NYCB was $6 Friday and back to $9 today, which is a $6Bn market cap. They made $650M last year and expected to make $775M this year but they also have $1Bn net of debt and $86Bn under management, up from $57Bn last year.

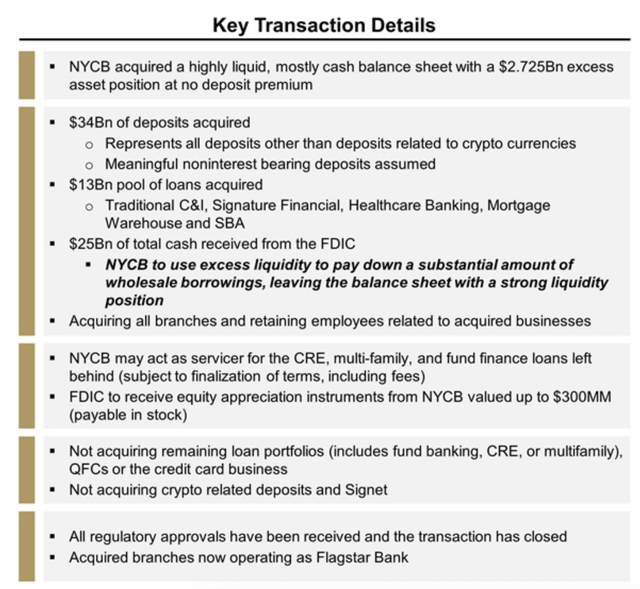

Then this happened (from SBNY):

When everything is said and done, New York Community Bancorp will boast 435 with branches across the markets in which it operates. Of the 40 branches added, 29 are located in New York, with seven others in California. Historically speaking, New York Community Bancorp has focused its footprint largely on parts of the Rust Belt like Ohio, Michigan, Indiana, Arizona, and Wisconsin. It also has a sizable footprint in Florida and, naturally, it has operations in New York and California already. On the loan side of things, the company's portfolio will grow from $69 billion to nearly $82 billion.

Their dividend is 0.68, which is a whopping 7.5% on $9/share so, for the Dividend Portfolio, let's add:

-

- Buy 3,000 shares of NYCB for $9 ($27,000)

- Sell 20 NYCB 2025 $7 calls for $2.80 ($5,600)

- Sell 20 NYCB 2025 $10 puts for $2.50 ($5,000)

That's net $16,400 on the $21,000 spread (1/3 uncovered) and we're obligated to buy 2,000 more at $10 ($20,000) which would be net $36,400 on 5,000 or $7.28/share as a worst case. Our dividends will be $2,040/yr so the upside potential at $10 would be $14,000 for 2,000 shares, $10,000 for $1,000 shares and $3,570 in dividends (we missed one) for $27,570 and a $11,170 (68.1%) profit - not bad for our first two years!

In the LTP, we can:

-

- Sell 50 NYCB 2025 $10 puts for $2.50 ($12,500)

- Buy 200 NYCB 2025 $7 calls for $2.80 ($56,000)

- Sell 200 NYCB 2025 $10 calls for $1.35 ($27,000)

That's net $16,500 on the $60,000 spread with $43,500 upside potential at $10.

![9866571-16793776558072612[1] NYCB](https://www.philstockworld.com/wp-content/uploads/2023/03/9866571-167937765580726121.png)