$100Bn in outflows!

$100Bn in outflows!

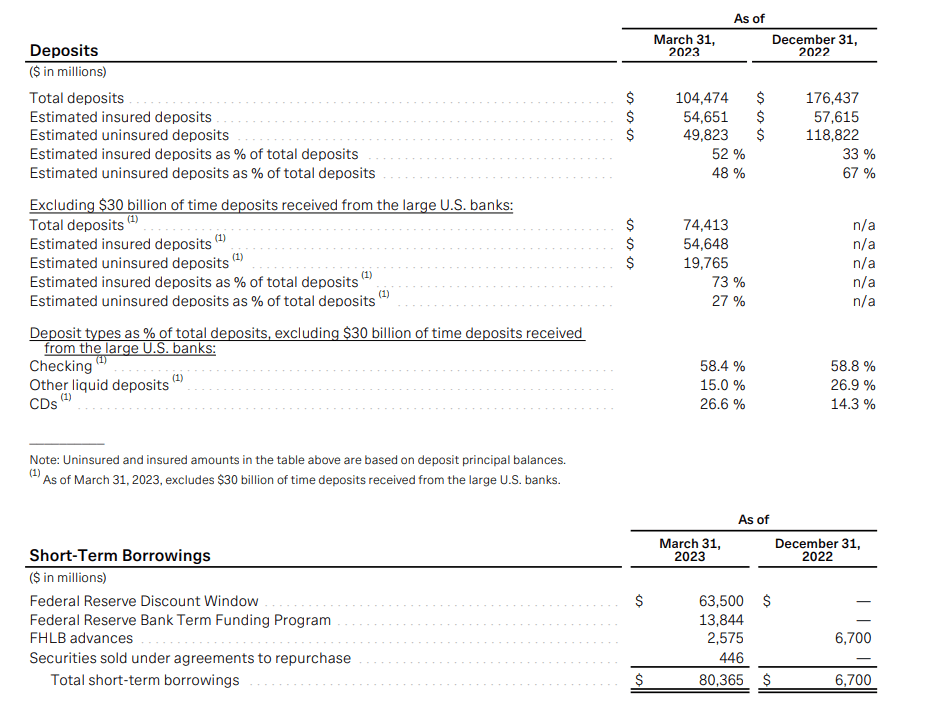

That’s what First Republic Bank (FRC) reported for Q1 “Earnings” (or lack thereof) last night. Profits were down 33% to $269M but that doesn’t tell the whole story as the bank was THEN forced to take on expensive loans from the Fed and the FHLB – and those will impact FUTURE earnings and HA! – I bet you didn’t think of that… This crisis ain’t over until it’s over and it ain’t over yet.

FRC intends to do it’s part by slashing head counts by 25% and they are even cutting Executive Pay – so you KNOW things are bad. The stock is down 20% at $12.50 this morning and it’s dragging a lot of financials back down with it but FRC was a bit unique. As noted by the WSJ:

“First Republic was once the envy of the banking business. The lender grew rapidly by catering to wealthy clients who wanted high-touch service that they couldn’t get from bigger banks. In a low-rate world, those customers were happy to leave large sums of money in accounts earning nothing. The bank also specialized in making huge mortgages, some at low rates, to rich people such as Mark Zuckerberg.

“The bank’s highflying business came back to earth after the Federal Reserve began raising interest rates. Wealthy customers, no longer content to leave giant balances in bank accounts earning paltry interest, began to move their money into higher-yielding alternatives.”

Like SVB, FRC had a lot of Silicon Valley clients and huge amounts of uninsured deposits. Had it not been for the FDIC and Fed stepping in after SVB collapsed, FRC would have been right behind them. As it stands now, the bank is just a shadow of it’s former self. The bank’s balance sheet showed $166.1Bn of loans as of Dec. 31, at amortized cost. A footnote said their fair-market value was $143.9Bn. The $22.2Bn difference was greater than First Republic’s $17.4Bn of total equity, or assets minus liabilities.

Keep in mind, this is their dire situation AFTER other banks chipped in $30Bn to shore up their balance sheets – they WILL be wanting that money back so FRC is not likely to survive and we do NOT know how many other banks will reveal issues like this so please, remain very cautious investing in this sector!

Banks with higher exposure to similar issues as FRC are more likely to face deposit outflows, funding pressures, credit losses, regulatory scrutiny, and investor skepticism. Banks that have a large amount of uninsured deposits, low net interest margin, high loan-to-deposit ratio, weak capital position, or significant exposure to troubled sectors or regions are also on our radar. Zions Bancorporation (ZION) just showed a lot of weakness as well as Comerica (CMA) – who also lost a lot of deposits.

On the other side of the valley, Tech Companies with dominant market share will likely meet earnings expectations, including those with moats around their business, like Apple, Microsoft, and cybersecurity stocks. If they don’t – that’s going to be a huge problem.

As you all know, I’ve developed a real issue with GOOG & GOOGL being counted as two companies when they are only two classes of stock and they not only double the impact of GOOG but, since each company is 10% of the Nasdaq – they make it seem like Nasdaq companies make 10% more money and that the Nasdaq itself is worth 10% more than it really is.

More to the point, GOOG/L is one of the biggest companies I am worried about as AI and specifically Bing is on the cusp of doing serious damage to Google’s golden search-revenue goose. It probably won’t show up in this earnings report but the company may feel the need to warn about it for Q2.

According to J.P. Morgan’s Global Markets Strategy team, earnings in the US are likely to exceed consensus expectations, but investors should still be underweight equities in the region. Strategist Marko Kolanovic stated that Q1 reporting season should see a lot of beats, with activity in most places being better than in the previous quarter. Kolanovic advised using any strength on the back of positive Q1 results as a good level to reduce from. Kolanovic also noted that stocks have benefited from a recent decline in volatility, but believes that low volatility is technical in nature and artificially suppresses perceptions of macro fundamental risk.

We’re keeping an open mind. We already cashed out our portfolios so we’re kind of hoping for a nice sell-off but, if that doesn’t come – it will be time to do some bargain-hunting – again.