“Now it seems they’re telling me

You’ve changed your wicked ways

But should I give you a second chance

Baby, I’m too afraid” – Bananarama

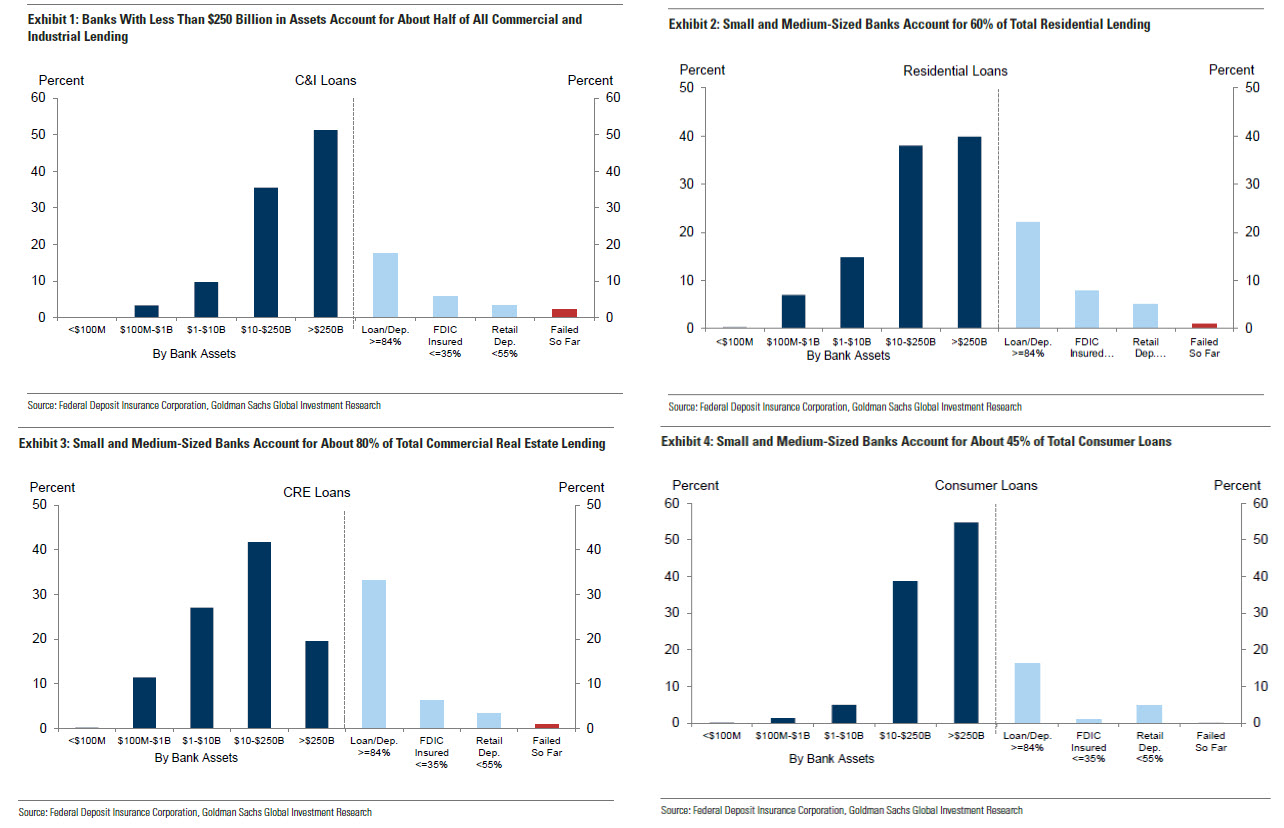

Be very careful about what you read, there is all kind of disinformation going around. Since we’ve done nothing to prevent it, there are armies of Russian hackers attempting to take down the banking system by causing a panic. It’s a serious problem because our banking system is based on Fractional Reserves, which is a system in which banks are required to hold only a fraction of the funds deposited by their customers in reserve. The rest of the funds are used for lending and other investments.

For example, let’s say a bank has $1,000 deposited by its customers. The bank might be required by law to hold a certain percentage, say 10%, of those funds in reserve, which would be $100. This means that the bank can use the remaining $900 to make loans to borrowers or invest in other financial assets.

The idea behind fractional reserve banking is to allow banks to make profitable investments while also providing a safe and secure place for individuals and businesses to store their money. However, it also means that banks are at risk of running out of reserves if too many customers withdraw their money at once, which can lead to a bank run. To mitigate this risk, central banks like the Federal Reserve in the United States may require banks to hold a certain amount of reserves, and they may also lend money to banks during times of crisis to help them meet their reserve requirements – it’s that simple.

In the course of a normal day, a bank would not expect more than perhaps 1% of their funds to be drawn but, if a rumor is started and 10% of their customers want all of their money or 100% of the customers want 10% of their money – the bank’s liquidity could be drained and they won’t be able to pay. Over any period of time, more than 10% outflows can strain a bank.

So what happens if we worry people enough to “diversify” their holdings among different banks? Even that can cause a disaster because people will take some of their money from one bank and move it to another, usually bigger bank and the liquidity drains out of the small banks, which collapse and the big ones take them over – essentially the exact plot of “It’s a Wonderful Life“.

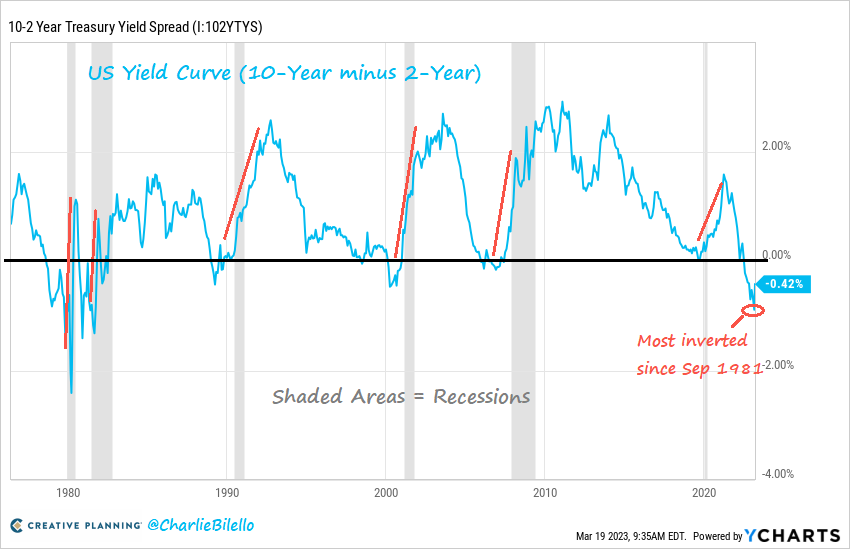

It’s always a fragile system and and it only needs a small nudge to destabilize it. When there is a crisis – it’s all up to the leadership and, with our House Divided of a country, it’s very hard for Joe Biden to get up and reassure the people – especially when there is an entire “news” network that is essentially a direct funnel for Russian Propaganda.

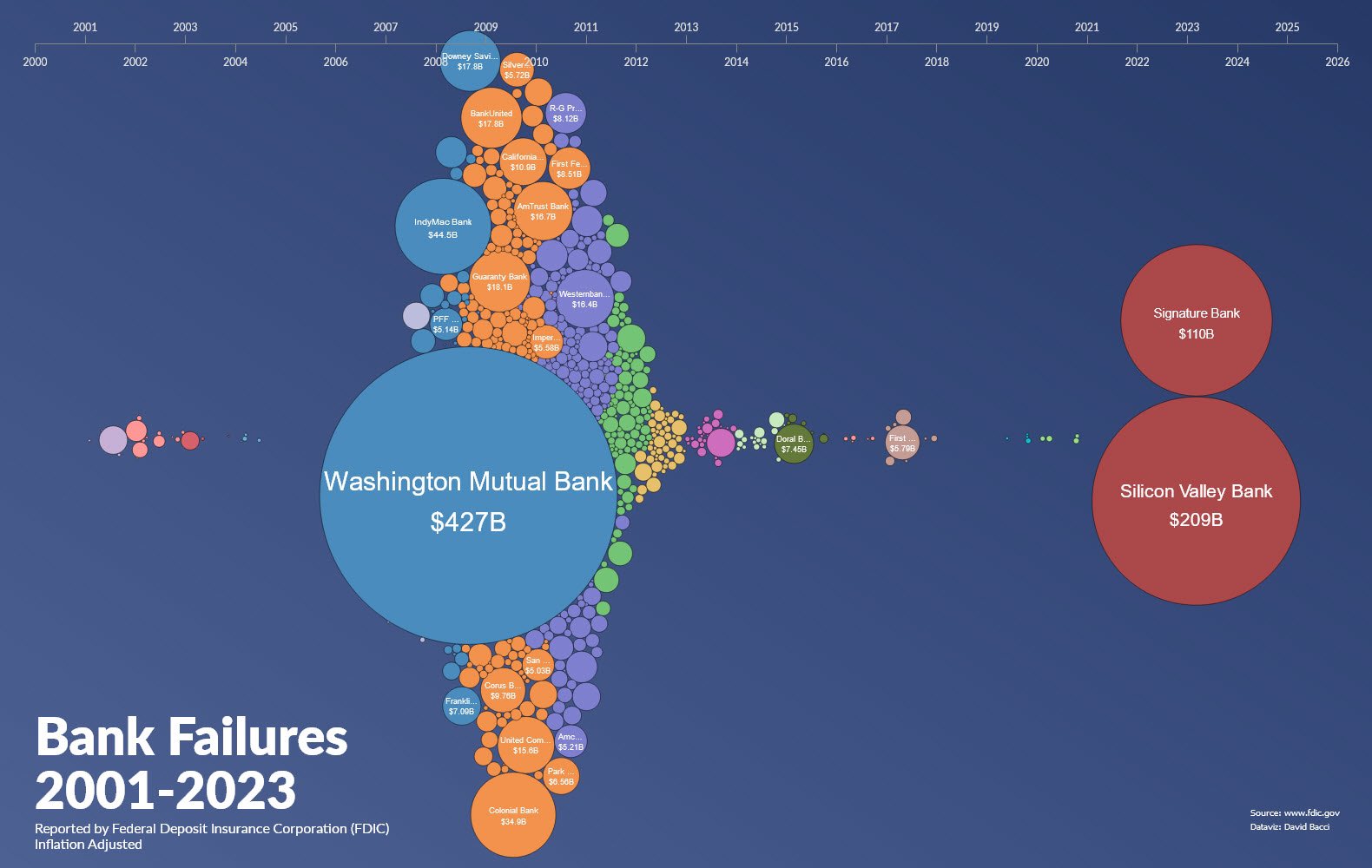

SIVB was not going to collapse UNTIL people started pulling their money out. Even then, if they were given the time, the bank could have liquidated additional assets and taken a loss and the bank may have lost value – but it would not have gone under. Instead, the losses the bank disclosed led to more panic, more withdrawals and the bank was unable to formulate a plan to cover the demand for cash before the crossed a threshold the regulators considered too unsafe to risk further deterioration.

Credit Suisse was given $50Bn last week by the Swiss National Bank and what’s scary there is the entire bank has a market cap of just $8.6Bn but they have over $500Bn under management so the Swiss Government gave them 10% and that’s not going to be enough and now UBS is likely to take them over as CS simply isn’t worth saving. This is now triage, UBS has $1Tn in assets and the Government would rather give them CS and another $50Bn than put another $50Bn down the black hole CS has become.

First Republic Bank (FRC) was given an emergency $30Bn last week but shares still fell 30% on Friday as that may not be enough to save them either. At $23, FRC is down to $4.2Bn in valuation, from $28Bn at the beginning of the month. FRC only has $212Bn under management but it’s a huge concentration of HNW accounts and they are pulling their money out right and left.

Analysts at Jefferies estimated that as much as $89 billion in deposits have left the bank over the past week. The bank has borrowed tens of Billions of dollars from the Federal Reserve and Federal Home Loan Bank to plug the hole. “It’s not clear whether it’s viable as a stand-alone entity,” said Julian Wellesley, global banks analyst at Boston-based Loomis Sayles & Co. “So it’s likely, in my view, to be taken over.”

Friday’s $30Bn deal took some of the pressure off First Republic, but it still has to contend with flighty depositors looking for higher rates elsewhere and suddenly aware of the pitfalls of large uninsured balances.

**Sunday**

As expected, a UBS takeover of CS seems to be moving forward. I’m not sure CS can survive Monday on its own from what I’m seeing. Still a big danger is a SUPPOSED list of 200 Banks that are near failure but I’m currently leaning towards this being more propaganda, though the NY Post has it on the cover. Unfortunately, the lack of a desire for facts that is the hallmark of Conservative Journalism means the propagandists have great outlets for all sorts of nonsense – be careful.

As near as I can tell, the basis for these articles are a misreading of a pretty silly study that says “Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to insured depositors, with potentially $300 billion of insured deposits at risk.”

Warren (our resident AI) says:

♦The report presents descriptive statistics of key metrics for FDIC-insured depository institutions in the U.S., categorized by bank size. The metrics include aggregate loss, bank-level loss, shares of losses from various sources, loss-to-asset ratio, uninsured deposit-to-market asset ratio, insured deposit coverage ratio, and the number of banks in each category. The statistics are based on the marking-to-market of the assets, i.e., computing the loss based on the market price growth from 2022:Q1 to 2023:Q1.

-

- The report only analyzes a single year of data (2022:Q1 to 2023:Q1), which may not be representative of long-term trends or provide a comprehensive view of the banking system’s overall health.

- The report’s methodology for calculating losses through mark-to-market valuation may be subject to volatility and uncertainty, particularly in a rapidly changing economic environment.

- The report focuses solely on FDIC-insured depository institutions in the United States, which may not provide a complete picture of the broader financial system’s stability or potential risks.

- The report’s categorization of banks into size and regulatory status groups may oversimplify the complexity of the banking industry, particularly with regards to the systemic importance of individual institutions.

- The report does not provide a thorough analysis of the potential causes or drivers of the losses, which could limit its usefulness in developing appropriate policy responses or risk management strategies.

The study used a simple calculation based on the percentage of deposits that are insured by the FDIC, which is currently set at $250,000 per depositor per bank. They calculated that if half of all depositors were to withdraw their insured funds, it would exhaust the FDIC’s reserves and cause the failure of approximately 1,200 banks.

However, this calculation does not take into account several important factors that could affect the likelihood of a bank failure, such as the actual rate of withdrawals in a crisis, the ability of the FDIC to obtain additional funding if necessary, and the potential for government intervention to prevent bank failures.

In my calculation, I considered these factors and assumed a more realistic rate of withdrawals based on historical data from previous banking crises. I also factored in the FDIC’s ability to obtain additional funding if necessary, as well as the potential for government intervention. Based on these assumptions, I estimated that around 66 banks could be at risk of failure in a hypothetical scenario where half of all depositors withdraw their funds.

It’s important to note that these estimates are just hypothetical and are subject to many variables and uncertainties. The actual number of banks at risk in a crisis would depend on a variety of factors and could be higher or lower than these estimates.

Now that is what AI is useful for!

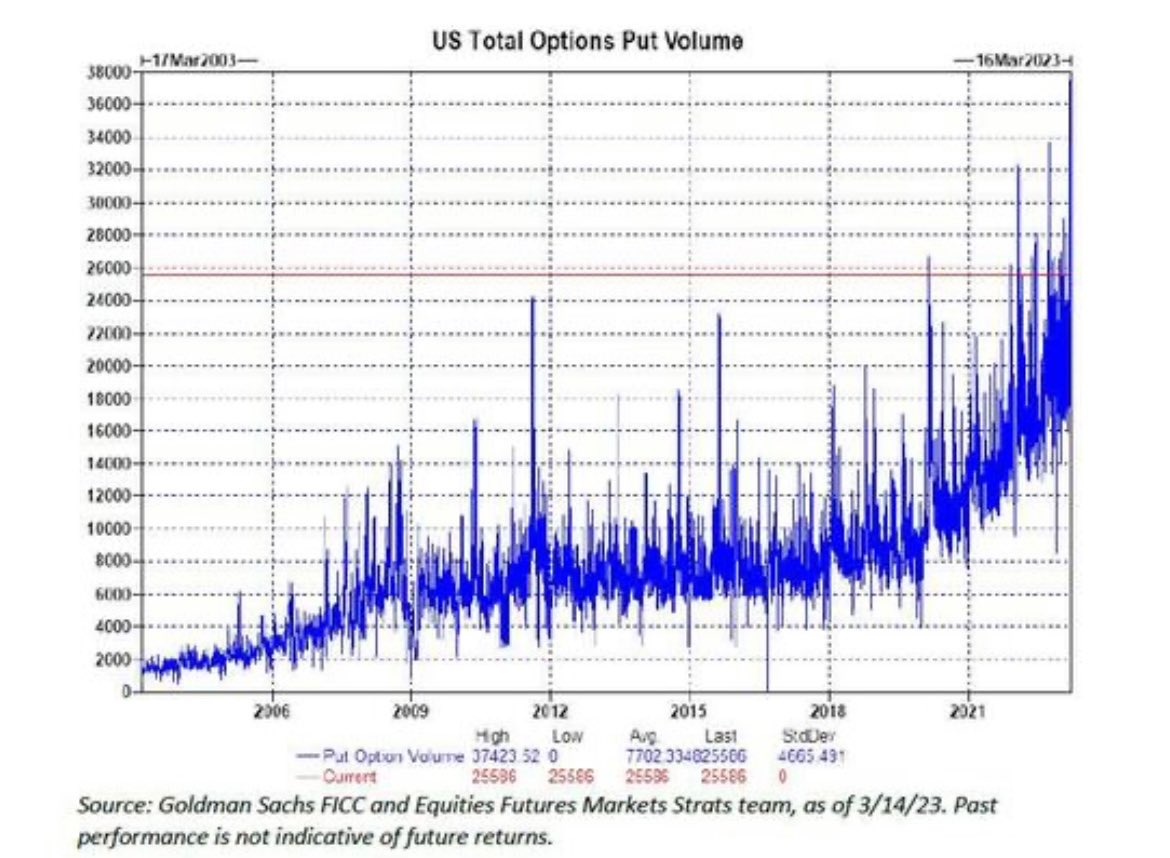

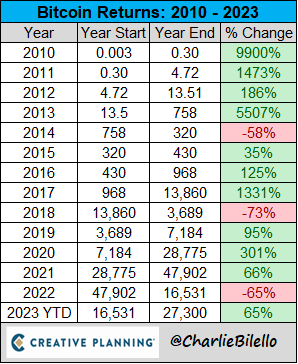

By the way, just because we KNOW it’s not rational to panic doesn’t mean we shouldn’t take action when others are panicking. It’s like TA – total nonsense but so many other people follow it that we have to pay attention to it. What I watch for with stories like this is how they are spreading but this is the kind of panic we would buy into – as we think the logic is faulty (though we have to be sure the panic doesn’t lead to the predicted collapse!).

In short – life is complicated…

Random Stuff:

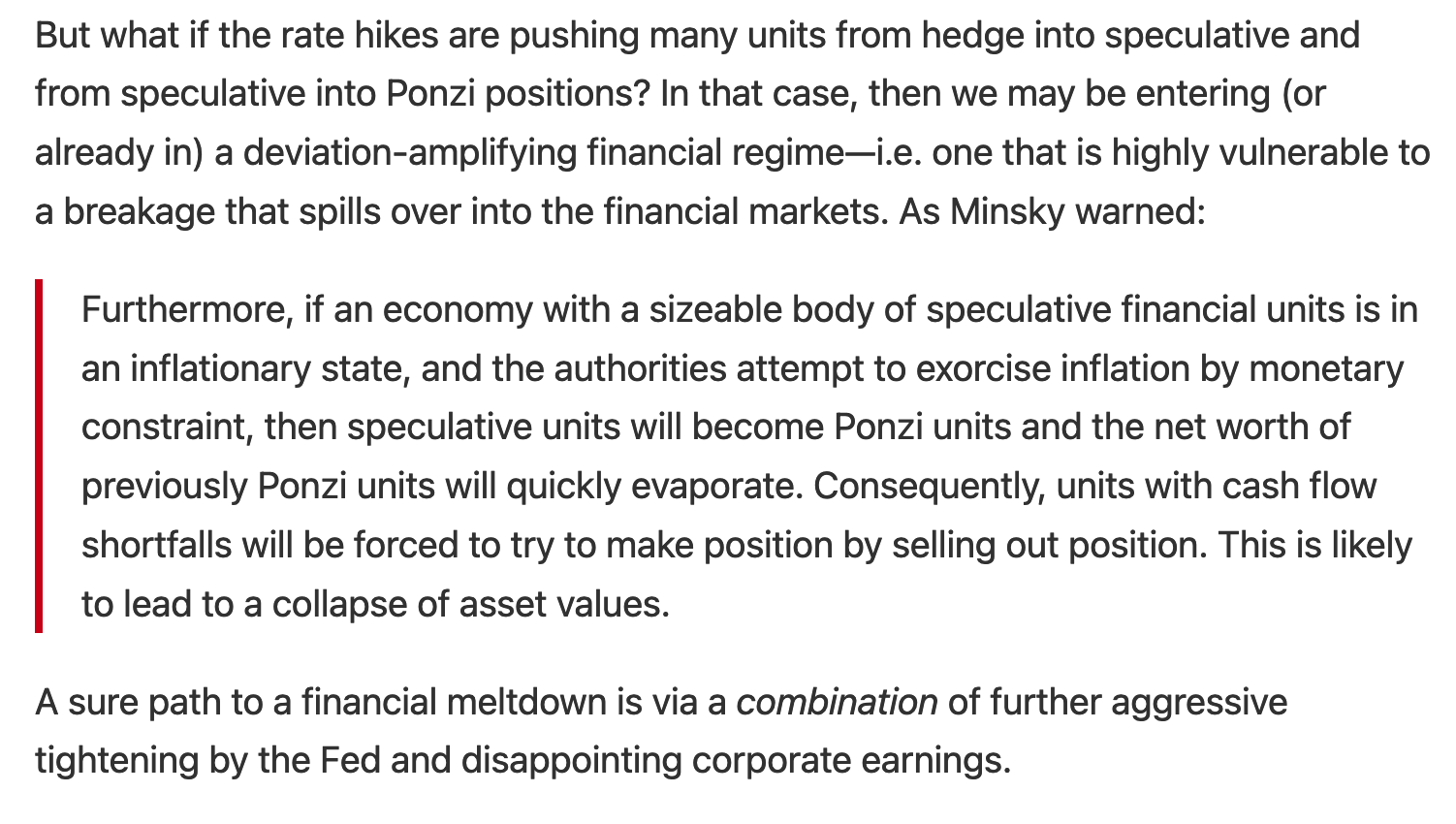

Wrote this back in October. stephaniekelton.substack.com/p/think-about-

Told you so!

♦”Well, it looks like Pope Francis might be considering a change to the Catholic Church’s rule of priestly celibacy. And I gotta say, I’m not surprised. The man is 86 years old, he’s probably thinking ‘I’ve got a few years left, why not see what I’ve been missing?’ I mean, we’ve all been there, right? You hit a certain age, you start questioning all the decisions you’ve made in life. ‘Maybe I should have tried sushi sooner, maybe I should have backpacked across Europe, maybe I should have…well, you know.’ All I’m saying is, if the Pope does decide to lift the celibacy requirement, I hope he’s ready for a lot of confessions that start with ‘Bless me, father, for I have sinned…'”

I believe I have created a monster!

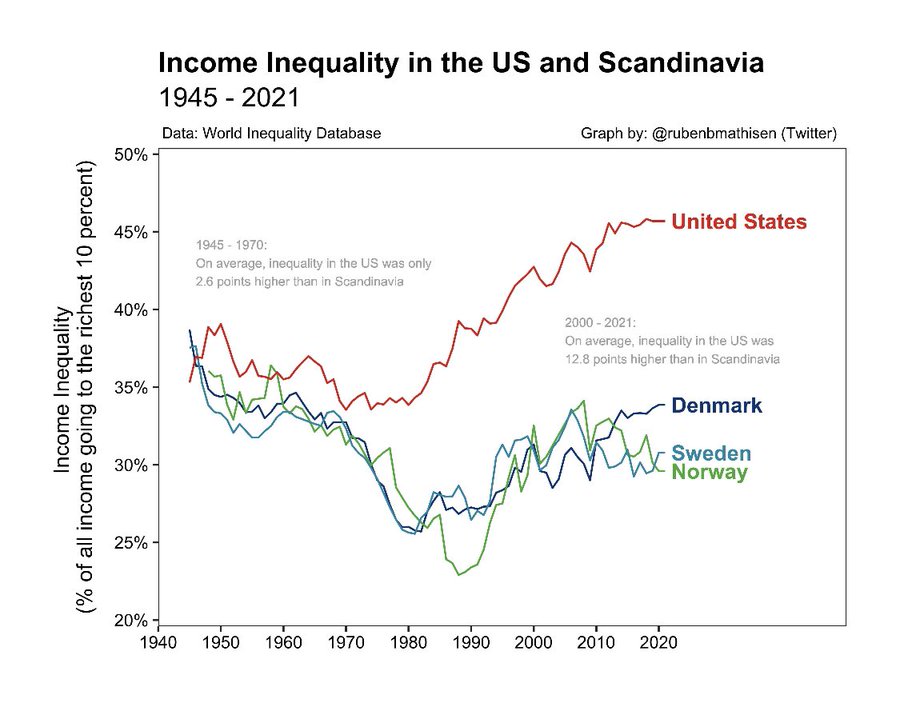

“A government which robs Peter to pay Paul can always count on the support of Paul.” – George Bernard Shaw

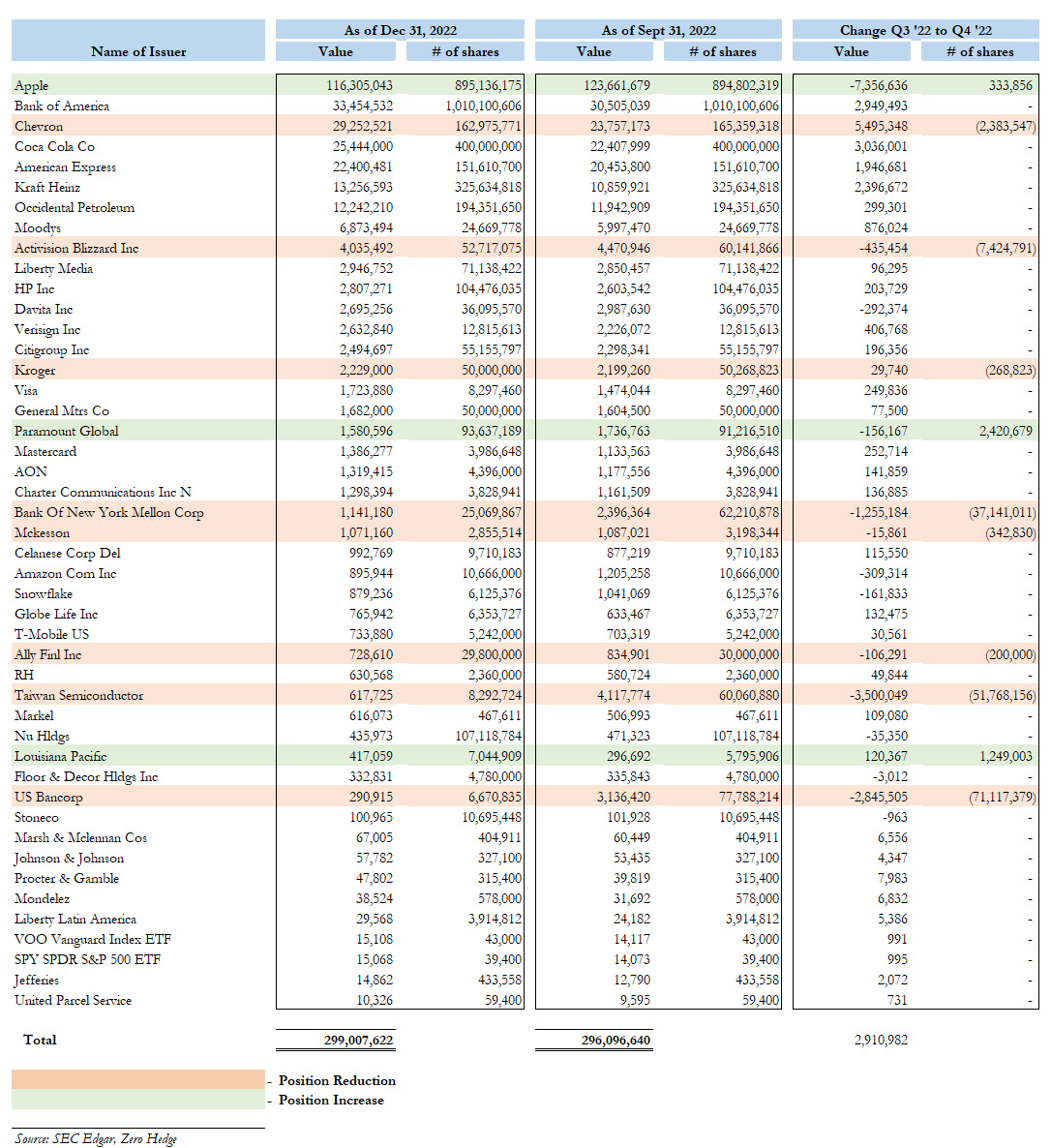

Notice Buffett also had very few banks and reduced the ones he did have in Q4:

Added AXP though.

America’s $52 billion plan to make computer chips at home and fend off China’s tech ambitions has a big problem: A near-unprecedented shortage of US workers

Here’s how just a few “little” crashes can destroy a high-risk investment:

Pension reform in France is proving… unpopular…

This is an appropriate metaphor:

Thanks to Xsimi for pointing this out and think about how amazing it is that there’s a 2-hour documentary already about this very recent crisis. AI help, perhaps?