Ahead of today’s final GAMMA earnings result (the other supercap tech names delivered and while AMZN fumbled on AWS guidance on the call, its earnings were also stellar), when the world’s largest company AAPL reports Q1 results at 4:30pm (and guidance during its 5pm conf call), here is the big picture courtesy of Goldman trader Peter Callahan:

- Positioning: stock +27% YTD. desk has as a 6.5 out of 10 (0-10 scale) – a widely held asset (Apple’s mrkt cap > GOOG + AMZN, combined), though, typically an UW for MFs and limited tactical length among HFs.

- Print: numbers hit at ~430pm ET, followed by a conference call at 5pm ET. Guidance / forward commentary typically given on the call (not in the PR). Focus on China trends and capital returns.

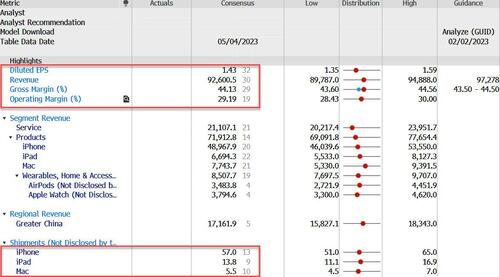

- Expectations: investors largely expecting a down the fairway March quarter (cons = ~$92.6bn in revs / $1.43 in EPS), with focus squarely on June quarter guidance (see: QCOM -7% on a guide down today), where Goldman previewed an expectation for AAPL to guide June revenues to decline at a similar magnitude of that in F2Q23 (GSe: -3% yoy) with Products revenue down y/y and Services revenue growth

A table of median sellside expectations:

JPM TMT sector specialist Jack Atherton chimes in that there has not been any major change to in positioning in AAPL of late “although the AI disruptive threat posed to GOOGL/AMZN has gifted some relative defensive qualities to the AAPL narrative.”

According to Atherton, the buyside is looking for FQ2 revenue to drop -6% y/y (guide -5%) with iPhone revenue $47.5BN (2% below consensus), and Q3 revenue guided to -2% y/y (vs est +2%), the miss coming from checks pointing to weaker iPhone build numbers. The other point to note is that this Q is typically when we get an update on annual buyback/dividend plans. Stock +29% YTD; Implied move 4.5%.

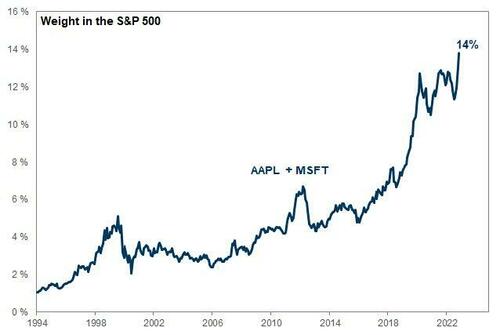

Finally, here is a stunning chart from Goldman showing just how concentrated the top 2 stocks have become.