Well, we certainly told you so.

Well, we certainly told you so.

Way back on October 27th, META was testing $100 and things certainly looked ugly but that was the day we decided to make META our Top Trade Alert. As I noted at the time:

“Mark Zuckerberg has bet his company and his fortune on the Metaverse and, so far, it’s sinking the ship but yes, building a new Universe is an expensive project but Facebook (the old company name) already has 3.71 BILLION people logging into this Universe – so they need a new place to visit to keep things fresh. 3.71Bn is the Monthly count and that’s up 4% over last year despite the release from lockdowns and Daily People are also up 4% at 2.93Bn.

As a new position for META, I’d go with:

-

- Sell 10 META 2025 $100 puts for $24 ($24,000)

Buy 15 META 2025 $80 calls for $43 ($64,500)

Sell 10 META 2025 $130 calls for $23 ($23,000)

- Sell 10 META 2025 $100 puts for $24 ($24,000)

That’s net $17,500 on the $75,000 spread that’s $30,000 in the money to start and, as noted above, once META bounces back, we can start selling calls for income. Even if we just sell 5 of the March $120s for $7 ($3,500), that’s nice and we can’t get burned and we just keep rolling them along. The only reason we’d need to roll them is if our $75,000 spread is in the money, right.“

We had a rough start (though it made it easy to fill the trade) for a couple of weeks as META fell to $88.09 but it was smooth sailing once the rest of the market began to agree with our valuation. Our entry was very conservative and, this morning, META is back over $230 on earnings – $100 over our goal in just 6 months – so congratulations to all who played along.

As of yesterday’s close, the 2025 $100 puts were down to $5 ($5,000) and the $80 ($140)/130 ($99) bull call spread was net $41 and that’s $41,000 on the 10 that were covered and $70,000 on the 5 2025 $80 calls that were not covered. That puts our net $17,500 entry up to net $106,000 – up $88,500 (505%) in six months!

Options allow us to make amazing returns on what are, essentially, conservative plays. Our downside risk was owning META at net $117.50 and our valuations indicated that was still too low. The biggest risk we took was not covering 5 of our longs but that turned out to be well worth it as FB stormed past our goal.

Much as we love the fact that they’ve exceeded our expectation, we won’t be chasing META in our new portfolios as Q1 results indicate a mixed performance for the company overall. While META beat revenue expectations with $28.65Bn, an increase of 3% YoY, and an increase of 6% YoY on a constant currency basis, its net income decreased by 24% YoY to $5.71Bn. The company’s operating margin also decreased from 31% in Q1 2022 to 25% in Q1 2023. Mark Zuckerberg expressed satisfaction with the company’s performance and growth in its community.

Meta’s user base continues to grow, with daily active people (DAP) and monthly active people (MAP) increasing by 5% YoY. Facebook daily active users (DAUs) increased by 4% YoY, while Facebook monthly active users (MAUs) increased by 2% YoY. However, the average price per ad decreased by 17% YoY in Q1 2023 – a problem that is plaguing the industry.

The company incurred significant restructuring charges of $621M (12% of profits) in Q1 2023, and it announced further planned layoffs to reduce its company size by approximately 10,000 employees across the Family of Apps and Reality Labs segments. The company expects to incur total pre-tax severance and related personnel costs of approximately $1 billion, of which $523 million was recognized during the first quarter of 2023.

Overall, Meta’s Q1 2023 results show both positive and negative trends for the company, with strong revenue growth and user base expansion offset by declining net income and increasing costs and expenses. The company’s restructuring efforts and planned layoffs indicate the strategic shift and a focus on efficiency announced by Zuckerberg as well as solid, long-term growth.

Keep in mind that’s 2,000,000,000 DAILY users! Monthly there are 3Bn people logging into Facebook/META. If the company can realize just a 10% improvement in engagement by adding AI – it could quickly add $3Bn to the bottom line (+10%) and cutting back on R&D can drop another $5Bn (16%) easily to the bottom.

Those numbers were all there 6 months ago, when we built our investing premise for META and on Nov 3rd, our Top Trade was GOLD, Dec 6th was SIG and Jan 24th was BBAR – all huge winners already because we are PATIENT and we wait until we are very sure to send out a Top Trade Alert.

Meanwhile, in the Macro World, GDP just crashed with Q1 coming in at 1.1%, from 2.6% in Quarter 4, so the economy is growing 57.7% SLOWER than was last reported as Consumption continues to crash. Leading Economorons, including the ones at the Fed had expected 2.3% growth – so off by more than 50% is actually closer than usual for these idiots.

Growth in the first quarter was dragged down by weakness in Housing and Business Investment, both of which are heavily influenced by interest rates. Spending slowed as the quarter progressed, however, and forecasters warn that it could weaken further amid headlines about Layoffs, Bank Failures and warnings of a possible Recession.

Growth in the first quarter was dragged down by weakness in Housing and Business Investment, both of which are heavily influenced by interest rates. Spending slowed as the quarter progressed, however, and forecasters warn that it could weaken further amid headlines about Layoffs, Bank Failures and warnings of a possible Recession.

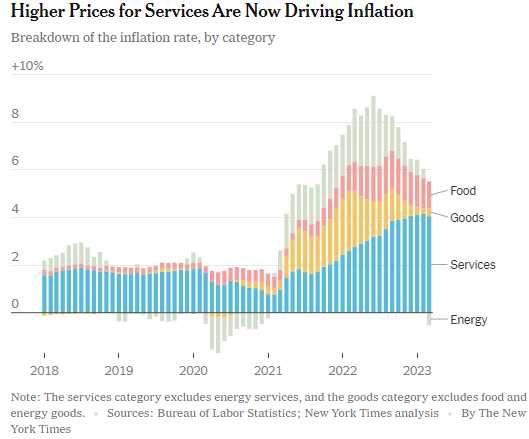

Inflation remains high after two years, though it appears to be slowly cooling down as supply chain issues are being resolved and the Economy is slowing. While the initial inflation spike was due to pandemic-related supply chain disruptions and the increased demand for goods, a second trend was the rise in service costs due to the higher demand for services like childcare and tutoring. Rising wage growth added to the inflationary pressure, prompting the Federal Reserve to raise rates – their next rate decision is coming on Wednesday.

Tomorrow we’ll get the Personal Income and Spending Reports as well as PCE Prices, the Chicago PMI and Consumer Sentiment so busy, busy to end our week.