And we’re out!

And we’re out!

We’ve been discussing whether or not to go into Year 4 with the same Member Portfolios as we usually cash out when we double but, for our Oct 2019 set, I had decided we would teach the lesson of what to do AFTER we doubled and Covid hit and we doubled again and doubled again an now that’s all getting a bit boring while, at the same time, the markets are getting more scary so it’s a nice time to CASH!!! out and reassess and start again with fresh portfolios in May.

As I’m doing our final Long-Term Portfolio Review, I’m highlighting the stocks we’re going to want to buy right back in the new portfolios as we switch our lessons back from Managing Wealth to Building Wealth again.

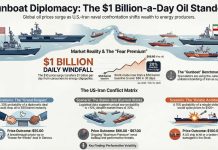

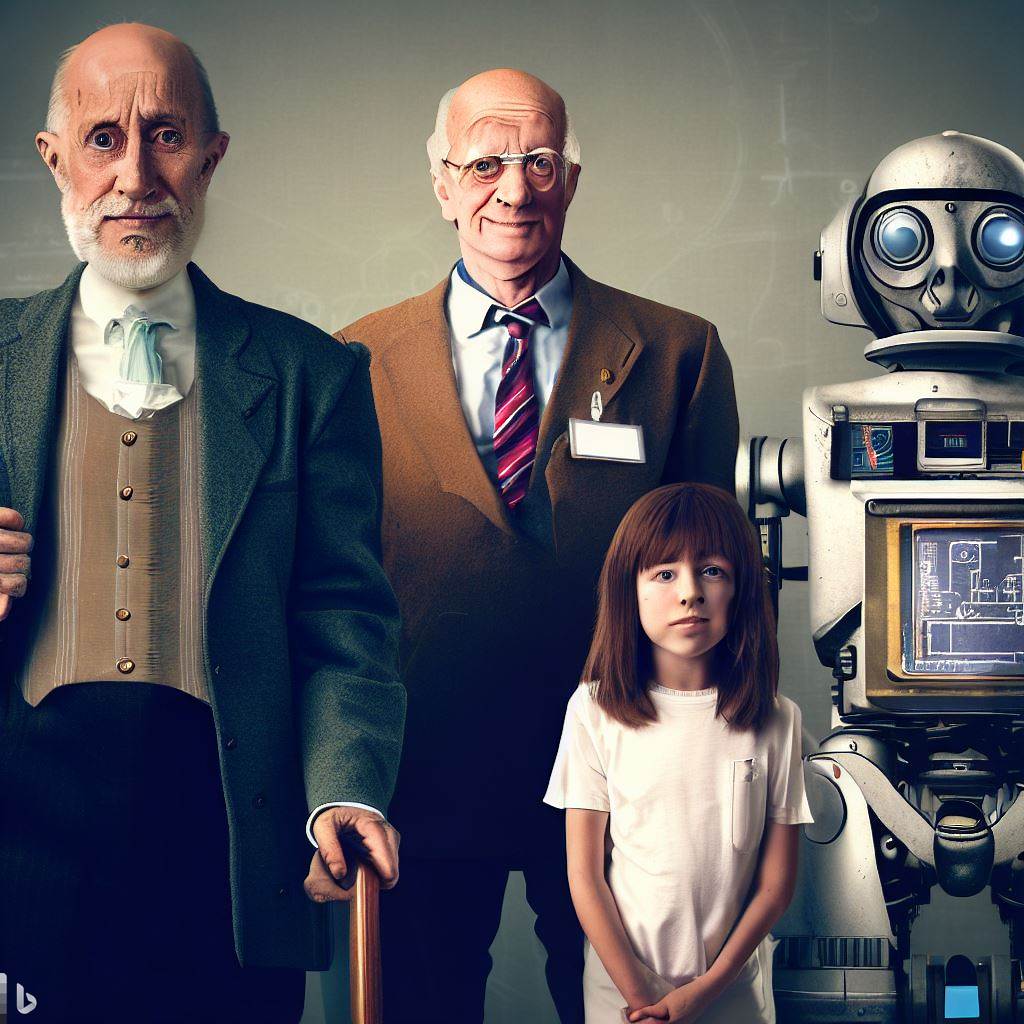

Our premise for 2023 – even before the banking crisis – was that we’d end the year between 3,600 and 4,000 on the S&P 500 and we’re currently at 4,150 – so a good 10% correction lies ahead of us – why risk it? The World is changing fast – in fact, I made the above picture using Bing in 10 seconds – our investing needs to change with the times as well.

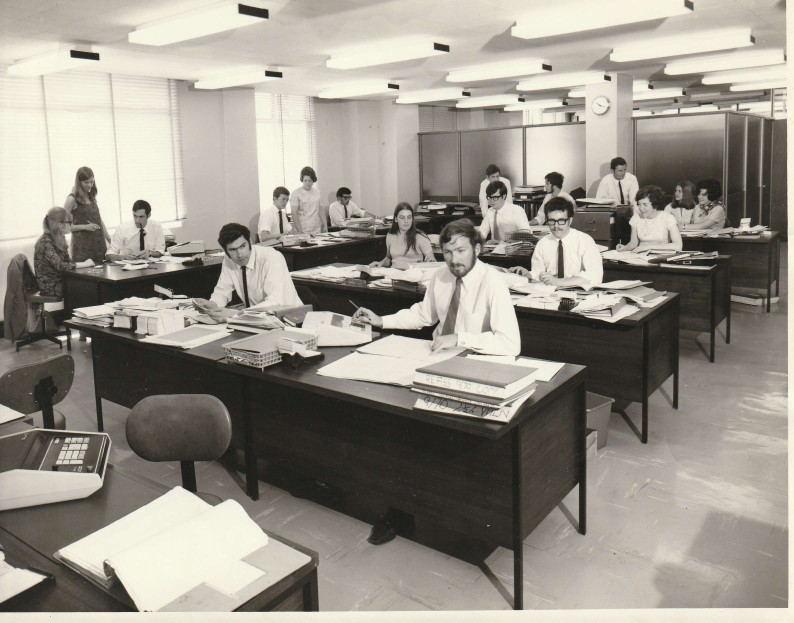

AI will eventually eliminate MOST jobs. Yes MOST jobs. Will it create new jobs? I’m not so sure. My father started out as an actuary in an accounting firm in the 1960s (he was born in 1936) and businesses had entire floors of these guys hand-writing spreadsheets and doing math all day.

AI will eventually eliminate MOST jobs. Yes MOST jobs. Will it create new jobs? I’m not so sure. My father started out as an actuary in an accounting firm in the 1960s (he was born in 1936) and businesses had entire floors of these guys hand-writing spreadsheets and doing math all day.

One day, they rolled in this computer the size of an entire office that ran on punch cards and handed my Dad the manual (there were no people with experience at all to teach) and said “See if you can figure out how to use this thing“. The thing about punch card coding is that there are hundreds of cards in a stack and, if you make one mistake, you have to redo the whole thing – so my Dad learned to write very clear, very tight, almost flawless code and he became a great programmer.

Notice everyone else who used to work there is gone! And that’s pretty much how automation works – it’s hard to predict what will happen other than DISRUPTION, disruption WILL happen! Like their punch-card grandparents, AI will likely lead to a revolution in productivity that will propel the World to new heights (if we survive climate change, of course) but it will be very chaotic along the way.

The Chinese symbol for “Crisis” is a combination of the symbols for “Danger” and “Opportunity” and we need to be well aware of both as things begin to change.

The Chinese symbol for “Crisis” is a combination of the symbols for “Danger” and “Opportunity” and we need to be well aware of both as things begin to change.

The biggest difference between the computer revolution of 1965-1985 is that we were not huge consumers in the 60s – nothing like we are today. In fact, the entire consumer society was in the process of being built (and check out the very excellent “Century of the Self” documentary about how this happened). In 1965 (I was 2) we had one car for the family and all my toys fit in a box and the kitchen for example, was missing, well everything:

I’m keenly aware of this because my Grandparents, who lived in England, had what we had in the 60s in 1985 – which was a stove, a small fridge and a sink. They did add a garbage disposal to the sink, which I guess made it easier not to have a dishwasher. Well, Grandpa had a dishwasher but I called her “Grandma.”

Our whole lives got like our kitchens with tons of useful and not useful gadgets and electronics so of course all those actuaries found other work, because everyone wanted more stuff (so many sales and marketing jobs!). When my Grandpa Max died at 96 in 1999, he had a very nice tea set and lots of fine art and fantastic furniture and a Bang & Olufsen TV set was about the only thing he owned that needed to be plugged in (it was kick-ass, though).

Our whole lives got like our kitchens with tons of useful and not useful gadgets and electronics so of course all those actuaries found other work, because everyone wanted more stuff (so many sales and marketing jobs!). When my Grandpa Max died at 96 in 1999, he had a very nice tea set and lots of fine art and fantastic furniture and a Bang & Olufsen TV set was about the only thing he owned that needed to be plugged in (it was kick-ass, though).

I wonder, in retrospect, if my Grandfather’s general disdain for electronics – to the point where he hid his only machine in a lovely wooden cabinet – was a rebuke of my Father, who chose to go to America and embrace the modern age that was thrust upon him?

When my Step-Father died in 2008, my Mom and I had to go through a garage that looked like the Sharper Image had merged with Best Buy and Polaroid and they put the whole thing in the Hammacher Schlemmer catalog to make sure there were no gadgets that had been overlooked.

I think these days we have enough stuff and the jobs that become obsolete won’t need to be replaced – as the world already has what it needs. The issue then becomes what do we do with Billions of people who simply don’t need to work anymore? The bigger question we need to start asking ourselves is not just how to adapt to this change, but how to distribute the wealth and resources that we have more fairly?

It’s not just about reacting to the latest advancements in AI and automation. We must also consider the broader societal implications of these changes. As more jobs become automated, we may see increasing inequality and social unrest. It’s up to all of us, as investors and citizens, to work towards solutions that ensure everyone benefits from the gains of technological progress.

It’s not just about reacting to the latest advancements in AI and automation. We must also consider the broader societal implications of these changes. As more jobs become automated, we may see increasing inequality and social unrest. It’s up to all of us, as investors and citizens, to work towards solutions that ensure everyone benefits from the gains of technological progress.

We already live in a world where a few individuals hold more wealth than entire nations, and as more jobs become obsolete, this gap is only going to widen. We need to start thinking about how we can create a more equitable system where everyone has access to basic necessities such as food, shelter, and healthcare, regardless of whether they have a job or not.

The good news is that we already have the technology and resources to create such a world. It’s just a matter of political will and collective action. By investing in Education, Healthcare, and Infrastructure, we can create a society that is not just sustainable but also more humane and equitable.

As we move forward into this this next era of rapid technological advancement, it’s crucial that we remain vigilant and adaptive in our investments. The lessons of the past tell us that disruption is inevitable, and with it comes both dangers and opportunities.

In the end, investing is about more than just making money. It’s about building a better future for ourselves and our communities. So let’s approach the markets with a clear-eyed perspective, and let’s use our resources to create a world that is more just, equitable, and sustainable for all.

And with that, we’re out.

By the way, the park image is Starfleet Academy in San Francisco but the image above is Dubai today: “Don’t dream it – Be it!”