Momentum Monday – Is Owning Microsoft, Apple, Nvidia Diversification and The Bull Market In France

Courtesy of Howard Lindzon

As a reminder, Marketsmith (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from Marketsmith (link).

Good morning…

I am on my way to New York from Amsterdam and excited to get home this week.

As always, Ivanhoff and I tour the markets on the weekend trying to get a handle on the price action and momentum.

Right now, the largest of large caps in technology are covering up for a lot of damage in indidual stocks. If you own Apple, Microsoft and Nvidia you may not be properly diversified but you are happy and beating almost everyone else. I continue to play defense with rates showing no signs of dropping, banks fail and the $VIX sits at 15. First Republic bank is now owned by JP Morgan , but Exxon is more like a bank as they pay interest on their debt of 3 percent and get 4 percent interest on their huge cash reserves

Ivanhoff and I walk through all this, restaurant leadership and some more ideas in this weeks Momentum Monday. You can watch this weeks episode right here on YouTube. It is easy to subscribe and if you do every Sunday you will get an alert when we post the show to YouTube.

Here are Ivanhoff’s thoughts:

The indexes remain resilient. QQQ is up 20% year to date. SPY is up 8%. And yet, participation hasn’t been widespread and very few breakouts have led to a follow-through. If you are underperforming the indexes ( I am), you should ask yourself the question – is the market really too thin or are you fishing in the wrong ponds? More importantly, are you chasing breakouts to new 52-week highs? Because they have not been working too well in this market. Most breakouts tend to work well in a typical bullish environment where a proper entry is followed by a 15-20% upside move. When you have a cushion like this, it is a lot easier to withstand normal pullbacks and even add to your position. The current market doesn’t fit the term “typical”. The indexes are rising, some industries are rising, and yet most typical breakouts are often immediately followed by quick shake-outs – quick and violent pullbacks hitting most stops. The one approach that still continues to work right now is buying dips in strong stocks to their 20, 50, and 200-day moving averages. They offer higher success rate and higher profit factors (reward vs risk taken). Don’t buy those dips blindly. Wait for a move above the previous day’s high. Keep in mind that the beauty and the challenge of the stock market is that as soon as enough people figure it out, it often changes again.

In the meantime, the earning season has led to some sizable moves. Big tech crushed the already lowered estimates. META and MSFT broke out to new 52-week highs. GOOGL and AMZN didn’t sell off and continue to set up. NFLX didn’t break down. TSLA tested its January earnings gap where it found buyers. Mega caps stocks are acting constructively and holding the indexes afloat. Three other trends that are standing out this season are notable strength and favorable market reaction to restaurants, homebuilders, and consumer staples earnings reports.

FOMC is on Wednesday (May 3rd). The expectations are for one last 25bps rate increase and confirming that the benchmark rates should remain around 5% until the rest of the year. We know the Fed is not going to be more hawkish than that. The odds are low that it is going to be more dovish than that either. Overall, I don’t really expect any surprises from this meeting. As usual, the market will be super volatile on Wednesday afternoon and we will learn about the actual market reaction the next day. Expected or not, those events can play the role of big pivots. Last week, we saw a quick pullback to QQQ and SPY’s 10-week moving average which ended up being a bear trap. The indexes closed strong near their highs of the week. Can a potential breakout next week end up being a bull trap? I wouldn’t be surprised so I will take things one day at a time and have an open mind.

Some extra links and charts here below…

There is a BULL MARKET IN FRANCE. I did not say ‘finance’, I said ‘France’. Imagine having to be nice to french people…the world and markets works in mysterious ways…

My pal Phil outlines how Junk Food and Obesity are at-all-time highs. Good for profits, bad for the nation methinks.

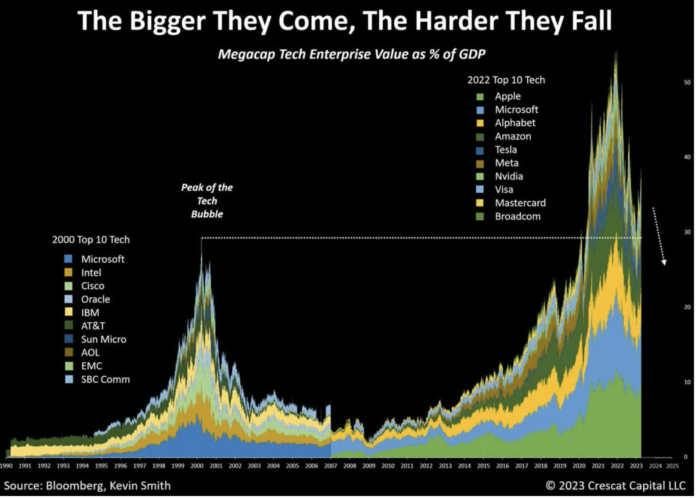

Will history repeat with ‘the bigger they come, the harder they fall’?

One could argue that this time, the oligopoly of tech giants maybe too big to totally collapse.

This weeks Stocktwits 25 momentum lists.

Have a great week.

PS – If you enjoy Momentum Monday, forward this email to a friend, and follow me on Stocktwits

Disclaimer: All information provided is for educational purposes only and does not constitute investment, legal or tax advice, or an offer to buy or sell any security. For full disclosures, click here.