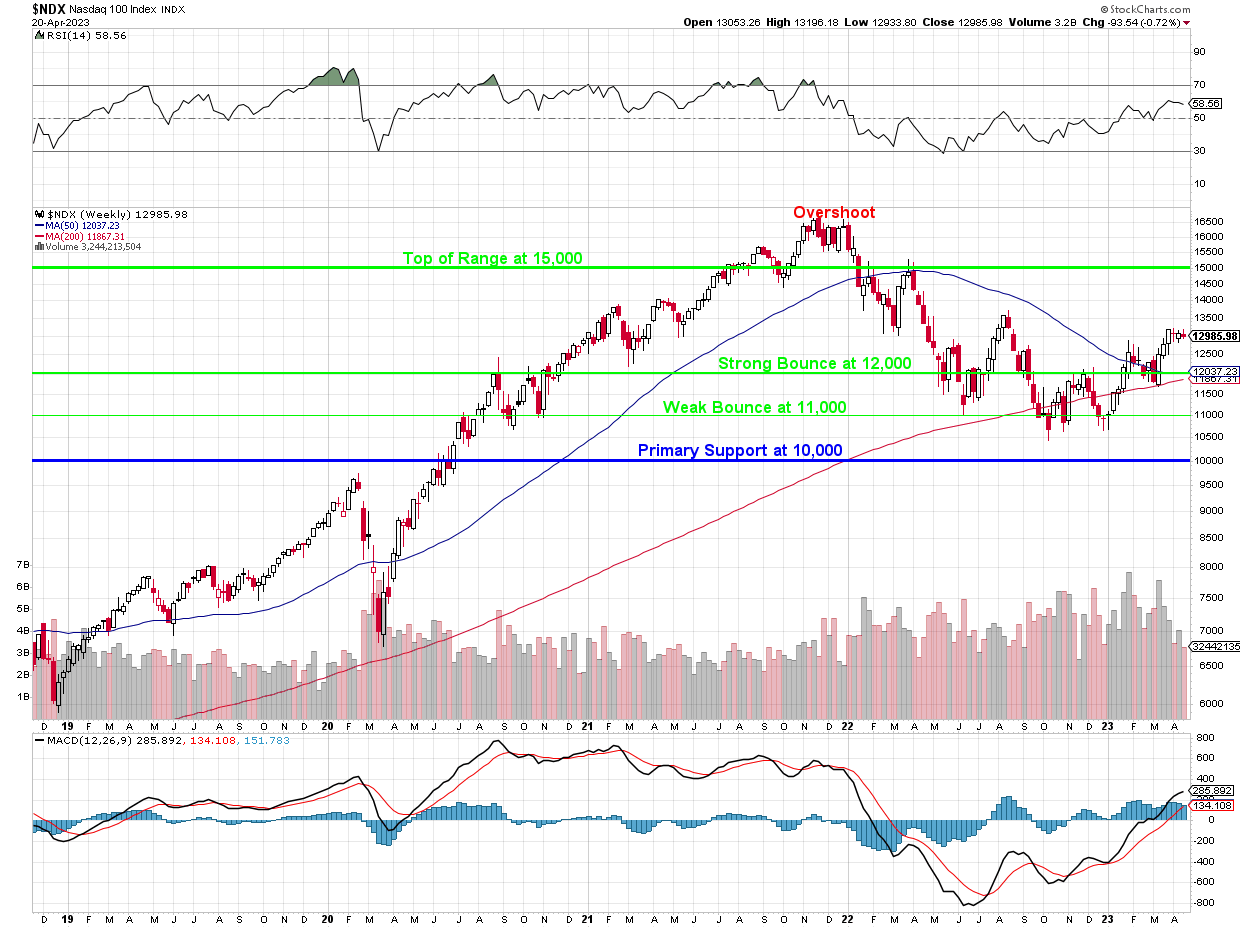

We are stuck below 13,000 on the Nasdaq:

Keep in mind this is a weekly chart so this is weak 4 at the 13,000 line and that’s not an attractive look after week one of earnings. Hope springs eternal as we’re heading for week 2 with about 30% of the S&P 500 reporting next week. There has certainly been more red than we like to see on the Earnings Calendar. Out of 118 reports this week, 42 companies had misses and/or lowered guidance – that’s 35%!

It’s too early to draw conclusions but we concluded it’s a good time to cash out and start with fresh portfolios in a couple of weeks – once we have a better handle on where things are going.

Speaking of new portfolios, I’ve been asked to do an old favorite – the Income-Producing Portfolio. This is a portfolio similar to what we have in our Hedge Fund, which seeks to pay out 2% per quarter without lowering the principle balance. We will start it with $150,000, which is about half of the average American’s retirement savings.

Speaking of new portfolios, I’ve been asked to do an old favorite – the Income-Producing Portfolio. This is a portfolio similar to what we have in our Hedge Fund, which seeks to pay out 2% per quarter without lowering the principle balance. We will start it with $150,000, which is about half of the average American’s retirement savings.

For example AT&T (T) had disappointing earnings yesterday but the analysis in our Live Member Chat Room led us to conclude it was oversold at $17.50. T pays a fat $1.11 annual dividend, which is 6% if we buy it for under $18 and our goal is to collect 2% per quarter so here’s how we make that work with some options enhancements:

-

- Buy 1,000 shares of T for $18 ($18,000)

- Sell 10 T 2025 $17 calls for $2.40 ($2,400)

- Sell 10 T 2025 $17 puts for $2 ($2,000)

That drops our net cash outlay to just $13,600 ($13.60/share) so now the dividend is at our 8% target. In a Portfolio Margin Account, the short puts require $3,256 in margin and they obligate us to purchase an additional 1,000 shares at $17 if T fails to hold $17 into January of 2025. That would give us 2,000 shares at $30,600 total, which would be $15.30/share – a 15% discount to the current price – that’s our worst case.

Our better case is T stays over $17 and, on top of the 2% we’re drawing out each quarter (at a low tax rate too!), we will make $3,400 (25%) when we cash out at $17,000. Of course, those who have followed our recent portfolios know that, when we do get to the end of our first two years, we simply sell more puts and calls, which further reduces our basis and boosts our returns!

If we can make 25% on T every 2 years WHILE drawing an income – then in 8 years what will happen? We will have gotten all of our money back from the investment and we’d STILL own the stock and then, for the next 8 years, we could buy another stock (or just double down on T) and DOUBLE our income stream and DOUBLE the returns for the next 8 years.

So it’s not just for retirement because, if you follow that pattern and make 12.5% on average for 32 years (even AFTER taking your 8% income), reinvesting your remaining returns – then $13,600 in 2023 becomes $589,412 in 2055. We’re going to do that with an entire portfolio for you!

So it’s not just for retirement because, if you follow that pattern and make 12.5% on average for 32 years (even AFTER taking your 8% income), reinvesting your remaining returns – then $13,600 in 2023 becomes $589,412 in 2055. We’re going to do that with an entire portfolio for you!

And, by the way, if you have children/grandchildren – why not set up accounts for them now? You are allowed to gift them EACH $16,000 per year tax free – it’s one of the most under-utilized tax inheritance loopholes there is. $16,000 now, using that strategy, is $700,000 in 32 years – and that’s if you only do it the one time. Not only that, but it would pay them 2% ($320 per quarter in year one, $14,000 per quarter in 2055 as the principle grows) if you use our portfolio strategy. Why wait until you die to insure your children and grandchildren have a comfortable future?

While it may be a bit of a rough patch in the markets right now, our Income Portfolio may be just the ticket to steady and reliable returns for the long haul.

Have a great weekend,

-

- Phil