Last Friday, we got more aggressive with our hedges.

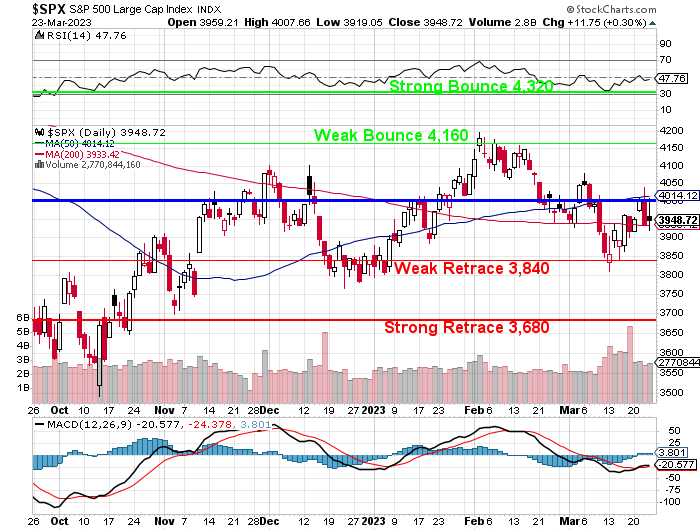

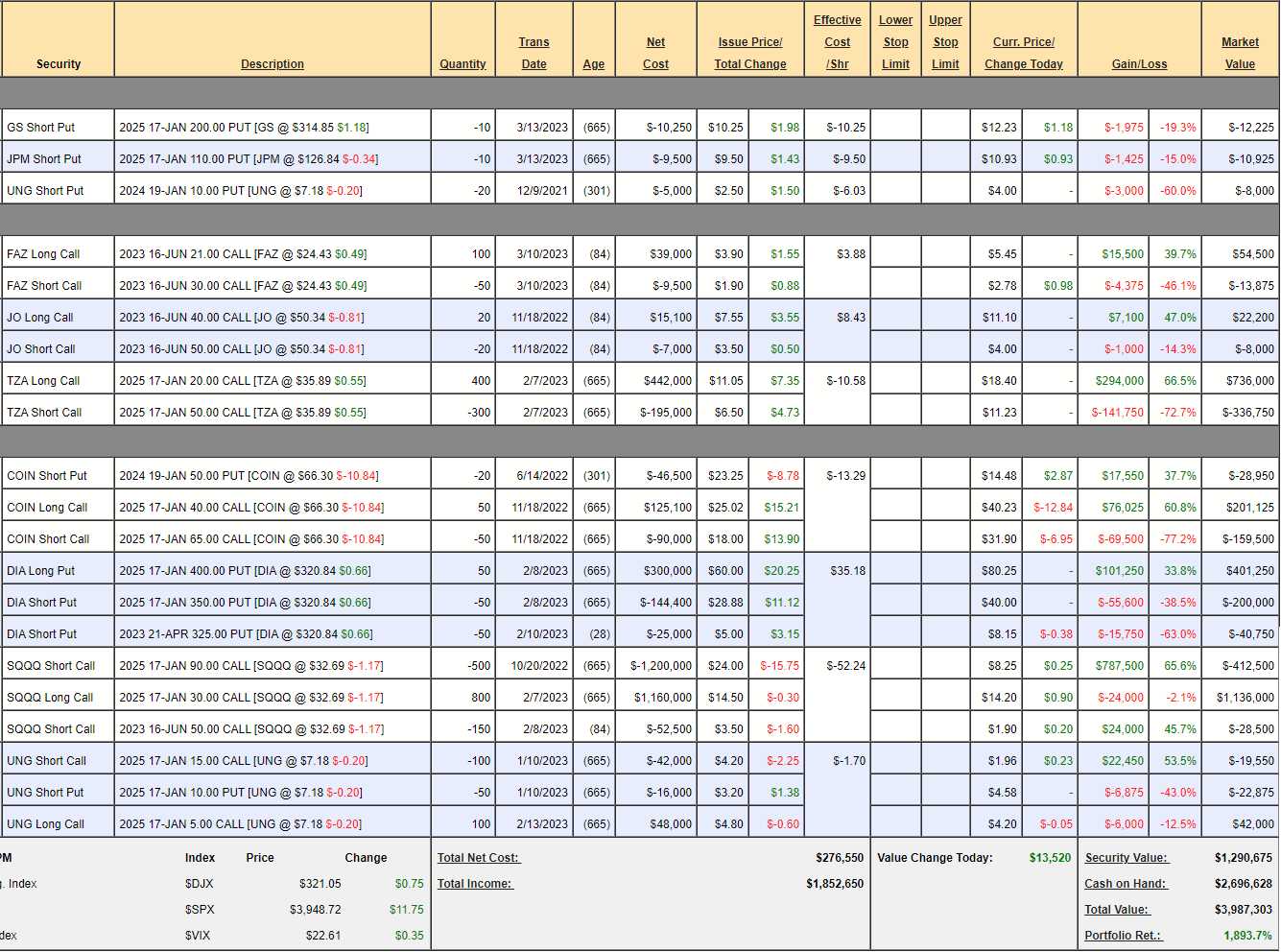

Friday is that red candle day after the big white one and we were worried about falling below the 200-day moving average and plunging to 3,840 and, a week later – we are still worried about the same thing. As we were aggressively hedged, we were able to add a lot of bullish positions to the Long-Term Portfolio on Wednesday – and we can still get great prices adding them today – as we’ve taken another dip.

Hedging a portfolio is lot like surfing – you have to shift and balance as you try to stay on top of the market waves. Having more hedges allows us to be more aggressive with our longs – but we don’t go crazy – we’re just looking to maintain a balance going forward.

Despite our efforts, the Short-Term Portfolio is down a bit from our last review (3/14), when we were last at 3,840 on the S&P 500. Still, it’s going to be a very profitable drop for us and, if 3,840 fails – we’ll pull the plug on those longs and wait for 3,680 to buy in again.

We are MUCH more bearish now than we were last Friday and it was hard not to back off this position as the market spiked this week but there were no FUNDAMENTAL reasons for the spike other than false hope the Fed would reverse itself – so we kept our position bearish and now we’re happy we did (I had told our Members no sooner than today would we adjust but now next week – if at all).

Hedges are insurance and you either need it or you don’t and, if it ends up you didn’t need it – then you “wasted” your money on the insurance – so you try not to buy too much but too little… well that’s bad too.

Are things suddenly worse again now that the Fed hiked 0.25% on Wednesday? Of course not. And now it was 0.25% out of 4.75%, which is 5% whereas before they were hiking 0.5% on top of 1%, which was 50% so what on Earth are people freaking out about?

This is all just a battle against unrealistic expectations and that’s because (and I noticed this during the week as I forced myself to watch the Financial Pundits on TV) NOBODY understands how rates work. The Talking Heads and even most Policymakers are ignorant of the complex nature of monetary policy and its limitations. Please, feel free to tell me if I’m wrong but I did not hear one single person explain that the Fed can’t simply decide what rates are going to be – that’s a huge fallacy!

This is all just a battle against unrealistic expectations and that’s because (and I noticed this during the week as I forced myself to watch the Financial Pundits on TV) NOBODY understands how rates work. The Talking Heads and even most Policymakers are ignorant of the complex nature of monetary policy and its limitations. Please, feel free to tell me if I’m wrong but I did not hear one single person explain that the Fed can’t simply decide what rates are going to be – that’s a huge fallacy!

As the Central Bank for the World’s strongest currency, the Fed can INFLUENCE rates by setting policies and HOPING (not a valid strategy) that the rest of the World will follow them but, when Inflation is running at 6% and your country is $32Tn in debt and running a $1.5Tn deficit and just pledged $2Tn to bail out the banks – rates are no longer up to you.

The Fed can influence rates through its policies, such as adjusting the Fed Funds Rate or conducting Open Market Operations, however, these actions are only effective insofar as they are supported by broader economic conditions and market forces. The Fed cannot simply dictate interest rates to the market.

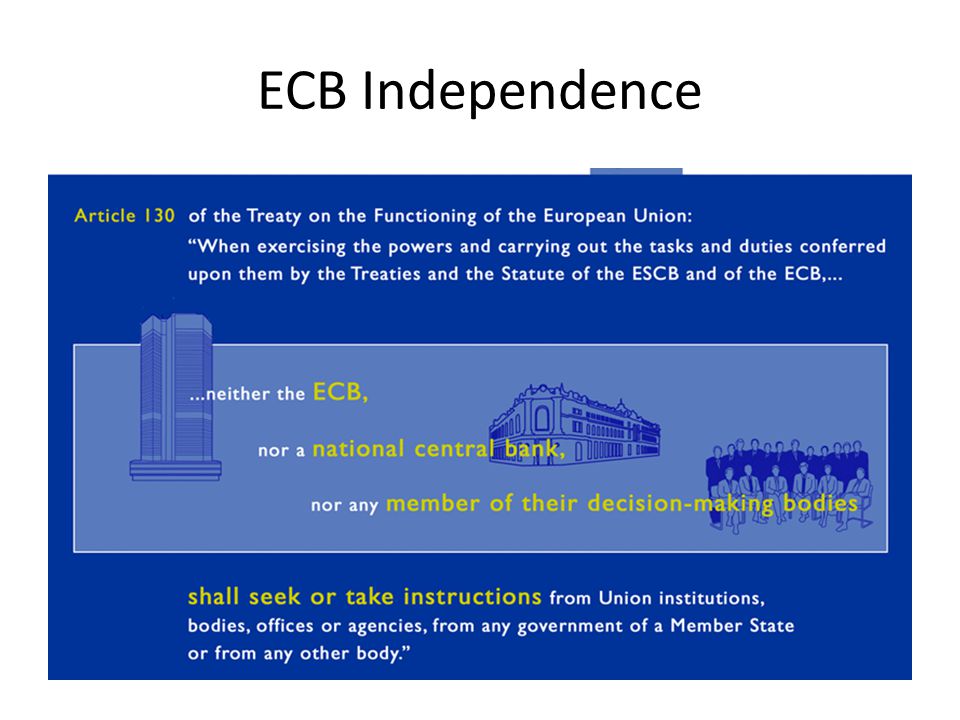

The European Central Bank (ECB) has a very different mandate than the Federal Reserve. While the Fed is tasked with promoting price stability and maximum employment, the ECB has a single primary objective: maintaining price stability in the Euro area. This means that the ECB must ensure that inflation does not exceed the target of “below, but close to, 2%” over the medium term.

The European Central Bank (ECB) has a very different mandate than the Federal Reserve. While the Fed is tasked with promoting price stability and maximum employment, the ECB has a single primary objective: maintaining price stability in the Euro area. This means that the ECB must ensure that inflation does not exceed the target of “below, but close to, 2%” over the medium term.

In contrast to the Fed, which has a dual mandate and some flexibility to adjust its policies based on economic conditions, the ECB’s mandate against inflation is very strong and inflexible. This is reflected in the ECB’s institutional framework, which prioritizes price stability above all else and gives the central bank a high degree of independence from political interference.

Despite their efforts, inflation in Europe has recently spiked to nearly 10%, driven by factors such as supply chain disruptions, higher energy prices, and government stimulus measures. This has put even more pressure on the ECB to take action, but the Central Bank’s mandate against Inflation means that it must balance these concerns with its commitment to price stability.

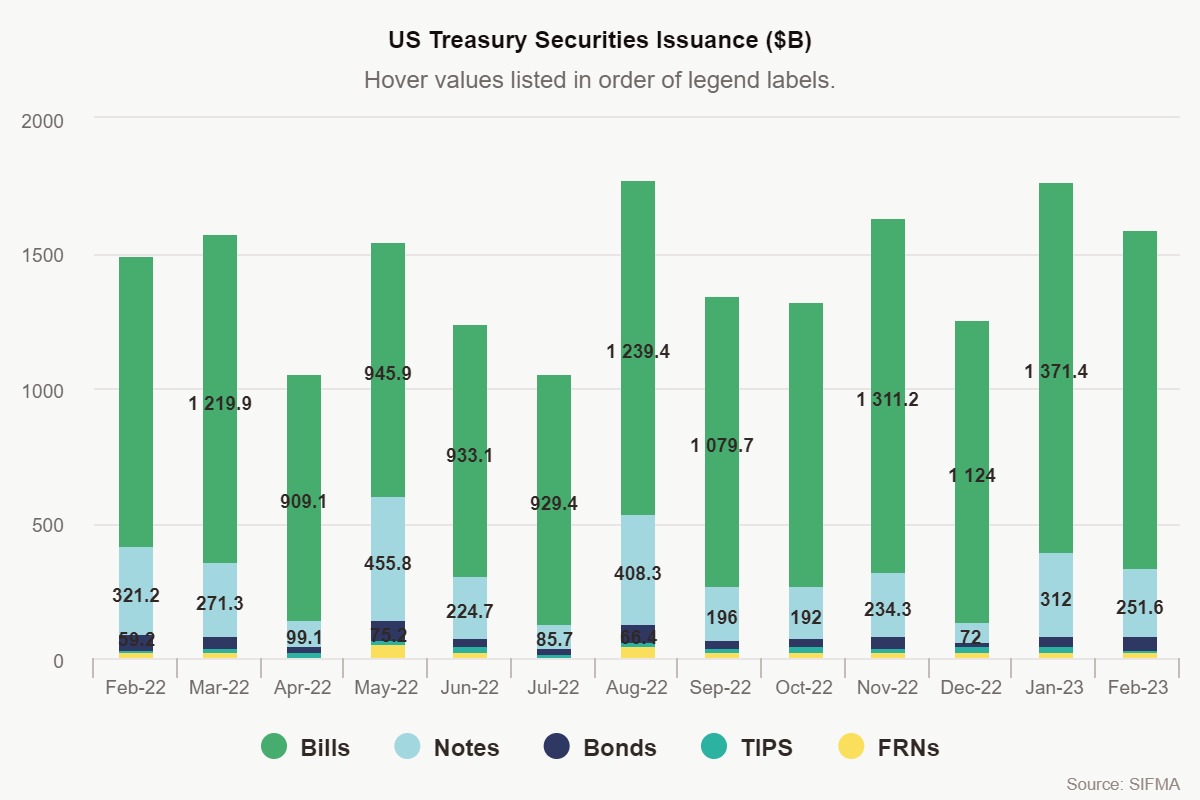

Between new issuance and rollovers, the Treasury has to sell $1,500,000,000,000 worth of securities each month and no one is going to buy them at below-inflation rates, are they? If the ECB is paying more than we are in Interest – we have no choice but to raise rates to match and the worst thing that can happen to the Fed is that the are shown to be ineffective in controlling rates – so they HAVE to double-talk and BS and do whatever it takes to make you THINK they can control things – while being forced to follow the prevailing trends.

Last month, the Fed bought $120Bn worth of notes – about half of what was offered. This is them supposedly “winding down” their purchases but who will buy bonds if the Fed stops and the rates are not even keeping up with inflation? Will it be our friends in China? Not only did the Fed buy half the T-Bills, they also spent $400Bn in the past two weeks buying below-market bonds from the Banks – so they wouldn’t have to show the catastrophic unrealized losses that are still on their books.

This reality of the situation is rooted in the history of monetary policy, which has been shaped by a complex web of economic, political, and social factors. From the Gold Standard to the Bretton Woods System to the current era of Fiat Currencies, Central Banks have grappled with a wide range of challenges and trade-offs. They have had to balance the needs of Inflation Control, Economic Growth, and Financial Stability, often in the face of powerful vested interests and competing ideologies.

Of course people harbor distrust and even hostility towards Banksters. After all, the history of Capitalism is rife with examples of greed, corruption, and exploitation, particularly in the financial sector. The battle against unrealistic expectations requires more than just technical knowledge and policy expertise – it requires cultural shift towards greater transparency, accountability, and public participation in economic decision-making.

In our Live Member Chat Room today, we’re going to discuss how these factors are likely to affect the market in the near future and what steps we plan to take to manage your Portfolio Strategies accordingly. We will also discuss the potential risks and opportunities that exist in the current market environment and how we plan to capitalize on them.

Have a great weekend,

-

- Phil