Momentum Monday – Sector Rotation and Breadth Thrusts

As a reminder, Marketsmith (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from Marketsmith.

Good morning…

It is a travel day for me as I head from Tuscany to the South of France for a week of cycling and fun with my friends.

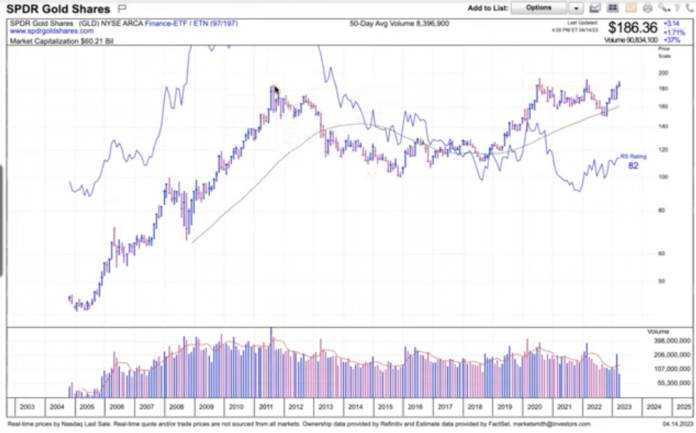

My travels are no excuse for me to miss my weekly Momentum Monday with Ivanhoff. We tour the markets as usual and ‘sector rotation‘ is the buzzword. The technicals are mixed overall. People are pointing to ‘breadth thrusts‘ in the market which have led to good returns one year out. The $VIX is well below 20 and a 15 month low. The good news for people unsure (that includes me) is you can get paid 5 percent on 90 day t-bills, a rate not seen since 2007.

You can watch this weeks episode right here on YouTube. It is easy to subscribe and if you do every Sunday you will get an alert when we post the show to YouTube.

Here are Ivanhoff’s thoughts:

Many of the recent breakouts to 52-week highs haven’t really followed through. In the meantime, pullbacks to rising 20 and 50-day moving averages in strong stocks keep getting bought. There is a constant sector rotation. Semiconductors are the undisputed big leader year to date but they have fallen behind in the past couple of weeks. Their relative strength line has been declining as other sectors have picked up. The net result is a resilient S&P 500. SPY broke out last week. As long as it holds above 407, it is likely to test 420. The Nasdaq 100 (QQQ) is setting up for a potential breakout near 320-322. If it clears that level, it is likely to test 330.

A lot will depend on the market reaction to earnings. The new earnings season has just begun. Big banks like JPMorgan crushed estimates and gapped above their 50-day moving average. This alleviates some of the concerns about the financial sector which has been keeping the S&P 500 down. Next on deck is Big Tech which reports in the next three weeks.

Much of equities’ resilience in the past month or so can be attributed to declining inflation expectations and a weak US dollar. The dollar has been almost perfectly negatively correlated to the S&P 500. If for whatever reason the US Dollar rallies, equities are likely to have a serious headwind.

Other links…

The Stocktwits momentum 25 lists.

Charlie’s ‘The Week in Charts‘.

Have a great week.

PS – if you enjoy Momentum Monday, forward this email to a friend, and follow me on Stocktwits

Disclaimer: All information provided is for educational purposes only and does not constitute investment, legal or tax advice, or an offer to buy or sell any security. For full disclosures, click here.