Panic, don’t, panic, don’t, panic, don’t panic?

Panic, don’t, panic, don’t, panic, don’t panic?

I got up early this morning to get ahead of things and I quickly realized that doesn’t help because things change pretty drastically from hour to hour. Over the weekend, multiple events hit the markets like a tidal wave. UBS’s takeover of Credit Suisse may have prevented an immediate collapse, but the massive bailouts required and the emergency nature of the situation can only make us wonder “who’s next“? The banking system is still on shaky ground.

The liquidity offer of around $100Bn from the Swiss National Bank to UBS to help it take on the operations of Credit Suisse is a sign of how dire the situation had become. The fact that it was needed at all is concerning, as it raises questions about the stability of not just Credit Suisse but the entire banking system.

First Republic Bank’s (FRC) shares took another 20% nosedive this morning, with Investors fearing a full-blown banking crisis. S&P Global downgraded the bank’s credit ratings for the second time in four days, citing concerns that a recently unveiled $30Bn rescue plan may not save the embattled bank. The deposit injection by 11 banks, including Wall Street giants like JPMorgan, Bank of America, and Morgan Stanley, may ease short-term liquidity pressures, but it may not solve the substantial business, liquidity, funding, and profitability challenges that the bank is likely facing.

All of these events suggest that we should be concerned about the safety of a banking system that rewards excessive risk-taking and short-term thinking. The massive bailouts and downgrades of credit ratings indicate that the problems in the financial sector are far from over. It’s a reminder that capitalism, particularly the banking system, is built on a foundation of risk and leverage. The fate of the banks is intertwined with the fate of the economy, and we all have a stake in the outcome.

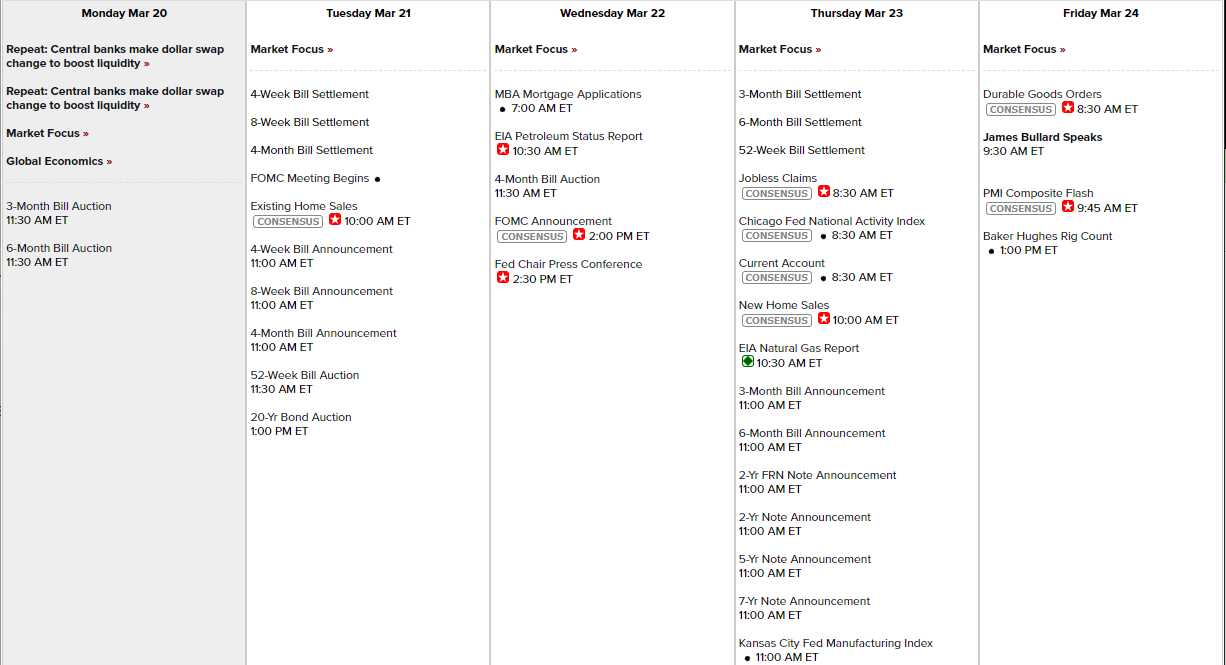

And no one has a bigger stake than Jay Powell, who is speaking on Wednesday after the Fed Meeting. It’s probably for the best that the rest of the Fed is in their “quiet period” around this meeting but that means it is entirely up to Powell to restore confidence in our Banking System. Bullard speaks Friday morning in case that doesn’t work.

Tomorrow will literally be the longest day of the year as we wait for the Fed’s comforting words and there sure isn’t much data to distract us but tomorrow’s 20-Year Bond Auction will be interesting, though I imagine there’s enough panic around to send investors flying to the safety of bonds.

Meanwhile, holy swap! The Fed and 5 other Central Banksters just announced a coordinated move to boost liquidity in their US dollar swap line arrangements. What does that mean? Well, imagine you’re a Central Bank in a foreign country and you need some greenbacks to help ease any strains in your local market. You can borrow those dollars from the Fed in exchange for your own local currency, thanks to the magic of Swap Lines.

Meanwhile, holy swap! The Fed and 5 other Central Banksters just announced a coordinated move to boost liquidity in their US dollar swap line arrangements. What does that mean? Well, imagine you’re a Central Bank in a foreign country and you need some greenbacks to help ease any strains in your local market. You can borrow those dollars from the Fed in exchange for your own local currency, thanks to the magic of Swap Lines.

Previously, these swaps were done on a weekly basis, but starting today, they’ll happen EVERY DAY. That’s right, daily operations to make funding available – at least until the end of April. This move is aimed at preventing a dash for cash like the one we saw at the beginning of the pandemic. Remember when everyone scrambled for US Dollars and the cost to borrow them against other currencies went through the roof? Yeah, not fun.

By expanding the frequency of the swaps, the Central Banks involved hope to enhance the provision of liquidity and ease strains in global funding markets, mitigating the impact on the supply of loans to households and businesses. This is especially important for the Swiss and European Central Banks, who are currently facing a liquidity squeeze that we DO NOT want spilling over.

By expanding the frequency of the swaps, the Central Banks involved hope to enhance the provision of liquidity and ease strains in global funding markets, mitigating the impact on the supply of loans to households and businesses. This is especially important for the Swiss and European Central Banks, who are currently facing a liquidity squeeze that we DO NOT want spilling over.

So what does this mean for you and me? Well, for one, it’s a good sign that the Central Banksters are taking serious action to prevent a financial crisis. It shows that they’re aware of the potential risks and are proactively working to address them. It also means that there will be more US dollars available in the global financial system, which could help ease any strains in local markets.

Of course, this move alone can’t erase every concern from the markets, and we’ll have to see how it plays out. But for now, it’s a step in the right direction. So take a deep breath, grab a cup of coffee, and let’s see what the markets have in store for us today!