This is why we love JP Morgan (seen here beating a poor person with his cane).

This is why we love JP Morgan (seen here beating a poor person with his cane).

It was the first bank we bought during this crisis because, rather than worrying about them being weak – you KNOW they will end up grabbing any assets that are worth having. JPM will also absorb FRC’s $13Bn in losses (and the FDIC will match) but they are getting $92Bn in Deposits, a $173Bn Loan Portfolio and $30Bn in securities. On top of that, the FDIC is “financing” $50Bn for JPM – which would have been enough to save FRC but HaHa – no takebacks!

Like JP Morgan, at PhilStockWorld we know how to take advantage of a good crisis and, on Friday, March 10th, as SIVB was collapsing, our knee-jerk reaction in our Live Member Chat Room was:

FAZ (3x anti banking ETF) has popped from $15 in Feb to $21.75 so call it 50% recently. A 10% drop in banks next week will give it a 30% pop ($28) and a 20% drop would be up 60% to $35 so, if you are overexposed to banks and need a hedge:

-

- Buy 100 FAZ June $21 calls for $4 ($40,000)

- Sell 100 FAZ June $30 calls for $2 ($20,000)

- Sell 10 JPM 2025 $110 puts for $9.25 ($9,250)

- Sell 10 GS 2025 $200 puts for $9.25 ($9,250)

That’s net $1,500 on the $90,000 spread and we’re betting on two of the biggest banks to survive whatever carnage this may be. JPM is at $131 and GS is at $328 – so a lot of buffer and the upside potential on a 20% drop in XLF is $88,500. Let’s put that in the STP just to show how it works out – using a hedge like this during a possible crisis.

The June $21 calls were our hedge and we took a quick profit when they topped out at $5 (as we expected they would), for a $10,000 profit and the short June $30 calls are already down to 0.30 ($3,000) for a $17,000 gain and the JPM $110 puts are now $7.50 for a $1,750 gain and the GS $200 puts are $7, for a $2,250 gain.

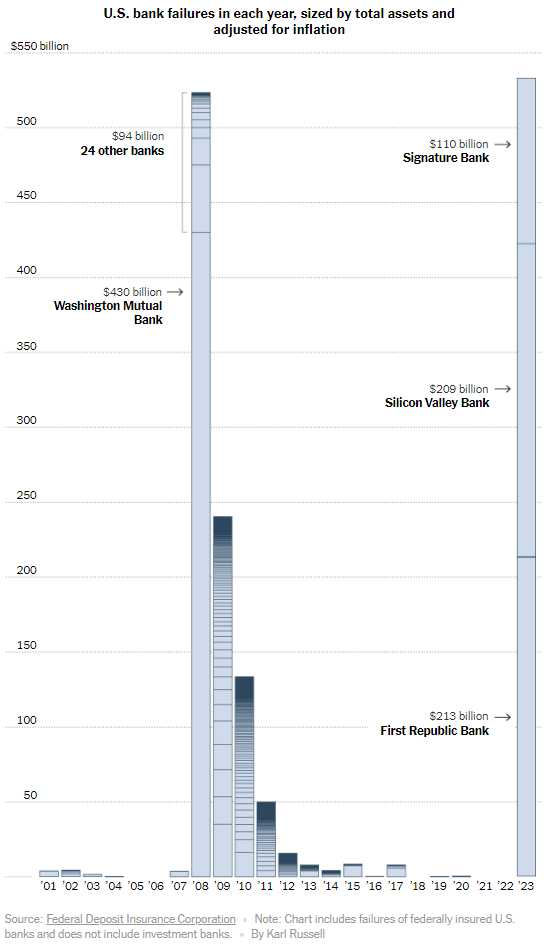

You can make that kind of money if you keep a cool head in a crisis but today heads may be too cool as the market seems to be taking the FRC failure with barely even a shrug – another mid-sized bank bites the dust and there will be a few more. Fun fact: The 3 banks that have failed (so far) this year, were bigger than the 25 that failed in 2008:

Still, the Trillions thrown in by the FDIC and the Fed to avert a full-scale crisis seems to have done the trick and we will see what the Fed has to say about the whole thing in their statement this Wednesday – and in Powell’s Press Conference right after.

There are still 105 Financials who will be reporting this week but that’s pretty much the end of it. Commercial Real Estate will be the other danger sector to watch along with Consumer Discretionary, of course:

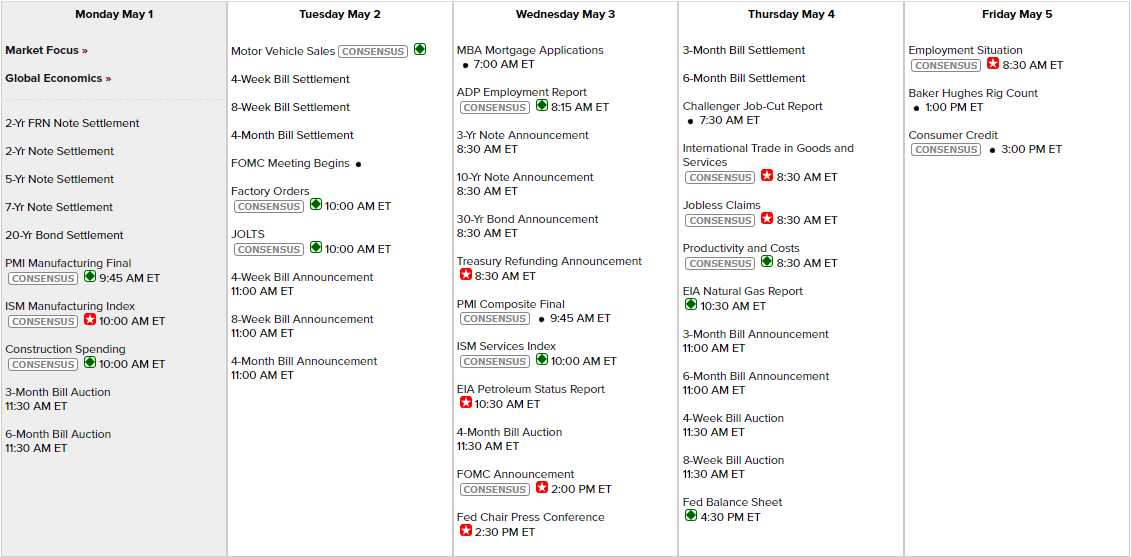

Other than the Fed on Wednesday, we’re getting right into the data this week with PMI, ISM and Construction Spending to wake us up this morning (but all after the open) and ten it’s Factory Orders and Jolts tomorrow. Ahead of the Fed is more PMI and ISM and Thursday it’s Productivity and short-term Note Auctions and Friday it’s the Big Kahuna – Non-Farm Payrolls and Consumer Credit will end the week.

Assuming nothing breaks this week, we get to go shopping next week with our brand new portfolios. As I’ve been updating our Watch List, I’m seeing lots of good stocks to buy and there’s no indications from earnings season that things are looking too pressured. As I’ve said, Commercial Real Estate is my biggest concern – which is what did us in in 2008 but, so far, that sector has been limping along without seeming too dire.

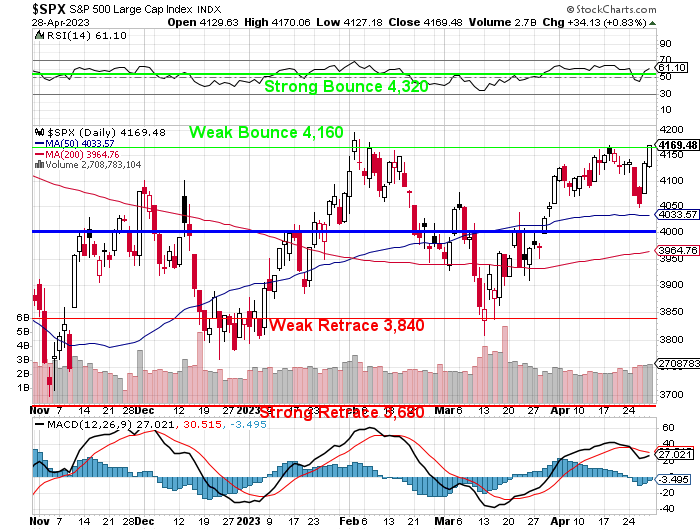

As you can see, we are back to testing the Weak Bounce line and, as long as the Fed doesn’t screw things up for us on Wednesday, we should have another 160-points to go – back to the Strong Bounce line at 4,320 – a level we haven’t seen since March of 2022.

Are we worried about missing out? Not really. Some things will be higher but, for example:

- AKAM was $120 last year, now $80

- BCS was $12 last year, now $8

- BLK was $850 last year, now $670

- BXMT was $32 last year, now $18

- C was $65 last year, now $47

- COF was $160 last year, now $97

- CMCSA was $50 last year, now $41

And those are just the first 3 letters of the Alphabet (also a good one to buy!). So there are plenty of stocks to buy and we’re in no hurry as long as the VIX is in the mid-teens and we are able to sell fat, juicy options against our positions.