Oil is below $70 this morning.

$80 was our official shorting line and my comment in the Morning Report of April 3rd was:

$80 was our official shorting line and my comment in the Morning Report of April 3rd was:

I do like Oil (/CL) as a short below the $80 line with tight stops above. The $80 line has been strong resistance all year with drops all the way back to $75 each time – so we just have to catch the right wave to make $5,000 per short contract – though I’ll be thrilled to see $77.50 with all this new excitement about the OPEC cuts.

Today the indexes should get a lift from the Energy Sector and 4,200 was the Feb high for the S&P 500 and 34,500 for the Dow but the Nasdaq is already over February’s 13,000 line and it’s the Russell that has the most catching up to do at 1,816, chasing the Feb high of 2,000.

Either the Fed tightens to stave off Inflation or the Energy Sector is wrong and Oil reverses or inflation just runs away again as we’re starting April at the Q1 highs – any way you slice it – it doesn’t seem like the indexes should be back at their highs ahead of Q1 Earnings Reports.

So be careful out there!

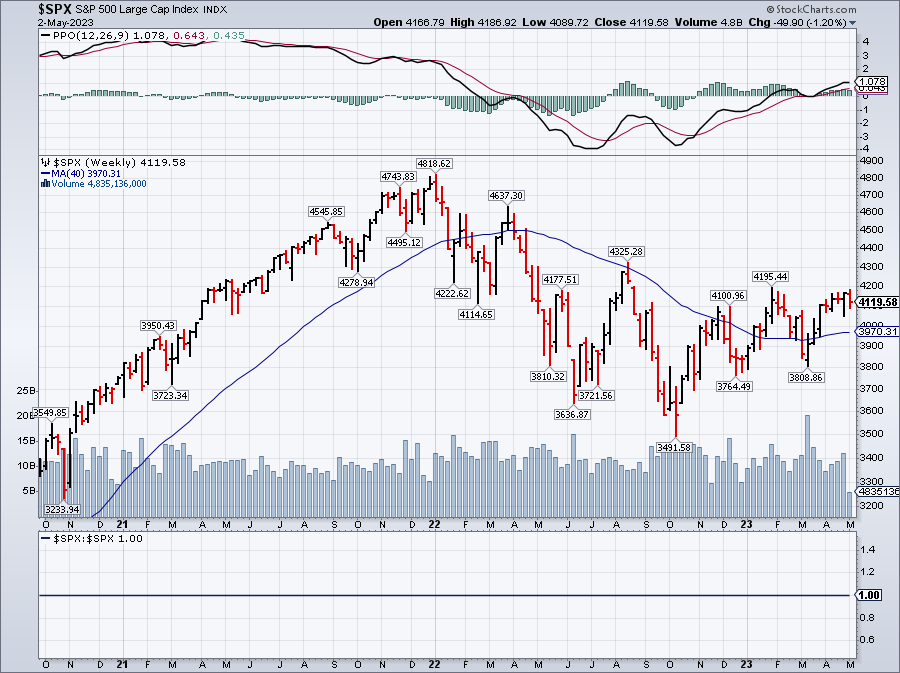

It’s been exactly a month and we haven’t really gone anywhere with the S&P 500 at 4,119, the Dow at 33,684, the Nasdaq at 13,113 and the Russell at 1,732. In fact, we haven’t gone anywhere in the entire past year as we topped out at 4,177 last May.

So this is really the top of the range we’ve been in for the past 12 months and, as I also said on April 3rd, the question AFTER earnings season is, did we do enough to justify breaking out to a higher trading range? Well, for one thing, very appropriate for the day – the Fed Funds Rate last JUNE was 0.75, now it’s 4.75 and by this afternoon it will be at least 5% – is that “better or worse” if you were at the optometrist?

Covid is kind of over, though we are on alert for the Arcturus Variant at the moment. Inflation peaked out at 9.1% last June and it seems to be around 6% now. There were 10.5M unfilled jobs and now there are 9.5M. But a pessimist might say that, since the Fed’s ENTIRE MANDATE is about Jobs and Inflation – they are both still out of control and the Fed is only about halfway done correcting the situation. In raw numbers…

On the down side, we did just have a major banking crisis and usually it takes more the 6 weeks for the effects to be felt in the broader economy, let alone for a full recovery. The FDIC and the Fed did quickly throw $2Tn at the problem and JPM could not possibly thank them enough but CS is still dead and UBS, who had to absorb them, is still teetering from that blow (Americans tend to forget to check what’s happening in the rest of the World, don’t we?).

That was yesterday that the banking index fell 6.27% so NOT RECOVERED DESPITE A $2Tn BAILOUT. The Banking Industry, the Fed and our entire Monetary System is, quite literally, a confidence game and, when people lose confidence – the game is over (see 2008 for a recent example).

Speaking of low confidence – getting back to oil – it has dropped by 13% since April 3rd, when it reached its highest level after OPEC agreed to cut output. Morgan Stanley just lowered their oil-price forecasts for the end of the year from $87.50 to $75. This is good for Inflation but Iron Ore has also slumped 17% this quarter so it’s more a case of Global Recession indicators than it is something to celebrate.

Our target for oil is $65 and we’ll see what happens when we get there. That’s going to very much depend on the Fed and a dozen other Central Banks who will make rate decisions and have statements in the next couple of weeks. All this uncertainty is why we went back to CASH!!! a few weeks ago. Isn’t CASH!!! relaxing?

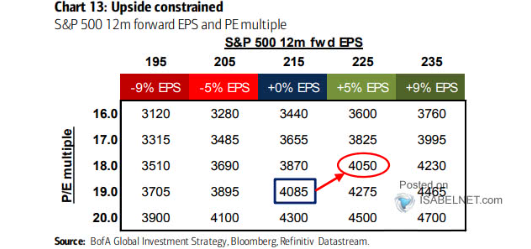

Traders are still paying a pretty high multiple for forward earnings but what if they lose faith in EITHER the amount of the forward earnings or refuse to pay the historically high multiple after beginning to realize there are more risks than they thought – or perhaps the alternative rates go higher and stocks simply become less attractive?

Although we cashed out 3 weeks ago, we don’t have all the answers yet because – that’s simply not the way things work. We need to digest the data, digest the Fed, digest the earnings and then think about it a bit before we can go responsibly diving back into a VERY uncertain and possibly unstable market.

Oh yes, and don’t forget the Government may shut down in 30 days – that’s always a fun side-bet.

So we’ll see what the Fed and Powell have to say at 2pm – that will be right in the middle of our Live Trading Webinar – which starts at 1pm, EST.