By Michael Msika, Bloomberg Markets live reporter and strategist, as published at ZeroHedge

As recession risks slam into stock markets, investors are making a beeline for shares of companies that offer the safest shelter during stormy times.

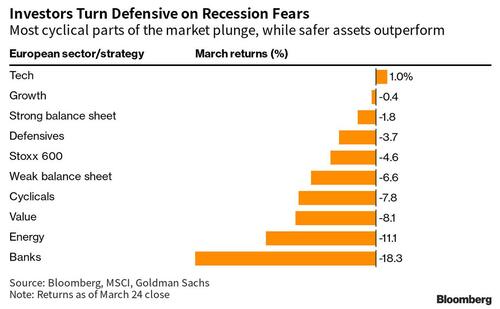

Turbulence is buffeting global markets, as interventions from US and European authorities fail to really soothe concerns about the health of the financial system. Any rallies in bank shares are proving short-lived as fund managers sell and rotate into either tech or so-called defensive sectors, such as staples and health care. Friday’s selloff has left Europe’s banking sector down 18% this month, while tech has gained about 1%.

“We expect weaker growth and more financial accidents ahead,” says Morgan Stanley strategist Graham Secker, who predicts credit availability will tighten, leading to renewed weakness in economic indicators and ultimately, earnings revisions. “Investors should reduce cyclical exposure and rotate towards stocks with more defensive/quality/growth characteristics.”

Based on valuation, profitability and EPS risks, Secker cites Lufthansa, Remy Cointreau, ABB, Alfa Laval, Volvo, Nibe Industrier and Geberit as examples of stocks to avoid. His list of names to overweight contains Kerry Group, BAT, BT, ABF Foods, Mondi, Croda, Siemens Healthineers, Brenntag, Reckitt Benckiser, SAP and EssilorLuxottica.

Cyclicals’ reversal accelerated on Friday, as a dismal manufacturing PMI preliminary reading reinforced the view that stocks are pricing in a too benign economic outlook for Europe.

Goldman Sachs strategist Sharon Bell also recommends buying defensives, and screening out companies with weaker balance sheets. “Financial stability, liquidity concerns and credit risk are at the forefront of investors’ minds, given risks related to the banking sector,” Bell says, adding that the impact of higher rates is yet to be fully felt.

As the chart below shows, weak balance-sheet names tend to underperform defensives when high-yield credit spreads rise. Any further tightening in financial conditions would exert more pressure on credit, raising risks for highly indebted companies.

Even assuming the Fed’s rate-hike cycle is close to peaking, cyclicals’ pain may persist for longer. Barclays strategist Emmanuel Cau has analyzed the impact of Fed policy tightening cycles since the 1970’s, comparing sector performance around its last rate hike and after its first cut. “Cyclicals and financials mostly underperformed defensives over the entire period, but more after the Fed started to cut rates,” Cau says.

So with recession looming, it’s getting harder to justify cyclicals’ valuations. Share prices have de-rated in the past two weeks but as the chart below shows, cyclicals’ valuations, relative to defensives, can fall another 10% to 20% during downturns.

Finally, the risks are fueling a rush for the safest of all assets — cash. The assets of money-market funds now exceed $5.1 trillion, a record. Over the past two weeks, over $300 billion flowed into these funds, taking their year-to-date tally to about $450 billion.