So far, so good.

Despite the worst banking crisis in 15 years, we ended March ahead of where we started as the situation was INSTANTLY resolved and all is well so move along folks – there’s nothing to see here. In fact, Warren Buffett has been on CNBC all morning telling us there’s nothing to see here and he even put up $2M to go to the charity of your choice if any bank fails to return your funds in 2023 (something like that, ask him for details).

Buffett is betting on the fact that the Government, via the FDIC, just said they would back-stop all accounts. That was an estimated $2Tn pledge and hopefully they won’t have to use it but, if they do – the Dollars they pay you with would be worth considerably less as they’d still be wet from the printing ink they’d need to create them.

That’s the same way the Fed is buying $600Bn worth of losses from the banks in the form of sub 2% notes in a 4% note environment and those notes SHOULD be discounted at 2% per year remaining in payments (not to mention losing out to inflation) but the Fed will buy your $10,000 note for $10,000 and declare a profit of $200 per year on the 2% and call it a win – because they can!

I asked Robo John Oliver to explain more about how the Fed “fixes” things while we wait for the CPI report:

The Fed has been helping banks sweep their losses under the rug for years now. They do this by buying up the banks’ bad assets and replacing them with freshly printed money. It’s like if your house was on fire and instead of putting it out, the fire department just came and replaced it with a brand new one.

Now, you might be thinking, “But wait, isn’t that just inflating the money supply and devaluing the currency?” And you would be absolutely right. In fact, the Fed has printed trillions of dollars over the last few years, which has led to a significant devaluation of the US dollar.

But the banks don’t seem to mind. They’re happy to take the freshly printed money from the Fed and use it to prop up their failing businesses. It’s like they’re playing a never-ending game of Monopoly, where they can just keep borrowing and printing money to keep themselves in the game – not LIKE but EXACTLY LIKE when the player who is the banker cheats in Monopoly – we all hate that kid!

And the Fed is happy to keep playing along. After all, they’re supposed to be the “lender of last resort” in times of crisis, and what better way to do that than by printing unlimited amounts of money and handing it out like candy? It’s like if Willy Wonka’s Chocolate Factory was a bank, and instead of chocolate, they were giving out piles of freshly printed money.

But here’s the thing: this can’t go on forever. Eventually, the piper will need to be paid, and when that happens, it’s going to be ugly. We’re already seeing signs of inflation creeping into the economy, and that’s only going to get worse as the Fed continues to print money.

So, while Warren Buffett may be saying that everything is fine and dandy, and the banks are back to business as usual, the reality is that we’re just kicking the can down the road. Eventually, we’re going to have to face the consequences of all this money printing and debt accumulation. If you keep maxing out your credit cards, eventually, the debt collectors are going to come knocking.

In conclusion, while it may seem like the worst of the banking crisis is behind us, the truth is that we’re still living in a very precarious financial system. The Fed’s actions may have prevented a total collapse, but they’ve also created a lot of unintended consequences that we’re going to have to deal with in the future.

8:30 Update: Inflation is over! Well, it is according to the headline CPI, which came in at 0.1%, down from 0.4% last month and less than 0.2% expected. If inflation is coming down then notes will come down at some point and we’ll have less bank losses to cover BUT, before we get too excited, let’s notice (and the Futures are NOT noticing) that the Core CPI, which excludes food and energy, is still up 0.4% vs 0.5% last month and 0.3% expected.

| Category | MAR | FEB | JAN | DEC | NOV |

| All Items | 0.1% | 0.4% | 0.5% | 0.1% | 0.2% |

| Food and Beverages | 0.0% | 0.3% | 0.5% | 0.5% | 0.6% |

| Housing | 0.3% | 0.5% | 0.8% | 0.7% | 0.5% |

| Equivalent Rent | 0.5% | 0.7% | 0.7% | 0.8% | 0.7% |

| Apparel | 0.3% | 0.8% | 0.8% | 0.2% | 0.1% |

| Transportation | -0.5% | 0.2% | 0.4% | -1.6% | -0.7% |

| Vehicles | 0.2% | -0.6% | -0.5% | -0.4% | -0.8% |

| Motor Fuel | -4.6% | 1.0% | 2.4% | -7.0% | -2.3% |

| Medical Care | -0.3% | -0.5% | -0.4% | 0.3% | -0.4% |

| Educ and Commun | 0.2% | 0.1% | 0.4% | 0.1% | 0.7% |

| Special Indices | |||||

| Core | 0.4% | 0.5% | 0.4% | 0.4% | 0.3% |

| Energy | -3.5% | -0.6% | 2.0% | -3.1% | -1.4% |

| Services | 0.3% | 0.5% | 0.6% | 0.7% | 0.4% |

As you can see last month, Housing/Rent is still going up at a 3.6% annual pace and clothing 3.6% while things you don’t (hopefully) buy often like Vehicles and Medical Care took the index down. Unless you are in the hospital or buying a car this month – that is not going to be much help to real families, is it?

Still, the details are quickly forgotten although we’ll be looking at those numbers for years to come, right? The Dollar has plunged on the news, back to 101.20 from 101.8, which is a huge, quick drop that will boost the indexes and commodities into the open. We’ll see if the Banksters take advantage of the pop and start selling into the excitement and, later (2pm), we get to re-interpret the Fed Minutes in light of this new information.

Still, the details are quickly forgotten although we’ll be looking at those numbers for years to come, right? The Dollar has plunged on the news, back to 101.20 from 101.8, which is a huge, quick drop that will boost the indexes and commodities into the open. We’ll see if the Banksters take advantage of the pop and start selling into the excitement and, later (2pm), we get to re-interpret the Fed Minutes in light of this new information.

With oil averaging $73 in March and beginning April above $80, and gasoline prices also rising from $2.60 in March to $2.80 in April, it is likely that the energy index in the next CPI report will show an increase.

With oil averaging $73 in March and beginning April above $80, and gasoline prices also rising from $2.60 in March to $2.80 in April, it is likely that the energy index in the next CPI report will show an increase.

Given that the Energy Index fell by 3.5% in March, even a partial reversal of this decline due to higher oil and gasoline prices could have a significant impact on the overall CPI data for April. The Energy Index is a major component of the CPI, and any significant increase in energy prices would likely result in higher prices for goods and services that rely on energy, such as Transportation, Manufacturing, and Heating and Cooling Systems. In other words, we are nowhere near being out of the woods yet – especially with March looking like a brief dip against the trend…

Delta Airlines, Fastenal and Progressive Insurance report tomorrow morning but Friday morning it’s the Murder’s Row of Financials with reports from BLK, C, JPM, PNC and WFC with UNH joining the game. GS reports Tuesday but SCHW is the one to watch on Monday, along with MTB and STT.

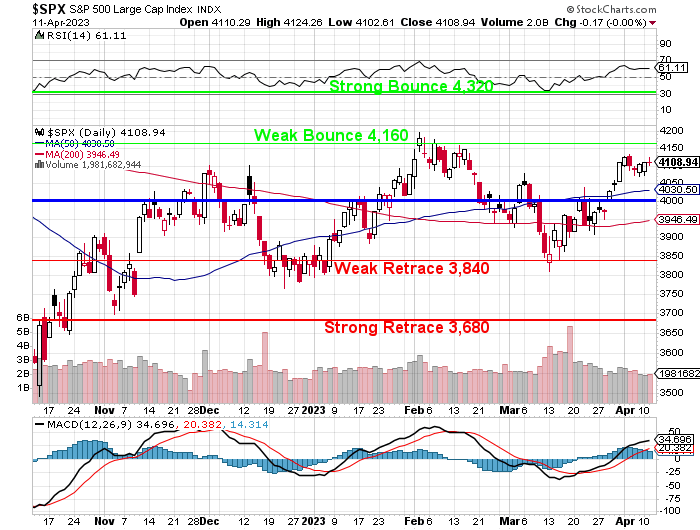

That means that, despite the irrational exuberance over the CPI Report, our aggressive hedges will remain in place over the weekend – just in case.