That is the difference between the S&P 500’s Earnings Yield and that of 10-Year Treasuries and it is at its lowest point since October 2007, indicating a challenge for stocks going forward.

Equities need to promise a higher reward than bonds over the long term, otherwise the safety of Treasuries would outweigh the risks of stocks losing some or all of investors’ money. The Federal Reserve faces the dual challenge of raising Interest Rates to cool Inflation and preventing a full-blown banking crisis from erupting – which clouds the outlook for stocks.

Although the current equity risk premium is closer to the longer-term norm, stocks appear pricey again, and markets and the economy face new challenges. Conditions like these indicate that still-frothy valuations mean Value Stocks (yes, it always comes back to that) are the smarter play for the moment.

We just went over that concept in yesterday’s Live Trading Webinar with our Members. Back in November, when we were running down the final 50 picks for our Trade of the Year selection, our primary criteria were low p/e, high earnings/employee ratios and lack of debt – that’s what we felt it would take to be a survivor in 2023 – and that was before the banking crisis.

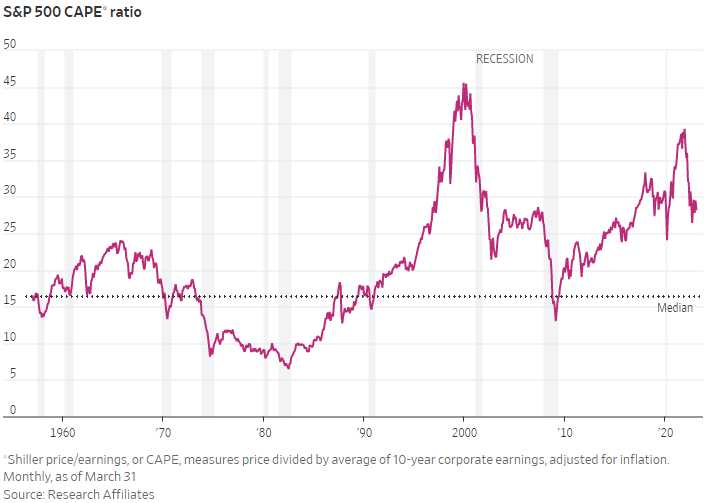

The Equity Risk Premium falls when bond yields rise, or a stock’s Price/Earnings ratio jumps — either due to weaker earnings or higher stock prices. The Earnings Yield, meanwhile, is the ratio of profits from the past year to current stock prices. Stocks in general are still priced to high, looking at the S&P 500’s CAPE Ratio:

While those P/E ratios are improving, they are still in the high end of the range and more stimulus is not likely to be coming. The S&P 500 is trading at 28 TIMES trailing earnings so, either earnings have to climb 40% or the indexes have to drop 40% – just to get back to 20, which is the high end of a normal range.

At the same time, the higher Treasuries go (the 10-year is currently 3.3% but the historical average is 4.3% and the Fed Funds Rate is 5%), the more debt begins to cut into earnings and the lower the ERP goes. These are still very dangerous times for Investors, unfortunately.

Tomorrow MIGHT BE a holiday (Good Friday), that’s not clear anymore as the SIFMA has on their web site: “Early Close Only (12:00 p.m. Eastern Time): Friday, April 7, 2023 – Early Close is recommended rather than a full close to accommodate the release of US employment data.”

Either way, we have strong hedges in place for the weekend. We had hoped we wouldn’t still need them but that’s not the read we’ve been getting on the markets and the Fed’s Bullard speaks at 10 and we get the Non-Farm Payroll Report tomorrow along with Consumer Credit at 3pm and it concerns me when the Powers that Be start cancelling our days off (they’d better not mess with Junteenth!).

The Economic Action starts next week on Wed (12th) when the Mortgage Applications Index for the week of April 8th will be released along with the Core CPI and CPI for March, which will have a major impact into the Fed’s May 2nd meeting. On Thursday we will get PPI for March, as well as Initial Claims and Continuing Claims for the week of April 8th.

On Friday, several economic indicators will be released, including Retail Sales for March, Import & Export Prices, Capacity Utilization and Industrial Production for March and Business Inventories for February along with Univ. of Michigan Consumer Sentiment for April, which should also be impactful.

More importantly, on Friday next week, we get earnings from BLK, C, JPM, PNC, UNH and WFC and, judging from the Fed’s balance sheet – they have not cleaned up their mess yet so things are going to VERY TENSE next Friday as we wait on those Big Bank Earnings.

SCHW goes on Monday, the 17th, along with MTB and STT and then lots of banks that week as well and, if we survive that, THEN we can happily go shopping but, for now, we will be watching and waiting.

I guess I will be around tomorrow morning – things could get interesting…