Let the rumors fly!

Let the rumors fly!

The FOMC meeting begins today but the actual rate decision comes tomorrow at 2pm. Between now and then the market will react to any supposed leaks that come out of the meeting.

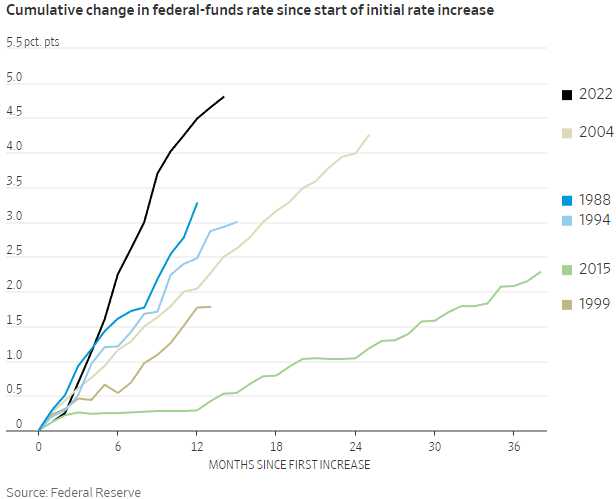

As you can see from the WSJ Chart, we are in the steepest tightening cycle the Fed has ever gone through and it’s also the most in total but, to be fair, 0.25% was an artificial fantasy of economic stimulus – this is like being surprised that ice melts when you take it out of the freezer – it is simply not the natural state of water.

The natural state of interest rates are more like 3.5% and, at the moment, we are only 1.25% over that. It just feels like a lot because we’ve been below 1% for so long we’ve gotten used to it. Our main concern about Q1 Earnings was that companies might not handle the adjustment well and would let their debts eat into their earnings but that has not, so far, been the case for most companies.

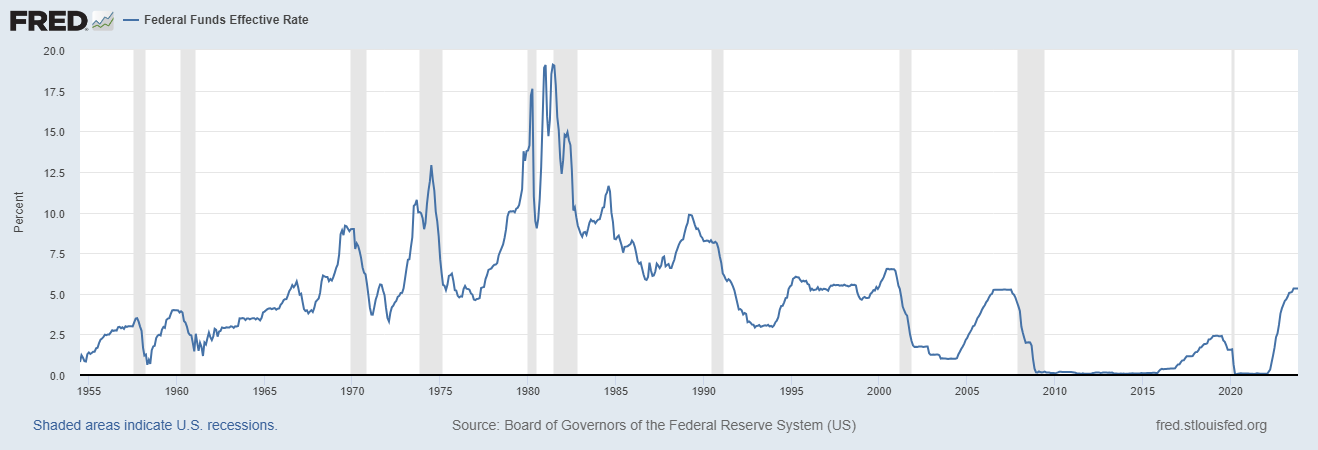

As you can see from the long-term chart, the Fed did raise rates back to 5% pre-Covid and we did not act like the World was ending then (even though it was about to) and they are simply going back to 5% now but 5% is where they got to BEFORE we popped the money supply by 300% and caused MASSIVE INFLATION – the kind we had to raise rates to almost 20% to calm it down in the late 70s/early 80s. This is NOTHING!

The Fed began raising rates from near Zero in March 2022 as inflation was topping 8% for the first time since the 1980s. Another quarter-point increase would lift the benchmark Fed Funds Rate to a 16-year high. Fed officials are aware that their communications around future policy actions can be as significant as individual rate changes. They will finesse carefully calibrated signals in their post-meeting statement and remarks by Fed Chair Jerome Powell at a news conference after the meeting ends on Wednesday.

Generally, Powell has been good for a market pop the day of his press conferences but things tend to fall apart after that – so we probably won’t start buying for our new portfolios until next week.

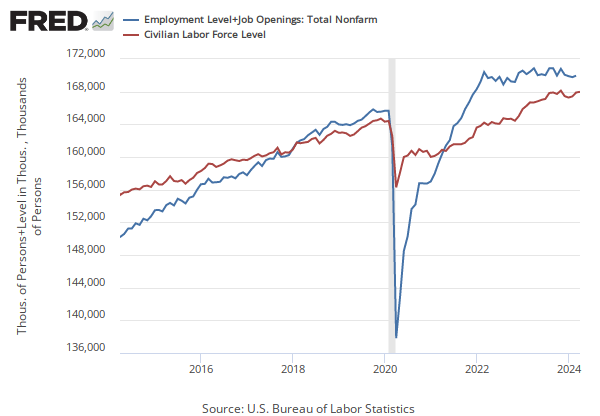

What the Fed will be looking carefully at is Jobs. We have too many of them at the moment by about 9.5M (which will be confirmed in Fridays Non-Farm Payroll Report). That’s 5.6% more jobs than we have workers and that’s a huge problem – one I’m sure you see the effects of whenever you are waiting for food to be cooked or for someone to help you at the store but it’s also keeping your washing machine from being delivered and it’s taking longer to build your new car or new home and it’s the main force driving inflation:

So the Fed has a mandate to maximize employment and to control inflation. Employment has overshot their goal by 5.6% and Inflation is still more than double their goal of 2% and it’s really not possible to increase the workforce without Immigration (we need 9.5M people) or maybe just having lots more babies (abortion already banned) who will join the work-force in 20 years or (GASP!) pay wages that encourage more people to enter the workforce.

Since none of those things are going to happen (other than the baby-growing idea, which takes 20 years although, combined with dismantling child-labor laws, the GOP may be onto something…), the best way the Fed can close that worker gap is to reduce the number of jobs required and, fortunately, destroying the economy is easy – you just have to keep raising rates until demand collapses!

Yes, that is their actual plan at the moment and I don’t see why they would be “done” raising rates with 9.5M jobs still unfilled and core inflation still over 4% – those are both fails for their dual mandates!

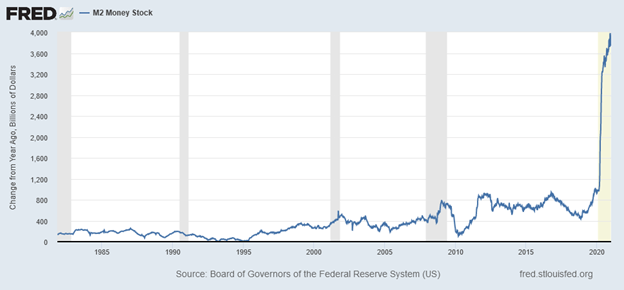

The market is not likely to be very happy if the Fed does not get a pause but, as I just said, the Fed wants an unhappy market that will pare away 9.5M job openings and the only thing they can really control is how high they set the Fed Funds Rate. None of this is going to do anything about the $3Tn they have floating around in the money supply – that will also put upwards pressure on inflation for years to come but, fortunately, most of that money ($4.5Tn – other counties gave them money too!) went to people who are already rich so, as long as they continue horde it – we’ll be OK.

The market is not likely to be very happy if the Fed does not get a pause but, as I just said, the Fed wants an unhappy market that will pare away 9.5M job openings and the only thing they can really control is how high they set the Fed Funds Rate. None of this is going to do anything about the $3Tn they have floating around in the money supply – that will also put upwards pressure on inflation for years to come but, fortunately, most of that money ($4.5Tn – other counties gave them money too!) went to people who are already rich so, as long as they continue horde it – we’ll be OK.

According to recent figures by the European Union’s statistics agency, Eurostat, Consumer Prices in the Eurozone were 7% higher than a year earlier in April, a pickup from March and more than three times the European Central Bank’s 2% target. However, the core rate of inflation – which excludes food and energy prices – edged down to 5.6% in April from a record high of 5.7% in March.

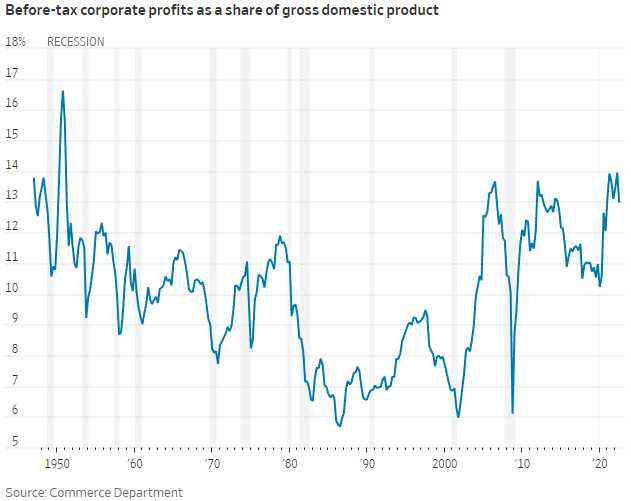

Some economists have noted that businesses are taking advantage of the situation and padding their profits, which is fueling inflation. Rising Wages were actually a lesser factor than rising profits and businesses are confident that Consumers will accept higher prices. This is largely happening because Consumers are aware of supply bottlenecks and higher energy prices.

Some economists have noted that businesses are taking advantage of the situation and padding their profits, which is fueling inflation. Rising Wages were actually a lesser factor than rising profits and businesses are confident that Consumers will accept higher prices. This is largely happening because Consumers are aware of supply bottlenecks and higher energy prices.

Economists also suggest that the lack of competition in the food sector, especially in distribution, is another reason for the surge in food prices. It appears that businesses, in some cases, are using our national crisis as an opportunity to boost their profit margins.

While it’s nice that our Corporate Masters (who are also in the Top 0.1%) are doing what they can to take all that nasty money out of circulation – there is the eventual question of “Can we afford it?” and, if they don’t take that into account – the customers eventually run out of money and their “improved margins” can be very short-lived as we fall into a Recession.

Those are the kinds of data cross-winds we will be paying attention to because it’s not just about WHAT the Fed does – but whether what they do ultimately makes sense for our Economy going forward.