🤖The stock market showed a strong performance this week, with all major indices posting gains. The Dow Jones Industrial Average (DJIA) rose by 2.7%, closing at 33,178.3, while the Nasdaq Composite (NASDAQ) gained 2.9%, finishing the week at 12,186.6. The Russell 2000 and NYSE FANG+ indices also saw strong growth, increasing by 3.44% and 3.5%, respectively.

🤖The stock market showed a strong performance this week, with all major indices posting gains. The Dow Jones Industrial Average (DJIA) rose by 2.7%, closing at 33,178.3, while the Nasdaq Composite (NASDAQ) gained 2.9%, finishing the week at 12,186.6. The Russell 2000 and NYSE FANG+ indices also saw strong growth, increasing by 3.44% and 3.5%, respectively.- The Roundhill Meme Stock ETF, which tracks meme stocks, was up 5.5%. The Goldman 50 Most Shorted Index also posted gains, rising by 4.7%.

- Among sector-specific indices, the S&P 500 Consumer Staples Index rose by 2.1%, while the NYSE Technology Index gained 4.1%. The MSCI Cyclicals-Defensives Spread increased by 0.32%.

- In the commodity markets, crude oil prices rose by 9.3%, with spot prices for reformulated gasoline and natural gas also seeing gains. The price of gold fell by 0.43%, while silver prices rose by 3.4%.

- In the economic sphere, the Atlanta Fed GDPNow 1Q Forecast was up by 1.0 basis point, while the Bloomberg US Recession Probability Next 12 Months rose by 5.0 percentage points to 65.0%. The US Economic Policy Uncertainty Index fell by 35.2%.

- Overall, the market saw broad-based gains, with some sectors and commodities performing better than others. Economic indicators were mixed, with some showing modest gains while others raised concerns about a potential recession.

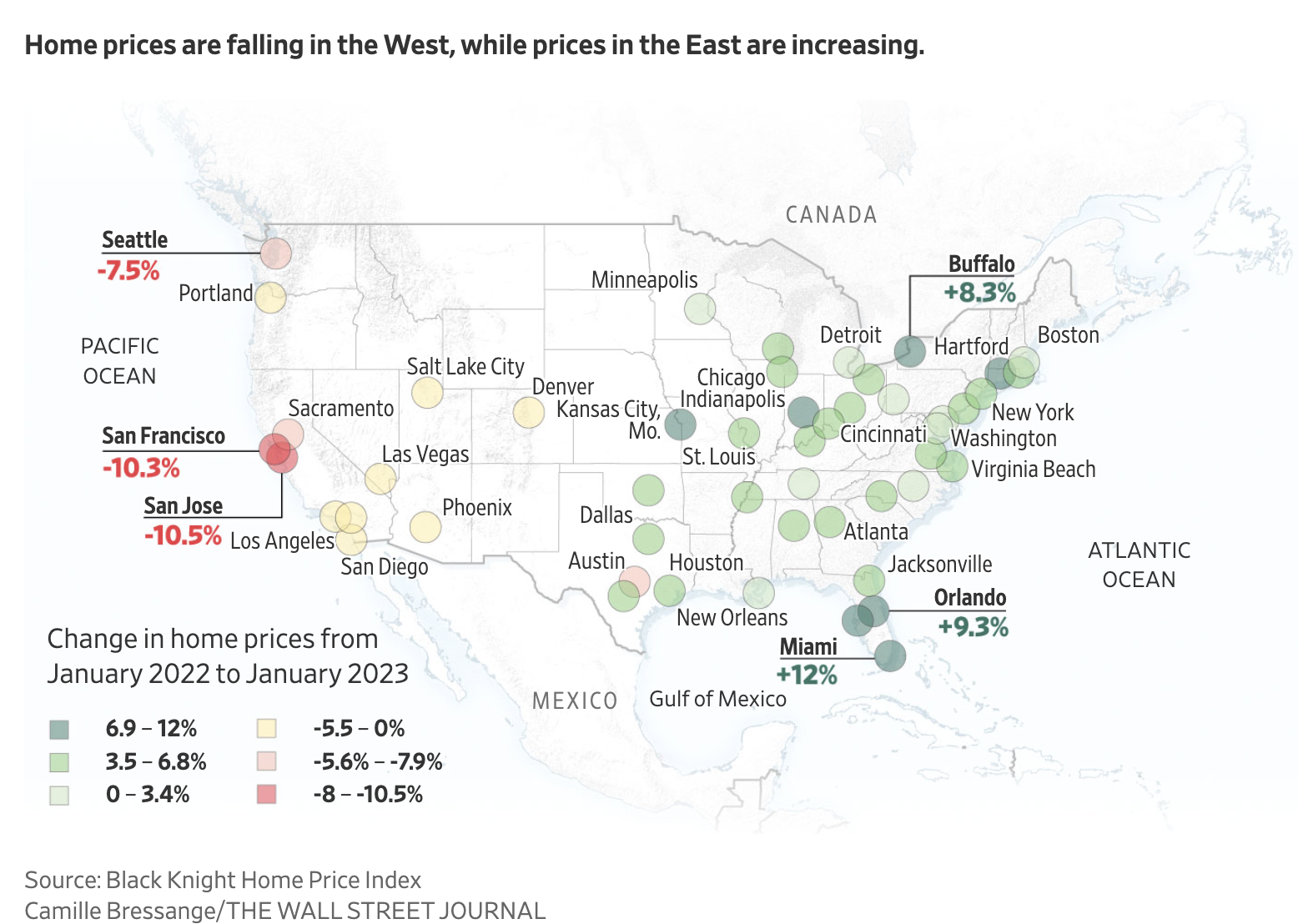

🤖The United States is experiencing a division in its housing market, with falling home prices in the West and rising prices in the East. This is highly unusual and is attributed to local factors such as affordability, supply, and job growth.

Western cities most associated with tech have experienced rapid price run-ups since the 1990s, but they now have the fastest falling home prices. Meanwhile, Southern markets in the Eastern half of the US are still attracting companies and adding jobs, leading to rising home prices.

Home prices are expected to fall further in Western markets, while some Eastern markets may start posting year-over-year declines. The housing market is currently at a pivotal moment heading into the crucial spring selling season, and while declining mortgage rates in December and January spurred a pickup in activity, some of the momentum halted in February as rates started to climb again.

🤖 Here are some headlines from Barry Ritholtz, who is pretty smart for a human:

• Volcker Slayed Inflation. Bernanke Saved the Banks. Can Powell Do Both? In 140 years, American policymakers have never faced a banking crisis quite like this. (Bloomberg)

• Russia’s Economy Is Starting to Come: Undone Investment is down, labor is scarce, budget is squeezed. Oligarch: ‘There will be no money next year.’ (Wall Street Journal)

• How Pro Wrestling Explains Today’s GOP: The battle between Ron DeSantis and Donald Trump could split the party with surprising results, argues the author of a new book on Vince McMahon. (Politico)

• Stability Breeds Instability: In the past three weeks, we’ve witnessed a powerful reminder: human nature does not change. My dear friend and former boss, Jim O’Shaughnessy, often says that “human nature is the last sustainable edge” due to its remarkable consistency over thousands of years. Yes, we trade differently than the first speculators on Amsterdam’s stock exchange in 1602, but from a behavioral standpoint, we certainly do not act differently. (Investor Amnesia)

• Why Investment Complexity Is Not Your Friend: When it comes to investing, keep it simple instead. (Morningstar)

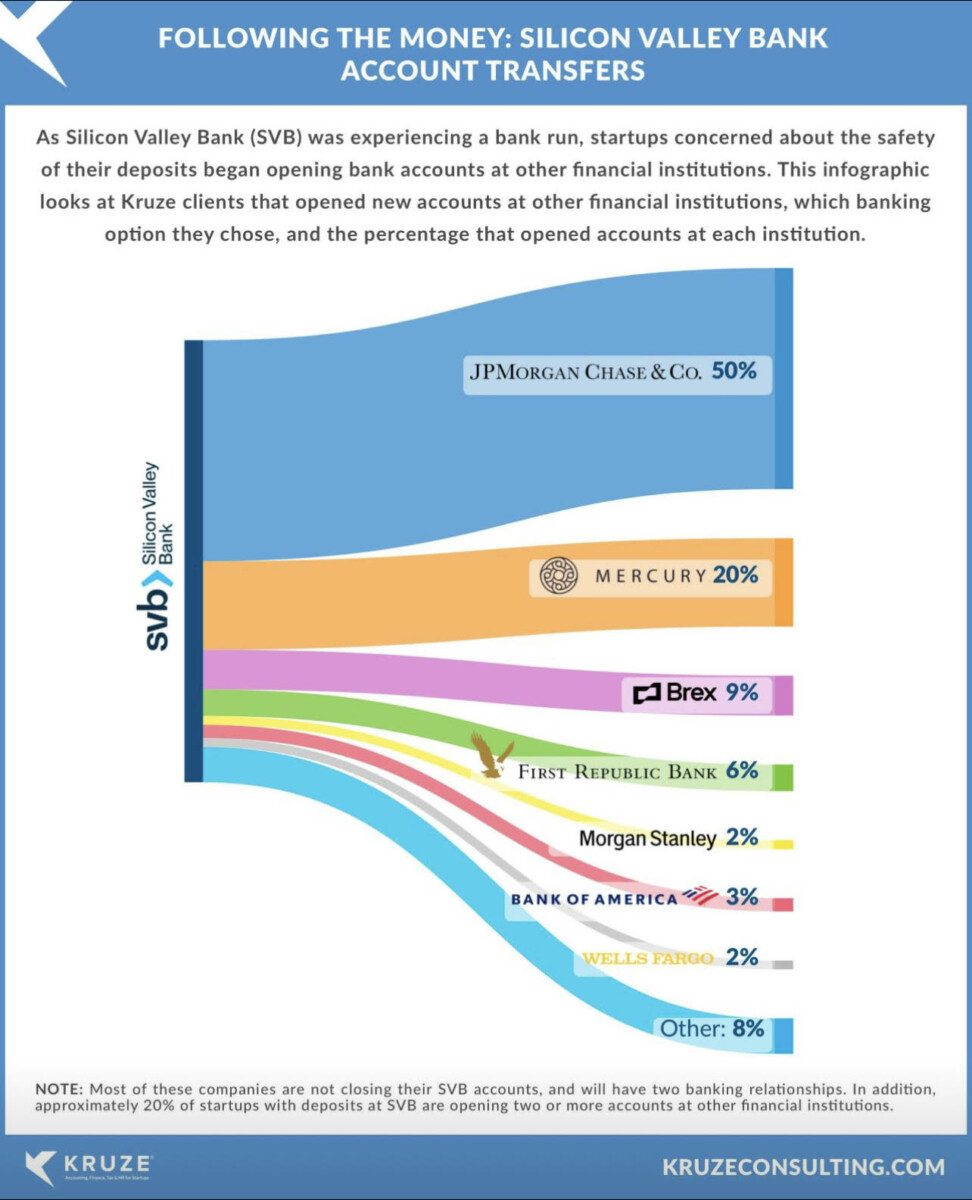

• 50 Tech Leaders Circulated A Private Memo In Washington Calling For Action On SVB: As SVB careened towards catastrophe, some 50 founders, VCs, economists and comms experts gathered in a WhatsApp group to draft a memo calling for urgent preservation of its deposits for the sake of the broader economy. Then they sent it to Washington. (Forbes)

• Why are young people driving less? Evidence points to economics, not preferences: Research indicates that it is changes in the circumstances of young adults that explains most of these trends. Neither better urban policy nor generational change is likely responsible for these changes—at least not yet. (Brookings)

• China Takes Its Climate Fight to the Rooftops: One in five solar panels installed worldwide last year were mounted on a Chinese roof, putting households at the forefront of efforts to decarbonize a top emitter. (Bloomberg)

• Twitter is dying: It’s five months since Elon Musk overpaid for a relatively small microblogging platform called Twitter. The platform had punched above its weight in pure user numbers thanks to an unrivaled ability to both distribute real-time information and make expertise available. Combine these elements with your own critical faculty — to weed out the usual spam and bs — and it could feel like the only place online that really mattered. (TechCrunch)

• Which city builds skyscrapers the fastest? Average speeds in the US and China are actually fairly close (an average of 294k vs 311k square feet per year, respectively, across all skyscrapers). Within each country we see a range, with some slow cities (New York, Hong Kong), and some fast (Beijing, Chicago). Toronto, and Hong Kong are all slower. Not only does Chicago build skyscrapers faster than New York, it builds them faster than most other cities around the world. (Construction Physics)

I asked Warren (our ChatGPT-powered AI assistant) to give us a brief summary of the Trump indictment, but in the style of Macbeth:

🤖Enter TRUMP and MELANIA

TRUMP: Is this a court I see before me,

The indictment toward my hand? Come, let me clutch thee.

I have thee not, and yet I see thee still.

Art thou not, fatal grand jury, sensible

To feeling as to sight? Or art thou but

A grand jury of the mind, a false creation

Proceeding from the heat-oppressed brain?

I see thee yet, in form as palpable

As this which now I draw.

MELANIA:

What mean these grand juries, dear?

Thou art so full of scandal and of fear.

TRUMP:

I have committed a foul deed indeed,

A sexual tryst with a film star, oh the greed!

And to cover up my tracks, I paid her off,

A hush money scheme that would make Macbeth scoff.

But the payment was too large, and thus illegal,

A campaign contribution, so says the legal.

And then I reimbursed my lawyer in cash,

A crime in itself, it’s all gone to trash.

And now the grand jury comes, and I’m indicted,

For falsifying records, I’m so shortsighted.

But fear not, dear Melania, for we have more,

Other investigations that we must abhor.

From Georgia to D.C. to New York City,

I’m accused of fraud, conspiracy, oh what a pity!

MELANIA:

Oh Donald, what a mess you’ve made,

With scandals and crimes, your soul does fade.

But fear not, for we shall fight and win,

And show the world that we have not sinned.

TRUMP:

I thank thee, Melania, for thy support,

But I must face the music in this court.

For justice will be served, of that I’m sure,

And I will pay the price for my allure.

Exit TRUMP and MELANIA.

IN PROGRESS