After last week saw The Fed’s balance sheet continue is decline back from its bank-bailout resurgence, all eyes will be back on H.4.1. report this evening for signs that the regional banking crisis is accelerating (as regional bank shares suggest).

The answer is not a good sign for the bulls as Money Market Funds saw $47 billion of INFLOWS, pushing the aggregate to a record high of $5.31 trillion. That is over $100 billion of inflows in two weeks…

Source: Bloomberg

The breakdown was $20.7 billion from Institutional funds and $26.4 billion from retail funds (up dramatically from the $4.98 billion last week).

Source: Bloomberg

This surge in money market fund inflows strongly suggests tomorrow’s H8 deposit report will show the bank run is accelerating…

Source: Bloomberg

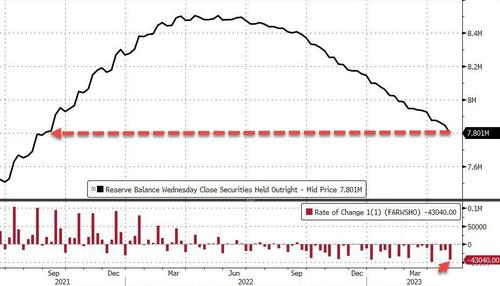

However, the most anticipated financial update of the week – the infamous H.4.1. showed the world’s most important balance sheet shrank for the 6th straight week last week, by a sizable $58.7 billion, notably more than last week’s tumble (helped by a $43bn QT)…

Source: Bloomberg

The Total Securities held outright on The Fed balance sheet plunged (QT back on track) by $43 billion to $7.80 trillion, the lowest since August 2021…

Source: Bloomberg

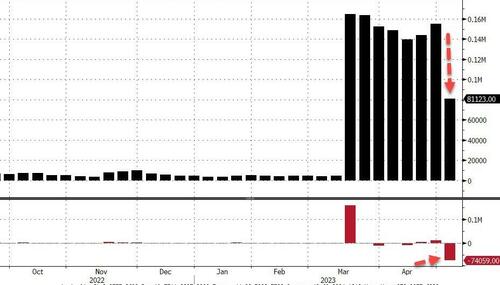

Looking at the actual reserve components that were provided by the Fed, we find that Fed backstopped facility borrowings plunged last week from $155.2 billion to $81.2 billion (still massively higher than the $4.5 billion pre-SVB)…

Source: Bloomberg

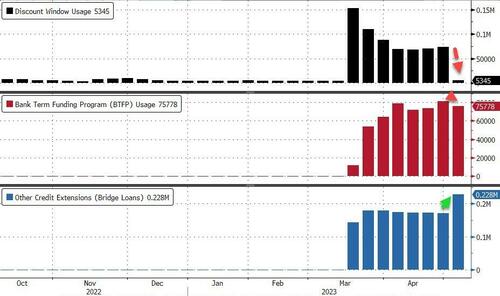

…but the composition shifted dramatically, as usage of the Discount Window plunged by around $68 billion to just 5.34 billion (upper pane below) along with a $6 billion decrease in usage of the Fed’s brand new Bank Term Funding Program, or BTFP, to $75.8 billion (middle pane) from $81.3 billion last week. Meanwhile, other credit extensions – consisting of Fed loans to bridge banks established by the FDIC to resolve SVB and Signature Bank rose notably from $170 billion to $228 billion (lower pane)…

Source: Bloomberg

Chatter is that FRC was hitting the discount window heavily and now it has gone away, that usage has gone. BTFP remains extremely high though. The jump in ‘Other Credit Extensions’ looks like the ‘loan’ to JPM to backstop the FRC deal.

Tomorrow we get more answers after the bell when The Fed releases its H8 report on bank deposit flows

Finally, the following chart showing Fed funds vs Regional Bank stocks needs little commenting…

Source: Bloomberg

The question is how this spills over… and how aggressively they start cutting? And don’t believe that universal deposit guarantees will make any difference now – this is not deposit fear, this is simply how it’s supposed to work as ‘cash’ seeks its highest (risk-free) return.