MORE FREE MONEY!!!

MORE FREE MONEY!!!

The Government has already put Trillions on the line guaranteeing deposits across the board and Yellen is speaking to the American Bankers Association where her speech has already been released, saying: “Our intervention was necessary to protect the broader U.S. banking system. And similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion.”

First Republic Bank (FRC), who were given $70Bn last week will be getting more this week and we’ll see what it takes to keep a single bank going. Moral hazards and blooming deficits aside, of course the fact that the Government is backstopping the Financials is a good thing. Extinguishing the panic will ultimately save the Government money in covering the true losses of bank collapses – but what about inflation?

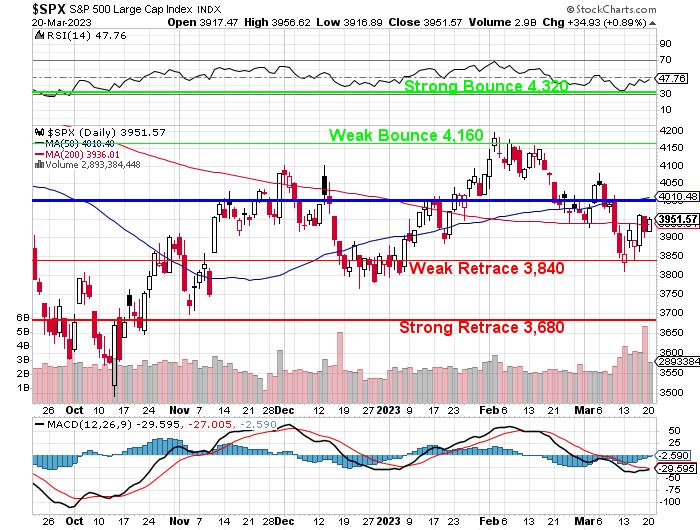

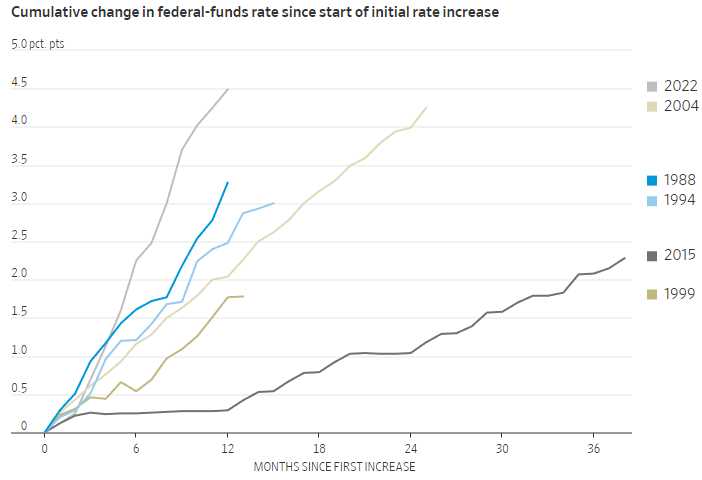

We’re currently seeing a rally based on the idea that the Fed will continue to put unlimited money to work rescuing banks while simultaneously lowering rates and giving up the fight against inflation. This is a recipe for disaster, and it remains to be seen whether Powell and his colleagues will make the tough call of raising interest rates to combat stubbornly high inflation or take a timeout amid the most intense banking crisis since 2008.

The forced merger of UBS and Credit Suisse, along with other steps to calm fears of contagion in the banking system, may influence the Fed’s decision-making process. While raising interest rates could underscore the Fed’s commitment to fighting price pressures, it risks exacerbating market upheaval and potentially leading to more exhaustive interventions if officials handle it incorrectly.

The Fed has been attempting to minimize volatility by telegraphing its rate moves, but the current crisis is abrupt and fluid, posing a challenge for officials. Therefore, it remains to be seen how the markets will react to the Fed’s decision tomorrow. The Fed is facing a delicate balancing act between addressing the current banking crisis and inflation concerns while also supporting a recovery.

The decision to raise interest rates could underscore the Fed’s commitment to fighting price pressures, but it also risks exacerbating volatility and potentially more exhaustive interventions if officials miscalculate. At the same time, doing too little to cool the economy could also have negative consequences.