Get ready for a wild ride!

Earnings Season usually gets off to a big start, boosted by the Banksters who tell us how much money they squeezed from their customers to kick things off right for Corporate America.

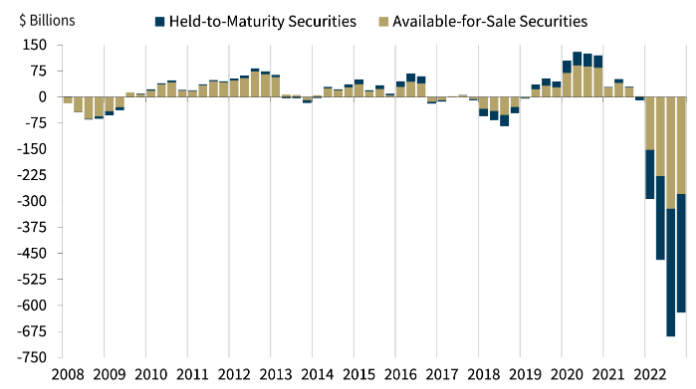

This year, it’s the Banksters who are getting squeezed with hundreds of Billions of Dollars in unrealized losses, losses that have already taken down Signature Bank, Credit Suisse and Silicon Valley Bank in the past month. The Fed quickly stepped in and offered to buy back all the notes that held those unrealized losses but if the losses were $300Bn (possibly double, possibly 5x) and they were 20% of the notes’ values – then we can assume there were $1.5Tn worth of notes and the Fed has “only” expanded their balance sheet by $500Bn so far – so there is still $1Tn that needs to be moved or taken into account in the month ahead.

Last Quarter, the Banksters simply neglected to mention there was an issue with unrealized losses that were greater than their combined 2022 pretend Earnings and now it’s all going to hit the fan if they can’t offload the damage to the Fed fast enough to pretend it never happened and, starting Friday, we’ll get an idea of how quickly they are sweeping their losses under the rug.

Still, as Buffett would say, the tide has now gone out and now we will see who was swimming naked and there are certainly a lot of sharks circling the banking sector. Any who show even a drop of blood will likely suffer dire consequences. So we can’t afford to be complacent – and now we are just 3 weeks away from the May 3 Fed Meeting.

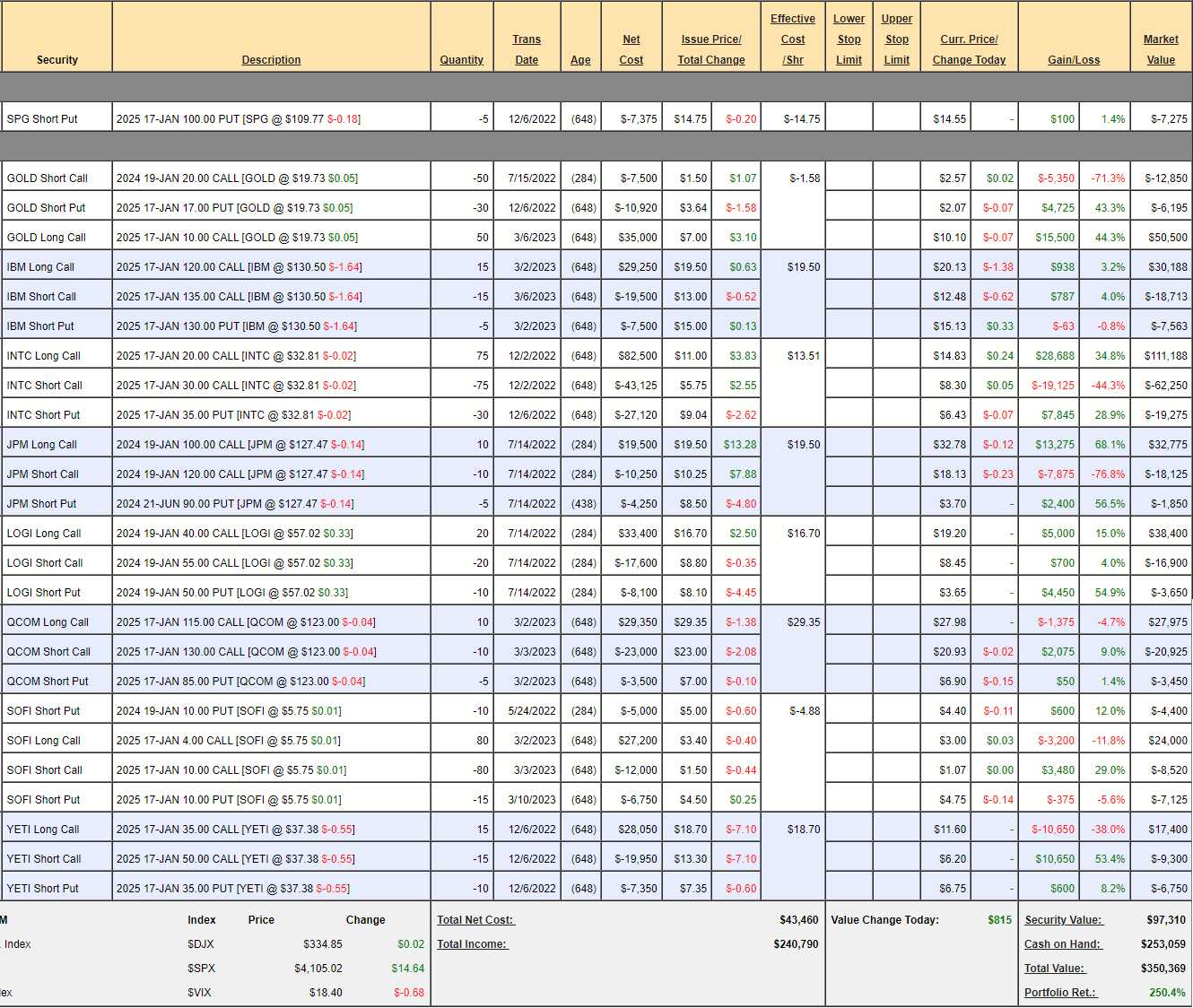

Fortunately, our Member Portfolios are doing very well as the S&P 500 is up 200 points (5%) since our March 14th reviews. Our Money Talk Portfolio, for example, is untouched when I am not on the show and I was last on March 1st(see video here), when we added IBM and QCOM and got more aggressive with GOLD and SOFI. At the time, the portfolio was at $310,971 and, as of Friday’s close, $350,369 – up $39,398 (12.67%).

What did we do with the Money Talk Portfolio during the banking crisis? NOTHING!!! That is the whole point of the MTP lesson – that you can make fantastic profits WITHOUT constantly fiddling with your positions. A well-constructed portfolio should be able to withstand some shocks and BALANCE is always the key.

The only Bank Stocks we have are JPM and SOFI and SOFI is not a normal bank, nor is JPM, who tend to benefit from a crisis like we just had (now $127, was $143). GOLD is a nice hedge on banking as well – so good balance.

Notice JPM fell 14%, SOFI held their ground (not a regular bank) and GOLD gained 25% – BALANCE!!! Now, if you combine BALANCE with our “Be the House – NOT the Gambler” strategy, you create a reliably flat market in which you can make money on both sides by selling risk premium to other people – who think they know how to beat the odds.

![Asset Allocation and Diversification [ChartSchool]](https://school.stockcharts.com/lib/exe/fetch.php?media=overview:asset_allocation_and_diversification:aad-figure1.png) After the changes last month, GOLD represented a net $22,835 investment in a $50,000 spread, JPM was a net $12,387 investment in a net $20,000 spread and SOFI was a net $1,517 investment in a $48,000 spread, so there was $36,739 of our CASH being used against $118,000 in spreads with an upside potential of $81,261 (221%) if all goes well.

After the changes last month, GOLD represented a net $22,835 investment in a $50,000 spread, JPM was a net $12,387 investment in a net $20,000 spread and SOFI was a net $1,517 investment in a $48,000 spread, so there was $36,739 of our CASH being used against $118,000 in spreads with an upside potential of $81,261 (221%) if all goes well.

But all rarely goes well – especially when gold and banks don’t tend to move in the same direction but we’re not expecting to make 221% – though HOPING to make 221% gives us a very good chance of making 20-40% – even with a few missteps along the way.

GOLD is now net $31,455, JPM net $12,800 and SOFI is net $3,955 (doubled!) and that’s $48,210, which is up $11,471 (31.2%) so we are clearly pleased with our Financial mix with the Gold hedge during this crisis and we still have a potential $69,790 (144%) of upside potential – if all goes well but, as I noted above – we have our first 20% profit under our belt already.

GOLD is now net $31,455, JPM net $12,800 and SOFI is net $3,955 (doubled!) and that’s $48,210, which is up $11,471 (31.2%) so we are clearly pleased with our Financial mix with the Gold hedge during this crisis and we still have a potential $69,790 (144%) of upside potential – if all goes well but, as I noted above – we have our first 20% profit under our belt already.

Also, as we discussed last week, we KNOW how much we expect to make from each position and from our entire portfolio so we are always aware of whether or not our positions or our allocations sectors (like this one) are on or off track at any given moment and, had they performed poorly, we would be looking to make adjustments but so far, so good – as they say.

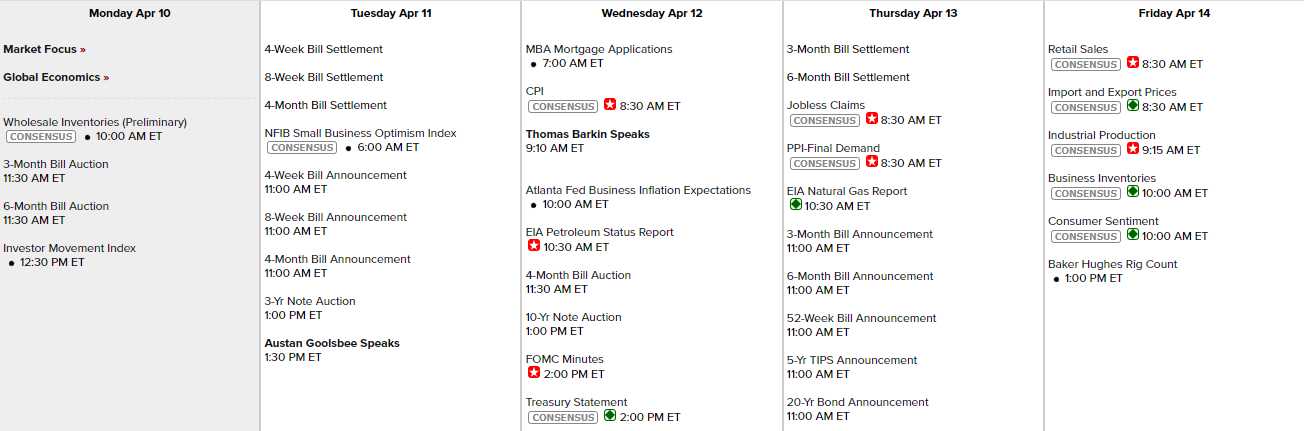

What else lies in the week ahead? Based on the upcoming data, it is likely that the Fed will need to continue to raise rates to keep inflation under control. While the unemployment rate remains stable at 3.5%, the Nonfarm Payrolls and Nonfarm Private Payrolls for March were lower than expected, which may indicate slower job growth. The Average Hourly Earnings and Average Workweek data showed a slight increase, but the Consumer Credit for February was MUCH lower than expected, which may indicate reduced consumer spending – something we expected would happen.

The NFIB Small Business Optimism Index for March comes out tomorrow, CPI is expected to show a moderate increase, while the PPI and Core PPI are expected to be slightly higher. as well but oil was all over the place – so we’ll have to wait and see on those critical indicators. The Treasury Budget for March is expected to show a decrease in the deficit, which may be a positive sign for the economy and Friday it’s Retail Sales, Industrial Production and Consumer Sentiment – all biggies.

There is not much Fed Speak scheduled this week and then it will be all about the earnings into the next Fed meeting, so stick around for some fun!