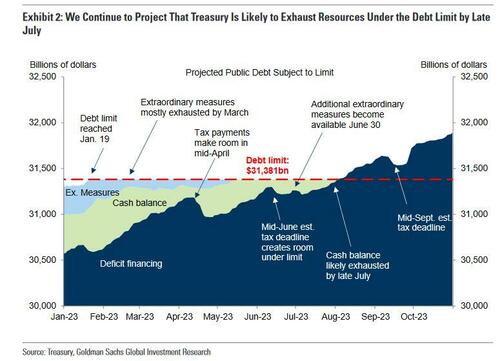

In a long-awaited update from Janet Yellen, shortly after the close, the Treasury Secretary sent a letter to Congress in which she said that as a result of the recent slowdown in tax receipts (extensively discussed here), the Treasury could run out of emergency debt-limit measures (i.e., hit the infamous X-Date) as soon as June 1 absent a debt-ceiling deal, a revision to her previous Jan 13 letter in which she said that it was “unlikely that cash and extraordinary measures would be exhausted before early June.” In other words, Congress has exactly one month to get a deal to raise the debt limit – which of course won’t happen without the market first plunging enough to prompt the extremely polarized chamber into action.

Here is the key part from the letter:

In my January 13 letter, I noted that it was unlikely that cash and extraordinary measures would be exhausted before early June. After reviewing recent federal tax receipts, our best estimate is that we will be unable to continue to satisfy all of the government’s obligations by early June, and potentially as early as June 1, if Congress does not raise or suspend the debt limit before that time. This estimate is based on currently available data, as federal receipts and outlays are inherently variable, and the actual date that Treasury exhausts extraordinary measures could be a number of weeks later than these estimates.

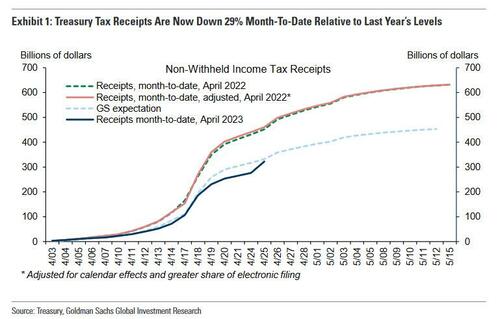

As a reminder, we have been tracking daily cumulative tax receipts which had fallen as much as 35% below last year’s levels…

… prompting banks to warn that a debt ceiling crunch could come far sooner than the expected X-date some time in late July/early August.

To be sure, Yellen admits that the X-date remains fluid, a function of the daily changes in tax receipts and outlays, and it is “impossible to predict with certainty the exact date when Treasury will be unable to pay the government’s bills” and Yellen will provide further updates to Congress in the coming weeks “as more information becomes available” but given the current projections, Yellen warns that “it is imperative that Congress act as soon as possible to increase or suspend the debt limit in a way that provides longer-term certainty that the government will continue to make its payments.”

Additionally, Yellen said that to avoid breaching the debt limit, the Treasury is suspending the issuance of State and Local Government Series (SLGS) Treasury securities: “SLGS are special-purpose Treasury securities issued to states and municipalities to help them comply with certain tax rules. When Treasury issues SLGS, they count against the debt limit.”

Such a move will deprive “state and local governments of an important tool to manage their finances”, which for a country that spends like a drunken sailor, is a move in the right direction.

Finally, as usual, Yellen ends by pleading with Congress to get a debt ceiling deal done as soon as possible:

We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States. If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests.

Needless to say, with the debt ceiling becoming the most controversial political topic and one which neither side is willing to compromise over, it is likely that nothing short of a market quake – similar to August 2011 – will be needed to prompt Congress into action.

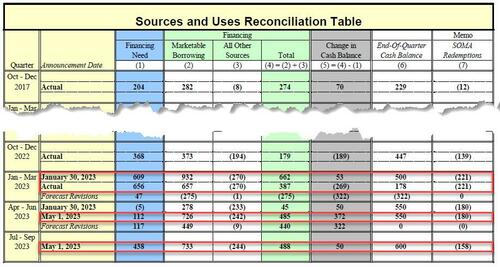

Separately, earlier today, the Treasury published its latest debt borrowing estimates for the April – June 2023 and July – September 2023 quarters.

Starting with the historical data, the Treasury notes that during the first calendar quarter of 2023, Treasury borrowed $657 billion and ended the quarter with a cash balance of $178 billion. This is a huge difference from the forecast made just three months ago, in January 2023, when Treasury estimated borrowing of $932 billion and assumed an end-of-March cash balance of $500 billion, a forecast which was prevented due to the lack of a debt ceiling deal. The $275 billion difference in privately-held net market borrowing resulted primarily from the lower end-of-quarter cash balance, somewhat offset by lower net fiscal flows.

Looking ahead…

- For the April – June 2023 quarter, Treasury expects to borrow $726 billion in new debt, assuming an end-of-June cash balance of $550 billion (up from the $178BN as of March 31).The borrowing estimate is $449 billion higher than announced in January 2023, primarily due to the lower beginning-of-quarter cash balance ($322 billion), and projections of lower receipts and higher outlays ($117 billion).

- For the July – September 2023 quarter, Treasury expects to borrow another $733 billion in net debt, assuming an end-of-September cash balance of $600 billion.

Similar to last quarter, the April-June 2023 forecast is unlikely to pan out if either Yellen’s forecast for a June 1 X-date is wrong (as the debt ceiling would remain in place and no net increase in marketable borrowing securities would take place until a deal is completed), or if Congress fails to get a deal done even if the X-date is crossed and the US is forced to compartmentalize spending.

That said, a debt ceiling deal will get done eventually, even if it means a market crash to get Congress to move, and the longer new debt issuance is delayed, the bigger the eventual burst in new debt to hit the market as Treasury, which as of today is roughly $32 trillion if there was no temporary barrier on new debt issuance.