Oil is back over $80 a barrel.

Oil is back over $80 a barrel.

Oil prices have surged by as much as 8% this morning following OPEC+’s announcement overnight that they will be cutting output by 1.16 million barrels per day. The voluntary cuts will start from May through the end of 2023, with our “friends” in Saudi Arabia leading the charge by reducing output by 500,000 barrels per day.

⊗ Total world oil production in 2022 averaged 98M barrels per day. Approximately 71% came from the top ten countries, and an overlapping 37% came from the thirteen current OPEC members. OPEC+ is a group of 24 oil-producing countries that includes OPEC and other major producers such as Russia, Mexico, and Kazakhstan. According to Statista2

OPEC+ crude oil production totaled some 31.7Mbd in 2022. Saudi Arabia was the leading producer among OPEC+ countries, with an average daily production of roughly 9.1Mbd in 2022. Iraq ranked second, at nearly 4Mbd. U.S. crude oil production averaged an estimated 11.9Mbd in 2022 and is forecast to rise to 12.4Mbd in 2023 and 12.8Mbd in 2024, surpassing the previous record of 12.3Mbd set in 2019.

The EIA also forecasts that global petroleum production averaged about 100 million b/d in 2022 and will rise by an average of 1.6 million b/d in both 2023 and 20243

This decision is significant and may push oil prices towards the $100 mark again, given China’s reopening and Russia’s output cuts as a retaliation move against western sanctions. This cut could also reverse the decline in inflation, which would complicate Central Banks’ rate decisions as prices above $80 can quickly lead to more inflation, which is likely to force the Fed to keep tightening, which could push the US and even the global economy back towards a recession.

While some analysts believe that the output cut could potentially be reversed in the future, Energy Aspects’ founder Amrita Sen expects prices to hit $100 per barrel. According to Goldman Sachs, the surprise cut is “consistent” with OPEC+’s doctrine to act preemptively, and this could nudge up Brent forecasts by $5 per barrel to $95 (now $85) per barrel for December 2023 – assuming the demand growth continues as promised above.

One of the reasons for this bullish demand outlook is China’s expected recovery, which could make up 40% of the world’s demand recovery in 2023, according to Wood Mackenzie. Another reason is the potential for Russian supply to go off-line because of sanctions or additional war issues, which could super-tighten the market and send oil prices soaring – so the “Fear Premium” is back in the market as well.

This is how OPEC often shoots themselves in the foot because, when oil prices rise, so do the costs of producing and transporting Goods and Services which, in turn, leads to higher prices for Consumers – who have to pay more for Gasoline, Heating, Chemicals and other Energy-Intensive items. As these prices increase, so does Inflation, which is simply a measure of the general rise in prices over time.

If Inflation starts going back up, Fed, who are responsible for keeping it in check, may have no choice but to raise interest rates to cool down the economy. The higher interest rates make borrowing more expensive, which can slow down Spending, Investment, and Hiring by businesses and households which, in turn, can lead to even lower economic growth, lower employment, and lower incomes – and we’re already teetering on the edge of a recession according to the last GDP Report.

Of course it’s only April and the cuts don’t take effect for another month but prices are already up 25% from the March lows of $65 so, very likely, the traders are overly excited and this may end up being a good short – as they are going to cause a fairly immediate pullback in demand from already-strapped consumers – and then those optimistic demand charts will not come to pass.

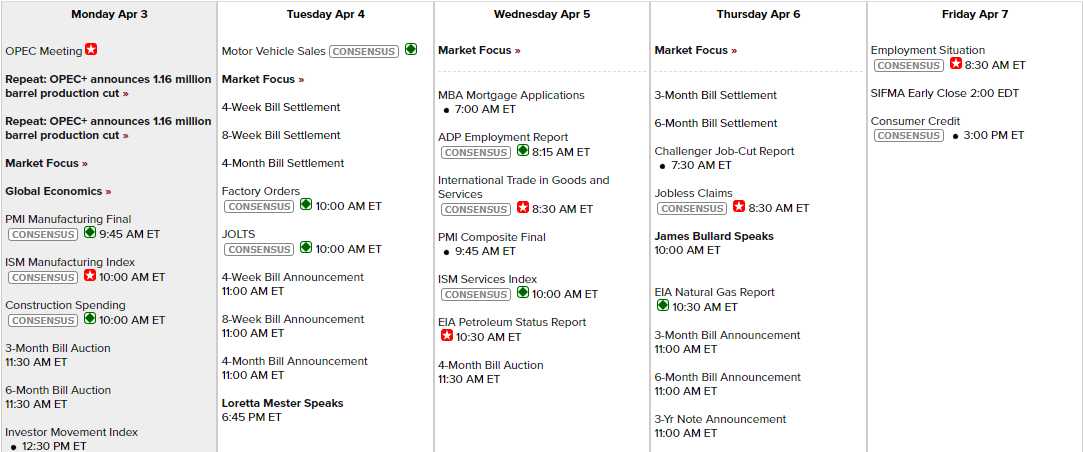

The ISM comes out at 10am and last month we were at 47.7% – which is CONTRACTING, not expanding! Construction Spending, also out at 10, was down 0.1% for February and we get Factory Orders tomorrow, which were down 1.6% in Feb and, at the end of the week – we get the Non-Farm Payroll Report:

I do like Oil (/CL) as a short below the $80 line with tight stops above. The $80 line has been strong resistance all year with drops all the way back to $75 each time – so we just have to catch the right wave to make $5,000 per short contract – though I’ll be thrilled to see $77.50 with all this new excitement about the OPEC cuts.

Today the indexes should get a lift from the Energy Sector and 4,200 was the Feb high for the S&P 500 and 34,500 for the Dow but the Nasdaq is already over February’s 13,000 line and it’s the Russell that has the most catching up to do at 1,816, chasing the Feb high of 2,000.

Either the Fed tightens to stave off Inflation or the Energy Sector is wrong and Oil reverses or inflation just runs away again as we’re starting April at the Q1 highs – any way you slice it – it doesn’t seem like the indexes should be back at their highs ahead of Q1 Earnings Reports.

So be careful out there!