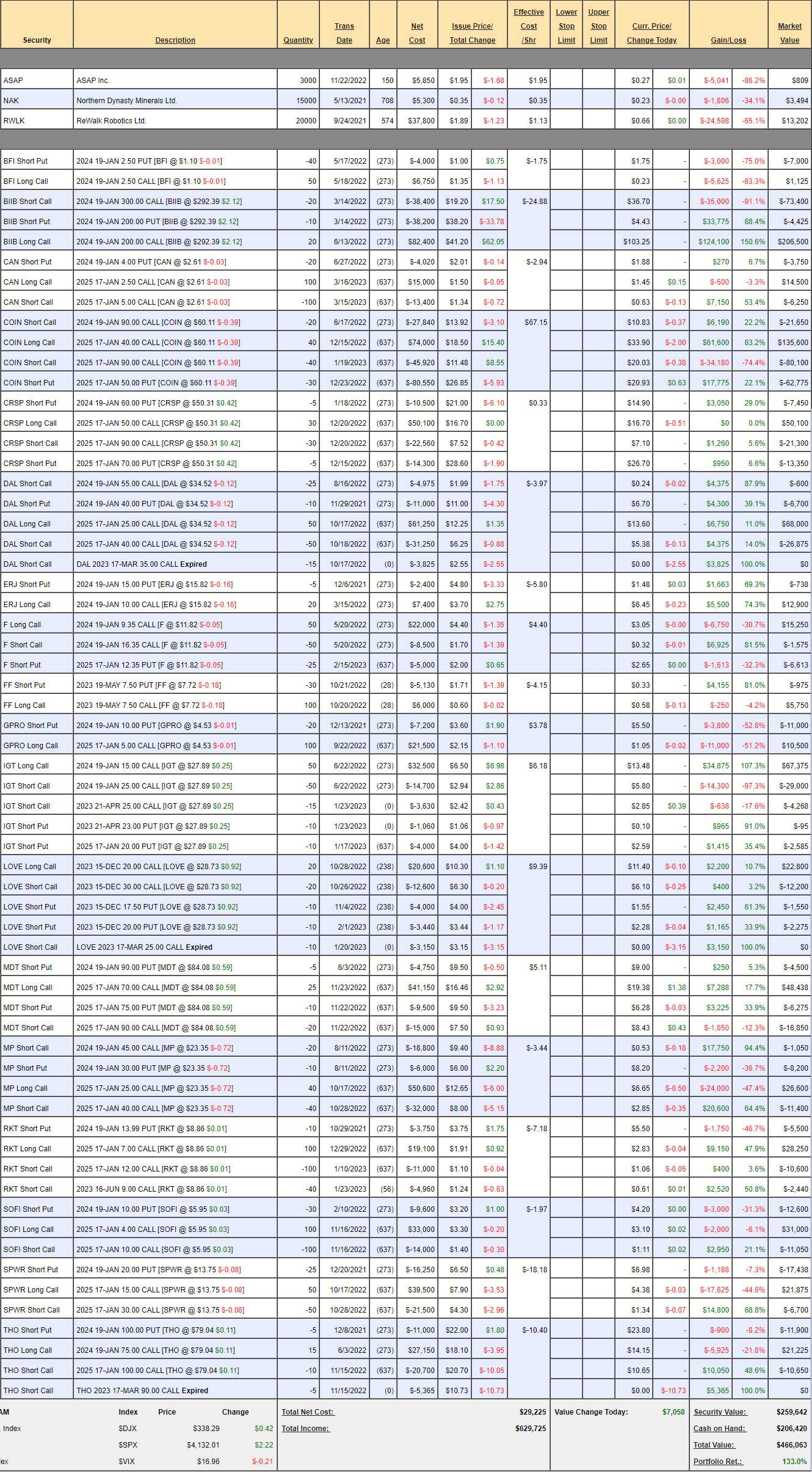

$7,686,573!

$7,686,573!

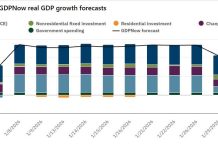

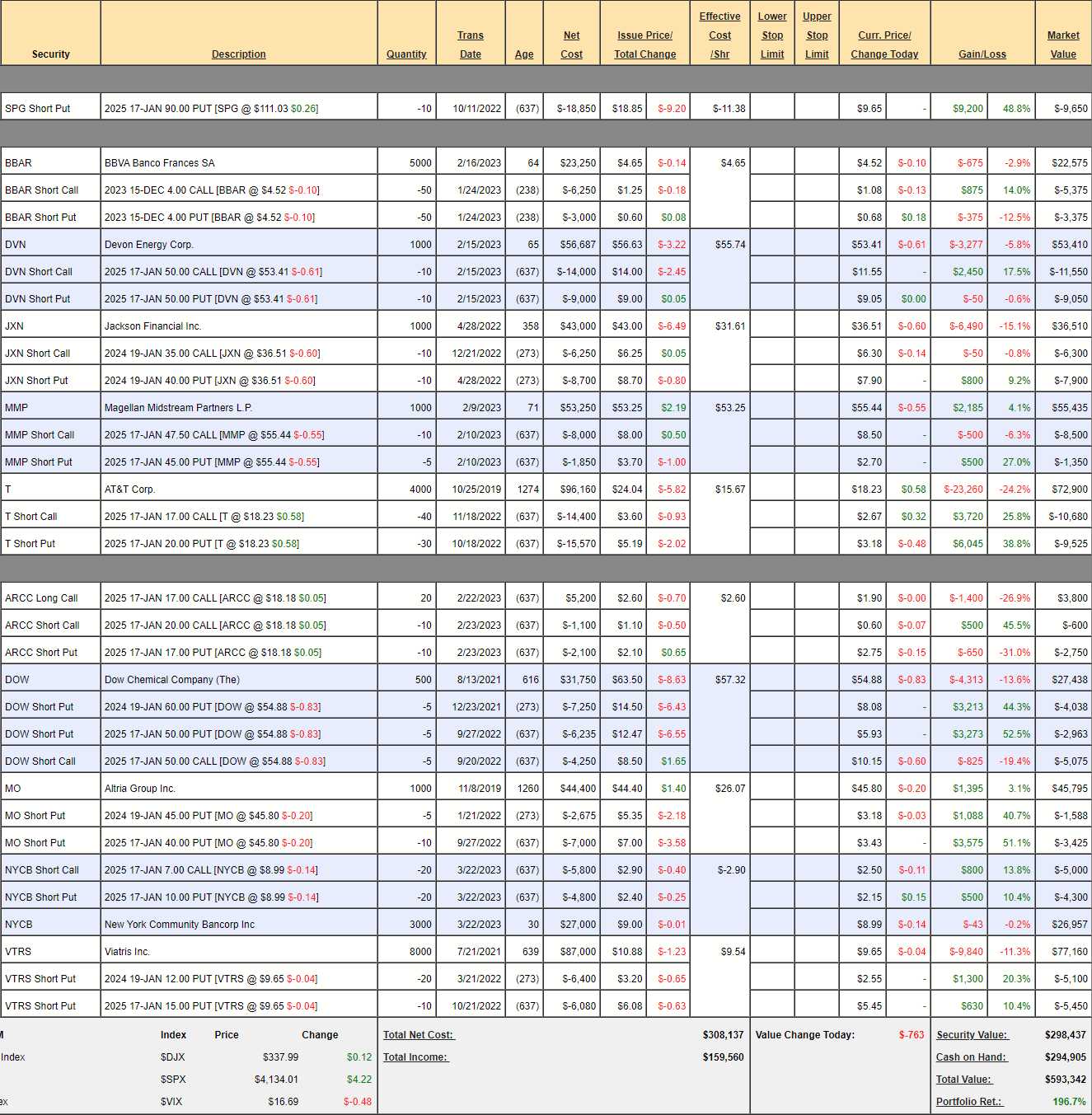

That is the current total for our Long-Term ($3,782,170) and Short-Term ($3,904,203) Portfolios coming off their $500,000 and $200,000 starts back on October 1st, 2019. Usually we stop when we double up but we decided to keep going at $1M, $2M and, not so long ago, $5M and now we’re over $7.5M so do we go for $10 Million or go back to scratch so we can have fun doing it all again?

The main lesson we were going for in the LTP is how powerful it is to use our system to re-invest the profits over time and we’ve certainly had our share of ups and downs in the market. Our STP is responsible for the hedges and our timing was lucky as we hadn’t bought much between October of 2019 and Feb of 2020 – when Covid collapsed the market – because we were worried about Covid collapsing the market.

As such, we had a bearish set-up and made a fortune in the STP early on and then, since we felt the markets were oversold in March of 2020, we went very bullish and caught a move up from 2,500 to 3,500 by October, which was so severe we had to move $100,000 from the LTP to the STP as it was down about 50% ($50,000) but the bullish $500,000 LTP had doubled – so we were perfectly fine with that.

In the next 12 months, the S&P blasted up to 4,500 and we mostly cashed out the LTP when it was about $2M and then we had the 2022 crash and it worked out perfectly for our very bearish STP, which hit over $500,000 by April with the LTP at $2.5M and, since then, we’ve done very well indeed, more than doubling in the past year in the kind of up and down market we thrive on.

A very important comment I made in last April’s LTP Review was:

“I know it seems like we have amazing timing with our entries but that’s because we don’t try to time them at all. We are VALUE investors so, when a stock gets to a valuation level where I can’t resist it (and the macros favor the move) – then we buy. It has nothing to do with the chart and that’s why our Members are able to be “ahead of the curve” so often. The information we have is like having GPS – we don’t need to see the road to know where we’re going – we just need to have faith in the data...“

That sums it all up nicely, I think. We are VALUE Investors who use options for hedging and leverage and that’s the power of our portfolios. It’s kind of boring to just navigate built-up portfolios to the next milestone – I’d rather have the challenge of starting from scratch again with a new batch of positions in new portfolios – what do you think?

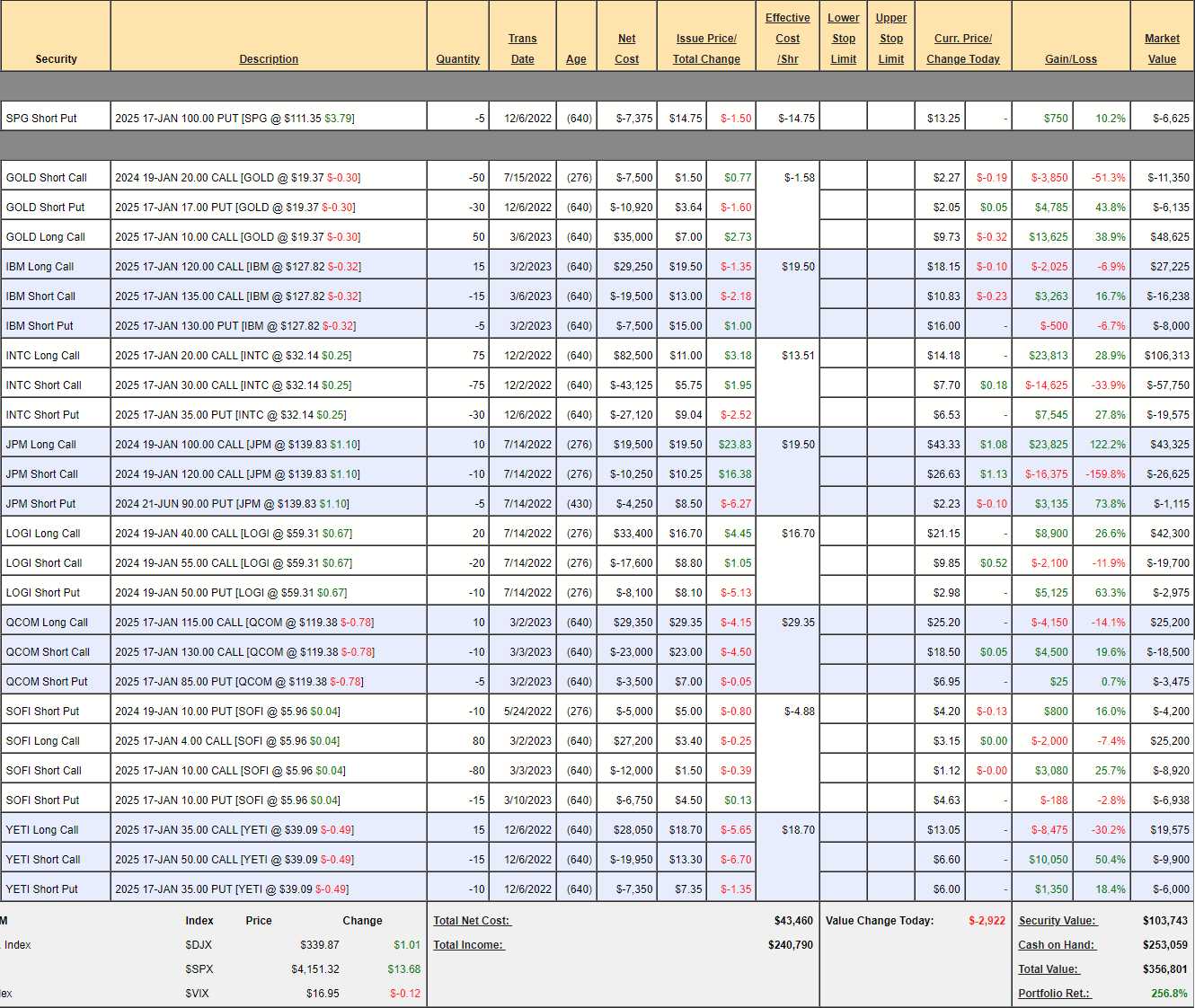

Money Talk Portfolio Review: We only trade this portfolio live, on Bloomberg’s Money Talk once each quarter and the last show was early last month, when we talked about the rise of AI and we pressed our GOLD bet with great timing, got more aggressive on INTC with great timing and more aggressive on SOFI and added QCOM and IBM as stocks that should benefit from AI without being too risky.

Different Portfolios have different rules and the hands-off trading style of the MTP keeps us in generally conservative positions but still, in the past 45 days, we’ve popped from $310,971 to $356,801 which is up a very nice $45,830 (14.7%) and that’s ahead of our expected $10,000/month goal so we have to now be worried that some of our positions have gotten ahead of themselves but, unfortunately, we can’t touch them again until about July so we’ll just have to see what happens.

Overall though, this portfolio, which is up 256.8% since Nov 13, 2019 demonstrates that you don’t have to keep fiddling with your positions to make very good, consistent returns.

-

- SPG – Short puts are generally placeholders to remind us to keep an eye on a position. We’d LOVE to own 500 shares of SPG if the go below $100 and we got paid $14.75/share in exchange for our promise to buy it for $100 so net $85.25 is our worst case – and that’s a 23.4% discount as our worst case. If it never goes that low, we just keep the $7,375 we got paid to watch the positions – it’s like babysitting for stocks!

- GOLD – As I said we got more aggressive on March 1st and that was very good timing. In a roll, we bought 50 2025 10 calls for $7 and they are now $9.73 so up $13,650 is a good portion of the portfolios total gains since then.

-

- IBM – One of our new ones in the portfolio but IBM was last year’s Trade of the Year but we took the money and ran at $150 – as that was a bit silly. Back at $125, however, we were thrilled to get back in. No real progress yet and it’s a $22,500 spread currently at net $2,987, so it’s got $19,513 (653%) of upside potential if IBM can manage to get over $135 by Jan 2025.

- INTC – Also good timing on our entry and this is a $75,000 spread that’s already up about $15,000 at net $28,988 but still a lot left to gain if they hit $35.

-

- JPM – Superbank! They made out well in the crisis and have recovered most of their panic losses already. They are well over our target so we were never worried – more disappointed that we didn’t have a chance to buy more on the dip (in this portfolio, we jumped all over it in our other portfolios).

- LOGI – Notice a theme here? INDUSTRY LEADERS! It’s a low-touch portfolio so I live conservative, blue-chip plays from the top players in their sectors and the sectors are diversified and our targets are usually in the middle of their range – NOT the top and, most importantly of all – we sell more premium than we buy. THAT is how you consistently make 50% a year in a low-touch portfolio!

-

- QCOM – I love these guys down here! Still just net $3,225 on the $15,000 spread with $11,775 (365%) upside potential at $130.

- SOFI – My favorite technically a bank. They held up well during the crisis – that’s a good sign going forward. This is an aggressive trade where we’re betting Biden’s Student Loan Forgiveness won’t harm SOFI as much as traders and analysts seem to think it will. This is a $48,000 spread at net $5,142 that’s $16,000 in the money at the moment. If we make it to $10, in Jan, 2025 (we’ll roll the 2024s) we can gain $42,858 (833%) and we’re risking owing 2,500 shares at $10 ($25,000) which are currently at $6 ($15,000) – not too terrible.

-

- YETI – Yeti is our current Trade of the Year, which means it’s the spread we think is most likely to make 300% in the current year. We began with a net $750 investment in December and it’s already net $3,675 so that’s up $2,925, which is 390% so – TaDa! Still, things were going better before the Feb crash and it is a $22,500 spread with 612% left to gain so still good for a new trade – even if you did miss the first 390%.

So that’s it. 9 positions with about $170,000 of upside potential using just $103,743 of CASH!!!, which is just 29% of the portfolio invested. Cash makes a nice hedge too!

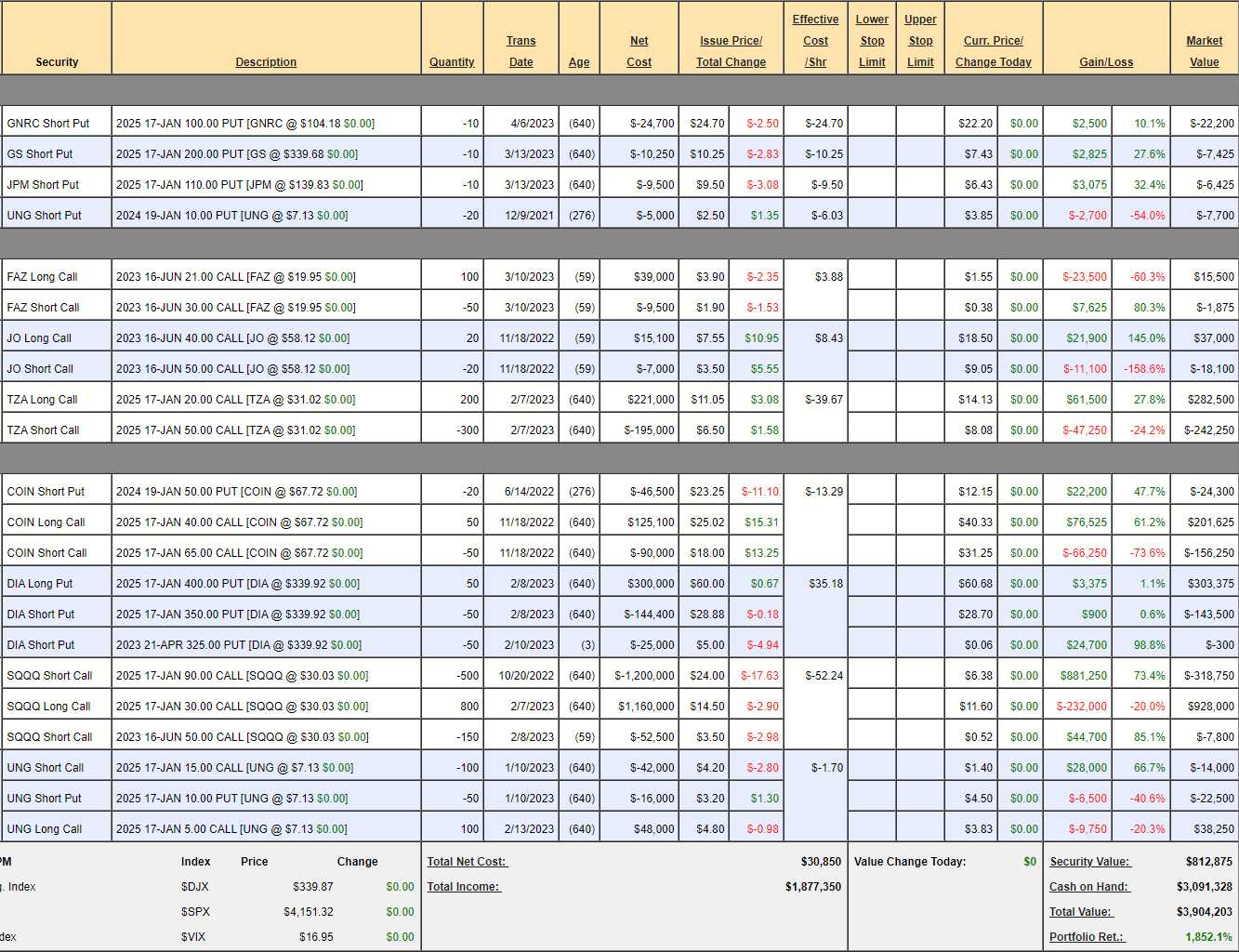

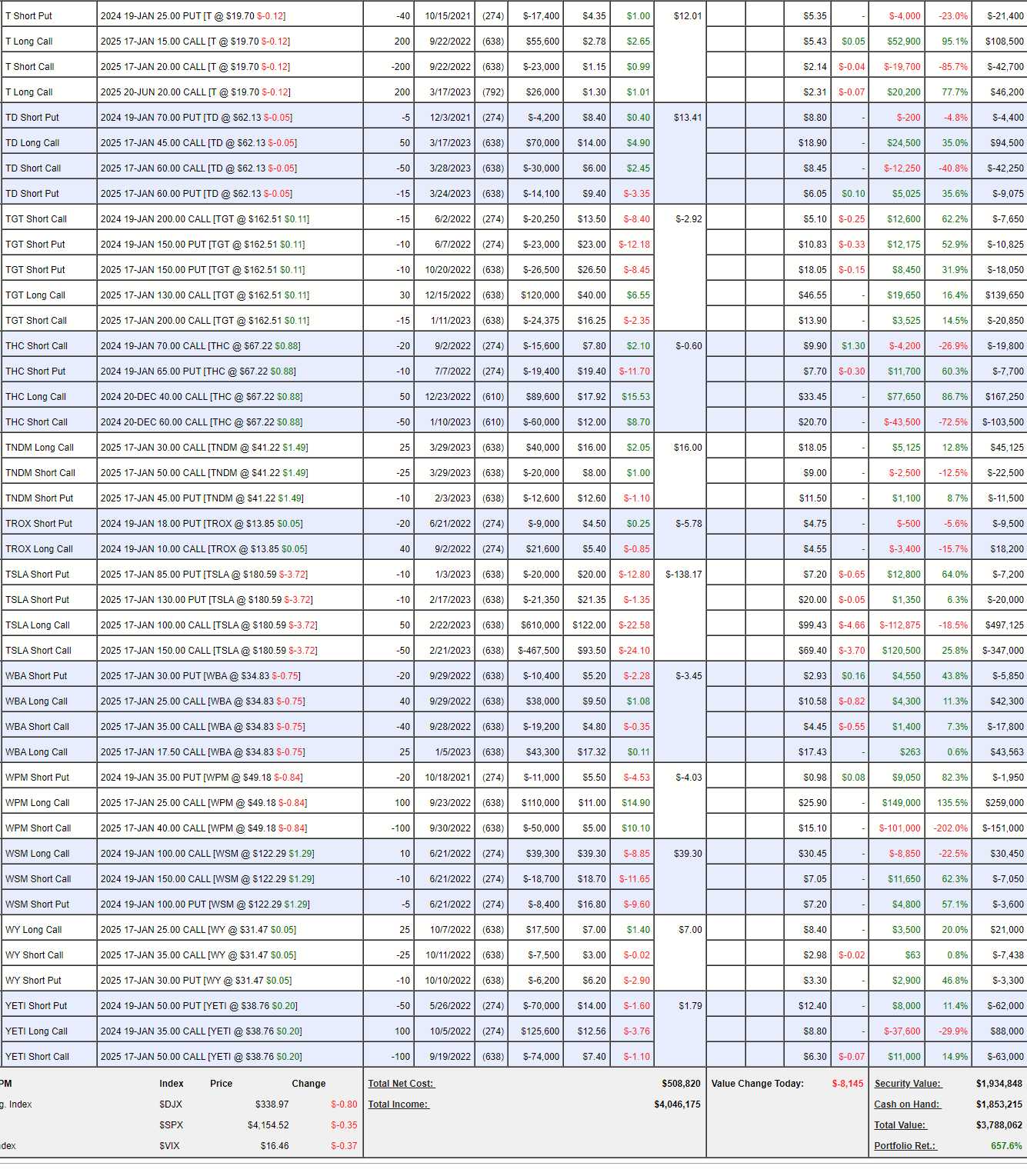

Short-Term Portfolio (STP) Review: Speaking of hedges… The STP is where we keep the hedging positions to protect our other portfolios. Other than the Money Talk Portfolio and the Earnings Portfolio, which are self-contained. The Butterfly Portfolio never seems to need any help – but that’s another story.

Short Puts – The main point of the STP is to protect us against a bad weekend, like 9/11, when you wake up and the market is down 20% before you can do anything about it. Over a longer period, we can add more hedges and, if the market drops more than 20% before we can adjust – we’ll probably be too busy running from whatever to worry about how our portfolios are doing.

Anyway, so – since we are betting against a general market collapse, we can use our short-put selling strategy to raise a little cash on things that should do well if the market DOESN’T drop – and that puts some cash in our pockets to offset our hedging losses.

-

- FAZ – We picked these up when the market was crashing and we overpaid for our longs but the net of the trade was $30,000 and we sold the June $30s for $9,500 and that was only a half-cover so let’s turn this into an income-producer by rolling the 100 June $21 calls at $1.55 ($15,500) to 100 2025 $20 ($6.70)/40 ($4.50) bull call spreads at net $2.20 ($22,000) and that’s net $6,500 and we can buy back the June $30 calls ($1,875) and sell 60 of the July $22 calls for $1.80 ($10,800) which puts net $2,425 in our pocket, which means our spread is now net net $27,075 and we used 90 of our 640 trading days for this $10,800 sale so, once this clears – we have 6 more shorts to make $10,800 against our spread and whatever value remains in the spread will be a bonus (and, of course, there will be more adjustments).

-

- JO – The STP is the closest thing we have to a day-trading portfolio so it’s where we do our speculating and we played Coffee long back in November and it looks like we’ll collect the full $20,000 from our $8,100 wager for a profit of $11,900 (146%) in 6 months – that will pay for a few lattes….

How do we do it? Well we know what Coffee is actually worth ($45 is the extraction cost) and, when it goes below that price – we buy it. Not complicated really… As you can see – it doesn’t guarantee we’ll hit the exact bottom but it makes for a nice entry and this was a very small play for us – just a fun way to check our premise.

-

- TZA – Notice we sold more short calls than we have long calls by + 50%. We think it’s very unlikely TZA hits $50 and, if it does, our $20 calls will be $600,000 in the money and the spread is currently net $40,250 so a very good risk/reward on what’s left of our original hedge.

-

- COIN – Speculative bet based on my belief that COIN will survive the purge of crypto exchanges. We were a bit early with our entry but back on track now – over our target, in fact. If we do hold $65 into 2025, this is a $125,000 spread and it’s still only net $21,075 so there’s still $103,925 (493%) of upside potential if they simply hold $65 – aren’t options fun?

-

- DIA – As we just did with FAZ, DIA is an income-producing play that can quickly become a hedge if we adjust it a bit. The short April puts should expire worthless and pay us $25,000 for 2 months against our $155,600 spread that has 20 months left to play. Notice the $250,000 put spread is in the money – so the only way it doesn’t pay is if the market goes up almost 20% – in which case our longs will more than compensate. Earnings don’t seem to be going too badly so let’s sell 50 of the DIA June $330 puts for $4.15 ($12,450) and we’ll sell some more if earnings stay strong this week.

-

- SQQQ – This is our main hedge and we actually have more longs than shorts, which is a rarity in our hedges. SQQQ is a 3x inverse to the Nasdaq at $30 so a 20% drop would be a 60% pop in SQQQ to $48 so the short $90s are very unlikely to happen unless something TERRIBLE happens in the market. Not only that but we’d be $4.8M in the money at $90 before we owe those short callers a penny.

- Realistically, we have $1.6M at $50 so that’s our real protection against a 20% drop. We’re not getting much bang for the buck out of our short June $50 calls so let’s buy those back for $7,800 and sell 200 Sept $40 calls for $3.25 ($65,000) and the 2025 spread is only net $609,250 for 800 so $76,156 per 100 means that $65,000 can buy us another $600,000 worth of protection if we decide we need it.

-

- UNG – More speculation along the same logical lines. Natural Gas wells are a poor investment if /NG is below $2.20 so under there and we get very interested in /NG and UNG, where $7 is about $2 on /NG. We have an orphaned short put up top and we have 50 more short puts with the main spread with an aggressive $10 target (not even $3 on /NG, so I’m comfortable) and we have 100 $5/15 spreads so $10 would pay us $50,000 and we’re at net $1,750 (not including the old short puts) so this spread has $48,250 (2,757%) upside potential at $10 and another $50,000 at $15 and $30 was last year’s high – remember what I said about aiming for the middle?

The trick to making huge returns on our hedges is simply playing the channel on the indexes. Sometimes that’s obvious and sometimes it’s not. In the last month, we have LOST about $100,000 in the STP but that’s because, rather than cashing it out, we bought more longs in the LTP hoping for a bounce. We got the bounce and the LTP did great and the STP lost a bit but, overall, we’re ahead and we got some super-bargains we would not have picked up otherwise if we were not so well-balanced going into the sell-off.

That’s the difference between staying on your board and wiping out – BALANCE!!!

— Thursday —

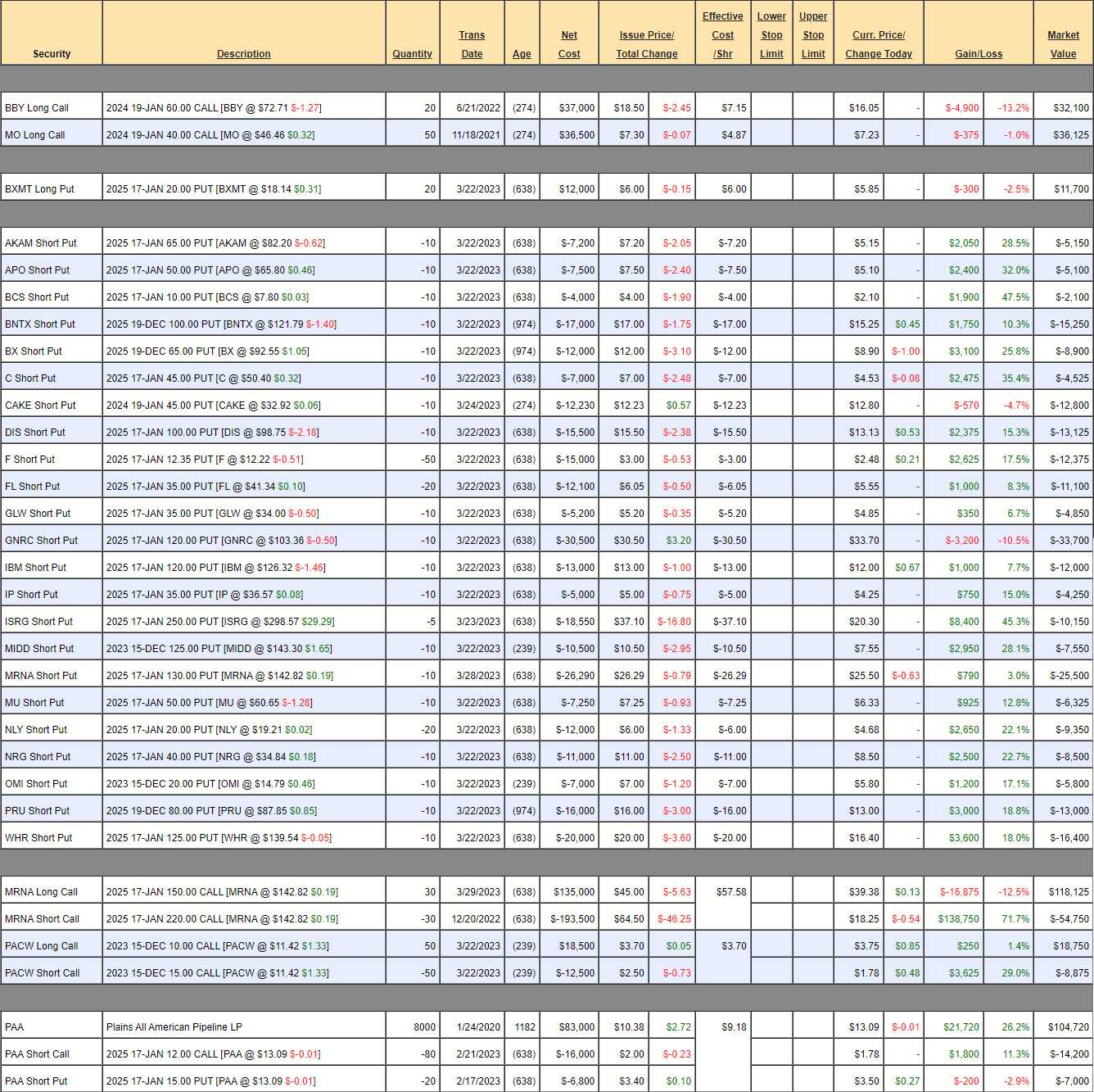

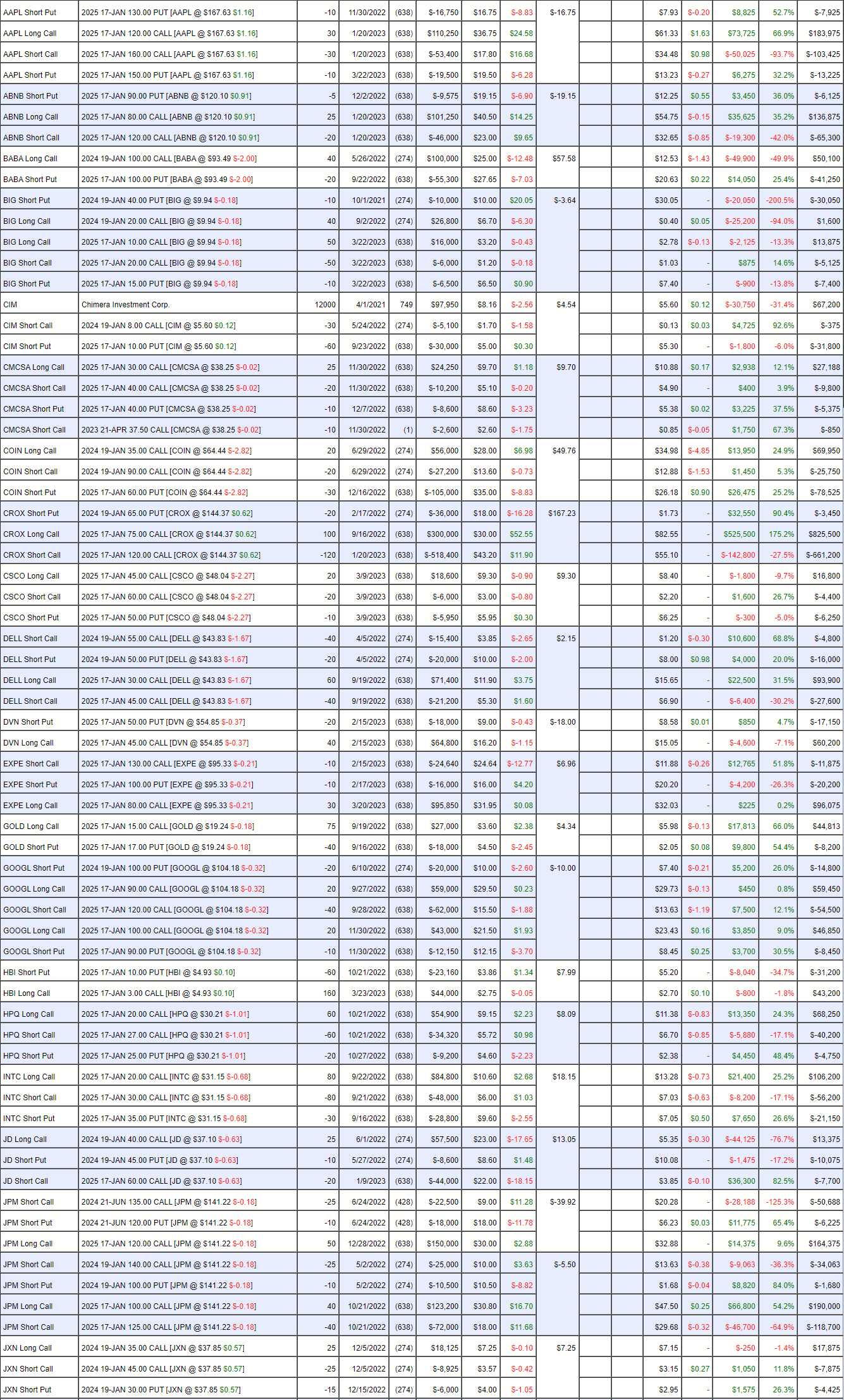

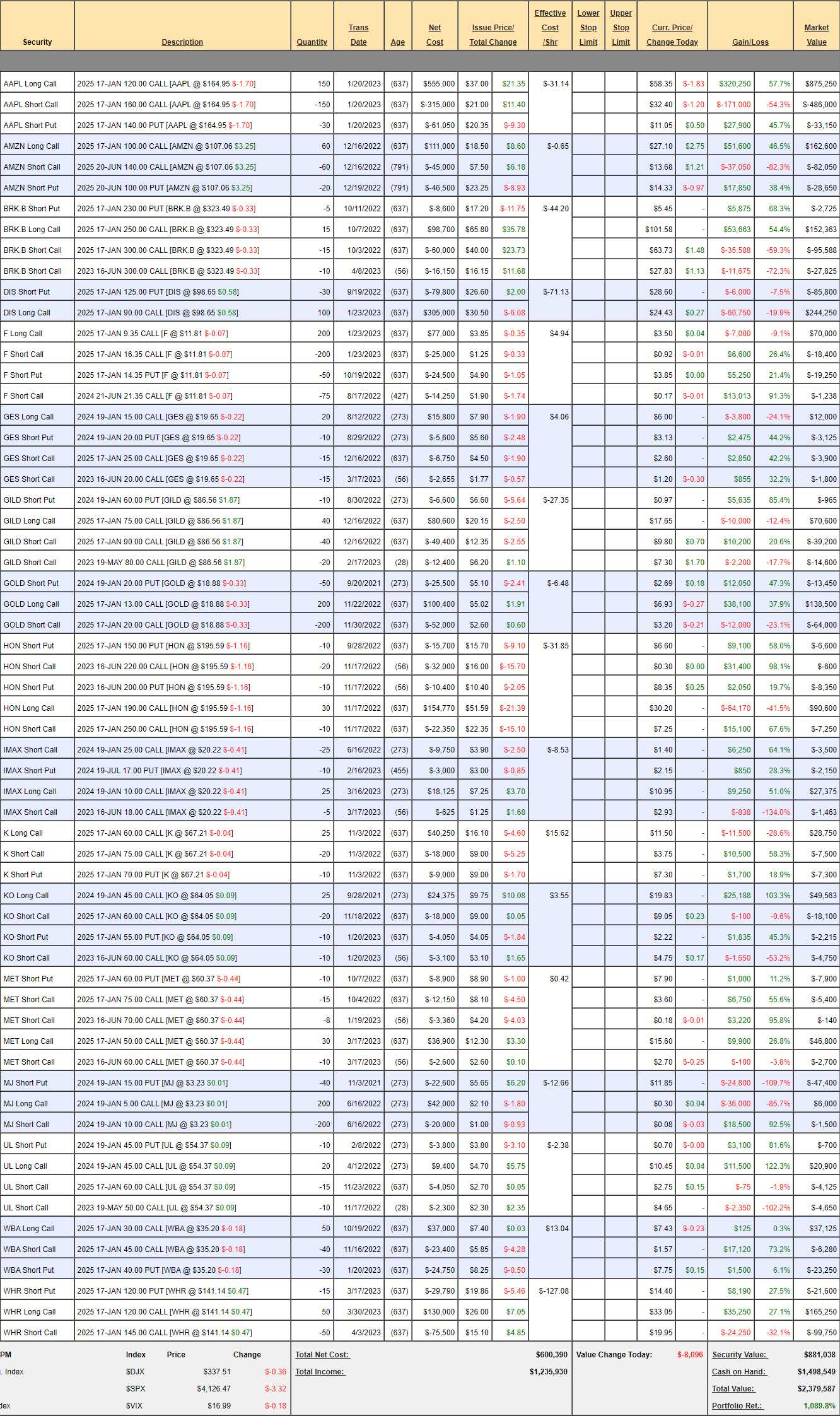

Long-Term Portfolio (LTP) Review: $3,788,062 is up $5,892 since Tuesday, even though the indexes are down 1%. That indicates our overall positions are pretty resilient and that’s why it’s been so hard to close these portfolios – it took us 4 years to get here but these things are EXTREMELY well-balanced and, because we are BEING the House and NOT the Gambler – we grind out gains by selling premium on a regular basis – in good or bad markets.

Long-Term Portfolio (LTP) Review: $3,788,062 is up $5,892 since Tuesday, even though the indexes are down 1%. That indicates our overall positions are pretty resilient and that’s why it’s been so hard to close these portfolios – it took us 4 years to get here but these things are EXTREMELY well-balanced and, because we are BEING the House and NOT the Gambler – we grind out gains by selling premium on a regular basis – in good or bad markets.

I am not going to miss maintaining what is now 84 positions but, of course, diversification is part of what makes these portfolios so resilient. As we close down our Member Portfolios, keep in mind that pretty much every one of these positions goes right back on the Watch List for the next cycle and some of them are cheap enough that they will become the building blocks of our new portfolios.

TO BE CLEAR: ALL positions in ALL portfolios are being closed other than the Money Talk Portfolio (which we will close on the show) and the $700/Month Portfolio. These are final adjustments for the portfolios for those who want to stick with them but we’ve decided to get out and start building new portfolios in May.

-

- BBY – Not one I’m going to rush back to buy.

- MO – They’ve been a disappointment but good Dividend or Butterfly stock.

- BXMT – Still way too low, a bit more research but might make a nice starter stock for our new Portfolios.

-

- Short Puts – All of these just go right back to our Watch List. We only just bought them on 3/22, when we felt the panic was over and we made a quick $44,000 out of a potential $300,000 so pretty much on track for the month.

- MRNA – I do love these guys as a long-term play, earnings are in early May, so we’ll see what they have to say.

- PACW – Another one we’ll be quick to add back if they don’t get away from us.

-

- PAA – Fantastic dividend stock. They just paid out $0.268 on Jan 30th so I’d hold this one until we get our next $2,144 around April 30th. Notice we sold the $12 calls, so we’re well in the money and the spread was net $60,200 so collecting $8,576 in dividends is 14.2% per year while we wait to get called away at $96,000 at $12 for another 59.4% profit. Who says dividend investing is boring?

-

- AAPL – You know we’ve been in a bullish market if we don’t have a ton of AAPL. APPL is my Stock of Forever but we don’t buy it when it’s expensive and it kind of is at the moment. It wasn’t in January ($130) – which is when we did jump back in in the LTP – after selling puts in November, in our usual pattern. We only spent net $20,600 and it’s already net $59,400 so up about 150% in 3 months is pretty good. It’s a $90,000 spread but it would have taken us 20 months to collect the last $30,000 so it was getting boring anyway.

Good point to make here. Timing is everything and we learned in March that $130 was a good line so, 8 months later, when it hit $130 again, we bought it by selling the $130 puts for $16.75, committing to buy 1,000 shares at net $113.25 – a number we are VERY comfortable owning AAPL at (see 2021). AAPL did go lower so we bought the bull spread for a good price AFTER we were sure $130 was holding (again) and we took a nice, conservative play and AAPL rocketed back over our target and PRESTO! 150% profit in 3 months.

Point is, when you have smaller portfolios (as we soon will), you are better off waiting a year for a great opportunity to make 150% than you are jumping into positions that might make you 100% if you are lucky. Luck is not what we play for! We buy GREAT stocks WHEN they are on sale and then you don’t need luck – just patience. Patience is a thing we can control and rely on – luck is not…

-

- ABNB – Over our range already.

- BABA – Big disappointment. Not sure I’ll play them again.

- BIG – Another big disappointment.

- CIM – My favorite REIT! Just paid 0.23 ($2,760) dividend on 3/30 which I forgot to log in but that’s why we doubled down last month – to catch it. The current net is $35,025 so that’s a 7.9% QUARTERLY return AND we can sell better calls… I can’t wait to buy this one again!

-

- CMCSA – Almost at goal but still just net $11,163 on the $25,000 spread. Notice it was set up to generate an income while we wait and we’re up $1,750 in 5 months on the short April $37.50s (how was my target, by the way?) so 4 more sales like that is another $7,000 if all goes well.

- COIN – FINALLY they came back a bit. We caught the dead bottom on the put sale. That’s what made this play so I’m not sure I’d do it again without that advantage.

- CROX – I love these guys! Zooming up now, miles past our 2025 goal already so I doubt we’ll do it again but thank you CROX…

-

- CSCO – Another one of my all-time favorites and we just added them so very likely to be an early new entry.

- DELL – Another income play that’s on track.

- DVN – We just added them and still cheap but I’ll want to see earnings and CC before deciding if we still want them.

- EXPE – I still like my premise for travel making a comeback so this seems way too cheap to me.

-

- GOLD – Nice move up and stalled at $20 but still good for a lot more.

- GOOGL – Not sure I’ll go back. They are way behind in AI and they are behind because it wrecks their ad model. MSFT had the benefit of GOOGL kicking their ass and they essentially made no ad revenue from Bing so they have nothing to lose by changing their search to AI – they have nowhere to go but up!

-

- HBI – They are so cheap we’ll have to re-buy them soon.

- INTC – I’m going to be unhappy if they pop over $40 and they can’t be my 2024 Trade of the Year. Our spread target was only $30 and we’re at net $28,850 on the $80,000 spread so lot’s left to gain so, actually, I would not close this one – that would be silly. We are closing the WHOLE LTP but we’ll buy this spread right back with it’s $51,150 (177%) upside potential if INTC doesn’t fall below $30 (we can always roll the 2025 $35 puts).

-

- JD – China is just not working. Another good reason to cash out and wait a while (overall, I mean).

- JPM – Bulletproof Bank. Pretty much no matter what happens, JP Morgan wins. The first spread is back where we came in and I still like it and the 2nd set is doing better but we’ll just find something new to play JPM with in the new portfolios.

- JXN – These guys are so volatile. Most likely we’ll add them back quickly if they are still cheap.

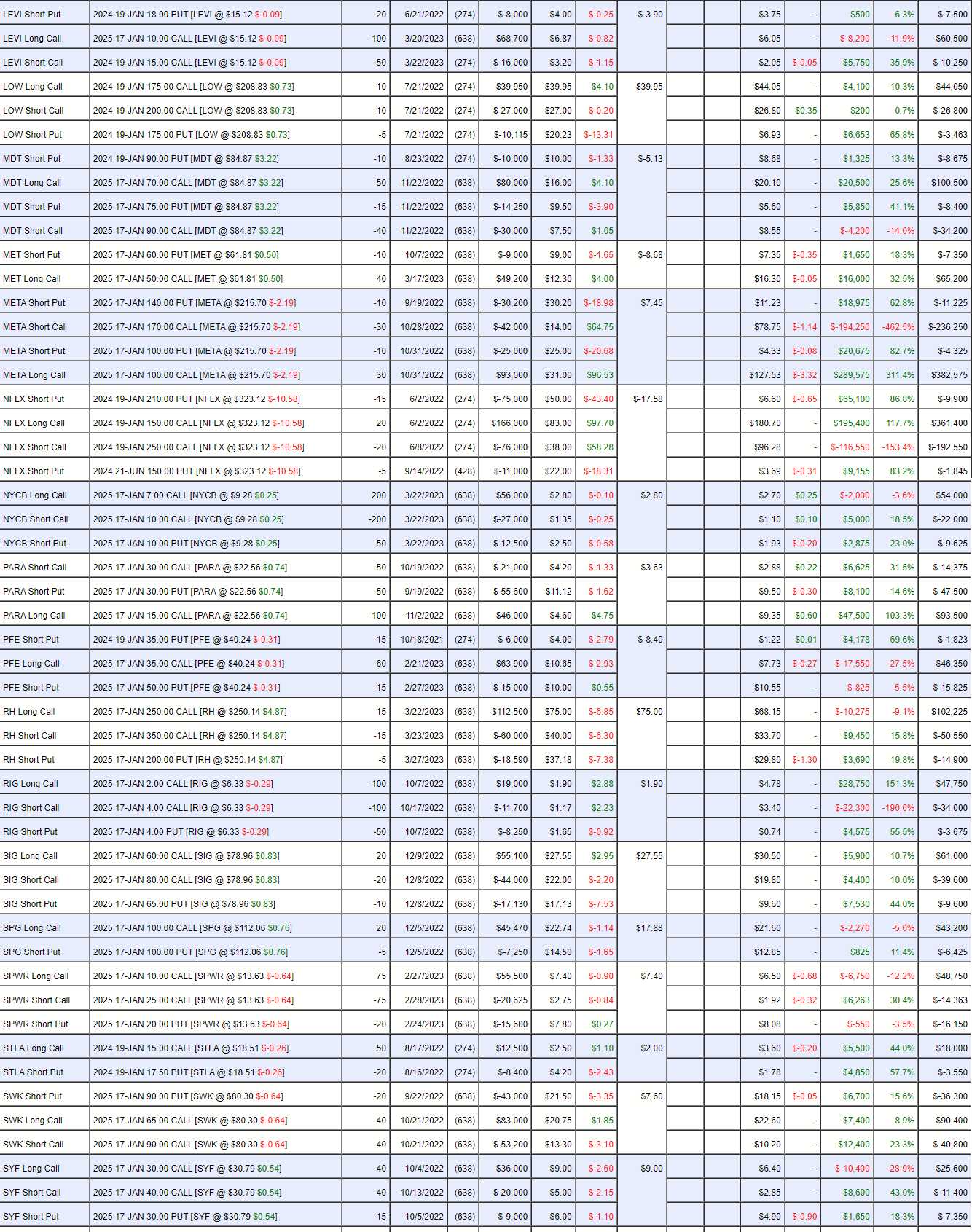

LEVI – Another sleeper stock we’ll be jumping back into.

LOW – Over our target at net $14,162 on the $30,000 spread – see how easy it will be to build new portfolios?

MDT – Still very cheap. We were conservative on the spread and a little aggressive on the put and, even though we’re already up $20,825, this spread is still only net $46,575 on the $100,000 spread AND we are planning to play for income when it comes off the floor. Aren’t options fun?

-

- MET – And this is AFTER a huge pullback from $75. My premise was that insurance companies, who conservatively invest huge reserves would benefit from higher rates. In the SVB collapse, people panicked out of MET because they hold a lot of bonds but, unlike SVB – there’s no one forcing them to redeem them – so there’s no impact to their bottom line and things just keep getting better as they roll over old notes.

- META – Well we made a fortune but will we re-invest? The spread we have still has 33% left to gain so I think there’s room for something. We’ll see how earnings look.

- NFLX – They made it past earnings, that’s good. We bought them in June when they were super-cheap and now they are not so not likely we’ll get back in.

-

- NYCB – They benefitted from the crisis and we’re up a bit and likely to get back in quickly.

- PARA – Not as sleepy as they were but miles to go still. Despite our $59,400 gain (we started with a credit) this is a $150,000 spread that’s half in the money at net $28,800. Unless their earnings suck, we could just make this our entire portfolio for next year with 6x upside potential (and only a 1/2 cover)!

-

- PFE – Or ATM, as I like to call them. They are cheap again so we’ll be back very soon.

- RH – Right where we started at net $35,400 on the $150,000 spread so only a 5x potential return here – pretty boring…

-

- RIG – I forgot we had these guys. We’re so far in the money on this $20,000 spread at net $9,500. I know you guys are spoiled as it will only make over 100% in 20 months but it’s a $2/4 spread and RIG is $6.21 so it has to get a couple of bonus stars for margin of safety. This stock has to fall more than 33% for you not to make 100% on the spread!

-

- SIG – Net $10,000(ish) on the $40,000 spread. Isn’t it amazing how many of these we can find? This is why we have so much trouble cashing out – so many great positions!

- SPG – Another fantastic bargain. Still cheaper than where we came in.

- SPWR – You KNOW we’ll be buying our Stock of the Decade again! At the lows too. How do people not get that Solar Energy is hot?

- STLA – If we like them enough not to be covered, we must like them as a new trade.

- SWK – Still languishing at the bottom. Net $10,000(ish) on the $100,000 spread that’s half in the money. Another one where earnings would have to be a disaster for us to stay out of them for long.

-

- SYF – Will all the S’s be blue? SYF is a surviving, sort-of bank and it’s back to where we came in due to the crash. Winner, winner…

-

- T – Gosh, I wish I could say I don’t like them as they are having a terrible earnings day today. Our net $48,500 gain above is down to $7,000 today but that just means they’re a huge buy again for the new portfolio.

- TD – Still cheap.

- TGT – Way too cheap despite our ridiculous profits already.

-

- THC – Over our target so tough to get back into but I do like them long, long-term.

- TNDM – For the same reasons I like THC long-term. This one is still very cheap.

- TROX – Still good going forward.

-

- TSLA – Great day for S stocks, not so good for T stocks. TSLA down 9% but still over our targets as I was never a lover of the stock but I also didn’t hate them enough to not buy it when it got cheap. It’s kind of back where we started so we’ll have to wait and see but probably worth another toss when it settles down.

- WBA – I don’t even have to look to know we’ll buy this again.

- WPM – 25% over target! Still only net $60,000 on the $150,000 spread so, if you want to make 150% as long as this stock doesn’t drop 20% – this could be a good trade to consider.

WY – Doing well and on track. $25,000 spread at net $10,000 so another 150% upside potential but this one has to go up 10% in two years to pay in full. Too much work…

YETI – Our Trade of the Year! We’ll have to adjust when we go back in but it’s a $150,000 spread that’s $40,000 in the money and we GOT PAID $18,400 to set it up so, if YETI finished here ($39), we’re be up $58,400 (and we’d have to roll the put). So the net loss is just a strangeness in the options values that does not reflect the reality of the situation at all UNLESS, like SVB, you are forced to cash out so keep in mind we are NOT forced to cash out – these prices are a bit silly. Of course it’s currently a net $37,250 CREDIT on the $150,000 spread that’s $40,000 in the money so this would STILL be my pick for the trade of the year with $187,250 (500%) upside potential. Earnings are May 11.

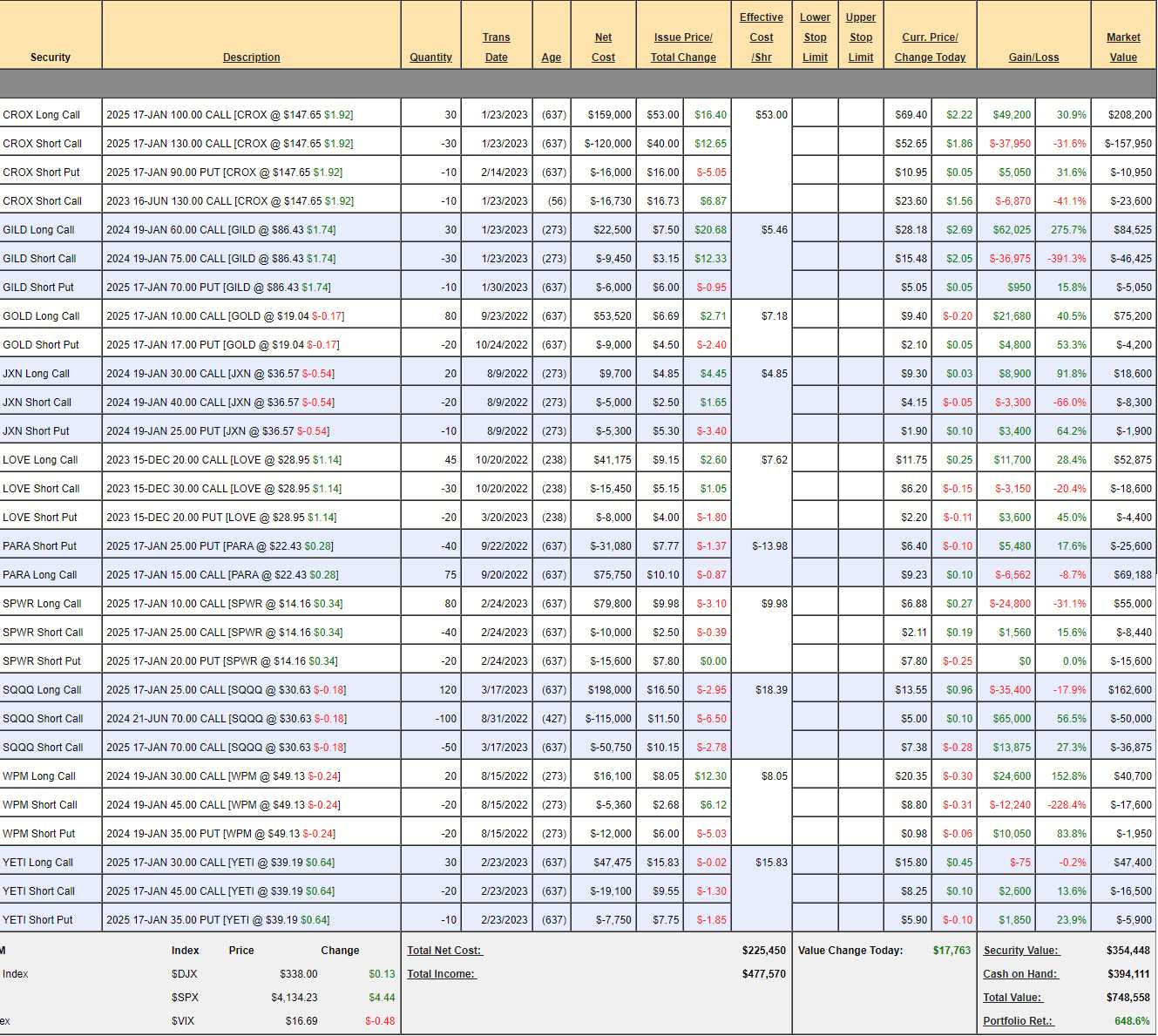

Future is Cancelled Portfolio Review: For whatever reason, the Future is Now Portfolio had a great month, jumping from $398,522 to $466,063. It’s “only” up 133% overall, which serves to remind me why I prefer Blue Chips to speculative plays. Since our system let’s us make 300-500% playing established Blue Chip stocks – we are generally better of waiting for these companies to at least stabilize before we start betting on them.

Of course, these were not stocks we expected to perform in the mid-term (2-4 years) but in the longer, 5 to 10-year periods – so we didn’t really give them a fair chance. We’ll check back in a year or two to see how they are holding up.

-

- ASAP – They signed a deal with CMG and they have $81M in sales and expect to lose $20M this year ($32M valuation) but next year they expect $261M in sales and $20M in profits so it’s a leap of faith to hold them.

- NAK – They need the Republicans to take power but Alaska is a red state and even they would prefer to protect the fishing industry rather than risk it on a new gold mine.

- RWLK – I’ll let Shel-Bot tell you why we plan to buy them again: ⊗ RWLK has a strong growth potential as it addresses a large and underserved market of people with spinal cord injuries, stroke, multiple sclerosis, and other conditions that impair mobility. According to the company’s website, there are over 3 million people worldwide who could benefit from its products1. The company has also received regulatory approvals from the FDA, CE Mark, and other agencies for its products1. RWLK has a positive outlook from analysts who cover the stock. The average price target for RWLK is $3, which implies a huge upside of 354.92% from its current price of $0.6599 as of April 21, 20234. The consensus among analysts is a “Buy” rating for RWLK5.

-

- BFI – Another one we’ll be buying again. ⊗BFI also has a favorable valuation compared to its peers in the restaurant industry. The company has a market cap of only $28.59 million as of April 19, 20231, which is significantly lower than its competitors such as Shake Shack ($4.4 billion), Habit Restaurants ($375 million), and Red Robin ($314 million)2. The company’s price-to-sales ratio is also very attractive at 0.33, compared to the industry average of 2.12.

- BIIB – Good, solid pipeline and trading at 14x vs 28x average in Biotech. Huge profits as we caught it well back in March and it’s already at goal at net $128,648 on the $200,000 spread. Not bad for a spread we paid net $6,000 for! This one will make the last $72,000 if it holds $300 into Jan so still a nice play with more than 50% upside potential in 8 months.

- CAN – We’re up nicely but I’m not into Chinese companies anymore this year.

- COIN – As noted in above review, We caught it well and they still have miles to go IF they can settle with the SEC but it’s not one I’d jump right back into. Certainly on the Watch List.

-

- CRSP – Boy, this is a fun set of companies! I love CRSP, extra CRSPy at Popeye’s (QSR). They have not been loving us with meager gains so far but moving up into earnings next week. ⊗CRSP has a strong growth potential as it leverages its expertise and innovation in gene editing to address some of the most challenging and unmet medical needs. The company’s most advanced pipeline candidate, CTX001, is in collaboration with Vertex Pharmaceuticals and targets sickle cell disease and transfusion-dependent beta-thalassemia, which have high unmet medical needs1. The company also has other gene editing programs for immuno-oncology, regenerative medicine, and rare diseases1. CRSP has a positive outlook from analysts who cover the stock. The average price target for CRSP is $84.23, which implies a decent upside of 63.62% from its current price of $50.89 as of April 21, 20232. The consensus among analysts is a “Moderate Buy” rating for CRSP4.

- DAL – Good structure saves this spread – the stock has not gone far (but our timing was also as good as possible). Certainly one for the watch list – maybe better suited for the Butterfly Portfolio?

-

- ERJ – Doing well and even better as we bought back the short calls on the fall dip. Back to the Watch list and we just hope they drop down again.

- F – About where we came in. My premise here was that TSLA, SUPPOSEDLY, has fantastic margins so F, as they move to electric, should improve margins but recent TSLA price cuts indicate that TSLA HAD an advantage and now it’s back to being a car company that will end up in price wars with all the other car companies and margins will move back to industry normal – NOT the other way around.

- FF – I really love these guys so we’ll look to get back in.

- GPRO – Not going well at all. My premise was that their move to high-end photography was a good one but apparently not a profitable one so far. ⊗ The company also suffers from a seasonal and cyclical demand pattern that depends on consumer discretionary spending and travel activities1. The company also has high operating expenses due to research and development, marketing, and litigation costs1. Thank you Shel-Bot!

-

- IGT – This was easy money as our play on the rise of Sports Betting as well as a comeback for casinos. Rather than try to pick specific winners – we picked the guys who sell the tools to all of the companies. Unfortunately, it’s way over our target so back to the Watch List.

- LOVE – Notice our biggest gain came from selling short-term calls. We will probably play them again.

- MDT – Gosh I love these companies! As we all Borgify ourselves over the rest of the century, a lot of those parts will say Medronic on them.

Notice how we wait and wait before we buy. In June of 2022, at about $90, we thought MDT was worth a toss so we sold the $90 puts (just 5) for $9.50 to net in for $80.50, which is where I felt that, if I had $100Bn (25x), I would have bought the whole company (I used to be an M&A consultant – that was my job).

That takes our trade off the Watch List and onto our portfolio where we wait to see if our net target ($80.50) gets tested or if we just keep the $4,750 for keeping an eye on it. Since it did get tested (a bit lower too), we jumped in to the bull call spread in late November as MDT was a potential Trade of the Year candidate at the time.

Our target is an extremely modest $90 (where we sold the puts) and we ended up paying net $11,600 for the $50,000 spread with the intent to sell short calls along the way AFTER the stock recovered a bit (hence having 5 more long than short calls). Even now, we’re “only” up about $10,000 so there’s still over 100% left to gain in an extremely likely-to-succeed spread – not even counting the potential of the short-term call sales along the way.

-

- MP – Rare Earths in the US. This is a no-brainer!

- RKT – They were gaining traction and then the crisis knocked them back – still cheap.

- SOFI – I love them. Also got knocked back over the SVB crisis.

SPWR – You know we stick with them.

- THO – People can’t afford houses so trailers. Still cheap.

Butterfly Portfolio Review: $2,379,587 is up 1,089..8% from our $200,000 start on 1/2/18. The Butterfly Portfolio is the ultimate example of what happens to trades like T that we discussed this morning (Friday) if you let them run for a while. The basis gets lower and lower but we collect the same amount of money selling puts and calls – more even – if the stock goes up in price.

Unlike the T spread, in the Butterfly we leverage the CASH!!! by using bull call spreads as a substitute for the stock and we’re very aggressive with our short-term put and call selling. So, in the Butterfly Portfolio, for example, the $16,000 T play would be:

-

-

- Sell 10 T 2025 $17 puts for $1.70 ($1,700 – they jumped up this morning, not $18.28).

- Buy 50 T 2025 $15 calls for $4 ($20,000)

- Sell 40 T 2025 $20 calls for $1.35 ($5,400)

- Sell 10 T July $19 calls for 0.50 ($500 – now 0.42)

- Sell 10 T July $19 puts for $1.15 ($1,500)

-

This is only $10,900 and it’s a $25,000 spread so the upside potential is $14,100 (129.3%). We’ve forsaken the dividends but we have 7 quarters to sell and, rather than collecting $277.50 in dividends for the quarter, we are collecting $2,000 from the short July $19s. We can’t lose both so, as long as T is not $2 over or under $19, we make money – probably more than $277.50 (our 2% goal).

It’s not a neutral bet. We think T will be back over $20 but we have 10 uncovered long calls so the only risk (and we can roll the short calls) is that we make $4,000 instead of $5,000 if called away at $19 on that set of 10 spreads. That would be great for our other 40 spreads, that would make their whole $20,000. If we miss on the short puts, we just roll them out to a lower strike and we’re really not worried about net $15.30 from a value perspective.

Even if we “only” get to keep half of the $2,000 we’re able to sell each quarter, that’s $6,000 (42%) more in profits against $14,000 in cash and margin and then, if we’re over $20, we get back $25,000 for another $11,000 profit (78.5%) – miles ahead of the dividend version of the play.

And THAT is how we ended up 1,000% after 5 years….

-

- AAPL – A good Butterfly position is one that goes up and down in a predictable range. At this point, if we were continuing, we would be selling calls as AAPL is getting a bit toppy above our predicted $160. If we are wrong and they go higher, we sell puts to pay to cover the roll of the short calls, etc. We only have to be right (both sides expire worthless) once in a while to make RIDICULOUS amounts of money. For example,

- AAPL hasn’t reported yet so they probably won’t report before July expirations so I can sell 40 July $165 calls for $9.20 ($36,800) and 30 July $155 puts for $4.25 ($12,750) and we’ve collected $49,550 against our net $356,100 position on the $600,000 spread so we have MILES of upside protection so I’m not worried about AAPL going up and the Jan $135 puts are $4 so, if we have to roll – I certainly don’t mind owning AAPL at net $131 (and we can always roll again) so not much downside and, if AAPL if between $155 and $165 in July – we make more than 10% on a spread in 3 months while we wait to make 90% more at our goal in Jan, 2025. And we started at net $178,950 in Jan. Why? Because it was at the bottom of our channel!

-

- AMZN – We added them in Dec and they haven’t made much progress but look how conservative our spread was. Only just getting in the money at net $51,900 (already up $32,400) on the $240,000 spread so tons of upside and I don’t see AMZN not improving with all the cloud sales they must be doing. With a $20,000(ish) initial entry, this is a 2-year, 10-bagger if it works!

Again PATIENCE!!!! I don’t actually like AMZN very much but, at $80, I liked them enough to take this trade. Our target was $100/140 with the stock at $80 and we aggressively sold the $100 puts so we ended up paying very little but what’s the risk? Possibly owning 2,000 shares of AMZN At $100 ($200,000) or $220,000 if we lost the whole spread.

If that happened, it would be 10% of our Portfolio and we’d simply sell the 2027 $100 calls for $20 (guessing based on 2025s) and the $80 puts for maybe $10 more and then our net would be $160,000 for 2,000 shares with the risk of owning 2,000 more at $80, which we feel is a very solid floor.

Anyway, the point is that almost every stock goes on sale if you wait long enough and we can make more money by being patient and making one 1,000% play than we could have if we tried to trade AMZN in and out for the past 5 years guessing a channel. We pick our bottoms based on solid valuations – that’s why we’re so successful.

-

- BRK.B – About where we came in overall, a solid way to play. It’s like playing the S&P but without the bad ones.

- DIS – We bought back the short calls so losses not as bad as they look but this war with DeSantis AND their business issues make them tricky to play.

- F – As noted above, we want to be careful but it’s been a good run for us.

- GES – Good but not great.

- GILD – Blasted higher and we’ll see where the new channel forms.

-

- GOLD – Also took off but we expected it and were not selling short-term calls. Still only net $60,000 on the $140,000 spread so great for a new play. Options are so much fun!

-

- HON – We came in at the very wrong time but I like them long-term.

- IMAX – As we expected, they took off. We always play them – such a great channel stock.

-

- K – Newish and about where we came in.

- KO – Another one we always play.

- MET – Above we discussed how people misunderstand insurance companies (to our advantage). Nice winner.

- MJ – Ugh! Gad to be done with them.

- UL – Grinding out a nice profit.

- WBA – More in bargain territory than Butterfly.

-

- WHR – Also way too cheap to sell short-term calls. Love these guys.

Dividend Portfolio Review: Up just under 200% in 3.5 years is right about where we should be as we were aiming for 30-40% per year and then compounding the wins, of course. We started with 100% in Dec, 2019 and, because we were trying to capture dividends, we stupidly bought a bunch of positions all at once and then the Covid crash dropped us to about 50%. Fortunately, that’s what hedges are for so we moved $100,000 from the STP to this portfolio at the market bottom and pretty much just doubled down on all our positions. Then the recovery and that’s why we did better than we thought in the end.

Honestly, there’s no magic beans here. As with today’s (Friday) T trade, we just set them up and grind them out. It’s dull and tedious and we’re not going to have a new Dividend Portfolio but I’m always happy to help setting up new positions if you ask.

Earnings Portfolio Review: Had a very nice month and now up 648.6% in 3.5 years. The idea of the Earnings Portfolio is to grab stocks that we believe have been oversold on earnings (like T this morning) and I love it as I get to show off my instant-analytical skills against the idiocy of the Cramers of the World who scream “SELLSELLSELL” while we “BUYBUYBUY”.

The great thing about buying on earnings dips is the volatility spikes and we get fantastic prices on short puts that we sell and, if we wait for the Downgrade Police to have their say, we can even get good prices on the longs and, often enough, we don’t even sell the short calls until the stocks recover a bit. That’s why it’s so wildly profitable – it’s a fantastic strategy from an options-management point of view and we also are very good at our jobs – so we combine that with a very high success rate.

Oh yes and PATIENCE!!! Often we have been watching a stock for a long while and then they report bad earnings and THEN we jump in and open a spread. We are like the cheetahs on the plains – waiting for the injured gazelle to pounce on…

-

- CROX – Love them but no longer cheap.

-

- GILD – Discussed above.

- GOLD – Discussed above.

- JXN – Almost good for a Butterfly.

-

- LOVE – Discussed above.

- PARA – Still way too cheap.

- SPWR – Way too cheap.

- SQQQ – This is a self-hedging portfolio. It’s a very good hedge, we’ll use it again.

- WPM – Love them but no longer cheap.

- YETI – Need good earnings to get back on track (should be up a lot more by now).

Well, it’s been a fun lockdown but now that’s over and we’re closing the books on our portfolios and hopefully on Covid too (I’m still getting my booster). However earnings season ends up – it will be fun to go into the summer with a clean slate and lots of shopping to do.