This is interesting:

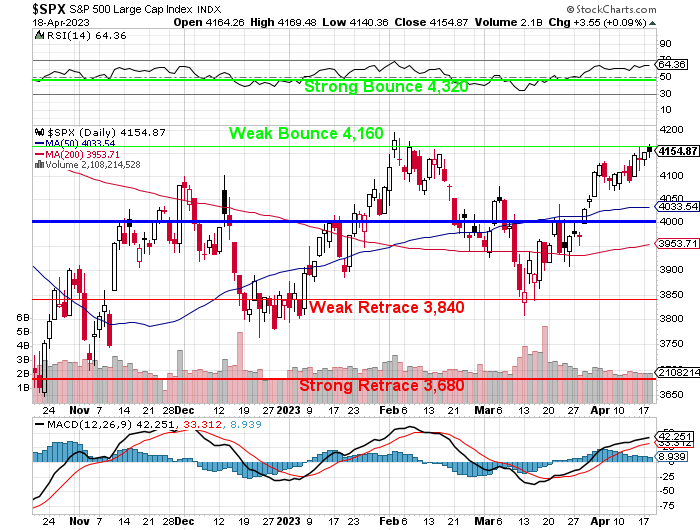

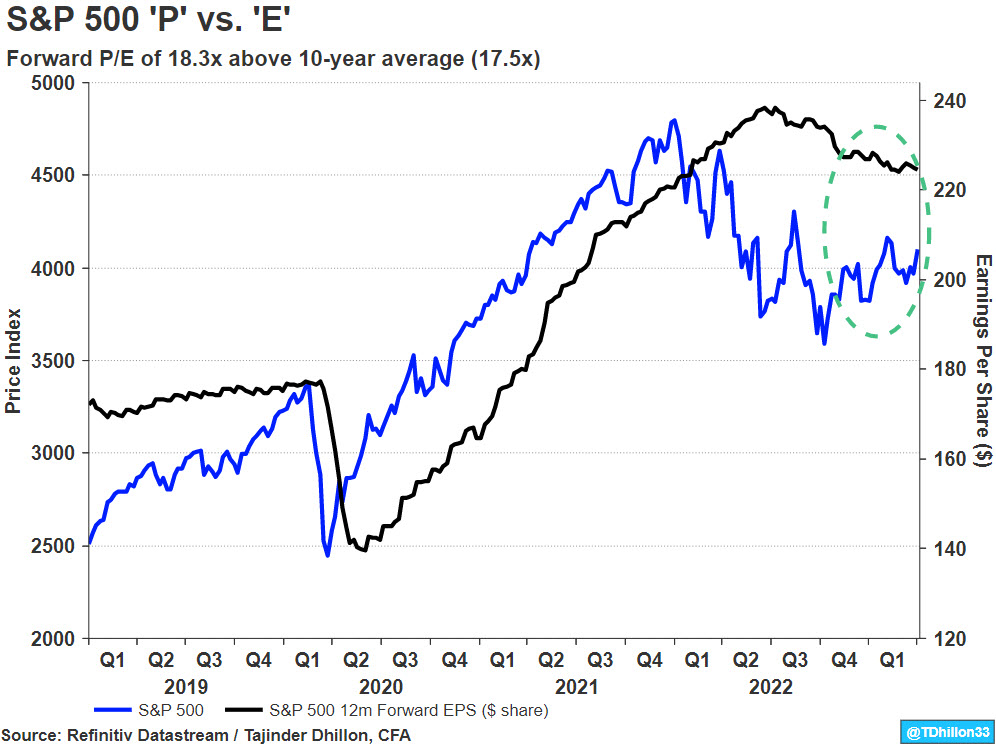

As you can see from the daily chart of the S&P 500, we’re testing the same 4,200 line coming into April Earnings as we did in January Earnings. Notice though the huge boost we had from the banks as earnings season began. Here we are, having just seen the problems the banks are having but, on the bright side – Trillions of Dollars in bailouts have already been deployed via the FDIC and the Fed.

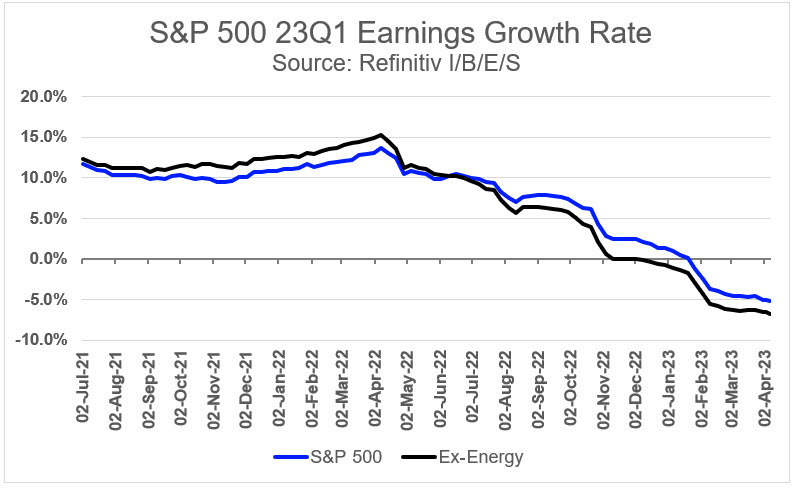

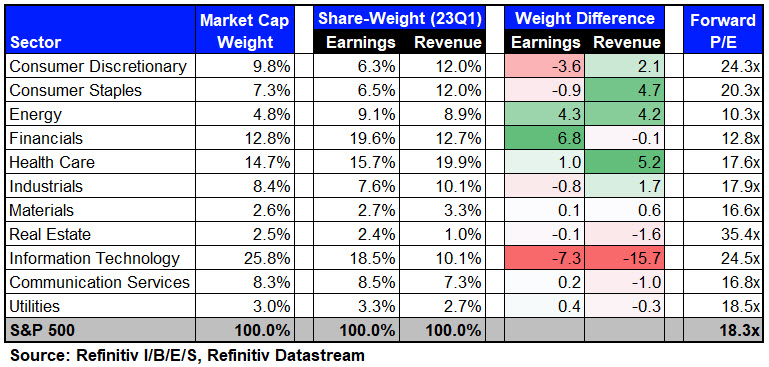

Expectations are certainly low as Analysts expect earnings in aggregate to have declined 5.2% in the first quarter of 2023 from the year-ago period, marking the second straight quarterly decline in U.S. earnings, or what we would certainly call a “Profit Recession.”

Q1 aggregate earnings have declined by 11.5%, to $419.1Bn from its high watermark set in 2022 Q2, when the index achieved $473.5 billion in earnings. Q1 earnings growth is forecasted to be the lowest y/y growth rate since 2020 Q3. Expectations for Q2 are also down 4% from last year – not really that good, is it?

Revenue growth has also been muted, with only two-thirds of reporting companies topping sales estimates so far. The Banking sector, which usually kicks off the earnings season with a bang, has been hit hard by the recent crisis and may face more challenges ahead. On the other hand, some sectors such as Media and Technology may benefit from recent changes in the landscape – especially hosting services due to massive AI traffic in Q1.

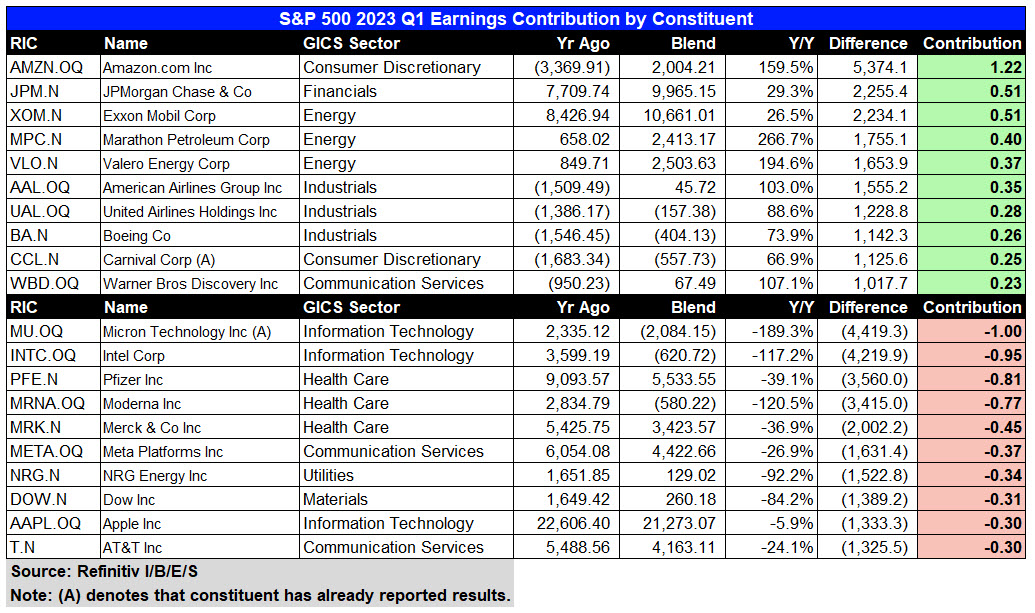

Here’s a glance of what’s expected from the top 10 winners and losers in the S&P 500 components in terms of earnings growth/shrinkage – it’s skewed very much to the downside, unfortunately:

Investors will be looking closely at the earnings guidance and commentary from different industries to gauge the health and outlook of the overall economy. The S&P 500 is priced close to perfection, having risen nearly 6% in the past month – so any negative surprises or disappointments could trigger a sell-off as we enter the once reliable “Sell in May, go away” downturn. On the flip side, any positive surprises or upbeat outlooks could provide some support and momentum for the index to break above the 4,200 line and reach new highs – it’s really too early to tell but we’re still loving our hedges!

Financials are a huge wildcard as we have not yet seen the true extent of the damages. The good news is SVB has been dissolved before they could report massive losses that would have knocked the entire S&P 500 down 20% in earnings – that’s why they had to wrap things up so quickly. Hopefully, they have managed to sweep other bank losses under the rug or, in the very least, kicked the Financial can down the road to another quarter. Aren’t Kleptocracies fun?

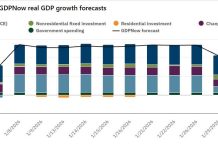

Uh-oh! I haven’t used that image since 2008. Sometimes I don’t realize how worried I am until I decide to use a certain graphic…

I did realize yesterday, as we started the Portfolio Reviews, that I felt it was a good time to cash out. I’m trying hard to keep an open mind but there are a lot of lights flashing and we’re about to cross the tracks – we should not be doing it in slow-moving vehicles.

If we are going to be saved it will have to be the IT Sector and that’s where AI is living so all hope is not lost – yet. Still, notice the fair value of the S&P remains right where we drew it on our 5% Rule™ Chart over 2 years ago, when we predicted 4,000 for the end of 2022 – taking into account Covid, Supply Chain Issues, Inflation, Higher Rates, etc.

We did NOT take into account the War (hadn’t happened yet) or the SVB collapse but we did expect China’s Real Estate to collapse and that hasn’t happened yet – so kind of balances out so far. We also took into account that the Government can’t afford to keep stimulating the economy and we expect a down year in 2023 overall with at least a 10% drop at some point – another good reason to cash out and wait a bit.

Speaking of earnings:

Morgan Stanley just dropped its first-quarter earnings, confirming once again that investment banking is still in the doldrums for Wall Street powerhouses.

-

- Profit fell 19% from one year ago, to $2.98 billion. That amounted to $1.70 per share, beating analyst expectations.

- Revenue was $14.52 billion, down 2% from a year ago, but beating the $13.97 billion expected by analysts polled by FactSet.

- Investment-banking revenue fell 24% from a year ago to $1.25 billion in the first quarter.

- Trading revenue fell 13%.

- The bank got some help from its wealth-management business, where revenue rose 11%. The unit accounted for about 45% of total company revenue in the quarter.

Be careful out there. Beige Book this afternoon (during our Live Webinar!).