few surviving crypto exchanges and this $75,000 spread is 90% in the money at net $11,825 so still $63,175 (534% left to gain if they can hold $65 into 2025) – I still like this as a new trade but we started with a net $11,400 credit when NOBODY believed me – so we’re already up 200%.

-

- DIA – Too complicated! Let’s see: We have 50 of the 2025 $400/2024 $350 bear put spreads. That’s $250,000 if we’re below $300. We also have 100 short 2024 $300 puts (2 x 50) AND 50 short April $325 puts, which just gave us a scare. Overall, it’s a pretty bullish position to hedge our other hedges with $335,650 worth of short puts that, if they expire worthless by January, will give us a nice, free DIA put into 2025.

-

- SQQQ – This is our Mack Daddy Hedge. 800 2025 $30 calls that are $8.69 ($695,200) in the money and the short calls don’t kick in until $90 in 2025, when we’d be $4.8M in the money but the Nasdaq would be down 44% – so it would be nothing to celebrate. Meanwhile, we do not think SQQQ will be over $50 by June, so we get paid $52,500 while we wait. That’s the plan.

Because we tend to sell more short calls (or puts in the case of DIA) than we have longs, a spike against us like we had last week can make our hedging portfolio look bad in the short-term and we adjust if needed but mostly we can just be patient. The only thing in the money on the SQQQs, for example, are the 800 2025 $30 calls at $695,200 yet the spread shows a total value of $387,500 and we don’t owe a penny to the short $50 callers until our $30s are $1.6M in the money so that is our short-term protection – the net of that is about $1.2M from where we are now and that’s the protection we can count on.

-

- TZA – Another big hedge at net $202,750 but the $20 calls are $487,200 in the money and, at $50, they’d be $1.2M in the money (+$700,000 ish) and we’d make another $800,000 before we ran into the short $70 calls. So we call that $700,000 of short-term protection.

Keep in mind these are not random numbers we picked out. This isn’t Roulette! To get to $70, TZA would have to more than double and that means the Russell would have to drop about 35% and we FUNDAMENTALLY do not believe that will happen. Therefore, we feel selling the additional short calls is a safe(ish) bet and, if forced to, we have $3.35M in CASH!!! sitting on the sidelines to make adjustments.

However, looking this over today I can see why we didn’t adjust last month, this is a pretty well-balanced portfolio that does guard us well against an unexpected 20% drop – which is what we should always aim for in our hedges.

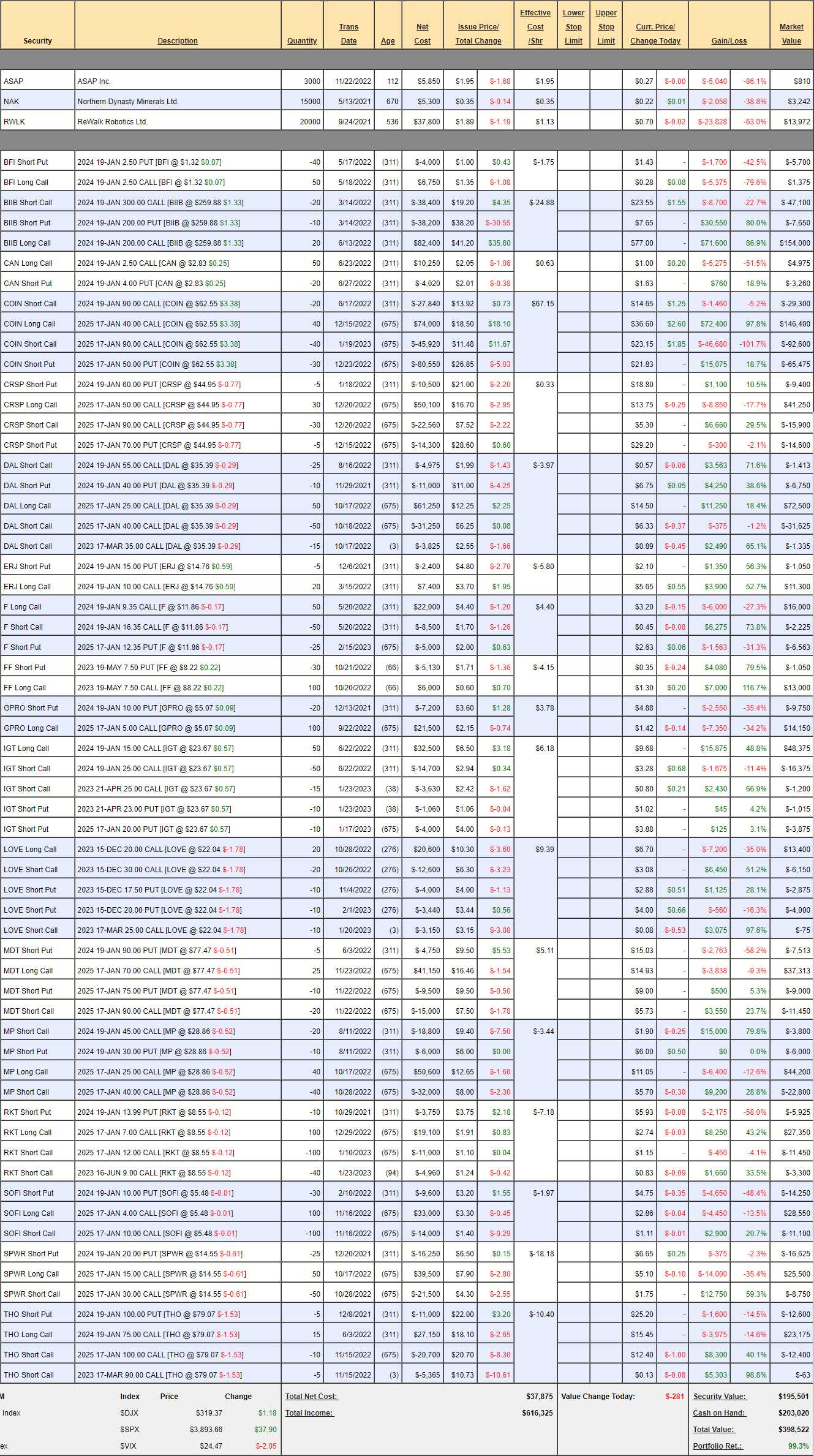

Future is Now Portfolio Review: $398,522 is down $70,354 from our last review in our most sensitive portfolio. We were up $53,134 last month so we lost all of that and a bit more as these are, generally, speculative positions. We’re about half cash – so maybe there are some opportunities to improve?

-

- ASAP – I don’t think they are going to make it but no point in selling.

- NAK – EPA blocked the mine, not sure there’s any way to save them unless the Republicans take charge in 2024.

- RWLK – Another one waiting for an approval. This one from Medicare but I think there’s a chance for them as they really do get people out of wheelchairs.

- BFI – Earnings were OK and they should make about $10M this year, which I think is nice for a $30M company (at $1.35). They are opening 30 ghost kitchens this year along with 3 company restaurants and 10 franchises and that’s up from 104 current locations – so huge growth. I think investors are really missing the bus on this one.

-

- BIIB – Zuranolone is approved for depression and will begin selling in August and they have a good pipeline and trading at 16x. We’re on track and this should make the whole $200,000 and currently net $99,250 so that’s all we need for this whole portfolio to do well.

-

- CAN – Nice little AI company with $700M in the bank and $2.81 is less than $500M so the company is priced below its cash. This is an investing year but they made $658M in 2022 and 2024 sales should be $5.3Bn with over $1Bn in profits so we’re going to roll our 50 2024 $2.50 calls at $1 ($5,000) to 100 2025 $2.50 calls at $1.50 ($15,000) and we’ll sell 100 of the 2025 $5 calls for 0.80 ($8,000). So we’re spending net $2,000 to move to a $25,000 spread on top of the net $6,230 we’ve spent so far.

-

- COIN – On track. It’s a $200,000 spread at a net $40,975 credit so $240,975 upside potential from here. Now you are starting to get the idea of this portfolio, right?

-

- CRSP – Holy cow I love this technology! This is a $120,000 spread at net $1,350 and there will be patent disputes and such along the way but someone will make many billions in this sector.

-

- DAL – IF Airlines start making money, DAL should lead. Our spread is not very demanding and we’re on track. In fact, we predicted $35 this week and here we are so winner for us and we’ll give it time to recover before selling more calls.

- ERJ – Taking off nicely. I don’t want to cover if they’re not showing weakness (is what I said at $12 too, so patience).

-

- F – We just adjusted them. It’s a $35,000 spread at net $7,212 and we’re $10,000 in the money so what’s not to like?

- FF – I love these guys, happy to be super-aggressive.

- GPRO – They have about $250M in the bank and $750M value so $500M net of cash at $5 and they should make $50M this year with very strong projected profit growth as R&D scales back next year. We’re nice and aggressive.

-

- IGT – So it’s a Butterfly Play with 50 2024 $15/25 bull call spreads ($50,000) with 10 short $20 puts covering 15 April $25 short calls (on track) and 10 April $23 short puts (also on track). So it’s a net $13,800 spread we sold $4,690 worth of puts and calls against for the quarter and, if they both go worthless, that’s 34% profit for the Q with 2 more left to sell and whatever we make on the spread (which is almost 100% in the money) is a bonus.

- LOVE – Having another silly sell-off. Nothing to do but wait for now as Dec are their longest options. March $25 calls will go worthless (as expected) so this sell-off was fine with us.

-

- MDT – So many companies I love in this portfolio! $50,000 spread is on track at net $9,350. I’m tempted to buy back the short calls is how much I love this…

-

- RKT – Holding up well during the turmoil. $15,000 in the money on our $50,000 spread but only showing net $6,675.

- SOFI – They didn’t fail! We’re $15,000 in the money on the $60,000 spread.

- SPWR – We already rolled the long calls to 2025 so nothing to do here but wait. It’s a $75,000 spread at net $125 so I think it’s kind of amazing as a new trade on our Stock of the Decade. But who would have ever thought Solar Energy was a good idea in 2023 – is what they will say in 2050?

-

- THO – The March $90s will go worthless for a $5,365 gain and the spread was a net $4,550 credit so we’re really getting our money’s worth. We’ll take a break from selling short calls for now and give them a chance to come back.

— Thursday —

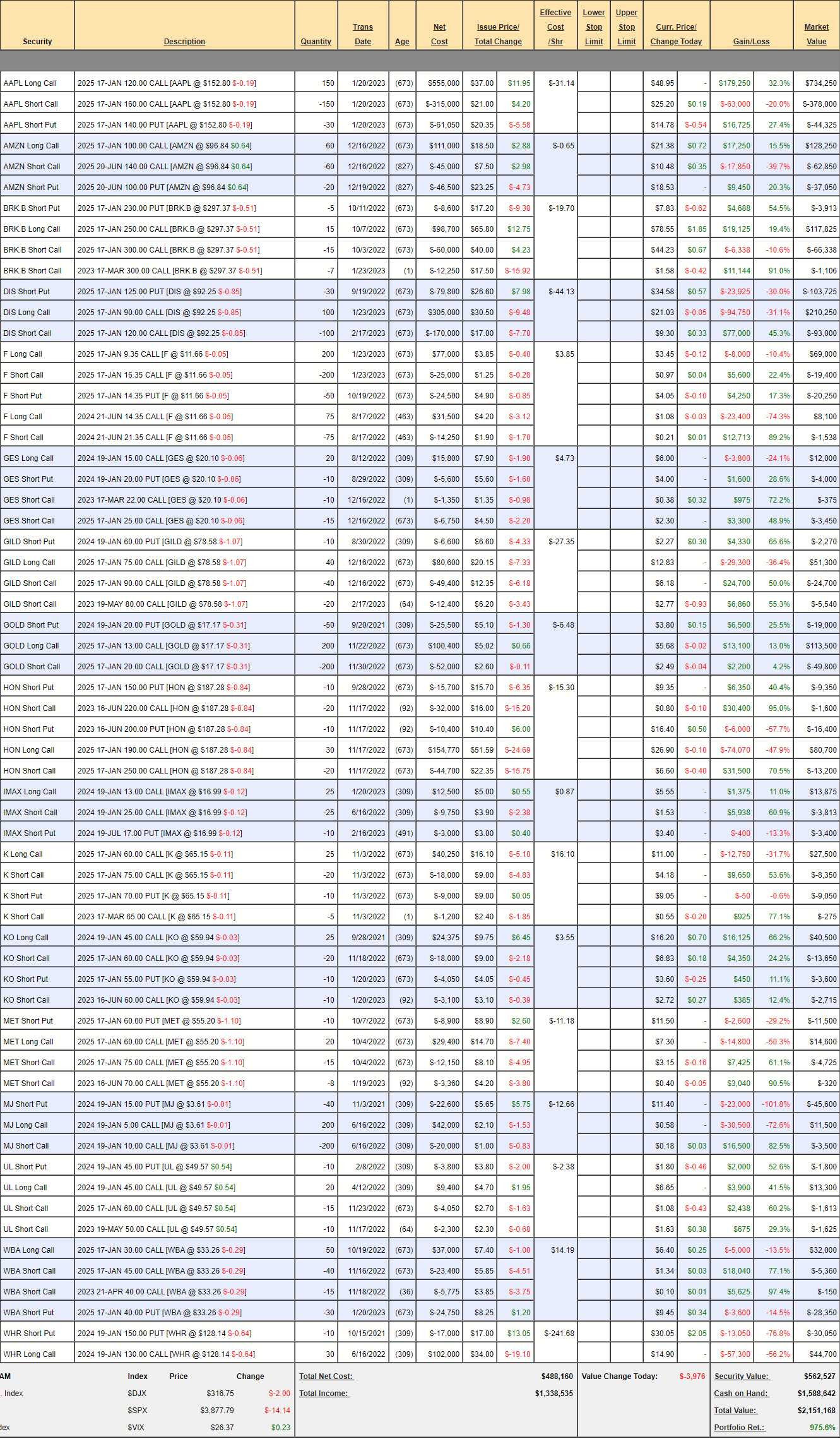

Butterfly Portfolio Review: The Butterfly Portfolio is like a box of chocolates, you never know what you’re going to get in the short-run but, in the long run – you can’t go wrong with a box of chocolates. $2,151,168 is down $205,729 from our Feb 14th review but that one was up $340,213 and we knew that was silly. The low VIX helped then and the high VIX hurts now as we sell a ton of premium in this portfolio. As I said last month:

This portfolio fully employs our “Be the House – NOT the Gambler” strategy and there is nothing better for the Butterfly Portfolio than a slowly rising market (so our short calls don’t get blown out). The VIX is also down 10% since our last review – also helpful in a portfolio where we sell a lot of premium.

-

- AAPL – Still on track.

- AMZN – We have just under $1.6M in cash so we can certainly afford to deploy some. The 2025 $100s are $21.38 and the $90s are $30, not at all worth a roll. The $140s are a fair target I think we’ll hit and far enough away to sell short-term calls – but I think we should wait for a bounce first. So – nothing worth doing.

-

- BRK.B – The March calls we sold for $12,250 are going to expire worthless! That is our favorite thing in this portfolio… The June $300s are $14 so let’s sell 10 of those for $14,000 as they give us downside protection and, if BRK goes higher – $14,000 should be enough to roll 15 2025 $300 calls to at least the $320 calls – and we’d pick up $30,000 potential on the spread. If BRK goes lower, then we roll the $250 calls to a lower strike. Lots of ways to win, not many to lose…

-

- DIS – Thank goodness we covered last month! Our timing was so good that we’re already up 45% ($77,000) on the 2025 $120 calls so it would be downright silly not to buy them back ($93,000) and lock in those gains. If DIS goes lower, we sell lower short calls and roll our $90s lower. If they go higher —- I look like a genius!

Notice our system almost forces us to do the right thing. It takes the emotion out of the events. As long as our valuation model hasn’t changed (and $120 in 2025 seems reasonable), then it’s all about just taking advantage of market swings along the way.

-

- F – Those older June $14.35s are going to be a loss so let’s close them for $8,100 and the other short calls are well-covered and we’ll see how things go next earnings.

- GES – Another winner on the short calls. Now we want protection so let’s sell 15 June $20 calls for $1.85 ($3,700). It’s a small position so we can easily adjust for whatever happens.

-

- GILD – So happy we sold the May $80s. I think we’re fine as it’s only a net $24,600 spread and we sold the $80s for $12,400 and we have 3 more halves to sell so it should end up being a free trade so there’s no reason to feel pressure to make a change. The $65s are $19 – so not worth rolling.

- GOLD – Damn, we already have 200. The $10s are $8, so not worth rolling. On track, then. It’s a $140,000 spread at net $44,700 – a nice hedge against inflation considering it’s $80,000 in the money.

-

- HON – How did this get so complicated? The only longs are the 30 2025 $190s and we sold two sets of puts and calls. Both short calls will go worthless and I’m not worried about owning HON for the long haul. I feel like I should buy back the 2025 short $250s but I’m not sure so let’s just buy back 10 (half) and see how things go.

- IMAX – If anyone will benefit from China reopening, it’s IMAX. Still, we had a nice run and now uncertainty so let’s sell 15 June $18 calls for $1.25 ($1,875) and use that to roll the 2024 $13s at $5.55 ($13,875) to the 2024 $10s at $7.15 ($17,875). If you can’t get the roll for $1.75 or less – it’s not worth doing!

-

- K – Right on target.

- MET – Taking a huge hit for no good reason. We already sold the June $70s and they are dead. We can roll our 20 2025 $60 calls at $7.30 ($14,600) to the 30 of the 2025 $50 calls at $12.25 ($36,750) and we can sell 10 June $60s at $2.50 ($2,500) to begin paying for the roll (and we already collected $3,360 from the June $70s). So again, half the roll is paid for by the short calls and they expire worthless and we retain the lasting value of more longs at a lower strike.

-

- MJ -We never catch a break on this one! Not putting more money in.

- UL – Wow, every leg is a winner! Nothing to change.

- WBA – Let’s buy back the short April calls and hope for a bounce.

-

- WHR – We thought this one would bounce and it did not at all. Let’s roll the 10 Jan $150 puts at $30 to 15 2025 $120 puts at $20 for about even. The 30 Jan $130 calls at $15 ($45,000) can be rolled to 50 of the 2025 $120 ($26)/$145 ($16) bull call spreads at $10 ($50,000).

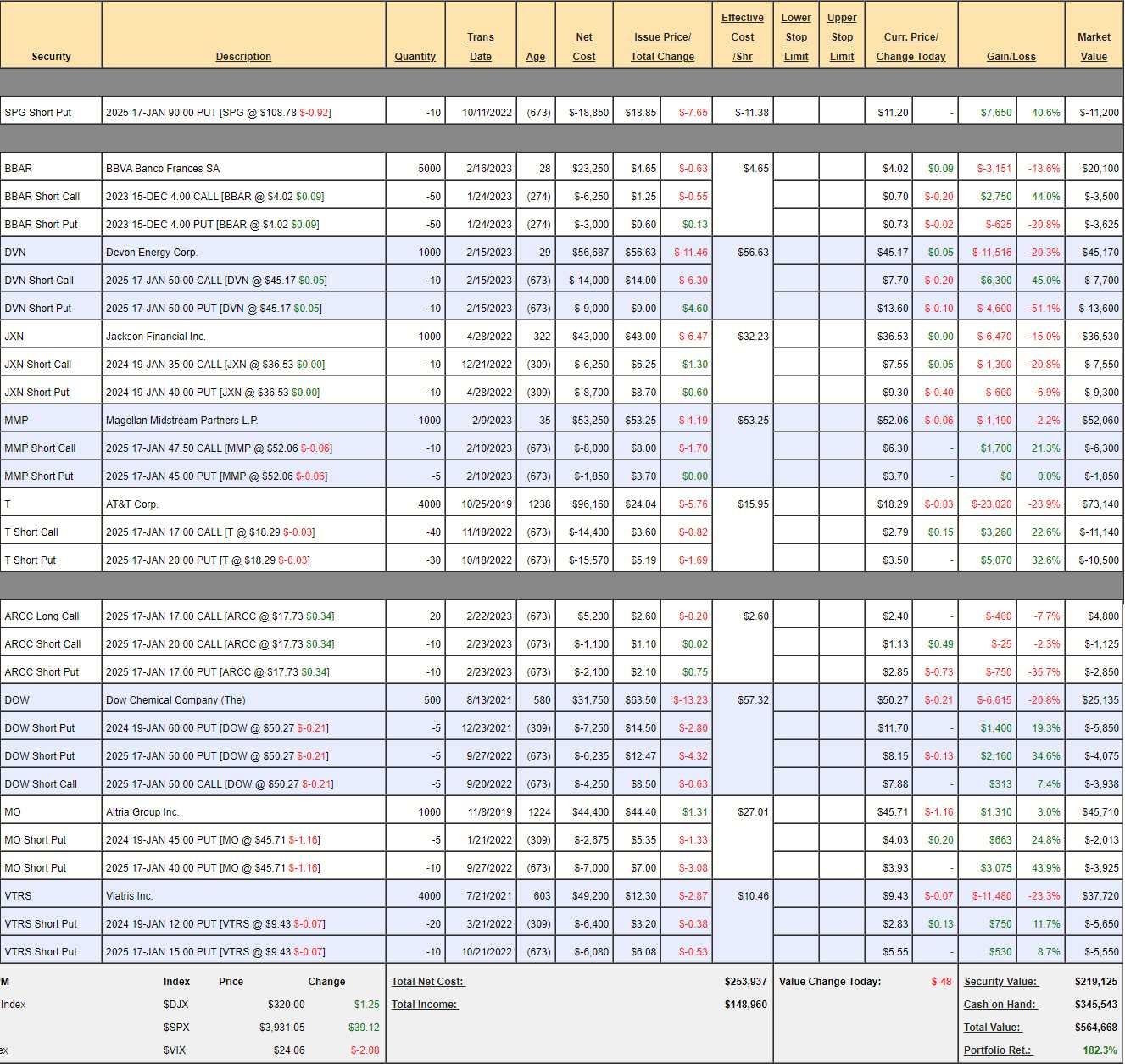

Dividend Portfolio Review: We made no changes last month and now we’re at $564,668, which is down $51,198 (about 8%) since then. We’re about 60% CASH!!! so we do have money to spend.

-

- SPG – Not at all worried about them. If they get cheaper we’ll jump in, in fact.

- BBAR – Ironically making an elephant pattern this year. It’s cheaper than when we came in but a small loss so far but $4 was our target and that’s where we are.

-

- DVN – A new trade! DVN has already taken a dive but our call target was only $50 and we have 2 years so nothing to worry about. Tempted to buy back the short calls as they are already up 45% but let’s wait and see.

- JXN – Dripping sharply but I doubt they are in trouble. Have to let it be. If 2025s were out, we’d roll the longs.

-

- MMP – Right where we came in.

- T – Still over our target despite the 10% pullback.

- ARCC – Another recent addition.

- DOW – We already sold 5 more puts so that’s our DD for now.

-

- MO – We’re still in good shape.

- VTRS – I think people are really missing the bus with these guys. They just paid an 0.12 dividend ($480) so here’s a good trick. Let’s buy 4,000 more shares for $9.45 ($37,800) and sell 40 $10 calls for $1.35 ($5,400), so we’re only spending net $32,400 to double down and now our average cost is $10.20 and now we’ll get $960 quarterly dividends while we wait.

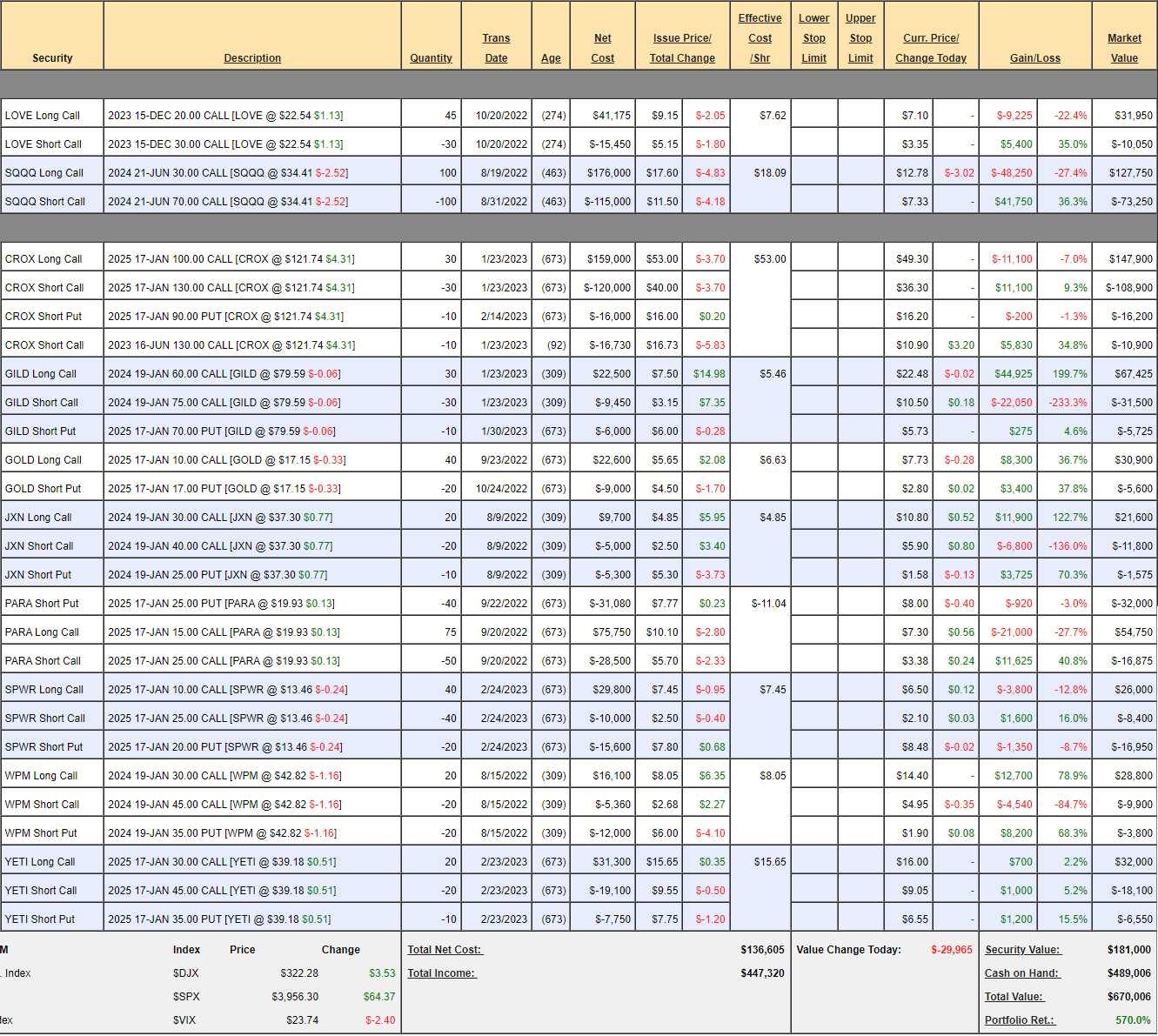

Earnings Portfolio Review: Another portfolio we did not change last month and now it’s down $42,025 at $670,006. Here we have plenty of cash on the side, so hopefully some opportunities to improve.

-

- LOVE – Big pullback but I don’t want to roll until longer calls come out. We’ll just see how it goes. We can sell 20 Dec $20 puts for $4 ($8,000) as we REALLY would love to own 2,000 shares for net $16 – so free money.

- SQQQ – Unfortunately, the hedge does not LOOK like it’s working but it’s $44,000 in the money at net $54,500 on the $400,000 spread so there’s $345,500 worth of protection left in it. The 2025 $30s are $15, that’s not an expensive roll ($2.22) to buy another 6 months of insurance. The 2025 $70s are $9.60 so let’s sell 50 of those for $48,000 and use that money to roll our 100 June 2024 $30s at $12.78 ($127,750) to 120 of the 2025 $25 calls at $16 ($192,000). That’s net $16,250 out of pocket but we picked up $50,000 in position and 6 more months of insurance.

-

- CROX – Holding up very well. On track.

- GILD – Over our target.

- GOLD – While they are still cheap, let’s buy 40 more of the 2025 $10 calls for $7.73 ($30,900)

-

- JXN – Still on track.

- PARA – Pulled right back to $20. Let’s buy back the short 2025 $25 calls at $3.38 as they are up $11,625 and I regretted selling them.

- SPWR – Sure, let’s double down on the 2025 $10 calls at $6.50 for another $26,000 – this is silly at $13.42.

-

- WPM – Has not taken much damage, still on target.

- YETI – Still all green but earnings were good so let’s buy 10 more 2025 $30 calls for $16 ($16,000).

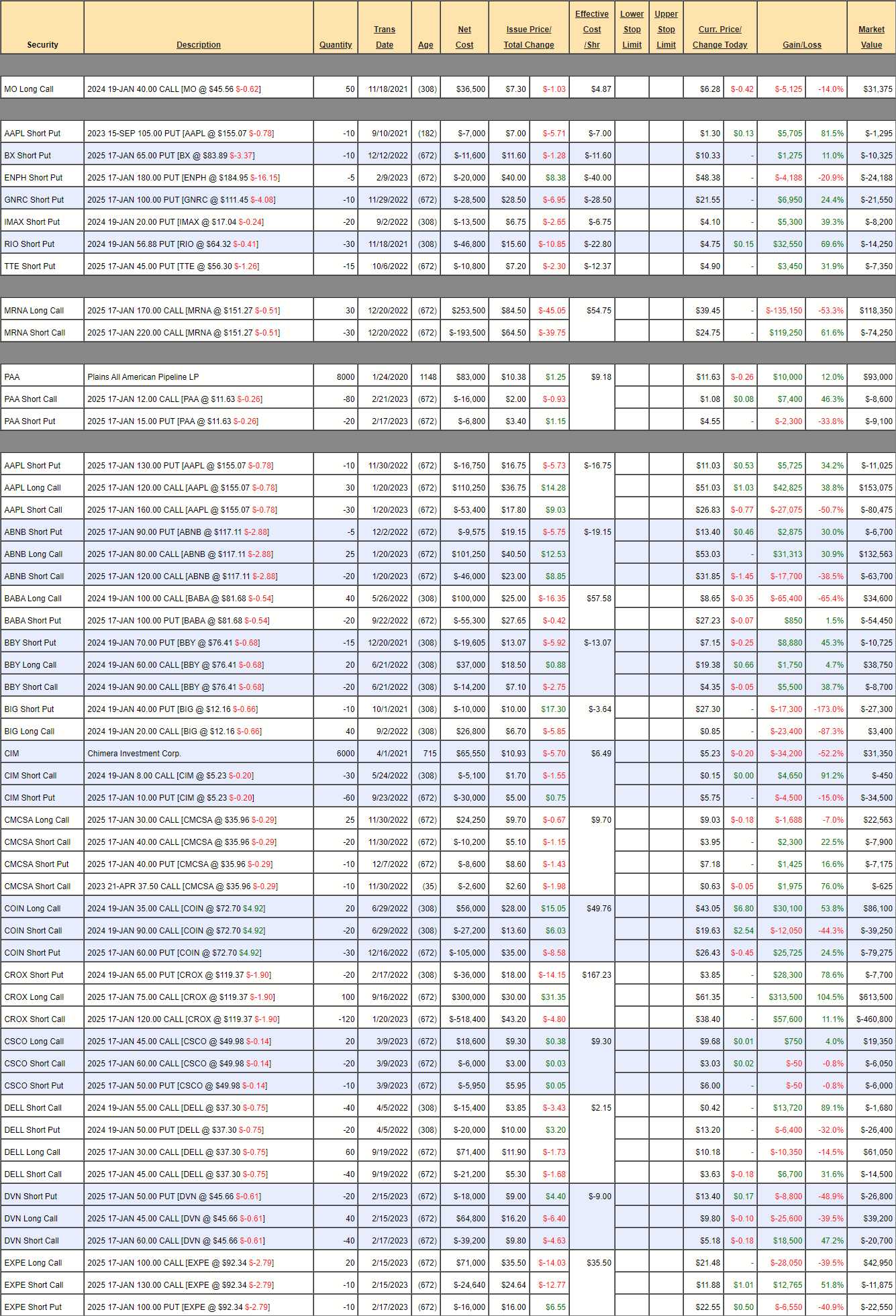

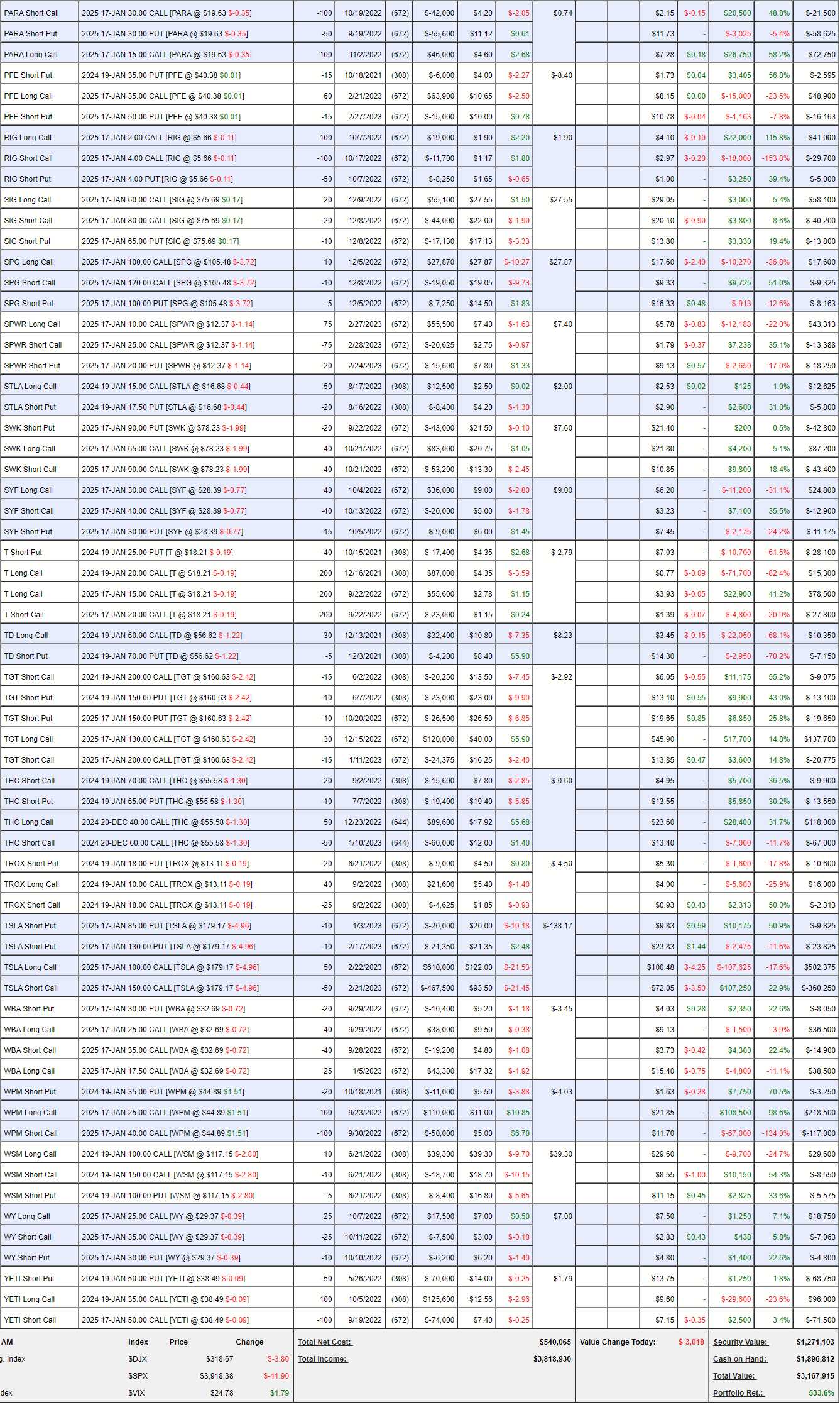

Long-Term Portfolio Review: $3,167,915 is down $382,893 since our last review and that’s to be expected with the VIX rising 25% to 25 from 20 since the last review. Between that and the overall pullback – we’re down 10% but we have $1.8M (56%) in cash, which we are able to deploy – IFF we can get confident in a bottom.

I just pushed the hedges in the STP to better cover us, that’s step one. Now we have room to get more aggressive as we’re very well-protected – so let’s see what opportunities there are.

-

- MO – Leftover from a spread. No hurry to change it.

- Short Puts – The total risk of assignment is roughly $650,000 so why risk it. While we have uncertainty, let’s just buy them all back.

- MRNA – The $150 calls are $45, that’s a no-brainer roll from the $39.45 $170 calls – net $16,650.

-

-

- PAA – HUGE drop off from $13.50 to $11.50 but we sold the short $12 calls so simply back on track for us.

- AAPL – Hasn’t been damaged by all this nonsense. Probably a safe place to park your cash, relatively. We’re 100% in the money now on our $120,000 spread at net $61,575.

- ABNB – Big pullback since last time but we were very conservative so still 100% in the money.

-

-

- BABA – Not inclined to put more into it just yet.

- BBY – Let’s buy back the short puts and the short calls and see what kind of bounce we get.

- BIG – Another one we got aggressive on that hasn’t worked yet.

- CIM – I’d like to DD but I need to get more clarity on the dividend situation first.

-

- CMCSA – Still on track.

- COIN – Actually doing well again. It’s a $110,000 spread at a net $32,425 credit so we’ll make $102,425 if they just hold $70 and another $40,000 if they hit $90. Aren’t options fun? I’ve been pounding the table on this one since the fall so this is falling into the “I told you so” category at this point.

-

- CROX – Love my CROX! It’s only net $145,000 on the $450,000 spread and we’re almost at $120 where we’d make $305,000 more at expiration. The fact that they are holding up well during the sell-off should tell you this is a nice way to make 200% between now and Jan – if you are so inclined. We started with a net $254,400 credit (after selling these new short calls with perfect timing) so this is a massive winner with even more massiveness to come!

-

- CSCO – Brand new trade still playable.

- DELL – Fortunately, we oversold the short calls so we’re doing OK. I don’t see them retaking $55 by Jan, so no point in buying those back and the longs aren’t cheap enough to add to – so we’ll just wait and see.

- DVN – Also new and much cheaper than our entry. The short calls gained 47% in a month so it’s silly not to buy those back and see if we bounce. If we don’t, we sell lower short calls and use the money to roll the long calls lower.

-

- EXPE – A lot of recession fear in these travel stocks. People still have to go places – this is not Covid – just a Recession. The 2025 $80 calls are $31 and that’s less than $10 to roll so let’s roll down our 2025 $100 calls and buy 10 more for 30 total 2025 $80s. Net $50,050.

-

- GOLD – You know I love them!

- GOOGL – Starting to recover a bit. I’m happy with the mix.

- HBI – Got clobbered from earnings as they cut dividends, but it’s a move I agree with. Our $7 calls are $1.15 and the $5s are $1.85, so it would be irresponsible not to spend 0.70 to gain $2 in strike and the $3 calls are $2.85, another $1 for another $2. I think we should spend $1.70 ($27,200) to roll to the $3 calls and I’m not inclined to cover this low.

-

- HPQ – We’re still in the money on our conservative spread so no worries.

- INTC – So much for being our 2024 Trade of the Year as they’ve jumped 20% this month. Fortunately, we didn’t wait to buy them!

-

- JD – Took a hit and I’m not inclined to chase Chinese companies at the moment but I don’t have enough reason to get out yet.

- JPM – Taking a dive with the other banks but nothing to really change as we had a conservative spread (because I was worried about the banks).

- JXN – Another chance to get into a spread that was going fantastically until recently.

-

- LEVI – Like HBI, I don’t think Recessions stop people from putting on clothes. No reason not to buy more time when it’s cheap so we can roll our 50 Jan $15 calls at $2.75 (not $2.20! Net $13,750) to 100 2025 $10 calls at $7 ($70,000) and we’ll sell 50 more of the Jan $15 calls at $2.70 ($13,750) to help pay for the roll so net net $42,500 to go $58,000 in the money and buy another year and we’re still only 1/2 covered (so more potential income moving forward).

-

- LMT – The economy is doing great for military contractors in Ukraine. Miles in the money on this one but it’s net $60,000 on the $70,000 spread so we’ll cash it in and hope we get a better entry on a pullback.

- LOW – On track

- MDT – I’m happy with where we are.

- MET – Ridiculous sell-off. The March calls will go worthless and we may as well buy back the short 2025 $75 calls and the $50 calls are $12 so net $4.40 ($8,800) to roll our 2025 $60s down is worth it and let’s buy 20 more while we’re at it ($24,000) for 40 total 2025 $50 calls.

-

- META – Has lost no ground this month. We knew it was way underpriced in October. This spread we entered with a net $4,200 credit and it’s a $210,000 spread currently at net $115,475 so plenty of room to grow if META holds $170. Easy money for value investors!

-

- NFLX – Another stock that traders panicked out of but they’ve pulled back again but we were very conservative on NFLX so we’re still comfortably in the money. It’s a $200,000 spread at net $132,712 at the moment.

-

- PARA – The short 2025 $30 calls are up 49% so let’s buy them back ($21,500) and hopefully $20 holds.

- PFE – We got aggressive last month so we’ll see how things play out.

- RIG – Big pullback from $7.50 to $5.50 but our target is $4.

- SIG – Whew, I thought that was Signature Bank for a second! Jewelry is right on track.

-

- SPG – My second favorite mall (SKT still hasn’t come back down). SPG has gone on sale at $105 so let’s buy back the short 2025 $120 calls for $9.33 ($9,325) and the rolls aren’t favorable so let’s just double down on the 2025 $100 calls at $17.60 ($17,600). If they keep going lower – THEN we roll!

-

- SPWR – A noted in chat today, there are certainly issues if liquidity is tightening. There’s nothing here really to adjust yet. It’s a $112,500 spread at net $11,675 so I’m liking the 1,000% upside potential at $25.

- STLA – Hit $19 before it got caught in the sell-off. I’m still inclined to let them run.

- SWK – Got clobbered from $95 to $78 but our target is $90 so not worried.

- SYF – Big sell-off and we don’t know enough to get more aggressive so we’ll see what turns up. This is a $40,000 spread we bought for net $7,000 and now it’s net $725 so down $6,275 but if we had bought 1,000 shares, we’d be down the same and, since our allocation blocks are $200,000 – there’s no reason to do anything until we better understand the situation.

-

- T – Since the 2025 $20s are $1.39 and the 2024 $20s are 0.77 – it makes no sense not to roll the 2024s to the 2025s and buy a year for 0.62.

- TD – Got hit pretty hard considering they are likely one of the strongest banks. The 30 2024 $60s are down to $3.45 ($10,350) and the 2025 $45 ($14)/$60 ($5.85) bull call spreads are net $8.15 so let’s sell the 2024 $60s and buy 50 of the spreads for $40,750. We are carrying forward a net $22,050 loss so net net $52,450 less $4,200 on the short $70 puts and let’s sell 15 of the 2025 $60 puts for $9.40 ($14,100) and now our net for the whole $75,000 spread is $34,150.

-

- TGT – Holding up OK at $160 and that’s right on track.

- THC – Also holding up well and on track.

- TROX – Wow, people lost faith in this one quickly. Let’s just buy back the short $18 calls for $2,313 and see what happens.

-

- TSLA – Holding up well in the crisis. Well over target for us but still only net $108,475 on the $250,000 spread.

- WBA – Got trashed again. Still near our target though because we came in so cheap. No reason to fool around with it.

- WPM – Enjoying the crisis and we’re well in the money. I guess, as a rule of thumb, it’s good to invest in our former Trade of the Years…

-

- WSM – Rich people gotta eat.

- WY – Pulled back quite a bit but we’re fin as we got a great entry.

- YETI – They’ve actually been holding up well this month – it’s last month that was an issue. The 2025 $25 calls are $18 and I don’t like spending $8.50 to roll down $10 – even if we are buying another year so I guess we’ll leave it for now as we were at $48 in Feb and our goal is $50 so we could easily come back in our timeframe.

On the whole, we’re using about $400,000 of our cash and giving ourselves another $1M of upside potential. That will more than pay for the additional hedging in the STP – even if we lose it and the additional hedging in the STP will more than cover the $400,000 we are spending.