By Robert Rapier via OilPrice.com

-

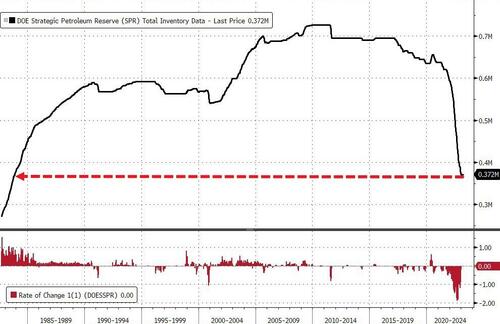

The Biden Administration has sold 266 million barrels of oil from the Strategic Petroleum Reserve since his inauguration.

-

In October, with prices still above $80, the administration announced that it would refill the SPR when oil was priced between $67 and $72.

-

If the Biden Administration refills the SPR now he would not only be helping to protect the country from supply disruptions but could claim to have turned a profit.

There is a narrative that I hear from time to time that President Biden made billions of dollars for the country by selling oil from the Strategic Petroleum Reserve (SPR) last year at high prices and buying it back at low prices. The only problem is that the story is only half true.

The Biden Administration did indeed sell a lot of oil from the SPR last year.

Further, oil prices in 2022 were the highest they had been in years, averaging nearly $95 a barrel — the highest level since 2013.

However, the Biden Administration hasn’t bought back any of the 266 million barrels of oil that have been removed from the SPR since his inauguration. If Biden wants to legitimately receive credit for successfully playing as an oil speculator, then he needs to put the oil back. Right now, all he has done is deplete oil reserves that were built up under several previous administrations (Democratic and Republican).

Previously, the Biden Administration had resisted calls to refill the SPR, citing high prices. In October, with oil prices still above $80, the administration announced it would set up a process to refill the SPR when oil was priced between $67 and $72 a barrel.

As Bloomberg energy and commodities columnist Javier Blas pointed out on Twitter, the entire futures curve for West Texas Intermediate (WTI) is now below that range:

“The whole WTI futures curve is now below the bottom range of $67-$72 a barrel given by the White House to buy crude for the SPR. That’s the **whole curve, including the contract for immediate delivery**. Let’s see if the Biden administration pulls the trigger.”

Of course, the public loves low oil prices.

Last year’s massive SPR release probably helped arrest the spike in oil prices.

The risk of buying back that oil is that oil prices may stop falling.

But, not refilling the SPR leaves the U.S. with a significantly lower insurance policy against any oil supply disruptions. This would seem to be an opportune time to put at least some oil back into the SPR, while claiming credit for selling high and buying low.

[This article is presented as posted at ZeroHedge]