“I’m scared to fall, it’s always been a fear

“I’m scared to fall, it’s always been a fearTo be stuck in here, but I don’t wanna leave

Hoping that one day

You’ll come along

Join me, ’cause I’ve been slowly falling

Like Ross – many investors have been stuck in the zone with the stock market. They’ve been eyeing the bargains for some time now, hoping to finally make their move and get in on the action but it never seems like quite the right time to make a move – and there’s that overwhelming fear of rejection…

just as Ross has been right in front of Rachel all along, value stocks have been right in front of these investors – they just don’t see them…

And, like Rachel, investors are still looking for something better, waiting for the market to fall further before making their move. They are afraid to commit, fearing that they’ll fall further or miss out on a better opportunity, ignoring the value stocks that are right in front of them! Ross eventually found his way out of the friend zone – but it was 9 years and 230 episodes later!

And, like Rachel, investors are still looking for something better, waiting for the market to fall further before making their move. They are afraid to commit, fearing that they’ll fall further or miss out on a better opportunity, ignoring the value stocks that are right in front of them! Ross eventually found his way out of the friend zone – but it was 9 years and 230 episodes later!

The key is to have patience, keep a close eye on market trends, and be ready to act when the time is right.

At Philstockworld, in our Live Member Chat Room last Wednesday morning, we made our initial move on 26 long positions, drawing from the Watch List we’ve had our eye on since late December. We patiently waited an entire quarter before jumping on about half of the positions (we did have a few dates along the way).

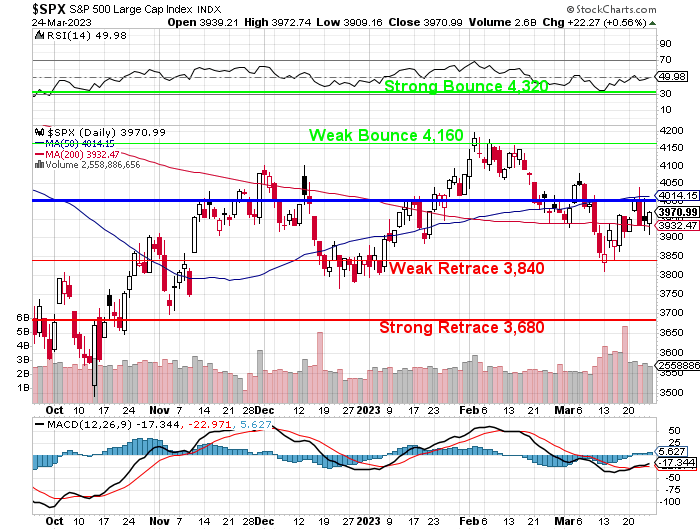

Hopefully it will work out and we’ll stay over the 200 dma and live happily ever after but, if not, we can work on our relationship and hopefully make it stronger and, if there are rough patches along the way, these are all stocks we’d love to buy more of if they do get cheaper.

No banks collapsed over the weekend – that’s nice. There’s still a lot of tension and worry out there but, as I noted on Wednsday – there’s also a lot of bailouts and stimulus and, as we’ve learned over the last 15 years, bailouts and stimulus Trump (don’t say Trump!) a crappy economy.

Speaking of Trump (don’t say Trump!), a lot of people think this is finally the week when they round him and his crew up and justice will finally be served – good luck with that! At the moment, it’s a very dangerous point of contention we have to keep watch of.

Speaking of Trump (don’t say Trump!), a lot of people think this is finally the week when they round him and his crew up and justice will finally be served – good luck with that! At the moment, it’s a very dangerous point of contention we have to keep watch of.

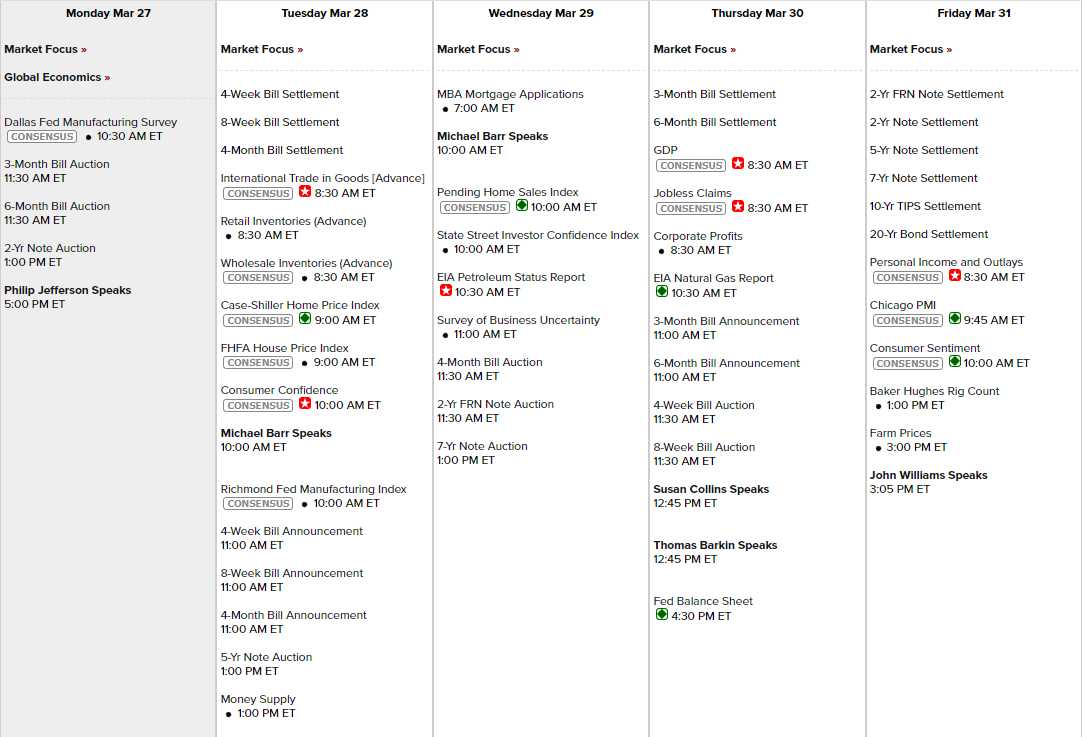

This week, we’ll get some fresh data on the US economy, as well as some insights into the housing and energy markets. Here are some of the highlights:

- Tomorrow we’ll see the advance reports on International Trade and Retail & Wholesale Inventories for February. These will give us an idea of how the trade balance, consumer spending, and business stockpiling have been affected by the pandemic and the global recovery. We’ll also get the latest readings on Home Prices and Consumer Confidence for January and March, respectively.

- Wednesday we’ll check the pulse of the mortgage market with the MBA Applications Index and we’ll also see how many homes went under contract in February with the Pending Home Sales Report. Both indicators will reflect the impact of rising mortgage rates and tight inventory on the housing demand. Finally, we’ll get the weekly update on crude oil inventories from the EIA. Oil is back up to $70.50 this morning after testing $65 last week.

- Thursday we’ll start the day with Weekly Jobless Claims, which has been steadily declining for several weeks and that is NOT what the Fed wants to see – so try to get yourself fired to make Powell happy… We’ll also get the final estimate of GDP growth and inflation for the fourth quarter of 2022. These will confirm how the economy performed at the end of last year and set the stage for the first quarter of 2023. We’ll also see how much natural gas was stored in the US last week with the EIA report. I will also be curious to see how much the Fed Balance Sheet has expanded.

- Friday we’ll end the week with some key reports on Personal Income and Spending, as well as core PCE inflation for February. We’ll also get reports on Chicago PMI and Consumer Sentiment for March. These will provide some clues about the state of manufacturing and consumer confidence in two major regions of the country.

We have 6 scheduled Fed speakers scheduled this week, but two are Barr – though they don’t seem to follow a schedule in the past month. If we get through all that, there’s not much to worry about next week until Non-Farm Payrolls next Friday.