What’s Driving Emerging Markets’ Sharp Slowdown in 2023 GDP Growth?

How have spillovers from the recent bank failures impacted emerging markets [EMs]? What’s driving EM’s sharp slowdown in 2023 GDP growth rates?

Satyam Panday, Chief Economist, Emerging Markets, S&P Global Ratings, says: “The events of the last two weeks are a timely reminder that not only does tighter monetary policy work with a considerable lag, but the effects do not always feed through gradually and smoothly. Going forward, bank lending will become more selective at the margin.”

Satyam Panday […] continues: “We expect real GDP growth to slow sharply this year in most major emerging markets (with China and Thailand as notable exceptions) as the post-pandemic rebound fades, and high inflation and interest rates bite.

Growth will be below-trend this year, before returning to respective potential growth rates in 2024-2025. Higher growth in China is a positive for emerging markets (EMs), but is not enough to offset slower growth in the U.S. and Europe.

The long shadow of the Russia-Ukraine conflict and even sharper tightening of global financial conditions remain key downside risks to growth for EMs.

Also, inflation is poised to decelerate through the year, easing pressure on EM central banks to continue hiking rates. Still, we don’t anticipate most to ease in 2023 before the Federal Reserve clearly signals its intent to do so.”

- The abrupt demise of Silicon Valley Bank (SVB) and Signature Bank, and UBS’ hasty takeover of Credit Suisse are reminders of banks’ sensitivity to confidence and liquidity

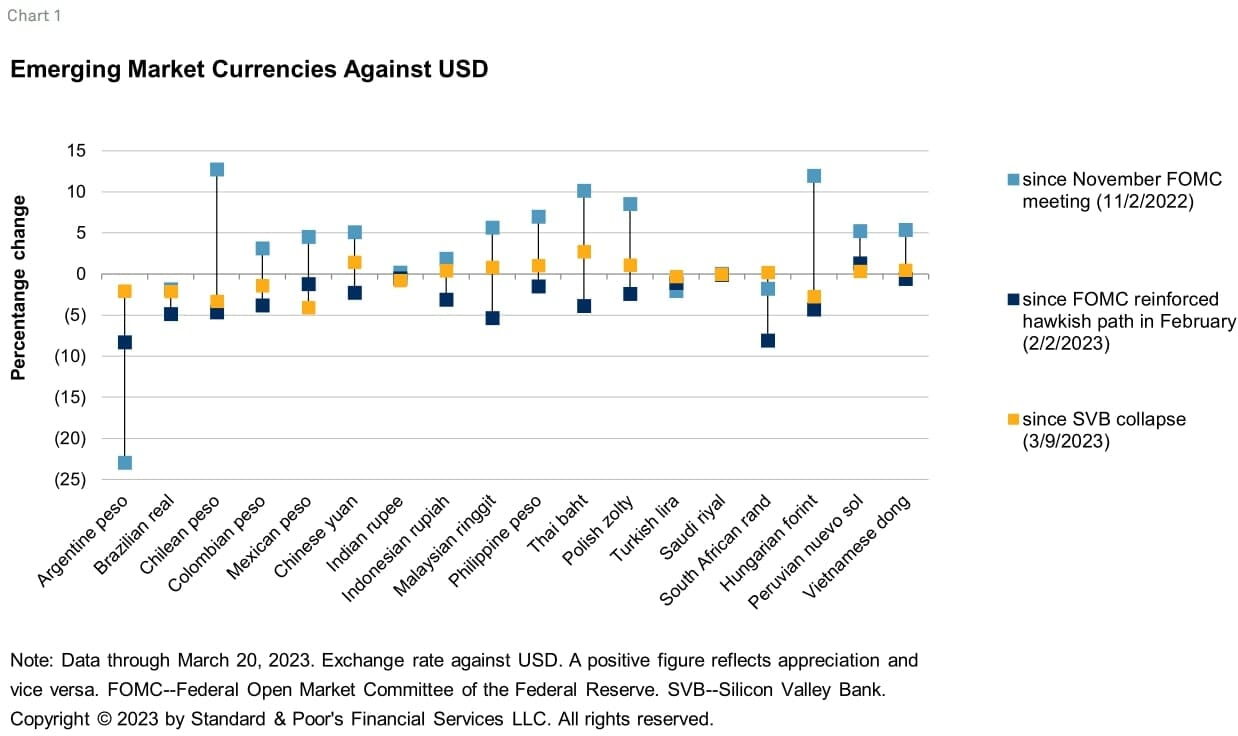

- In EMs, direct spillovers from the bank failure(s) appear small, and evidence of adverse effects through risk aversion channels are ambiguous based on foreign exchange markets

- EM currencies moves were small between March 10–when the U.S. FDIC put SVB in receivership–to March 20, two days before the March FOMC

- Many strengthened against the dollar, perhaps helped by expectations for a lower path for U.S. rates

- Some EM currencies that came under relatively more pressure were in Latin America reflecting concerns about the U.S. economy (given the trade channel)

- U.S. and eurozone to weaken sharply while China growth rebounds

- We expect GDP growth will be well-below potential growth for the U.S. and eurozone (downside risk has increased)

- Although we raised our 2023 growth forecasts in the two economies, we still expect they will remain close to recession in 2023 and early 2024

- S&P Global Ratings revised up China’s 2023 GDP growth forecast by 70 basis points (bps) to 5.5% and 30 bps for next year to 5.0% helped by China’s announcement it will soften its stance on the property sector and the rapid easing of COVID-19 policies

- We expect GDP growth will be well-below potential growth for the U.S. and eurozone (downside risk has increased)

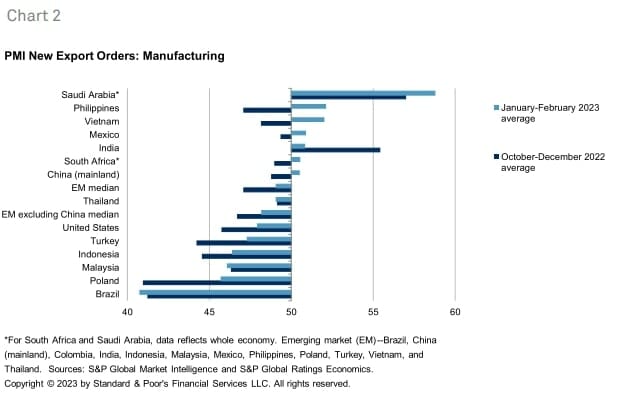

- Stronger than expected start to the year

- Sustained labor market strength in the U.S., a milder winter in Europe, and China’s reopening are already felt in business sentiment data globally

- EM’s manufacturing PMIs in the first months of 2023, albeit weak in many countries, showed signs that the industry has fared better than in late 2022

- GDP growth to slow sharply this year in most EMS compared to strong 2022 performances

- Common drivers of slowing growth in 2023:

- Fading post-pandemic catch-up/recovery momentum

- Weakened demand from key major trading partners

- Still-elevated prices eating into disposable income growth

- Higher interest rates globally and locally holding back consumption and investment

- Exceptions: China and Thailand; EMEA (excluding Saudi Arabia) and Latin America are poised to expand well below longer-run trends in 2023; India and Southeast Asia will grow under their respective trends

- LatAm – 9% growth in 2023 vs 3.7% in 2022

- EM-Asia (excluding China) – Thailand: tourism is set for a strong year after more than two years of pandemic-driven doldrums

- EM-EMEA –

- Improvements in the eurozone energy outlook and economic growth prompted us to revise up our GDP projections for Hungary and Poland in 2023 and 2024, respectively

- Saudi Arabia, after strong real GDP growth of 8.7% in 2022, we expect economic growth to moderate but remain resilient, averaging 2.6% in 2023-2026

- South Africa – anticipate severe electricity disruption during the first half of the year, bringing the economy to a near standstill

- Turkiye – we have lowered our 2023 GDP growth forecast by 0.3 percentage points, mainly reflecting the earthquake that hit the country in early February and partially offset by an improved outlook for energy prices

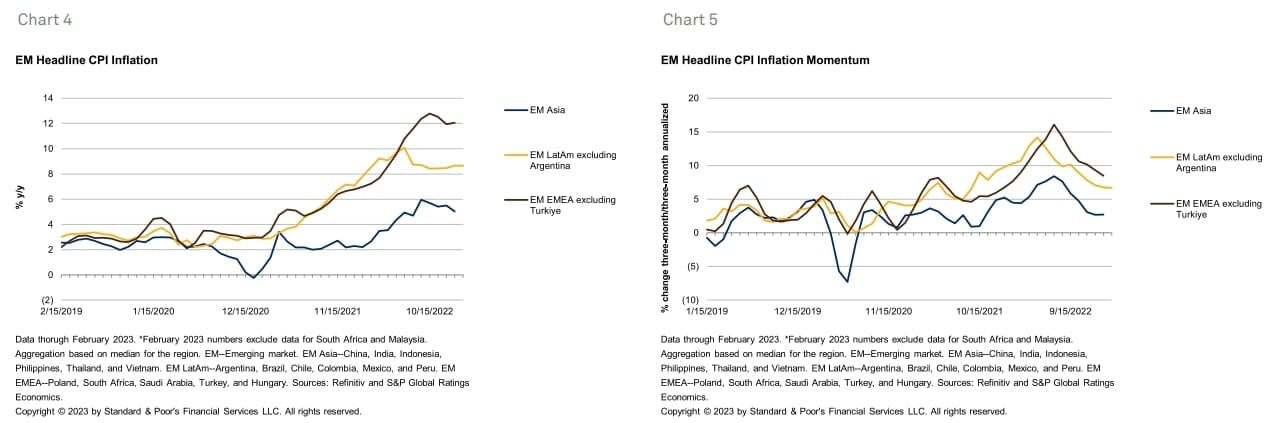

- Inflation peaked in most EMs & inflationary pressures begin to recede

- Across most EMs, energy price inflation is moderating while food inflation remains elevated but is not accelerating

- Common drivers of slowing growth in 2023:

- Monetary policy

- Given expected disinflation, several central banks have signaled an end to their rate hikes, including Brazil, Chile, Poland, and Hungary

- Since we no longer expect the Fed to start cutting interest rates this year, we also no longer expect most central banks in LatAm to start lowering interest rates this year.

- In EM-Asia, there is some runway for gradual monetary policy tightening

- in EM-EMEA, considering high inflation and exchange rates pressures, we do not expect South Africa, Hungary, and Poland to cut interest rates in 2023

Satyam Panday, concludes: “As shown during the COVID-19 pandemic, central banks in EMs have tools to counter contagion risks (via liquidity provisions or broadening deposit insurance). Nonetheless, recent developments underscore that we are in for a bumpy ride.”

Sources: Data – S&P Global Ratings | Commentary – Satyam Panday, Chief Economist, Emerging Markets, S&P Global Ratings

Top image: aallm / Depositphotos