What Blows Up Next? Commercial Real Estate

And then the regional banks again …

Commercial real estate — i.e., America’s $20 trillion of office buildings, warehouses, strip malls, and apartments — is all about financing. The lower the interest rate, the easier it is to justify marginal projects toward the end of a business cycle when only cheap money gets the deal done. That’s why the sector typically booms late and then drops into the abyss when interest rates rise and/or the economy contracts. Put another way, commercial real estate is the living embodiment of the adage that easy money makes you stupid.

Since we’re now coming off of the longest stretch of unnaturally easy money in human history, it’s no surprise that a whole bunch of buildings exist that probably shouldn’t. It’s also no surprise that with interest rates rising a wave of defaults and bankruptcies might soon swamp the sector.

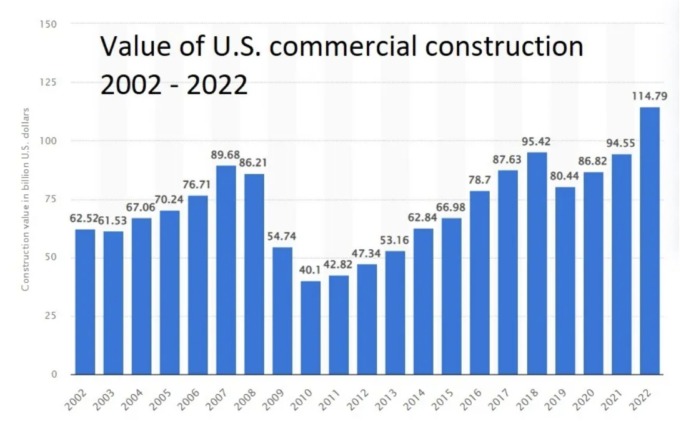

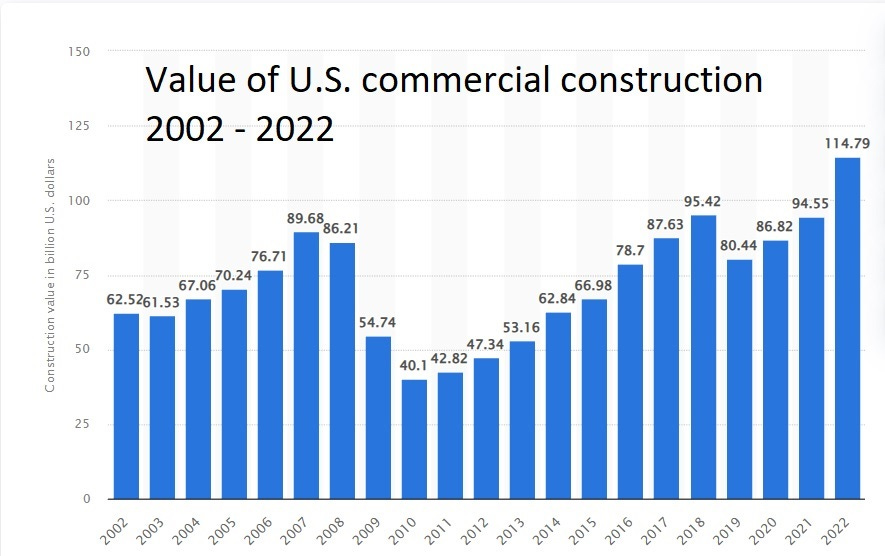

We’re talking big numbers: Since the trough of the Great Recession over a trillion dollars of commercial real estate went up in the US, mostly funded with interest rates far below today’s.

Over the next 5 years, more than $2.5 trillion in commercial real estate debt will mature and in many cases will have to be refinanced. This might be manageable if the projects were living up to initial projections by throwing off tons of cash. But most of them are not, for three reasons.

Remote work. One of the many unintended consequences of the recent covid lockdowns was the realization by millions of people that they prefer to work from home — and the realization by many companies that it’s vastly cheaper to let their people do so. The result is a structural decline in demand for office space that might never recover. In fact, the combination of artificial intelligence displacing millions of knowledge workers and next-gen satellite Internet making it possible to work from any gorgeous place anywhere should give the remote work trend very long legs.

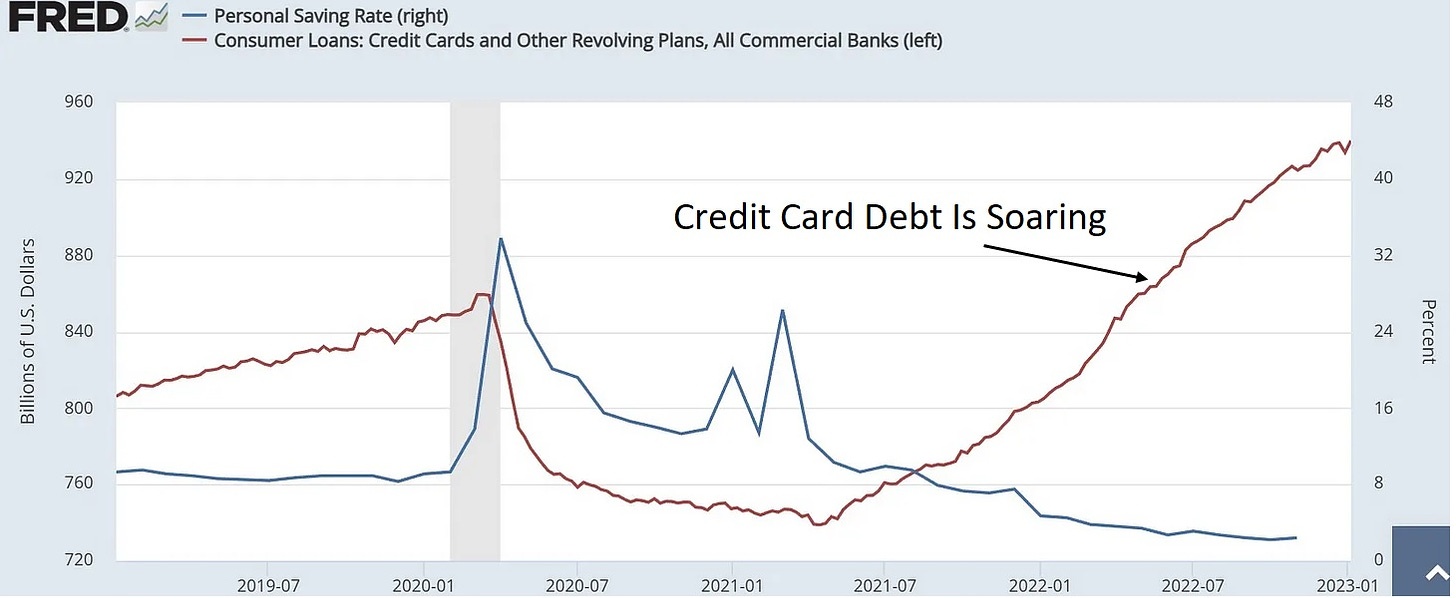

Tapped-out consumers. Inflation has been eating into household budgets such that a growing number of Americans are having to put day-to-day expenses on credit cards. The result: Millions of people are carrying balances that charge 20%+ interest, which puts many on a fast track to bankruptcy. These dead-broke consumers are not going to power an economic recovery. Just the opposite. Their inevitable retrenchment will slow the economy and make commercial real estate even less profitable.

Traumatized small banks. The recent failures of Silicon Valley Bank and Signature Bank exposed the deadly imbalances lurking in bank bond portfolios. But an even bigger potential problem is the fact that local and regional banks own a ton of commercial property loans. Goldman Sachs’ analyst Richard Ramsden now expects smaller banks to “pull back on commercial real estate commitments” as they become “more focused on liquidity.” That means refinancing will be a nightmare for developers.

Soaring vacancy rates

Combine overbuilding with falling demand, and you get a lot of vacant space. Silicon Valley, for example, is at the intersection of the work-from-home movement and a slowing economy, causing West Coast offices to empty out:

Meta and Microsoft are ditching office space in the Seattle area

Meta and Microsoft are both giving up office space in the Seattle region amid the shift to hybrid work and broader tech downturn.

Facebook parent Meta is subleasing its 6-story space at the Arbor Blocks 333 building near downtown Seattle, as well as Block 6, a 325,000 square-foot space at the Spring District complex in Bellevue, Wash., east of Seattle.

Microsoft, meanwhile, will not be renewing its lease at a 561,494 square-foot space in downtown Bellevue, Wash., according to a report from The Puget Sound Business Journal.

Amazon paused construction on five towers in Bellevue, citing ongoing uncertainty about the impact of hybrid work on its office designs.

Vacancy rates across the Seattle region are up from 16% to 18% in the past year, while only a “trickle” of tech tenants signed new leases in Q4.

A few miles down the road, San Francisco’s office vacancy rate just hit a terrifying 30%. And on the right coast, Manhattan’s leasing activity is the lowest since the depths of the pandemic while its vacancy rate tops 16%.

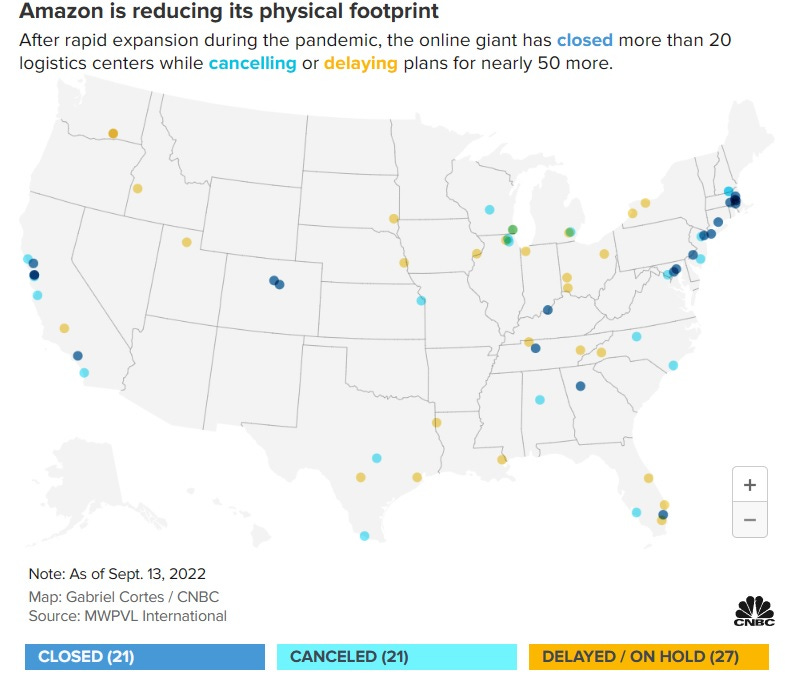

As for warehouses, Amazon is closing, canceling, or delaying them all over the place.

Now about that refinancing…

With demand in free-fall, a collision approaches between unavoidable refinancings and already-traumatized small banks that want no part of unprofitable commercial real estate.

The likely result: Many refinancings will either fail or happen on such onerous terms that future profitability is unlikely. Developers will default, bankruptcies will follow, and small banks will fall back into crisis. Let one big player implode and it’s Silicon Valley Bank all over again, with the government having to choose between letting a major sector fail or bailing the whole thing out with trillions of taxpayer dollars. Notice the pattern?

It might be too late to short commercial real estate. But I’ll look into it this week and will post some ideas if any seem promising.