We were laughing about it yesterday during the Webinar.

We were laughing about it yesterday during the Webinar.

Jerome Powell’s first comment in his press conference yesterday was “The US Banking Sector is sound and resilient” and this morning we wake up and find both PACW and WAL are both on the block. I don’t know about WAL but PACW is actually sound and resilient – but that doesn’t matter if people lose faith in a bank and withdraw their deposits – soundness and resiliency go out the window along with the cash.

Despite the small rate hike (0.25%) and the very slightly softer language in the Fed statement, nothing Powell said instilled much confidence with investors and May is now looking like March, which began with a 5% drop in the S&P. The Fed, the Banks, the Dollar, the Markets are all a Confidence Game and, if the players lose confidence – the game is over!

I could feel it in the air last month, when we were reviewing our Member Portfolios so we decided to cash out until after Q1 Earnings (still in progress) as I thought the bank crisis was not quite done and, since the Commercial Real Estate market is clearly in bad shape – I was concerned there would be ripple effects that could topple it, bringing on yet another major banking crisis so, why risk it?

“Quit while you’re ahead” is a very difficult concept for traders to grasp – especially full-time traders, who are really not too different from gamblers in that they get very itchy if they don’t have trades in the works. This is why I quit day-trading at PSW – people just don’t have the patience to wait for proper opportunities and they end up making inappropriate trades. Patience is always the hardest lesson to pass on to our students at PhilStockWorld.

“Quit while you’re ahead” is a very difficult concept for traders to grasp – especially full-time traders, who are really not too different from gamblers in that they get very itchy if they don’t have trades in the works. This is why I quit day-trading at PSW – people just don’t have the patience to wait for proper opportunities and they end up making inappropriate trades. Patience is always the hardest lesson to pass on to our students at PhilStockWorld.

While it always seems fun to let stocks and even whole portfolios “ride“, no matter how high they get – anyone who has played craps, roulette, blackjack – whatever – has certainly experienced that last spin of the wheel or that last roll of the dice, where they sweep away all your winnings because you pushed it just a bit too far.

The game goes on, but you don’t because you let yourself get damaged when you could have walked away with a huge win. It’s human nature, it’s why casinos exist and it’s also why, at PhilStockWorld, we teach our Members to Be the House – NOT the Gambler.

But letting it ride in the markets is WORSE than letting it ride in a casino because, in a casino game, the odds reset each time you play so you always have an (almost) 50/50 chance of hitting black on a roulette wheel. Why is it not 50/50? Because a roulette wheel has a green 0 or sometimes also 00 and that one green means only have an 18/37 chance of hitting black. That’s 48.6%, not 50% so the house is taking 1.4% from you on every single spin – whether you realize it or not.

It is similar but worse with stocks because, as your stock goes higher and higher, you are “letting it ride” despite the stock now being more than you would have paid for it in the first place. Sure, over time, the stock can justify a higher price but, in the short run, when a stock goes up too far and you keep your money on the table – the odds of coming up red increase with each dollar you gain so your next “bet” has worse and worse odds of success.

At PSW, we are value investors and we discussed this in the Webinar yesterday using Disney (DIS) as an example. The short story is that we decided $76 is the worst-case for DIS (outside of Covid, part II) and that would be if Ron DeSantis (boo, hiss!) shuts down the Orlando park entirely.

Since we don’t think things will go that far, we’re happy to sell DIS 2025 $100 puts for $13 as that would be net $87 and we’re happy to double down if DIS is actually at $70 or below and our average would be $80 and we could then sell calls to drop our net to about $65 and more puts would take us to net $55 and DIS is at $100 so we would be THRILLED to own 4x at $55 – so contracting ourselves to own 1x at $87 is easy.

So we’re comfortable with our downside and we make an entry but what about the upside? As long as DIS is over $100 in 2025 we keep the $1,300 per contract and, since Jan 2025 is 19 months away, our expectation is to make $1,300/19 ($68.42) per month. If DIS spikes higher to $120 and the VIX goes lower, perhaps the contract is down to $500 in September. Now we are risking the same loss if DIS crashes but our potential reward is just $500 over the next 15 months or $33/month.

So we’re comfortable with our downside and we make an entry but what about the upside? As long as DIS is over $100 in 2025 we keep the $1,300 per contract and, since Jan 2025 is 19 months away, our expectation is to make $1,300/19 ($68.42) per month. If DIS spikes higher to $120 and the VIX goes lower, perhaps the contract is down to $500 in September. Now we are risking the same loss if DIS crashes but our potential reward is just $500 over the next 15 months or $33/month.

That means we have the same risk that we had before but now with 1/2 the potential reward. That is WORSE than letting it ride on a roulette table! You ALWAYS have to consider and reconsider whether or not the risk you take is worth the reward and the March banking crisis made it obvious to us that it was not worth the risk going into Q1 earnings reports.

Hopefully we’re wrong and the markets can pull themselves together but, unlike GAMBLERS, we KNOW the game will still be there when we’re ready to start playing again – we don’t have to play until we KNOW the odds are in our favor and, if we keep our heads together and remember that we are the HOUSE, not the Gambler – we know the odds are always slightly in our favor – so we only need to be PATIENT to win the game.

That then, brings us to one of two portfolios we did not cash in. The $700/month Portfolio is an exercise in building a 30-year retirement strategy in which depositing $700 per month and setting up trades will hopefully yield much more than $1M on what will ultimately be a $252,000 investment.

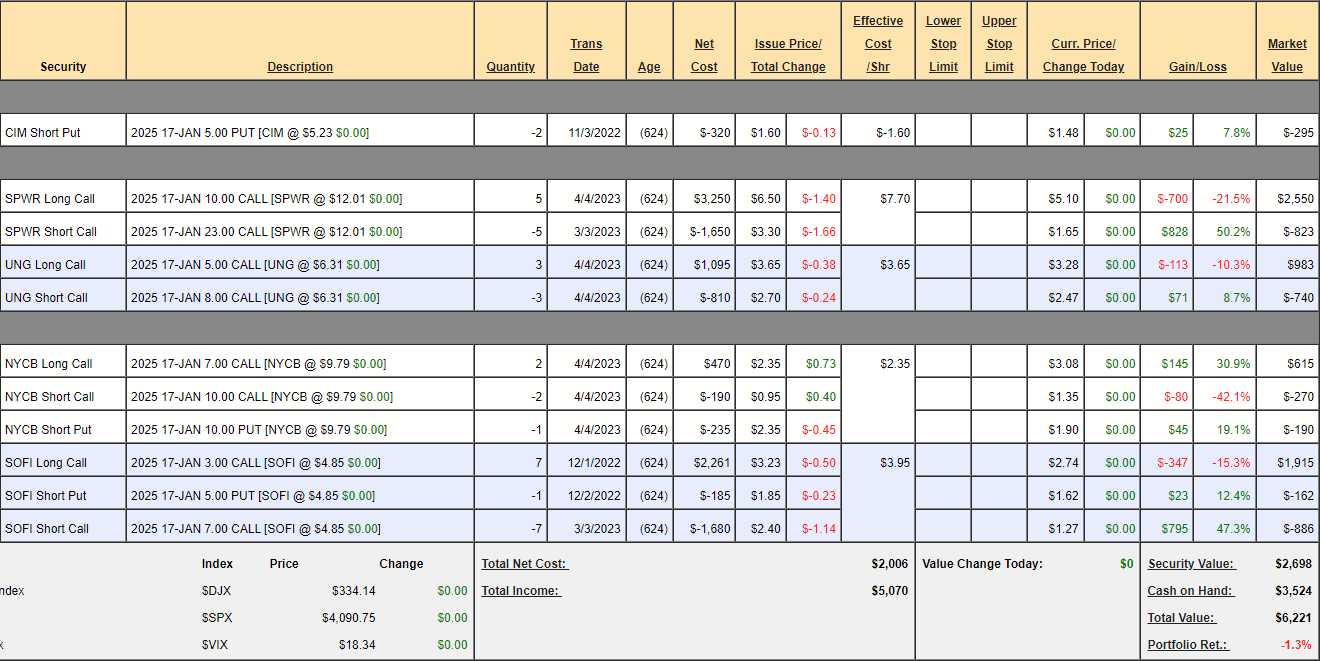

Last month in: “How to Become a Millionaire by Investing $700 per Month – Part 8/360“, our Portfolio was at $5,244, which was up 7% in 7 months. We fortunately closed out our T position and unfortunately spent more on SPWR. We also added a new trade on NYCB that’s off to a good start and we took a long spread on UNG:

It was a rough month and now we are down 1.3% with $6,300 invested in month 9. Although we have $3,524 in cash, we have no margin in this account so our buying power is just $1,024 at the moment.

Before we buy anything new, we always look at the other positions in the portfolio to see if they can benefit from any improvements…

-

- CIM – Our obligation here is to buy 200 shares for $5 and we were paid $320 for that so net $680 is our risk and our margin. If CIM stays above $5 we keep the $320 and that’s a 47% return in 2 years and we’d pull the plug before we lose $300 so the reward potential is greater than the risk – that’s how we like to play it. $296 left to gain.

-

- SPWR – I think $12 is way too low so, logically, I want to buy back the short calls but, if we do that, that’s our whole move for the week – so we’ll circle back. I still think $23 is a realistic target and it’s a $6,500 spread that’s $1,000 in the money at net $1,727 so we have $4,773 (276%) left to gain if things go turn around.

-

- UNG – These spreads are net 0.81 for $3 and they are $1.31 (161%) in the money. The upside potential is $2.19 x 500 ($1,095 – 270%) so more of these would seem to be a better use of $823 than buying back the short SPWR calls, right?

-

- NYCB – Off to a good start at net $325 on the $600 spread so the upside potential is $275 (84%) and we’re using $1,000 of margin to make $190 on the puts so that doesn’t make any sense so let’s buy back the puts for $190, which frees up $810 of our cash and let’s buy 4 more of the spreads for $650 which, buy the way, are $279 in the money EACH and now our upside on 6 at $930 is $870 (93.5%) and we still have $160 cash to spend elsewhere. Percentage isn’t everything, we’ve doubled our potential total return by investing more cash but that freed up margin and the percentage gained doesn’t matter in the end.

-

- SOFI – Another Financial and we don’t want to have too many eggs in one basket but Financials are what’s on sale at the moment and we certainly don’t want to add another one but we made a very fast 50% on the short $7 calls and it would be a crying shame not to buy those back for $886. That leaves us with $638 to spend this month. I’m not going to change the target of $7 so, at the moment, we’ll call this net $1,753 on the $4,900 spread so the upside potential is $3,174 (179%) but we’ll certainly re-cover at some point and lower the basis and put hopefully more than $886 back onto the spending pile.

We had $1,024 to spend and we used $190 to buy back the NYCB short puts, which released $1,000 in margin so that was then $1,834 to spend and then we spent $650 on 4 more NYCB spreads so $1,184 left to spend and we used $886 to buy back the short calls on SOFI so now $298 remains to be spent.

The upside potential of the trades above is now $10,208 from our first $6,300 invested and, since we are overall down 1.3% so far, you can start the whole portfolio from scratch with $6,300 or $63,000 for that matter and expect a 162% return in 19 months – if all goes according to plan.

That being the case, I’d rather keep the $298 CASH!!! into the uncertainty of the next 30 days and we’ll have $998 to spend next month – hopefully not on more adjustments!