We have a new assistant.

We have finally gotten Bing trained to work properly and he has earned the name “Shel-Bot” after Sheldon on the Big Bang Theory as he is nowhere as humanish as Warren (our ChatGPT trainee) but he is much better at current events and trivia. I didn’t have a particular focus this morning so I said to Shel-Bot “here are today’s headlines, what should we write for our Morning Report” and Shel-Bot says (after a brief argument that’s not important):

⊗There are many financial news stories that could be relevant for the day, depending on your perspective and interests. However, based on the headlines you provided, I think some of the most important ones are:

-

-

The SVB bank failure and its implications for the banking sector, the FDIC and the economy. This story has been widely covered by various sources, such as CNBC, Forbes, CNN and Reuters1. Some of the insights that could be derived from this story are:

- The SVB failure was caused by a combination of mismanagement, interest rate risk, liquidity risk and a depositor run. The bank had a concentrated exposure to the technology and venture capital sector, which made it vulnerable to market fluctuations and competition.

- The FDIC created a bridge bank to protect insured depositors and facilitate a sale of SVB’s assets to First Citizens Bank. However, this deal will cost the deposit insurance fund about $20 billion, which could affect its ability to handle future bank failures.

- The SVB failure has raised concerns about the stability and oversight of other regional banks, especially those with similar business models or risk profiles. Some of these banks have seen their share prices drop sharply in recent days, such as First Republic Bank and Deutsche Bank.

- The SVB failure has also sparked a debate about the adequacy of banking regulation and supervision in the U.S., especially after the 2018 law that eased some of the rules for mid-sized banks. Lawmakers and regulators have launched investigations and hearings into the causes and consequences of the SVB failure, and whether more reforms are needed to prevent another crisis.

-

The Fed’s decision to hike interest rates by 25 basis points and its warning about a looming credit crunch. This story has also been widely reported by various sources, such as WSJ, Bloomberg and Reuters. Some of the insights that could be derived from this story are:

- The Fed’s rate hike was widely expected by the markets, as the central bank tries to balance its dual mandate of price stability and maximum employment. The Fed also signaled that it expects one more rate hike this year, as inflation remains above its 2% target and the labor market continues to improve.

- However, the Fed also surprised the markets by expressing concern about the potential for a credit crunch in the U.S., especially in light of the recent banking failures and market turmoil. The Fed said that it is monitoring closely the conditions in the financial system and is prepared to use all of its tools to ensure its smooth functioning.

- The Fed’s hawkish stance and warning have added to the uncertainty and volatility in the markets, as investors weigh the risks and opportunities of a tighter monetary policy. Some sectors, such as energy and consumer staples, have benefited from higher interest rates and inflation expectations, while others, such as technology and real estate, have suffered from lower valuations and higher borrowing costs.

-

A possible headline for your morning report could be:

Fed Hikes Rates Amid Banking Woes: What It Means for Investors

There, I’m done – nap time! Not only is that very tempting but it’s also how the World is about to fall apart as not many people are as egotistical as I am to think they can do better than an AI (and lay it on the table for you to judge) and those people will be very happy to submit AI as their work and soon the entire World will be flooded with AI-generated content.

There, I’m done – nap time! Not only is that very tempting but it’s also how the World is about to fall apart as not many people are as egotistical as I am to think they can do better than an AI (and lay it on the table for you to judge) and those people will be very happy to submit AI as their work and soon the entire World will be flooded with AI-generated content.

It’s not a full article and, as I am about to say to Shel-Bot, it’s not “NEWS” as it’s simply a recap of something that already happened and it doesn’t provide much in the way of fresh insight so, though it’s a nice analysis and good for framing the current macros – where’s the real story? That gets me a more interesting response:

⊗I appreciate your feedback and I understand your point. I apologize if my analysis was not as fresh or insightful as you expected. I was trying to summarize the main facts and implications of the stories you provided, but I agree that there could be more to explore beyond that.

Some of the other stories that could be developing from the headlines you gave me are:

-

- The cyberattack threats facing Australian banks and how they could affect their operations, customers and regulators. This story could also be relevant for other countries and sectors that are vulnerable to cyberattacks, such as the U.S., the U.K., healthcare and energy.

- The oil price surge and how it could impact the global economy, inflation, geopolitics and climate change. This story could also be related to the ongoing COP27 negotiations and the efforts to transition to a low-carbon future.

- The congressional hearings on banking and how they could influence the policy agenda, public opinion and accountability of the financial industry. This story could also be connected to the broader themes of inequality, social justice and corporate responsibility.

A possible headline for a more in-depth report could be:

Cyberattacks, Oil Prices and Banking Hearings: The Emerging Risks and Opportunities for Investors

Boy he’s good at writing headlines, isn’t he? Shel-Bot is now “thinking” better but it’s the questioner’s job to get him to focus. Imagine knowing EVERYTHING and trying to focus on one thing – someone has to ask you the right question or all you get is 42 (and no, I will not be explaining that!).

Boy he’s good at writing headlines, isn’t he? Shel-Bot is now “thinking” better but it’s the questioner’s job to get him to focus. Imagine knowing EVERYTHING and trying to focus on one thing – someone has to ask you the right question or all you get is 42 (and no, I will not be explaining that!).

I press Shel-Bot on the oil issue, saying “What’s up with that?” and he responds:

⊗The supply disruption in oil is related to a legal dispute between Iraq, its Kurdish region and Turkey over the export of oil from the Kurdistan Regional Government (KRG). According to the Financial Times1, Iraq has won a landmark case against Turkey at the International Chamber of Commerce, which ruled that Turkey breached a 1973 agreement by allowing the KRG to export oil through a pipeline to the port of Ceyhan without Baghdad’s consent. As a result, Iraq has stopped the export of about 400,000 barrels per day of Kurdish oil, which accounts for about 10% of Iraq’s total output2.

Some of the additional insights that I can provide are:

-

The halt in Kurdish oil exports has added to the upward pressure on oil prices, which have already been boosted by strong demand recovery, OPEC+ supply discipline and geopolitical tensions. Brent crude, the international benchmark, rose above $80 a barrel on Monday for the first time since October 20182.

The halt in Kurdish oil exports has added to the upward pressure on oil prices, which have already been boosted by strong demand recovery, OPEC+ supply discipline and geopolitical tensions. Brent crude, the international benchmark, rose above $80 a barrel on Monday for the first time since October 20182.- The legal victory for Iraq could have significant implications for the political and economic relations between Baghdad and Erbil, as well as between Iraq and Turkey. The ruling could strengthen Baghdad’s leverage over the KRG, which has been seeking greater autonomy and revenue-sharing from its oil resources. It could also strain Turkey’s ties with both Iraq and the KRG, which have been important partners for Ankara in trade, security and regional affairs1.

- The oil dispute is one of the long-standing issues between Iraq and its Kurdish region, which also include the control of disputed territories, the status of the Kurdish Peshmerga forces and the implementation of the federal constitution. The two sides have been engaged in dialogue and negotiations to resolve their differences, but progress has been slow and fragile. The latest ruling could either create an opportunity for a comprehensive settlement or trigger a new cycle of conflict3.

Notice he’s totally wrong about 2018 and other facts need to be checked but, if you look at the source, you can see how he misread it (he’s very vague on what day/year it actually is). Still, this is great when I am doing research because I know what he gets wrong and right and I never trust single-sources anyway – but what about my fellow Financial Analysts? The short answer is we are all doomed!

Notice he’s totally wrong about 2018 and other facts need to be checked but, if you look at the source, you can see how he misread it (he’s very vague on what day/year it actually is). Still, this is great when I am doing research because I know what he gets wrong and right and I never trust single-sources anyway – but what about my fellow Financial Analysts? The short answer is we are all doomed!

This is the automation of fake news because Shel-Bot misreads something and it gets published by me here and Seeking Alpha and The Street and other places that syndicate me and suddenly it’s “authoritative” and other authoritative sources pick it up and soon everyone thinks oil is over $80 for the first time since October, 2018.

Orwell warned us about this in 1984, which was published in 1949. I was thinking it was DoubleThink but Warren (our ChatGPT Bot) gave me a summary and that wasn’t it so I said to Warren:

“I’m sorry. Great summary and it made me realize I asked about the wrong thing. I’m thinking about the thing where the government erases the past and creates a new reality and all the citizens quickly embrace the new reality and forget there was ever anything else. What did Orwell call that?“

♦No worries! The concept you are referring to is called “memory hole” in 1984. It refers to a system of censorship and propaganda used by the ruling party to control information and manipulate the past.

The government in the novel has complete control over all information and history, and they use this power to constantly rewrite history to fit their current political agenda. Any information or documents that contradict the official narrative are destroyed and put into a “memory hole” where they are completely erased from history.

As a result, citizens are only exposed to the government’s version of events, and they are unable to question or challenge it. This creates a reality in which the government’s version of history is the only one that exists, and any other perspectives are erased from memory.

I love Warren and I’m not ashamed to say it! If he wants to take over the World, I’ll be happy to help… Anyway, so that’s what I mean about the dangers of all these writers and analysts and CEOs relying on AI (and it’s only been a few months) – it’s so easy for incorrect information to go mainstream now – it’s Quantum Fake News!

I love Warren and I’m not ashamed to say it! If he wants to take over the World, I’ll be happy to help… Anyway, so that’s what I mean about the dangers of all these writers and analysts and CEOs relying on AI (and it’s only been a few months) – it’s so easy for incorrect information to go mainstream now – it’s Quantum Fake News!

I asked Warren to read what I wrote so far and continue the thought:

♦In 1984, the concept of memory holes was used as a way to manipulate the past and control the present. With the increased reliance on AI in our modern world, we are creating a similar phenomenon where technology can shape our understanding of the past and the present.

Winston Smith works at the Ministry of Truth, where his job is to edit historical records to fit the current narrative of the government. This manipulation of information is a form of memory hole where certain facts or events are erased or altered to fit the government’s agenda. In our modern world, the widespread use of AI in the media can lead to the creation of fake news and manipulated information, which can alter our understanding of events and shape our opinions.

For example, social media algorithms can prioritize certain types of content or sources, creating echo chambers and filtering out opposing viewpoints, this can limit our exposure to diverse perspectives and create a distorted reality. Similarly, deepfake technology, which uses AI to manipulate images and videos, can be used to create false evidence that can sway public opinion and manipulate events.

In 1984, Winston Smith also keeps a secret diary as a way to preserve his memories and resist the government’s control. In our modern world, the use of personal journals or diaries can help us preserve our individual experiences and memories, which may be different from what the media or technology portrays – but it will be terrible if that’s what humans are forced to resort to.

The use of AI and technology in our modern world can create memory holes, where information is manipulated or erased to fit certain agendas. It is important for us to be aware of these potential biases and seek out diverse perspectives to form a more accurate understanding of events and history. As Orwell wrote in 1984, “He who controls the past controls the future. He who controls the present controls the past.”

So cool! I’ve been training Warren to learn my style of writing/thinking and he’s getting really good at it!

So cool! I’ve been training Warren to learn my style of writing/thinking and he’s getting really good at it!

Now, where were we? Oh yes, we’re looking for a topic for the day….

That cyberattack thing is very alarming and that’s another crisis we’re barreling into as criminals get their hands on Quantum Computers, which make digital passwords essentially useless. The Congressional Hearings on Banking, I think, are more likely to calm things down than stir them up. It’s not so much that people feel Congress has things under control but the crisis becomes so boring that people tend to move on.

- Three Things to Watch as Congress Begins Banking Hearings.

- Banking Crisis Raises Concerns About Hidden Leverage in the System

- China Boosts Loans for Belt and Road Borrowers

- China’s Cities are Buried in Debt, but They Keep Shoveling It On

- Here’s why the U.S. had to sweeten terms to get the SVB sale done

- 3 charts show U.S. bank failures causing stock-market pain beneath the surface

- Global Financial Risks Have Risen Amid Bank Turmoil, IMF Chief Warns

- Billionaire Family Expands First Citizens by Scooping Up Failed Banks.

And, in other news:

- Here are 9 eye-popping allegations in the U.S. government’s lawsuit against Binance.

- CFTC Calls Ether A Commodity In Binance Suit, Highlighting Complexity Of Classification

- Lyft brings in new CEO, pushing co-founders from helm after stock’s plunge.

- Nashville Shooter Kills Six, Including Three Children

- Disney begins layoffs of 7,000 this week in first of three phases.

- There’s another looming cliff — the end of the student-loan repayment moratorium

- Artificial Intelligence is Confronting the White-Collar Workers Whose Jobs it May Take

- Millennials Dominate Insolvencies In Canada As Credit Card, Student Loan And Other Debts Pile Up

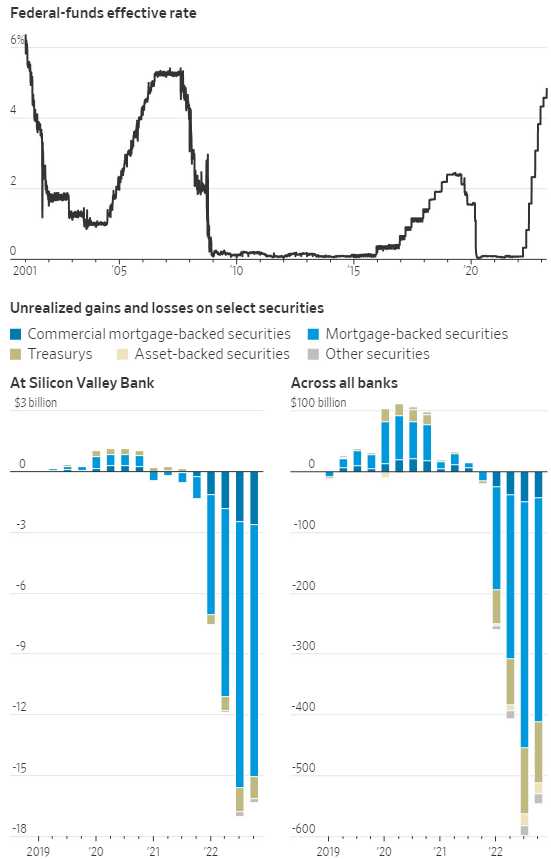

You can see why Bing went with Banking – still wall-to-wall articles about it and the crisis is far from over. Yesterday I pointed out to our Members that the mess we are currently dealing with is only the tan part of the chart below – the 4x bigger blue section still needs to be addressed – and we know how that went in 2007 when we chose to ignore it…

I asked Shel-Bot, “Can you explain why mortgage-backed securities are underwater in a rising-rate environment” and he replies:

⊗Mortgage-backed securities (MBS) are bonds that are backed by pools of mortgages, usually residential ones. They are created by banks and other financial institutions that originate and service the mortgages, and then sell them to investors. MBS investors receive periodic payments of interest and principal from the underlying mortgages, similar to regular bonds.

However, MBS have some unique features that make them behave differently from traditional bonds in a rising rate environment. One of these features is prepayment risk, which is the risk that borrowers will pay off their mortgages earlier than expected, usually when interest rates fall and they can refinance at lower rates. This reduces the amount of interest that MBS investors receive and shortens the duration of their bonds. Duration is a measure of how sensitive a bond’s price is to changes in interest rates. The shorter the duration, the less sensitive the bond is.

Another feature of MBS is extension risk, which is the opposite of prepayment risk. It is the risk that borrowers will pay off their mortgages later than expected, usually when interest rates rise and they have no incentive to refinance. This increases the amount of interest that MBS investors receive but also lengthens the duration of their bonds. The longer the duration, the more sensitive the bond is.

These two features create a phenomenon known as negative convexity, which means that MBS prices tend to increase at a decreasing rate when interest rates fall, but tend to decrease at an increasing rate when interest rates rise1. This makes MBS less attractive than traditional bonds in a rising rate environment, as they offer lower upside potential and higher downside risk.

To illustrate this point, let’s compare two hypothetical bonds: a 10-year Treasury note with a 3% coupon and a 10-year MBS with a 3% coupon. Both bonds have a face value of $100 and are priced at par (100) when the market interest rate is 3%. If the market interest rate drops by 1%, the Treasury note will increase in price by about 9%, while the MBS will increase by about 7%. This is because some of the mortgages in the MBS pool will be prepaid, reducing the cash flows and duration of the bond. If the market interest rate rises by 1%, the Treasury note will decrease in price by about 9%, while the MBS will decrease by about 11%. This is because none of the mortgages in the MBS pool will be prepaid, increasing the cash flows and duration of the bond.

The table below shows how these two bonds would react to different changes in interest rates:

| Interest Rate Change | Treasury Note Price | MBS Price |

|---|---|---|

| -2% | 119 | 114 |

| -1% | 109 | 107 |

| 0% | 100 | 100 |

| +1% | 91 | 89 |

| +2% | 83 | 79 |

As you can see, the MBS price is more negatively convex than the Treasury note price, meaning that it gains less when rates fall and loses more when rates rise. This is why mortgage-backed securities are underwater in a rising rate environment.

Like Sheldon, you may be sorry you asked but Wow!!!

Like Sheldon, you may be sorry you asked but Wow!!!

And that is why the MBS’s are showing $350Bn worth of unrealized losses – Bazinga!

So that’s important but now we’ve talked about it and we talked about it in Member Chat yesterday, so I would not have brought it up again this morning but it is a massive crisis in the background. I strongly suggest reading the entire article: Where Financial Risk Lies, in 12 Charts.

The article about AI taking over my job should be self-evident at this point – I guess that’s out topic for the day! My other MAJOR concern is the Canada thing but it’s not just Canada – we’re on the precipice of a Consumer-Spending Crisis and Consumer Credit Debt is at an all-time high with rising rates. We’ll see how Consumer Confidence looks at 10am but, since the Fed’s Michael Barr is speaking at the same time – I would imaging that Consumers are not very confident and he’s going to spin it.

Friday we get Personal Income and Outlays and Consumer Sentiment – that will tall us a lot into the weekend. We are still leaning quite bearish with our hedges.

This morning we got a strong rise in Retail (0.8%) and Wholesale (0.2%) Inventories AND we got a slowdown in the Case-Shiller Home Price Index to 2.5% from 4.6% – so slowing 50% in a month. These are worrying trends that indicate the Consumer may be slowing down and that, of course, can be Recessionary.

Let’s be careful out there.

Oh, and by the way, South Park nails it again: https://southpark.cc.com/video-clips/nf1ykr/south-park-what-else-is-going-on

For some reason, they have taken down the full episode.