Just when we thought it was safe to go back in the water…

Just when we thought it was safe to go back in the water…

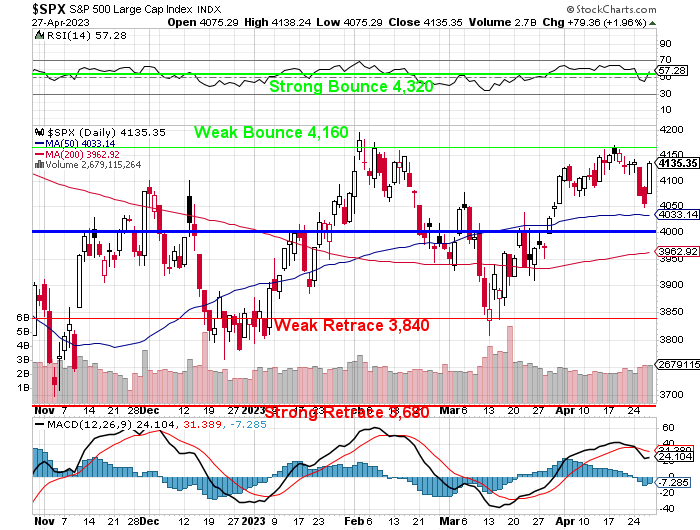

The Dollar has come flying up a full point off Wednesday’s lows and NOW it looks like a proper rally as the S&P 500 is up 1.5% off off Wednesday’s lows (4,080) as well. Of course, on the other hand, NOTHING looks like a “proper” rally when 7 days of selling are turned around by one day of buying:

This is most likely end-of-month window-dressing and you KNOW fast turnarounds like this aren’t very helpful as it’s like rebuilding your Jenga tower with half as many blocks. Sure it LOOKS as tall as it was before but now you have no foundation and it won’t take much of a nudge for the whole thing to come tumbling down again…

Earnings have not been that bad and we were mostly worried about Bank Earnings and it is amazing what a difference a couple of Trillion Dollars worth of bailouts can do for a sector. The question now is whether all that stimulus is going to be inflationary but, if we can make it past the Fed next week – then it’s certainly going to be time to start buying again.

We have some good data coming up in 30 mins (8:30), so we’ll talk about that when it gets here. Meanwhile, with the Fed meeting ahead next week, recent data suggests that the U.S. economy is still growing at a moderate pace, but it has slowed down from the previous quarters due to Supply Chain Disruptions, Labor Shortages, still-high Inflation and tighter Credit. The Labor Market is still very tight and Consumer Spending is still resilient, but Industrial Production faces headwinds from rising costs and lower demand.

A rate hike at the next meeting is a near-certainty but the market has priced in no higher than 5-5.25% for the rest of the year while my target remains 6% before the Fed is actually done. It doesn’t seem like a big difference but the markets won’t like it one bit if the Fed indicates they are not done next week.

A rate hike at the next meeting is a near-certainty but the market has priced in no higher than 5-5.25% for the rest of the year while my target remains 6% before the Fed is actually done. It doesn’t seem like a big difference but the markets won’t like it one bit if the Fed indicates they are not done next week.

Just to bring things full-circle… Do you see this building? It’s NYC’s own “Jenga Tower” and it just so happens to be the one Gustavo Arnal, the CFO of Bed, Bath & Beyond (BBBY), jumped off last September. The stock was at $9 that day – but he knew it was over – yet it still took over 6 months (this week!) before everyone else accepted the fact.

We have a bit of a Jenga market at the moment, but people refuse to accept it…

8:30 Data Update from Shel-Bot:

⊗The 8:30 Data Reports show mixed signals for inflation expectations. On one hand, the employment cost index and the core PCE price index both rose more than expected in Q1 and March, respectively, indicating that wage and price pressures are still elevated. The Fed’s preferred measure of inflation, the core PCE price index, increased 0.3% in March and 2.4% over the year, which is above the Fed’s 2% target1. On the other hand, personal income and spending both came in lower than expected in March, suggesting that consumer demand may be weakening as fiscal stimulus fades and inflation erodes purchasing power. Personal income rose 0.3% in March, below the consensus estimate of 0.2%, while personal spending was unchanged, missing the consensus estimate of -0.1%2.

Based on these data reports, the Fed may have to balance the risks of higher inflation against the risks of slower growth when it meets next week. The Fed has adopted an average inflation targeting framework, which means that it will allow inflation to run moderately above 2% for some time to make up for periods of below-target inflation3. The Fed has also signaled that it will soon raise its policy rate and end its bond purchases to prevent inflation from becoming too high and unanchored4. However, the Fed may also want to avoid tightening too quickly or too much if growth prospects deteriorate or new shocks emerge. Therefore, the Fed may have to adjust its policy stance and communication depending on how the data evolve and how inflation expectations respond.

While the month/month Core PCE may be down to 0.3% (3.6% for a year), we’re still up 4.5% from last year and that is still VERY HOT if you have a 2% target. Since Personal Incomes are not coming up, Personal Spending is coming down – that’s just math:

Remember that spike in Income was BAILOUT money, not actual income. REAL (adjusted for inflation) Personal Consumption was down 0.2% after being down 0.1% in February and it was negative in November and December as well. More importantly, the Core PCE Deflator increased 0.3% – a hotter pace than the trailing 12 months’ 2.4% so no, the Fed is NOT going to take this as a sign that their job is done.

Worker pay and benefit gains firmed during the first quarter with Employers spending 1.2% more on wages and benefits last quarter versus the prior three months, a slight uptick from an upwardly revised 1.1% increase in Q4. From a year earlier the employment-cost index advanced 4.8%, easing from the 5.1% gain at the end of last year. Also not really going the Fed’s way – even after all the rate hikes.

Not much to do today but watch the windows get dressed but next week should be very interesting.