We don’t have GNRC in our portfolios anymore but I still like them.

We haven’t been in a hurry to get back in as they are spending a lot to expand so revenues are up (12% over last year) but profits are down (20% less) so they did and may still get negative interpretations from traders (and poorly constructed algos!).

🤖 Generac Holdings Inc. (GNRC) is an energy solutions company that sells power generators to residential customers, commercial and industrial sectors, and outdoor power equipment for property maintenance. The company has also entered the residential solar market through its acquisition of Pika Energy, and offers outdoor power equipment such as log splitters, trimmers, and stump grinders.

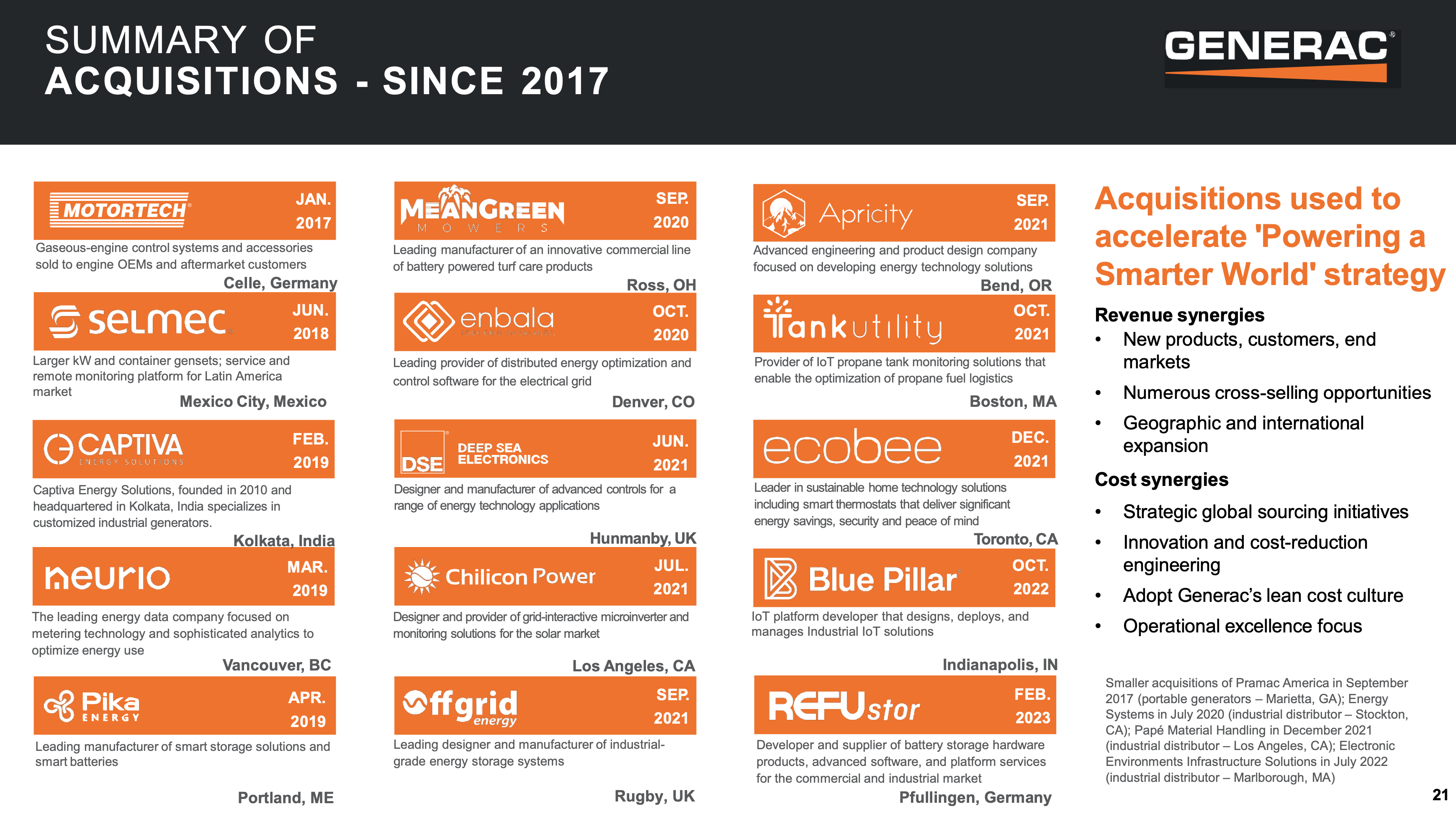

On the C&I side, GNRC sells both commercial-grade natural gas and diesel-powered generators, microgrids, and Energy-as-a-Service applications, as well as products designed for the mobile industry. The company has made 15 acquisitions since 2017 and 28 since 2011 to transform from a generator supplier into a whole-home power-management company. The company’s strategic vision is highly attractive, and GNRC has an extensive suite of products, including a new EV charging system that it will introduce this year.

The demand environment for mobile products is expected to remain robust, and GNRC believes it will benefit from the secular trend towards investment in telecom infrastructure. While the company’s execution issues have hampered its transformative story, GNRC is committed to targeting the market and adjacent opportunities. Generac Holdings (GNRC) has recently introduced its first residential electric vehicle (EV) charging system to meet the growing need for charging solutions as the demand for EVs continues to rise in the United States. The 48A/11.5kW Generac EV charger is a Level 2 home charger that can charge a car battery in as little as four to six hours. The product’s out-of-the-box compatibility with almost all EVs on the market today makes Generac’s solution available to most EV owners.